Long-Term Bitcoin Investors Control Record Amount of BTC!

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

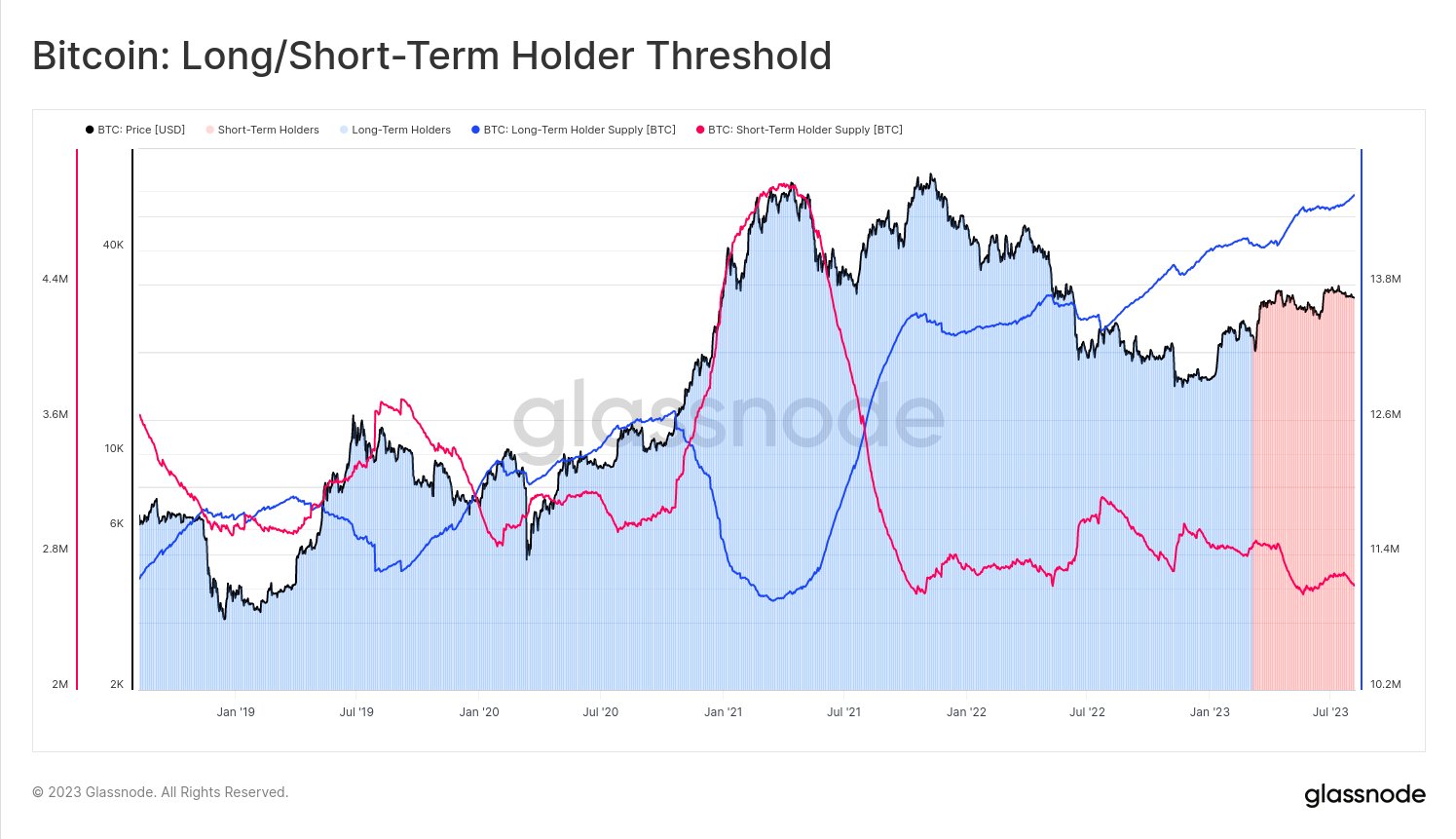

- According to data analytics firm Glassnode, long-term Bitcoin holders are currently controlling a record 14.599 million BTC.

- The amount held by long-term holders also constitutes 75% of the circulating supply of Bitcoin.

- Meanwhile, a Glassnode analyst pointed out that Bitcoin’s realized volatility has also dropped to historically low levels.

According to the latest data from Glassnode, long-term Bitcoin holders are currently in control of a record amount of BTC, and this has seen an impressive increase in the last 7 days.

New Record from Long-Term Bitcoin Investors

According to data analytics firm Glassnode, long-term Bitcoin holders are currently controlling a record 14.599 million BTC. In the past seven days, the total balance held in these wallets increased by 43,949 Bitcoin, or $1.274 billion at current prices.

Long-term Bitcoin holders are those addresses that have held their coins for at least 155 days. According to Glassnode, previous research indicates that spending from such an address is statistically unlikely, thus making it a practice known as “HODLing” in the Bitcoin parlance.

The amount held by long-term holders also constitutes 75% of the circulating supply of Bitcoin, indicating a preference among investors to hold onto their assets for an extended period.

In February, long-term Bitcoin holders controlled 78% of the circulating supply of the network. However, the continuation of this long-term holding pattern could suggest increased confidence in Bitcoin’s potential as both a store of value and a medium of exchange.

Bitcoin’s Realized Volatility Hits Historically Low Levels

Meanwhile, a Glassnode analyst noted that Bitcoin’s realized volatility has also dropped to historically low levels. The analyst stated, “On 1m–1y timeframes, we’re seeing the quietest Bitcoin since post-bear market euphoria after March 2020,” and added:

“Historically, such low volatility is compatible with post-bear market accumulation phases.”

Realized volatility, sometimes referred to as historical volatility, refers to the price fluctuation experienced by an asset over a specific period. It’s often calculated based on changes between closing prices.

Currently, Bitcoin is trading at $29,140, a 0.4% increase over the past 24 hours. While the world’s largest cryptocurrency has dropped more than 3% in the last month after surpassing $31,500 in the wake of a new wave of Bitcoin ETF applications, it has still outperformed major stock indexes such as the Nasdaq Composite (+33% YTD), S&P 500 (+17% YTD), and Dow Jones (+5.82% YTD) by over 75% since the beginning of the year.