-

Bitcoin’s futures market shows signs of bearish pressure, yet other key metrics suggest the correction may be limited and short-lived.

-

Despite a dip in Futures Market Power to -93K, Bitcoin’s bullish fundamentals remain intact, reflecting cautious optimism among investors.

-

According to CryptoQuant analyst Axel Adler, the current bearish shift in futures is moderate compared to historical levels, indicating a potential minor retracement rather than a major downturn.

Bitcoin’s futures market signals moderate bearish pressure, but bullish fundamentals suggest a shallow correction, keeping BTC near its all-time highs.

Bitcoin Futures Market Power Indicates Moderate Bearish Sentiment

Bitcoin’s Futures Market Power recently dipped into negative territory, reaching approximately -93K, signaling a moderate tilt towards bearish positions. CryptoQuant analyst Axel Adler highlights that while this shift points to increased caution among futures traders, it remains relatively mild compared to previous spikes, such as the -150K and -450K levels observed earlier this year. This suggests that the market is experiencing hesitation rather than a decisive sell-off.

Historically, similar drawdowns in the Futures Market Power within the 50K–150K range have led to minor corrections of 5–10%, implying that Bitcoin could see a retracement toward the $93,000–$98,000 range. However, the absence of aggressive selling pressure indicates that investors still hold confidence in Bitcoin’s potential to surpass its current all-time high.

Futures Market Dynamics and Investor Sentiment

The current bearish lean in the futures market reflects a cautious stance among traders rather than a fundamental shift in Bitcoin’s long-term outlook. This nuanced sentiment is important for investors to monitor, as it may signal short-term volatility without undermining the broader bullish trend. The Futures Market Power metric serves as a valuable barometer for gauging market positioning, and its moderate negative reading suggests traders are preparing for a possible pullback while remaining optimistic overall.

Bullish Fundamentals Counterbalance Futures Market Weakness

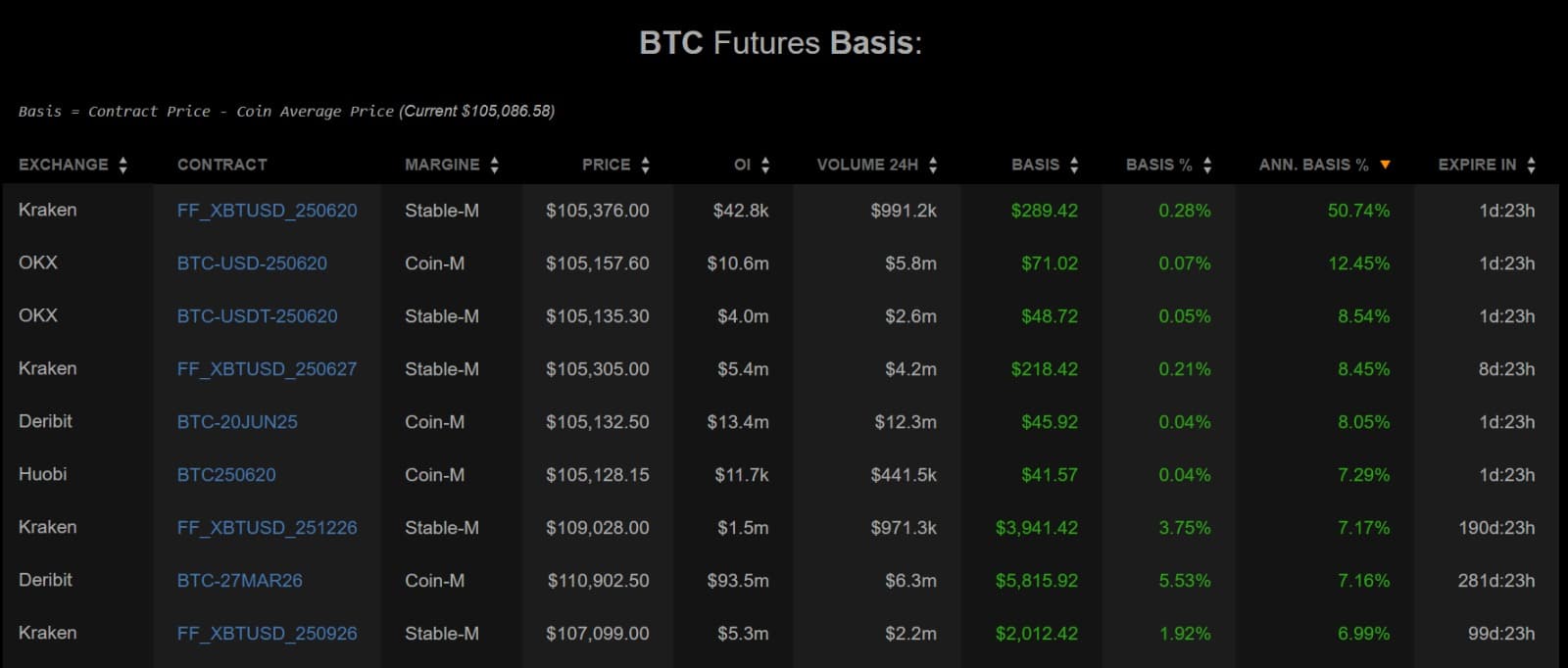

Despite the bearish signals from Futures Market Power, other critical indicators maintain a bullish narrative. Bitcoin’s Futures Basis remains positive across major exchanges, indicating that traders are willing to pay a premium to hold long positions. This premium reflects ongoing expectations for price appreciation in the near term.

Source: Coinalyze

Additionally, Bitcoin’s Funding Rate has remained positive after a brief dip into negative territory ten days ago. A positive Funding Rate, combined with a positive Futures Basis, typically signals that traders expect upward price movement and are willing to pay to maintain long positions.

Source: CryptoQuant

Open Interest has remained stable near $33 billion over the past week, indicating that traders are not aggressively increasing their positions in either direction. This stability suggests a balanced market sentiment, with neither bulls nor bears dominating the landscape.

Source: CryptoQuant

Implications for Bitcoin’s Price Trajectory

The mixed signals from Bitcoin’s derivatives market suggest a phase of consolidation rather than a decisive trend reversal. Should a correction occur, historical support levels near $102,850 may provide a strong foundation to prevent deeper declines. Conversely, if bullish fundamentals persist, Bitcoin is likely to maintain its position within the $104,000 to $107,000 range, staying close to its all-time highs.

Investors should monitor key metrics such as Futures Market Power, Funding Rates, and Open Interest to gauge shifts in market sentiment. The current environment underscores the importance of a balanced approach, recognizing that while bears have surfaced, they have yet to assert control over the market.

Conclusion

In summary, Bitcoin’s futures market shows moderate bearish pressure, but the broader market fundamentals remain bullish, suggesting any correction is likely to be shallow and temporary. Traders and investors should remain vigilant, using derivative indicators alongside price action to navigate this nuanced landscape. The resilience of Bitcoin’s key metrics points to sustained interest and confidence, keeping the cryptocurrency well-positioned near its historic highs.