Bank of America Advances Stablecoin Plans as TRON Leads USDT Transfer Volumes

TRX/USDT

$115,098,670.07

$0.2794 / $0.2751

Change: $0.004300 (1.56%)

+0.0047%

Longs pay

Contents

-

Bank of America is rapidly advancing its plans to launch a USD-backed stablecoin, signaling a significant shift in traditional finance’s approach to digital assets.

-

Meanwhile, TRON blockchain continues to dominate USDT stablecoin transfers, processing an unprecedented $691 billion in a single month, primarily driven by large whale transactions.

-

According to COINOTAG sources, Bank of America CEO Brian Moynihan emphasized the bank’s commitment to navigating regulatory challenges to integrate blockchain technology effectively.

Bank of America accelerates its USD stablecoin launch as TRON leads with $691B in USDT transfers, highlighting growing competition between traditional finance and blockchain networks.

Bank of America’s Stablecoin Initiative Marks a New Chapter in TradFi Blockchain Integration

Bank of America’s decision to fast-track the development of a U.S. dollar-backed stablecoin represents a pivotal moment for legacy financial institutions embracing blockchain technology. Historically cautious about digital assets, the banking giant is now positioning blockchain as a strategic priority to enhance transaction speed and maintain competitiveness in a rapidly evolving financial landscape. This move underscores the increasing urgency among traditional banks to innovate amidst mounting pressure from fintech disruptors and crypto-native platforms.

At a recent Morgan Stanley conference, CEO Brian Moynihan highlighted the regulatory uncertainties that previously hindered progress but affirmed that clearer guidelines are enabling the bank to move forward. This evolving regulatory clarity is vital for institutional adoption, as it mitigates compliance risks while unlocking new operational efficiencies. Bank of America’s stablecoin project is expected to leverage blockchain’s inherent transparency and settlement speed, potentially reshaping how large-scale financial transactions are conducted.

TRON’s Unmatched Dominance in USDT Transfers Reflects Whale Activity and Network Efficiency

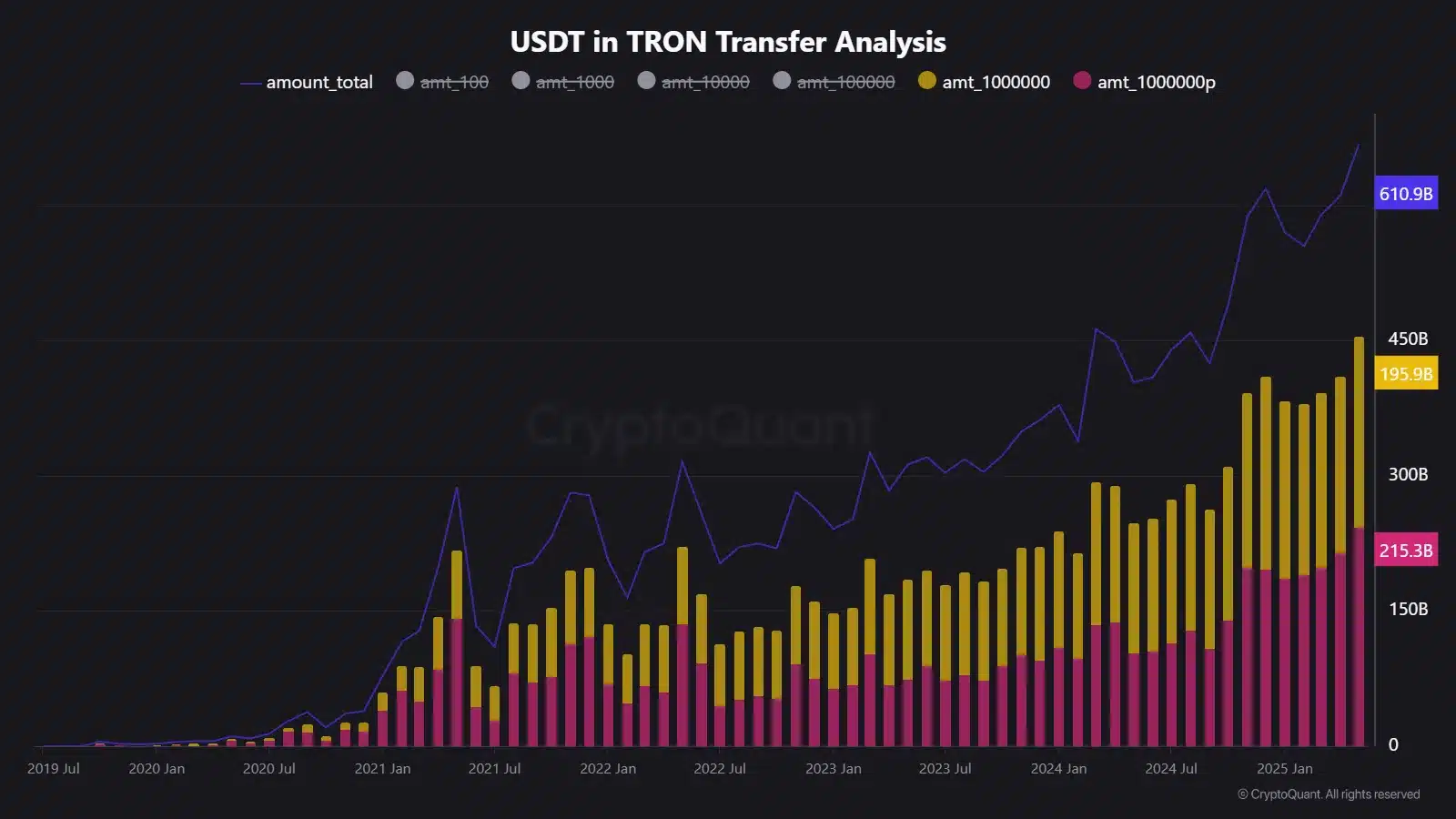

While Bank of America prepares its stablecoin entry, TRON continues to solidify its position as the leading blockchain for USDT transactions. In May alone, TRON processed over $691 billion in USDT transfers, with whale transactions—those exceeding $1 million—accounting for $411 billion of this volume. This data, sourced from CryptoQuant, highlights TRON’s appeal to high-net-worth individuals and institutional actors seeking efficient, cost-effective stablecoin transfers.

Source: CryptoQuant

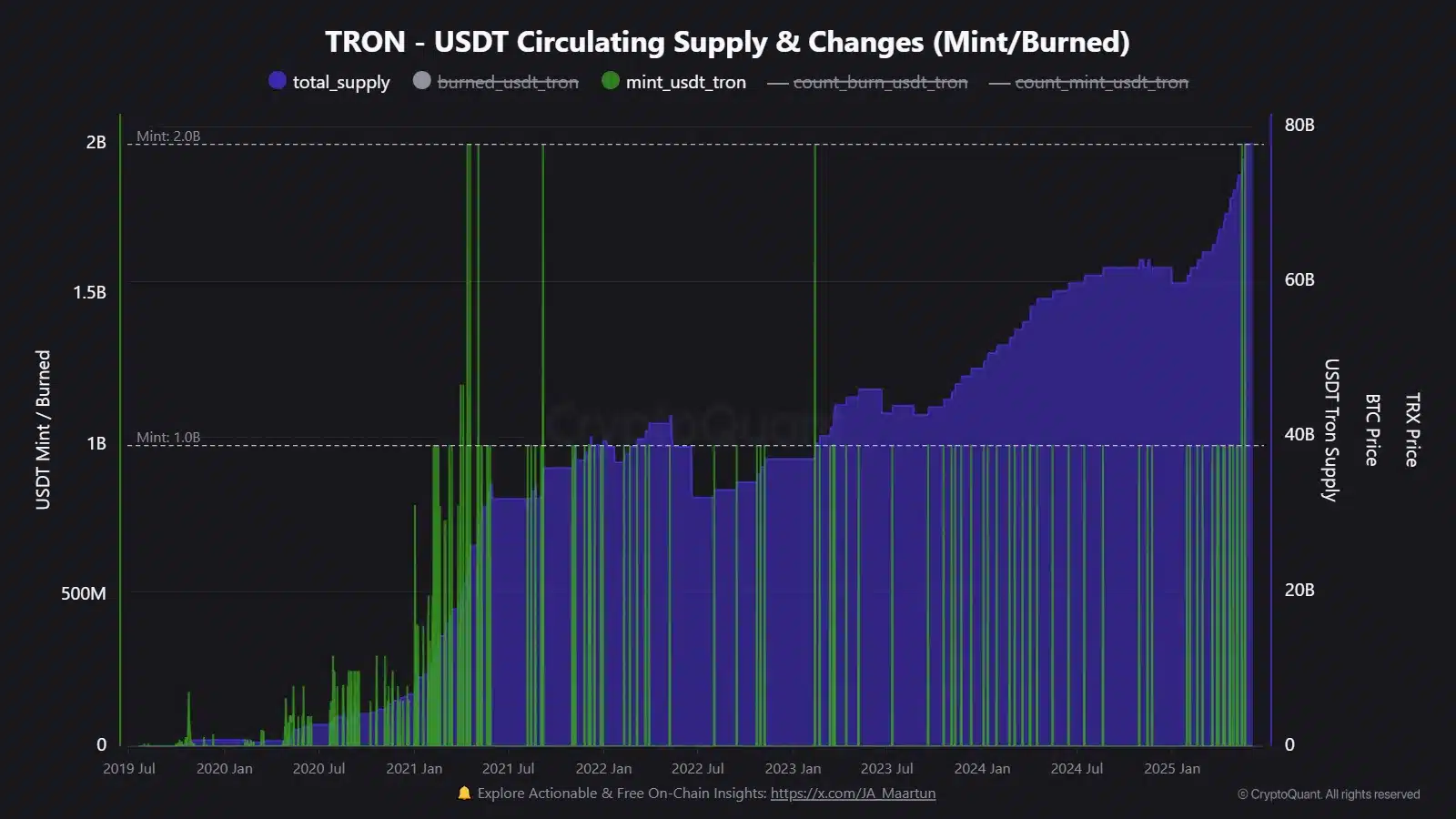

With 17 separate $1 billion-plus USDT mint events already recorded in 2025, TRON’s network activity underscores its scalability and reliability for large-scale stablecoin operations. The blockchain’s cumulative 10.5 billion transactions further attest to its widespread adoption among crypto whales who prioritize speed and low fees when transferring substantial sums.

Source: CryptoQuant

Global Implications of Stablecoin Expansion on Finance and Monetary Policy

The rapid growth of stablecoins, particularly USDT on TRON, is reshaping global financial dynamics and monetary policy considerations. In emerging economies, dollar-pegged stablecoins are increasingly used for remittances and as a hedge against local currency volatility, effectively extending the reach of the U.S. dollar beyond traditional borders. This trend poses both opportunities and challenges for regulators and central banks worldwide.

U.S. lawmakers have intensified scrutiny of stablecoins amid concerns about their systemic risks, especially regarding their impact on Treasury markets and overall financial stability. Congressional hearings in early June highlighted the urgent need for clear regulatory frameworks to govern stablecoin issuance and usage. Concurrently, central banks globally are accelerating their exploration of Central Bank Digital Currencies (CBDCs), signaling a broader shift towards digital monetary systems.

Conclusion

Bank of America’s accelerated stablecoin development and TRON’s record-breaking USDT transfer volumes illustrate a transformative phase in the intersection of traditional finance and blockchain technology. As legacy institutions embrace digital assets and blockchain-native networks continue to expand, the stablecoin landscape is becoming a critical battleground for innovation and regulatory clarity. Stakeholders should closely monitor these developments, as they will significantly influence the future of global payments and monetary policy.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/9/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/8/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/7/2026

DeFi Protocols and Yield Farming Strategies

2/6/2026