Bitcoin Dominance Nears 65% Amid $36B Altcoin Volume Gap, Delaying Potential Altseason Recovery

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Altcoins continue to struggle as Bitcoin dominance surpasses 64%, creating a significant volume gap and delaying the anticipated altseason.

-

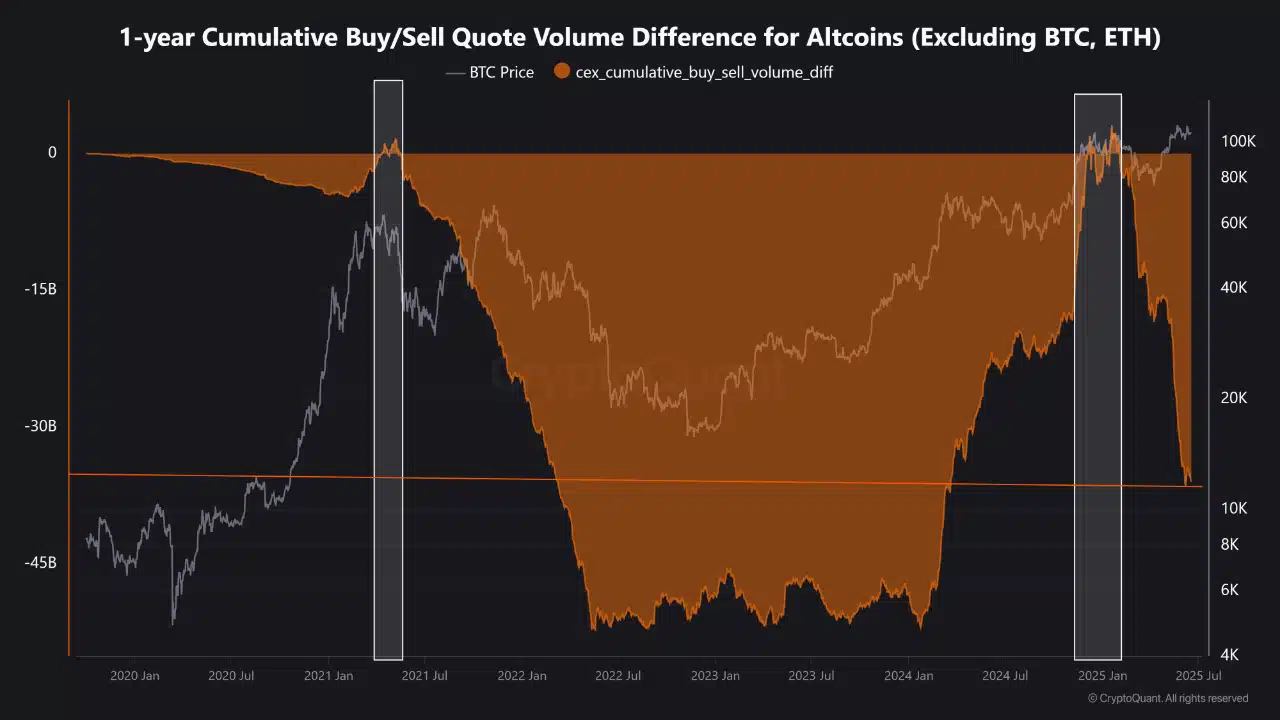

The persistent -$36 billion buy/sell volume gap for altcoins highlights ongoing liquidity challenges despite Bitcoin’s bullish momentum.

-

David Hernandez from 21Shares emphasizes Bitcoin’s growing appeal as a resilient and scarce asset amid global financial uncertainty.

Bitcoin’s dominance climbs past 64%, causing a $36B volume gap that stalls altcoins and delays altseason despite strong BTC rallies and ETF hype.

Altcoin Volume Gap Deepens Amid Bitcoin’s Market Dominance Surge

The altcoin market is currently facing a pronounced liquidity crisis, evidenced by a staggering -$36 billion cumulative buy/sell volume gap over the past year. This figure, the lowest since 2022, underscores a widespread investor reluctance to engage with altcoins beyond Bitcoin and Ethereum. While Bitcoin has surged past the historic $100,000 mark, altcoins remain trapped in a net-sell zone, reflecting a cautious market sentiment that favors the perceived safety and maturity of BTC.

Source: CryptoQuant

Historically, brief altcoin rallies have coincided with positive shifts in buy/sell volume metrics. However, the current sustained negative differential signals that altcoins have yet to recover from bear-market inertia, even as Bitcoin enjoys renewed investor confidence.

Bitcoin Dominance (BTC.D) Breakout Reinforces Capital Concentration

Bitcoin’s market cap dominance has surged to nearly 65%, marking a significant increase of over 1% since mid-June. This rise is largely attributed to the growing influence of Bitcoin ETFs, institutional inflows, and its role as a macro hedge amid global financial uncertainties. The surge in BTC.D often results in capital being funneled away from altcoins, reinforcing Bitcoin’s position as the crypto market’s primary safe haven.

Source: Trading View

David Hernandez, crypto investment specialist at 21Shares, commented on Bitcoin’s current market position:

“Bitcoin has firmly cemented itself above $100,000, and its resilience amid geopolitical shocks demonstrates its widespread adoption and developing investment case.”

He further added,

“As confidence in a perfectly engineered ‘soft landing’ wanes, and as global financial currents diverge, Bitcoin’s fundamental properties – its scarcity, decentralization, and neutrality – make it an increasingly relevant and compelling asset for investors navigating an uncertain future.”

Given this context, unless BTC dominance reverses, altcoins are likely to remain suppressed, regardless of their individual project strengths.

Key Conditions Needed for Altseason to Materialize

The return of altseason hinges on several critical market dynamics aligning. Firstly, Bitcoin’s rally must stall or enter a consolidation phase, creating an environment conducive to capital rotation. Secondly, there needs to be a renewed risk appetite among retail investors, often driven by positive market sentiment and speculative interest. Finally, a reversal in the 1-year buy/sell volume differential for altcoins is essential, signaling increased liquidity and investor confidence in the broader altcoin market.

Historically, altseason follows a cooling period in Bitcoin’s price after a significant run-up, as speculative capital seeks higher returns in smaller-cap assets. However, current data shows no clear signs of this transition, suggesting that altcoin markets may remain subdued in the near term.

Until these conditions are met and BTC dominance retreats, the prospect of an altcoin supercycle remains uncertain, urging investors to monitor market signals closely before reallocating capital.

Conclusion

In summary, the crypto market is currently characterized by a pronounced divergence between Bitcoin’s bullish momentum and altcoins’ ongoing liquidity challenges. The substantial volume gap and rising BTC dominance underscore a cautious investor stance that favors Bitcoin’s perceived stability and scarcity. While altseason remains a sought-after phase, its arrival depends on a complex interplay of market factors, including Bitcoin’s price behavior and shifts in investor risk appetite. Market participants should remain vigilant and consider these dynamics carefully when making portfolio decisions.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC