Bitcoin ETF Inflows Rise Amid Rally, While Market Signals Suggest Cautious Trader Sentiment

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Bitcoin’s recent surge to nearly $110,000 has ignited a significant influx of capital into BTC-backed ETFs, underscoring renewed institutional confidence in the leading cryptocurrency.

-

BlackRock’s iShares Bitcoin Trust (IBIT) dominated the inflows, attracting $267 million and pushing its total assets under management above $50 billion.

-

Despite the price uptick, market indicators such as negative funding rates and rising put option demand reveal cautious sentiment among traders, signaling potential short-term volatility.

Bitcoin’s rally to $109,952 sparks $408M inflows into BTC ETFs, led by BlackRock’s IBIT, amid mixed market signals from funding rates and options activity.

Institutional Demand Drives Bitcoin ETF Inflows Amid Price Rally

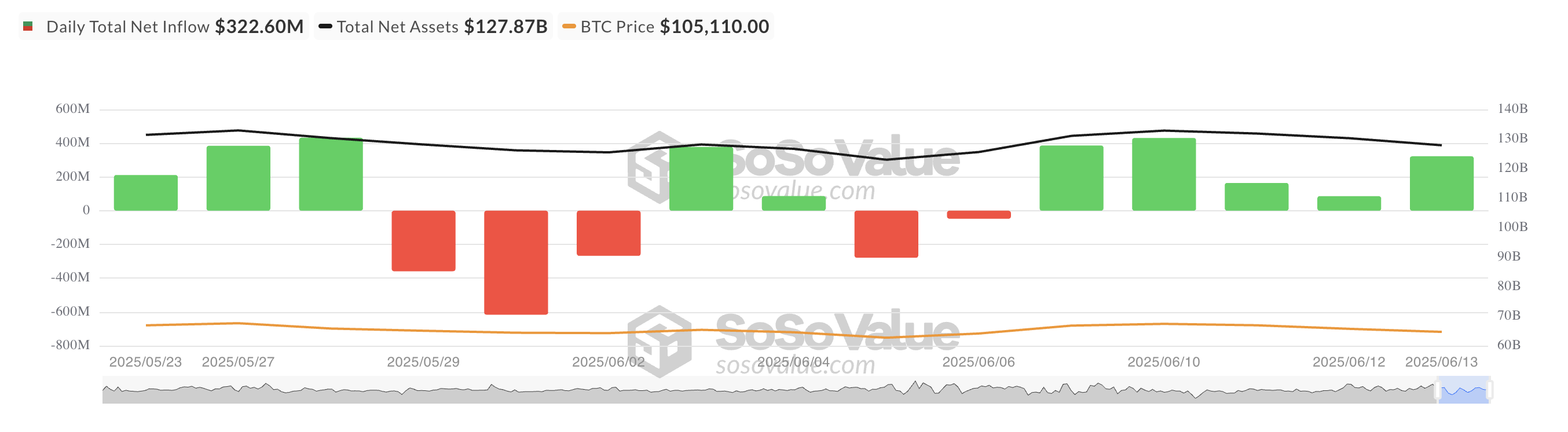

Bitcoin’s climb to an intraday peak of $109,952 on Monday marked a pivotal moment, catalyzing a surge in capital flows into US-listed spot Bitcoin ETFs. The combined net inflows of $408.59 million represent the largest single-day injection since early June, highlighting robust institutional appetite for direct BTC exposure through regulated financial products.

Leading the inflows, BlackRock’s iShares Bitcoin Trust (IBIT) recorded $267 million in new investments, elevating its total net inflows to an impressive $50.03 billion. This milestone underscores IBIT’s position as a preferred vehicle for institutional investors seeking portfolio diversification and inflation hedging via cryptocurrency.

The inflow data suggests that despite recent price fluctuations, institutional investors maintain a strategic conviction in Bitcoin’s long-term value proposition, leveraging ETFs as a regulated and accessible entry point.

Market Sentiment Revealed by Derivatives Activity and Funding Rates

While the spot market reflects a modest 1% gain for Bitcoin, derivatives markets paint a more nuanced picture. Funding rates for perpetual futures contracts have turned negative, currently hovering around -0.0007%, indicating that short sellers are paying longs. This dynamic typically signals a prevailing bearish sentiment among leveraged traders, who may be anticipating downward price pressure.

Negative funding rates can amplify selling momentum if sustained, as traders adjust positions to hedge against potential declines. This is a critical metric for market participants to monitor, as it often precedes increased volatility.

Complementing this, options market data from Deribit reveals a surge in put option open interest relative to calls. This shift suggests that investors are actively seeking downside protection, reflecting heightened caution despite the positive ETF inflows.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

BTC Funding Rate. Source: Coinglass

BTC Options Open Interest. Source: Deribit

Balancing Optimism with Caution: What This Means for Bitcoin Investors

The juxtaposition of strong ETF inflows against cautious derivatives positioning illustrates a market at a crossroads. Institutional investors appear confident in Bitcoin’s medium to long-term outlook, as evidenced by substantial capital allocations to ETFs. However, the derivatives market’s defensive posture indicates awareness of potential near-term headwinds.

For investors, this environment calls for a balanced approach—recognizing the strategic value of Bitcoin as a portfolio asset while remaining vigilant to signals of increased volatility. Active monitoring of funding rates and options activity can provide early warnings of market shifts, enabling timely risk management.

As Bitcoin continues to navigate these dynamics, market participants should consider diversified strategies that incorporate both spot holdings and derivatives hedging to optimize exposure and mitigate downside risks.

Conclusion

Bitcoin’s recent price surge has reignited institutional interest, driving record inflows into BTC-backed ETFs, particularly BlackRock’s IBIT. Yet, the derivatives market reveals a more cautious sentiment, with negative funding rates and rising put option demand signaling potential short-term volatility. Investors should weigh these contrasting signals carefully, adopting strategies that balance growth opportunities with prudent risk management in an evolving crypto landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC