Bitcoin Faces Bear Market Risks if Key Support Levels Are Breached

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

As Bitcoin’s price teeters on critical support levels, market observers brace for signs of a potential bear market amid high volatility.

-

Investor sentiment hangs in the balance, influenced by recent profit-taking trends among holders of substantial Bitcoin reserves.

-

“Historically, breaking below significant price thresholds often signals the beginning of bearish cycles,” notes a prominent analyst from COINOTAG.

This article explores Bitcoin’s precarious position as it hovers near key support levels with the potential for a bear market looming as profit-taking intensifies.

Critical Support Levels Under Surveillance

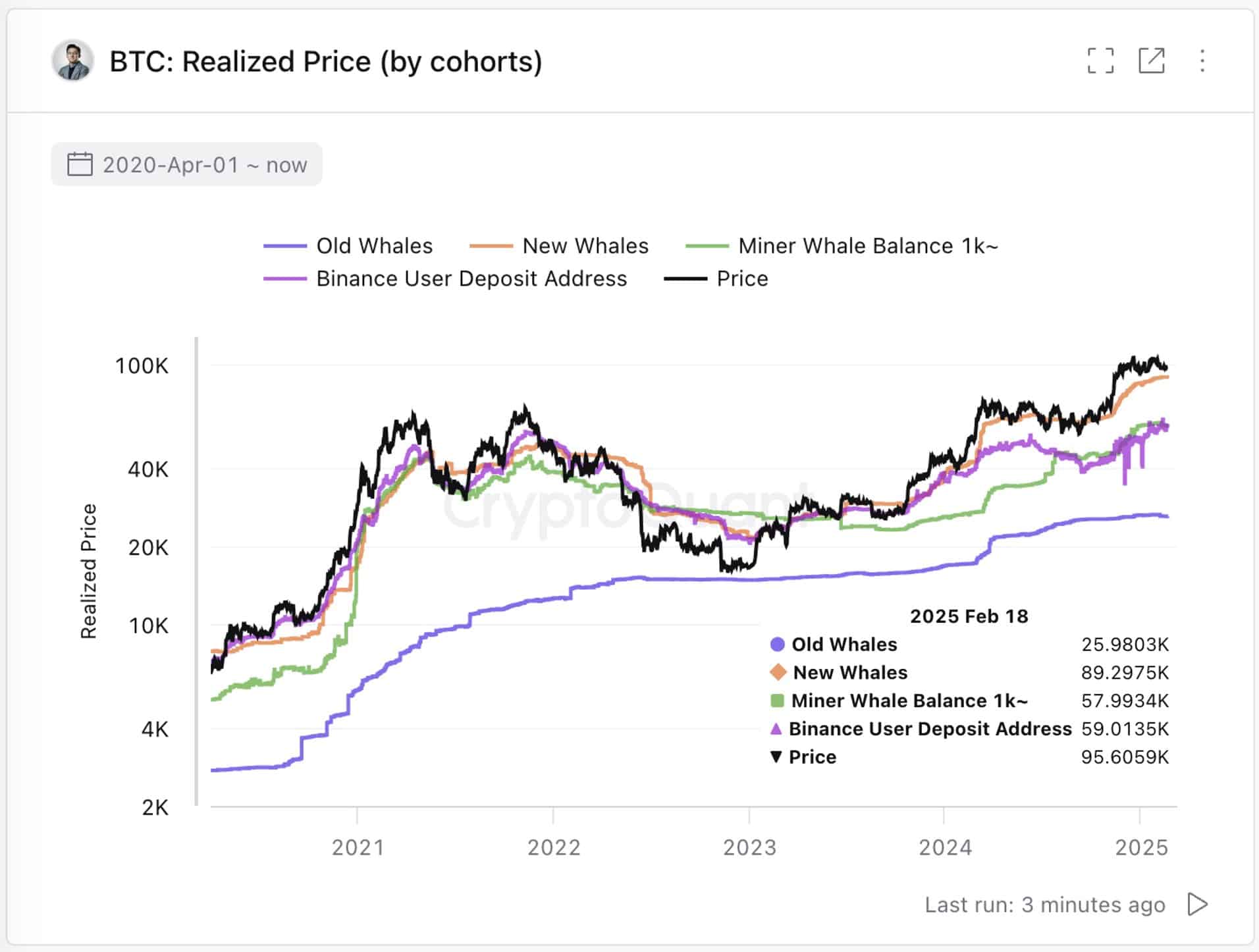

Bitcoin (BTC) recently demonstrated its volatility by bouncing from $94K to a high of $96,200. However, the pressure mounts as analysts warn that a drop below $89,300 could trigger substantial profit-taking by whales.

This profit-taking could escalate sell pressure significantly, especially among short-term holders—those with more than 1,000 BTC held for less than 155 days. The behavior of these investor cohorts is vital for the market’s stability.

Additionally, the $58,000 mark is crucial as it represents the realized price for many miner wallets, which tend to be a strong indicator of price support. Historical data suggests that falling below this threshold often correlates with prolonged bear market conditions.

Source: CryptoQuant

Market Dynamics: Bullish Defense Against Bearish Pressures

The resilience of the bulls has been notable, with the $90K level being defended for over a month despite a challenging macroeconomic environment. This ongoing support indicates strong demand, but it also highlights the fragility of the current market structure.

Source: TradingView (BTC/USDT)

While bulls appear to maintain the upper hand for the moment, the market’s current consolidation phase near critical resistance levels suggests a liquidity trap might be forming. This is especially concerning if Bitcoin could breach $99K without adequate spot demand, potentially leading to a cascade of liquidations.

Investors should be particularly attentive; a decline to $90K could signal heightened volatility. If that level fails to hold, pressures from short-term holders may exacerbate the market’s downturn towards $89,300, increasing the likelihood of a bear market.

Conclusion

While the threat of a Bitcoin bear market looms larger as key support levels are tested, current market dynamics show a fragility beneath the surface. Investors should watch the aforementioned thresholds closely, as their breach could signify an impending downturn, with potential ramifications across the broader cryptocurrency market. Understanding these dynamics and taking appropriate levels of caution will be paramount for navigating the months ahead.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC