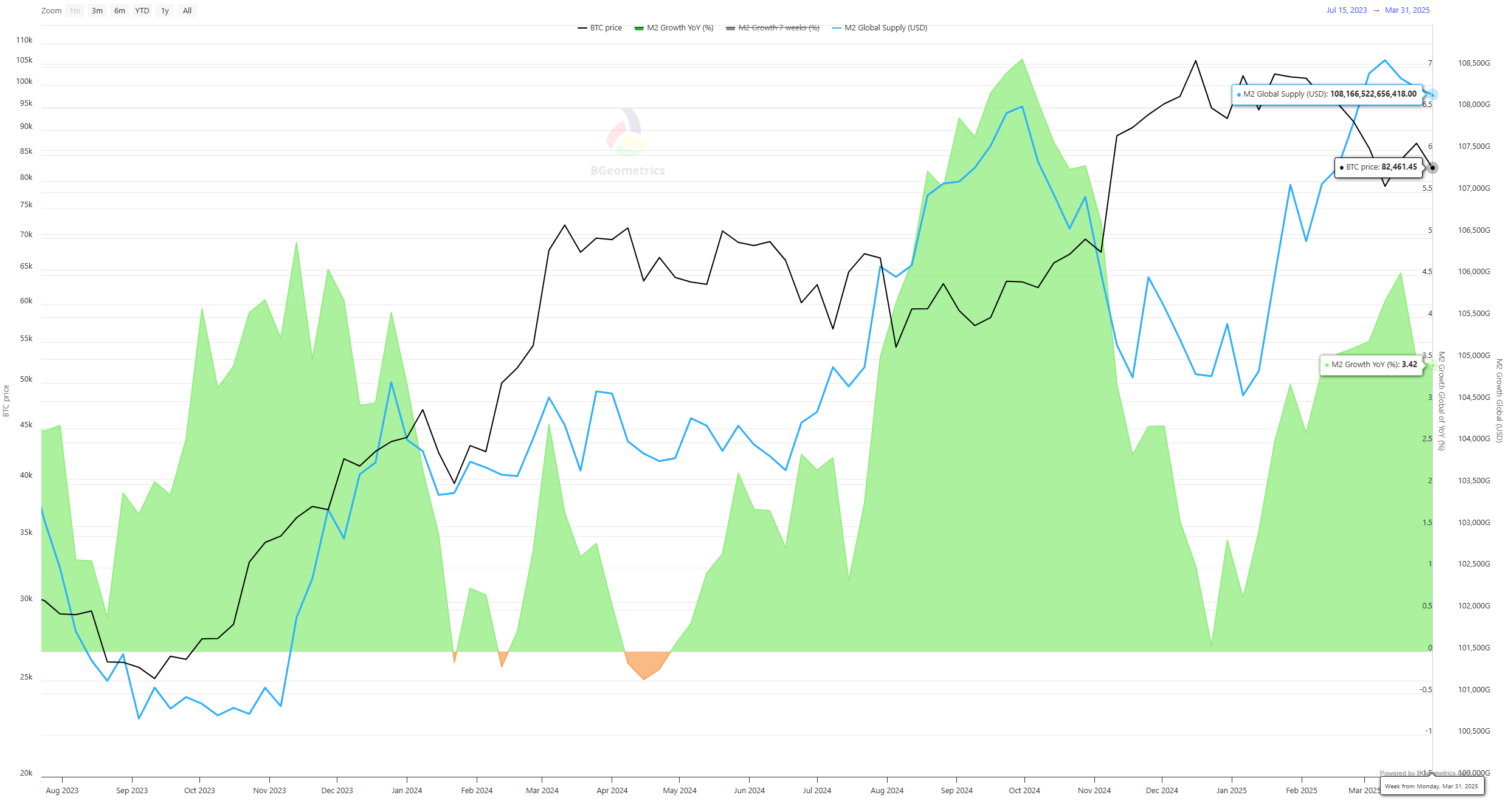

Bitcoin Poised for Potential Upsurge as M2 Money Supply Reaches $108.4 Trillion Amid Economic Uncertainty

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

The global M2 money supply has reached an unprecedented $108.4 trillion, indicating increased liquidity and potential ramifications for Bitcoin’s future.

-

This record increase in M2 comes at a time of heightened economic uncertainty, exacerbated by recent geopolitical tensions and inflationary pressures.

-

According to Maksym Sakharov, Co-Founder of WeFi Deobank, “The exact timeline for when extraordinary measures will be exhausted is unclear,” reflecting the unpredictable nature of current economic conditions.

The M2 money supply hits a record high, raising questions on how it will impact Bitcoin’s stability and future price movements amid global economic challenges.

Understanding the Implications of Rising M2 for Bitcoin Investors

With the M2 money supply surpassing $108.4 trillion, analysts are closely observing the ramifications this may have on Bitcoin’s price trajectory. Despite Bitcoin’s recent volatility, its average value remains relatively stable at around $84,000. Historical data suggests that fluctuations in the money supply often correlate with Bitcoin’s market behavior.

Investors should consider that an increase in M2 indicates greater liquidity in the financial system, which typically drives capital towards higher-risk assets like Bitcoin. This correlation is supported by past trends where significant M2 increases have preceded notable price rallies in the cryptocurrency market.

When we analyze the implications of a rising M2, it is essential to understand that funds released into the economy are often perceived as fuel for investment in assets, including cryptocurrency. The relationship between M2 and Bitcoin price gains has been evidenced throughout different monetary interventions, especially during the COVID-19 stimulus period when Bitcoin’s price surged dramatically.

Bitcoin’s Historical Performance Relative to M2 Surges

Historically, Bitcoin has tended to react positively to surges in the M2 money supply. For example, during the extensive monetary easing measures implemented in 2020, Bitcoin’s value skyrocketed from under $10,000 to a peak of over $69,000 by late 2021. This connection implies that the current surge in M2 could set the stage for similar bullish trends, albeit with a potential delay as seen in past occurrences.

Analysts highlight the likelihood of a delayed reaction from Bitcoin’s markets, with price movements typically trailing M2 increases by about two months. This delayed response could present a compelling opportunity for investors looking for significant gains as market conditions normalize and liquidity continues to flood into the system.

Geopolitical Pressures and Their Impact on Crypto Markets

While the surge in M2 is generally a positive sign for cryptocurrency markets, current geopolitical tensions, including Donald Trump’s new tariffs and ensuing trade tensions, cast a shadow on immediate market reactions. The uncertainty stemming from these developments may lead to a cautious approach from investors, delaying significant allocation towards high volatility assets like Bitcoin.

Furthermore, rising inflationary pressures could challenge the Federal Reserve’s monetary policy stance, creating a complex environment for both traditional and cryptocurrency markets. Historically, such macroeconomic headwinds have tempered the enthusiasm of investors, prompting caution even in the face of liquidity growth.

Market Sentiment and Future Outlook

As the market grapples with the implications of the surging M2 supply amidst geopolitical instability, it remains to be seen how Bitcoin will fare in the short term. Market observers suggest that once trade tensions stabilize and confidence begins to restore in financial systems, Bitcoin’s momentum may strengthen substantially.

In conclusion, while immediate gains may be stymied by macroeconomic challenges, the overarching trend of increasing liquidity paired with Bitcoin’s fixed supply suggests a compelling case for long-term investment strategies. Watching how these factors unfold will be crucial for investors aiming to position themselves advantageously in a rapidly evolving market.

Conclusion

The recent rise in the M2 money supply is a critical indicator of potential bullish movements for Bitcoin, albeit tempered by geopolitical and economic uncertainties. Investors should remain vigilant as these conditions unfold, maintaining a keen eye on the implications of liquidity on cryptocurrency valuation. Overall, historical patterns favor a positive outlook for Bitcoin, should the relationship between increased money supply and market conditions hold true.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/9/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/8/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/7/2026

DeFi Protocols and Yield Farming Strategies

2/6/2026