GENIUS Act Stablecoin Bill May Advance in House Before August, Potential Delays Possible

Contents

-

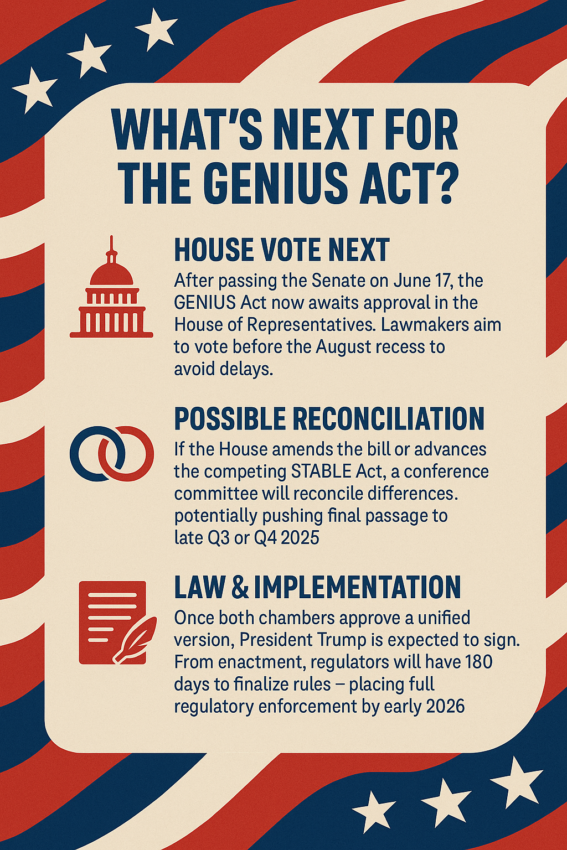

The GENIUS Act, a landmark stablecoin regulatory bill, has successfully passed the Senate and now awaits a critical vote in the House of Representatives before becoming law.

-

With bipartisan support evident in the Senate, the bill faces potential amendments in the House, where competing legislation like the STABLE Act could influence the final framework.

-

According to COINOTAG, the legislative timeline suggests that if the House acts promptly, regulatory enforcement could be fully operational by early 2026, marking a significant milestone for US crypto policy.

GENIUS Act stablecoin bill advances after Senate approval; House vote and potential reconciliation will determine final law, with enforcement expected by early 2026.

House Vote: The Next Crucial Step for GENIUS Act Stablecoin Regulation

The GENIUS Act’s passage through the Senate with a 68–30 bipartisan vote underscores a growing consensus on the need for clear stablecoin regulation in the United States. The bill now moves to the House of Representatives, where lawmakers face a pivotal decision. The House can either adopt the Senate’s version swiftly, ensuring a smooth legislative process, or pursue its own stablecoin framework through the competing STABLE Act. This divergence could lead to a conference committee to reconcile differences, potentially delaying final approval.

The House aims to vote before the August recess to maintain momentum. Key Republican members of the Financial Services Committee have expressed support for regulatory clarity, which could facilitate passage. However, some Democrats remain cautious, emphasizing stronger consumer protections and systemic risk oversight. This dynamic creates a delicate balance between fostering innovation and safeguarding financial stability.

Potential Impact of the STABLE Act and Conference Committee Negotiations

If the House opts to advance the STABLE Act or amend the GENIUS Act, a conference committee will be convened to harmonize the bills’ provisions. This process will address critical issues such as reserve requirements, audit standards, and the role of government-issued digital currencies. The committee’s negotiations will be instrumental in shaping the final regulatory landscape for stablecoins.

Both chambers must approve the reconciled bill before it proceeds to the President. The timeline for this stage is tight, with expectations for completion by mid-August. Delays could push the legislative process into late 2025 or beyond, underscoring the importance of swift bipartisan cooperation.

Presidential Signature and Regulatory Implementation Timeline

Following congressional approval, the GENIUS Act will be presented to President Trump for signature. The President has a 10-day window to sign the bill into law or allow it to become law without signature. Upon enactment, federal agencies including the Federal Reserve, OCC, FDIC, and CFTC will have 180 days to finalize implementing regulations.

This rulemaking phase will establish comprehensive oversight mechanisms, including licensing requirements, reserve audits, disclosure mandates, and enforcement protocols. The anticipated completion of these regulations by early 2026 will mark a significant advancement in the US stablecoin regulatory framework, providing clarity and stability to the crypto market.

GENIUS Act Timeline Overview: Key Dates to Watch

| House vote | By late July before recess |

| Conference Committee (if needed) | Late July – early August |

| Final congressional approval | Mid-August |

| Presidential signature | Late August (within 10 days post-passage) |

| Rulemaking completion | Approximately late February 2026 (180 days after enactment) |

Conclusion

The GENIUS Act represents a pivotal moment in US cryptocurrency regulation, aiming to establish a robust framework for stablecoins. While Senate approval signals strong bipartisan support, the House vote and potential reconciliation with competing legislation will determine the bill’s final form. Timely action is essential to maintain momentum and ensure regulatory clarity by early 2026. Stakeholders across the crypto ecosystem should closely monitor these developments to align with forthcoming compliance requirements and market standards.