Javier Milei’s LIBRA Meme Coin Association Raises Investor Concerns Amid Allegations of Profiteering and Legitimacy Issues

SOL/USDT

$3,875,175,794.90

$89.20 / $86.02

Change: $3.18 (3.70%)

-0.0160%

Shorts pay

Contents

-

Argentina’s President Javier Milei has distanced himself from the controversial LIBRA meme coin, shedding light on market manipulation fears.

-

Despite initial support, the project now faces scrutiny as blockchain analysts reveal a substantial profit of over $100 million linked to key insiders.

-

Industry experts warn that the incident underscores significant risks associated with politically tied meme coins, which can mislead unsuspecting investors.

Amid mounting controversy, President Milei retracts support for the LIBRA meme coin, raising concerns over market manipulation and investor protection.

Milei’s Controversial Endorsement of LIBRA

The LIBRA meme coin controversy began with a February 14 endorsement by President Milei, which caused a trading frenzy that catapulted the token’s market cap to an extraordinary $4.5 billion. Investors eagerly rushed to partake, driven by the perceived endorsement from the President.

This political backing was purportedly meant to bolster local businesses and economic initiatives. However, Julian Peh, the co-founder of KIP Protocol, stated that their role was purely administrative regarding fund distributions and not tied to the management of the LIBRA token.

Critically, Conor Grogan, a noted crypto analyst, highlighted that the wallet responsible for deploying LIBRA had received significant funds from an exchange that typically avoids rigorous Know Your Customer (KYC) compliance, casting doubt on the project’s integrity.

Following this revelation, Milei retracted his endorsement swiftly, stating he had not been fully aware of the project’s details at the time of the initial tweet. He noted, “I decided not to continue spreading the word after becoming informed about it. To the filthy rats of the political caste who wish to exploit this situation for their gain, I commend your vile attempts as they only further solidify our resolve.”

Impact of Blockchain Analysis on Investor Sentiment

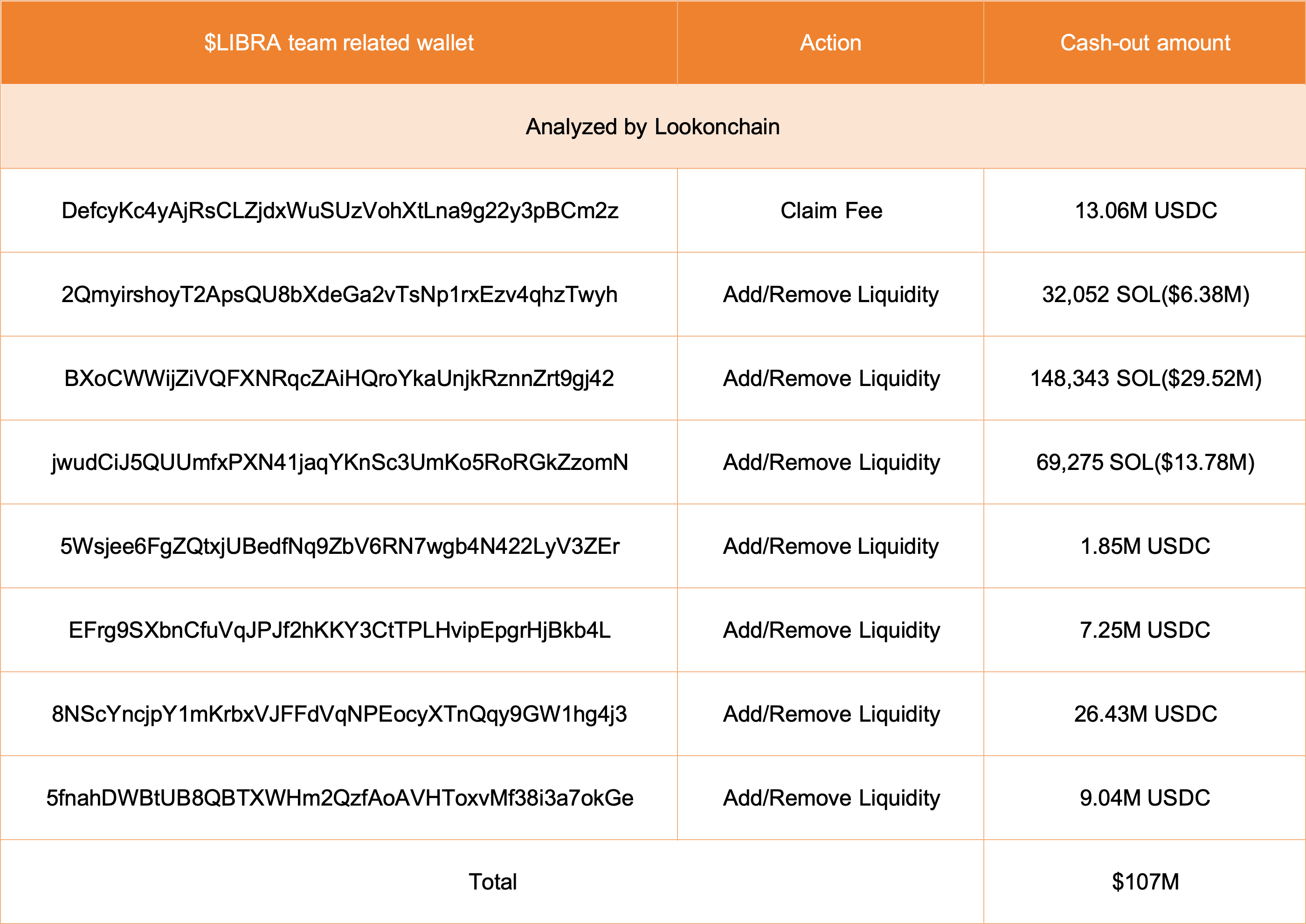

Subsequent blockchain analysis from Lookonchain unveiled alarming withdrawals of approximately $107 million linked to insiders, with notable transactions of $57.6 million in USDC and others in SOL. These patterns strongly suggest manipulative practices aimed at inflating liquidity and extracting profits during the token’s speculative surge.

Further reports by crypto analysts, including EmberCN, indicated that individuals connected to the project made at least $20.18 million by strategically purchasing the tokens shortly after the promotional tweet’s release, capitalizing on the ensuing price surge.

Regulatory Scrutiny and Industry Fallout

The tumultuous events surrounding LIBRA echo ongoing discussions about regulatory scrutiny of politically affiliated meme coins. Following January’s launch of the TRUMP token and the notable CAR meme coin in Central African Republic, traders have been quick to invest yet hesitant to fully trust the validity of such ventures.

While the previous tokens ultimately proved legitimate, LIBRA’s sudden collapse has ignited alarms across the crypto community regarding potential pitfalls of blindly engaging with politically influenced projects.

Industry veterans, like Andre Cronje, have been vocally critical. He noted that the demographic participating in these meme coins often lacks a foundational understanding of decentralized finance, weakening the overall legitimacy of the entire sector. Moreover, SlowMist’s founder, Yu Xian, outlined the necessity for accountability, arguing for legal ramifications against those initiating dubious projects to protect investors.

This situation presents a stark reminder of the speculative risks encompassing the meme coin realm, especially in contexts intertwined with political figures. The LIBRA episode is likely to intensify discussions surrounding necessary regulatory measures aimed at safeguarding investors in the increasingly complex crypto landscape.

Conclusion

The LIBRA meme coin incident serves as a crucial lesson on the volatile nature of cryptocurrency investments, especially those associated with political endorsements. The ramifications of this controversy highlight the pressing need for enhanced regulatory oversight and greater investor education to mitigate the risks inherent in speculative markets. Protecting the interests of investors is paramount in navigating the future of digital currencies and their multifaceted interplay with politics.