2025 Crypto Losses Reach $3.4B Led by Bybit Hack, 2026 Trends Uncertain: Chainalysis

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Crypto losses in 2025 reached $3.4 billion, the highest since 2022, driven by three major hacks including the $1.4 billion Bybit incident, which accounted for 69% of total thefts. Enhanced DeFi security measures limited broader vulnerabilities, while North Korean actors stole $2.02 billion through sophisticated tactics.

-

Three major incidents dominated crypto losses in 2025, comprising 69% of the $3.4 billion total.

-

Personal wallets saw increased targeting, representing about 20% of stolen funds, though individual hauls were smaller than exchange breaches.

-

North Korean hackers executed fewer but more lucrative attacks, netting $2.02 billion, up $681 million from 2024, via advanced infiltration methods.

Crypto losses in 2025 hit $3.4B from hacks, led by Bybit’s $1.4B breach. Discover key trends, DeFi security wins, and North Korea’s role. Stay informed on crypto security—read now for essential insights!

What Were the Major Crypto Losses in 2025?

Crypto losses in 2025 totaled $3.4 billion, marking the highest annual figure since 2022, primarily due to targeted attacks on large entities and personal wallets. According to a Chainalysis report released in December 2025, just three significant hacks accounted for 69% of these losses from January through early December. The largest incident, a $1.4 billion breach at crypto exchange Bybit, highlighted the vulnerability of centralized platforms and dwarfed typical hack sizes by a factor of a thousand.

Three major incidents accounted for the majority of crypto losses in 2025, while upgraded security across DeFi protocols managed to keep hackers at bay, according to Chainalysis.

Crypto hackers focused on large crypto entities and personal crypto wallets this year, resulting in $3.4 billion in crypto losses in 2025 — the highest figure since 2022.

Just three hacks in 2025, led by the $1.4 billion hack of crypto exchange Bybit, accounted for 69% of all losses from January through to early December, a Chainalysis report released on Thursday found, with the largest attacks a thousand times larger than the typical incident.

Andrew Fierman, the head of national security intelligence at Chainalysis, noted that while massive attacks drove this year’s uptick in losses, future patterns remain uncertain. “It’s difficult to predict if it will get worse in 2026, as hacks are very outlier-driven — one or two big hacks can set records for a given year. But what I can say is that this trend of big game hunting seems to be continuing, and there’s no reason to believe hacks will decline next year,” he said.

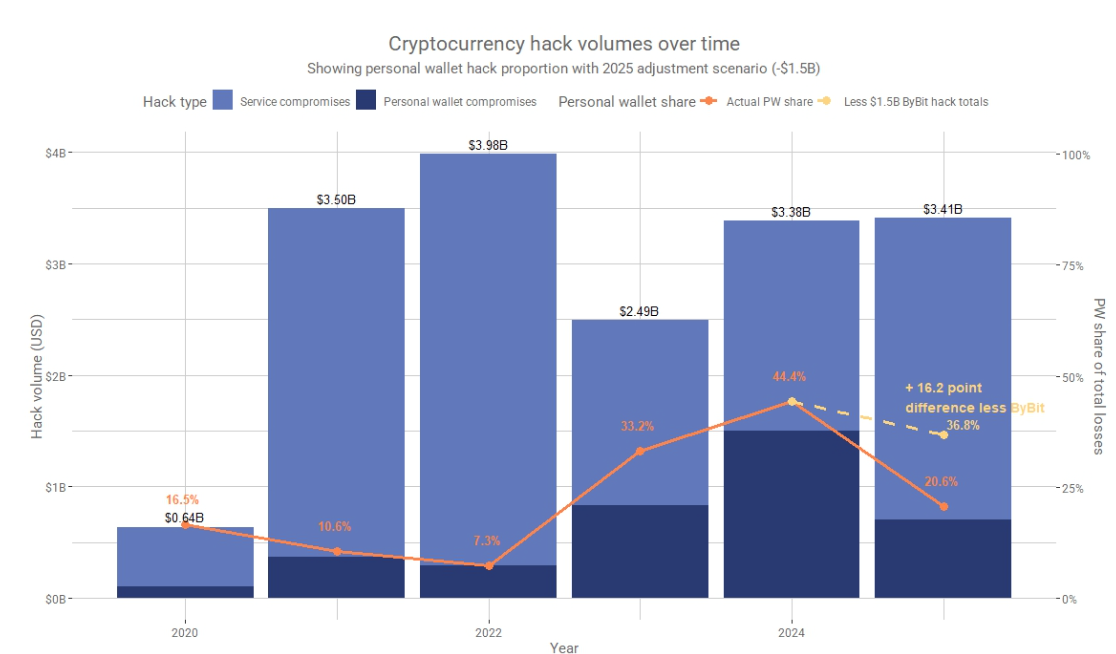

The $1.4 billion hack on Bybit contributed nearly half to 2025’s total losses. Source: Chainalysis

Why Did Personal Wallet Compromises Increase in Crypto Losses in 2025?

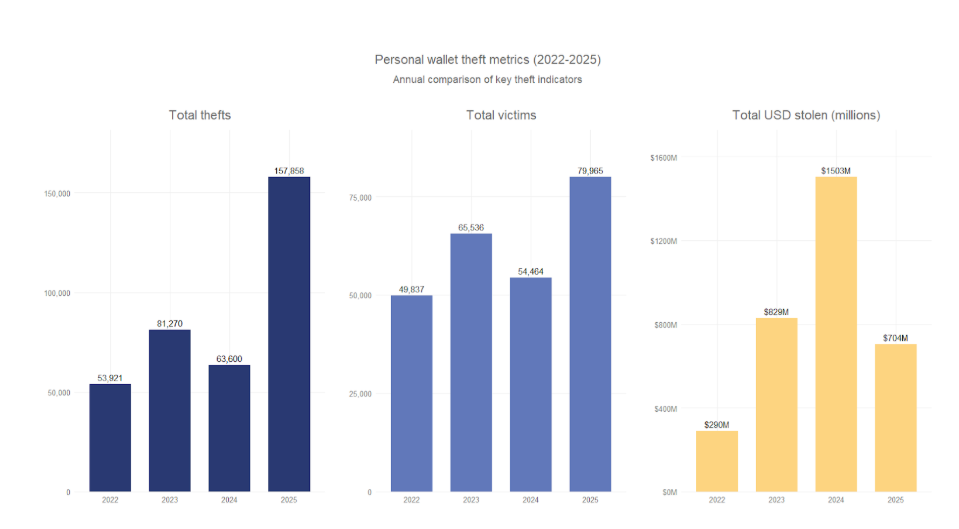

Personal wallets emerged as a key focus for cybercriminals in 2025, contributing around 20% to the overall stolen value. This shift marked a notable rise from 7.3% in 2022 and, when excluding the Bybit hack, would have approached 37% of total losses. Chainalysis data indicates that while the number of individual wallet incidents nearly tripled compared to 2022, the total amount stolen from these breaches dropped to $713 million from $1.5 billion in 2024.

Andrew Fierman explained this trend by noting the inherent differences in fund holdings. “These amounts are smaller because individual personal wallets tend to hold less funds than large exchange wallets, which pool many users’ funds together,” he stated. This focus on private keys and wallet security underscores the need for robust personal safeguards, as hackers increasingly exploit smaller, dispersed targets alongside high-value institutions.

Meanwhile, Fierman said that on the opposite end of the spectrum, personal wallets have also become a popular target for hackers.

They represented 7.3% of the total stolen value in 2022 and 44% in 2024. This year it’s around 20%, but ignoring the Bybit hack, the total would have been closer to 37%.

However, the overall amount stolen from individual hacks declined from $1.5 billion in 2024 to $713 million this year, despite the number of incidents nearly tripling compared to 2022.

More personal wallets were hacked this year, but the total stolen was far less. Source: Chainalysis

How Did DeFi Security Improvements Impact Crypto Losses in 2025?

Despite a robust recovery in decentralized finance (DeFi), with total value locked reaching approximately $119 billion—more than double the 2023 lows below $40 billion—hacks in this sector remained subdued. Chainalysis highlighted this as a significant departure from past patterns, where influxes of capital often correlated with heightened attack risks. Instead, 2025 saw DeFi protocols bolster defenses, reducing vulnerabilities even as funds returned en masse.

The analytics firm attributed this stability to advanced security implementations and a redirection of hacker efforts toward wallets and centralized exchanges. “The sustained lower level of DeFi hacks, even as billions of dollars have returned to these protocols, represents a meaningful change,” the Chainalysis team observed. This evolution suggests that proactive measures, such as multi-signature wallets and rigorous auditing, are proving effective against exploits.

DeFi total locked value is around $119 billion, according to the analytics platform DefiLlama, more than double from 2023 lows when it dropped to below $40 billion.

However, Chainalysis said the recovery in DeFi markets hasn’t led to a spike in hacks, which presents “a clear divergence from historical trends.”

Previously, areas of the industry flush with funds tended to suffer more hacks. However, in this case, Chainalysis points to DeFi protocols implementing more effective security measures and attackers shifting their focus to wallets and centralized services as possible causes.

North Korean Hackers’ Role in 2025 Crypto Losses

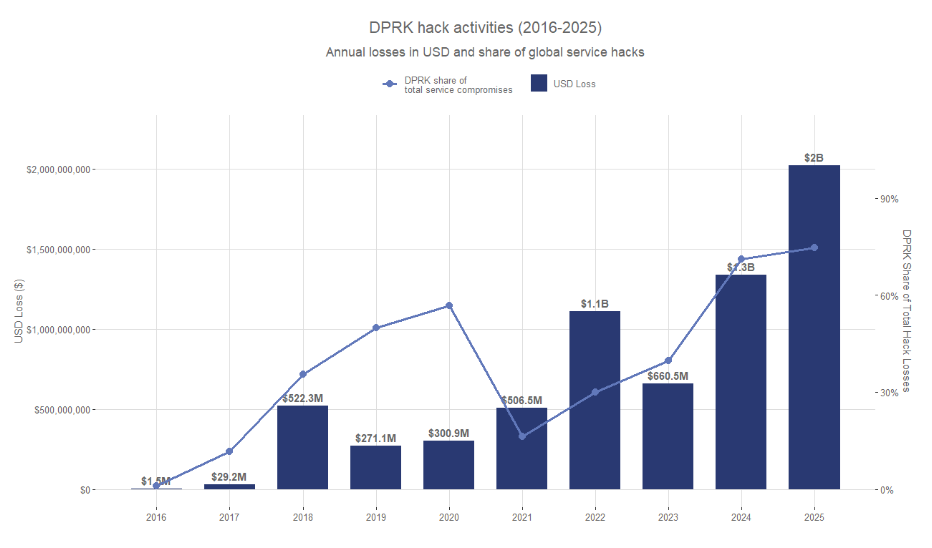

State-sponsored actors from North Korea amplified crypto losses in 2025, pilfering $2.02 billion—a $681 million increase from 2024. These groups executed fewer operations but achieved greater impact through refined strategies, including embedding operatives as IT workers within Web3 firms and exploiting third-party vendors. Chainalysis analysis revealed a pattern of patience and sophistication, prioritizing high-yield targets over volume.

North Korean hackers stole more in 2025 than in previous years. Source: Chainalysis

Analysis found that North Korean hackers executed fewer but far more damaging attacks in 2025, which Chainalysis attributes to an increase in sophistication and patience as they focus more on achieving larger scores.

Related: Solana under ‘industrial scale’ DDoS attack: Co-founder says it’s ‘bullish’

“The regime is consistently training and developing new tactics by which their operators execute their strategies, whether infiltrating Web3 companies as IT workers or finding exploitable access points through third-party vendors,” Fierman said.

“While with every hack the industry learns more about DPRK tactics, and strengthens security measures to mitigate future risk, the DPRK is also evolving, in an ongoing attempt to find new attack vectors to continue yielding returns for the regime through their ill-gotten gains.”

Magazine: Do Kwon sentenced to 15 years, Bitcoin’s ‘choppy dance’: Hodler’s Digest, Dec. 7 – 13

Frequently Asked Questions

What Caused the Spike in Crypto Losses in 2025?

The surge in crypto losses in 2025 stemmed from three major hacks totaling over $2.3 billion, with the Bybit exchange breach alone at $1.4 billion. Chainalysis reports indicate hackers targeted high-value centralized platforms and personal wallets, exploiting vulnerabilities in pooled funds and private keys for maximum impact.

How Can Users Protect Their Crypto Wallets from 2025-Style Hacks?

To safeguard crypto wallets, users should enable multi-factor authentication, use hardware wallets for cold storage, and regularly update software. Avoiding phishing scams and verifying third-party integrations are crucial, as personal wallet compromises rose to 20% of 2025 losses despite smaller individual thefts.

Key Takeaways

- Major Hacks Dominated Losses: Three incidents, including Bybit’s $1.4 billion breach, drove 69% of the $3.4 billion in crypto losses in 2025, emphasizing the risks of centralized exchanges.

- DeFi Resilience Shown: With $119 billion in locked value, DeFi avoided proportional hack increases thanks to improved security protocols, diverging from historical trends of vulnerability during growth phases.

- North Korean Threats Evolved: These actors stole $2.02 billion using sophisticated infiltration tactics; industry players must enhance vetting and monitoring to counter ongoing adaptations.

Conclusion

In 2025, crypto losses underscored persistent challenges from sophisticated hacks, with $3.4 billion stolen amid a focus on major exchanges like Bybit and personal wallets. DeFi’s strengthened security and North Korean hackers’ refined strategies highlight the need for vigilant defenses. As the sector evolves, prioritizing robust protocols and awareness will be key to minimizing future risks and fostering sustainable growth.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026