2025 Stablecoin Illicit Flows 141 Billion Dollars

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

Blockchain analysis firm TRM Labs's report published on Tuesday states that illegal entities received approximately 141 billion dollars through stablecoins in 2025; this is the highest level in the past five years. The increase does not indicate overall growth in crypto-based crimes, but it has created deep dependency in certain activities due to the advantages stablecoins offer in sanctioned networks and large-scale money transfers.

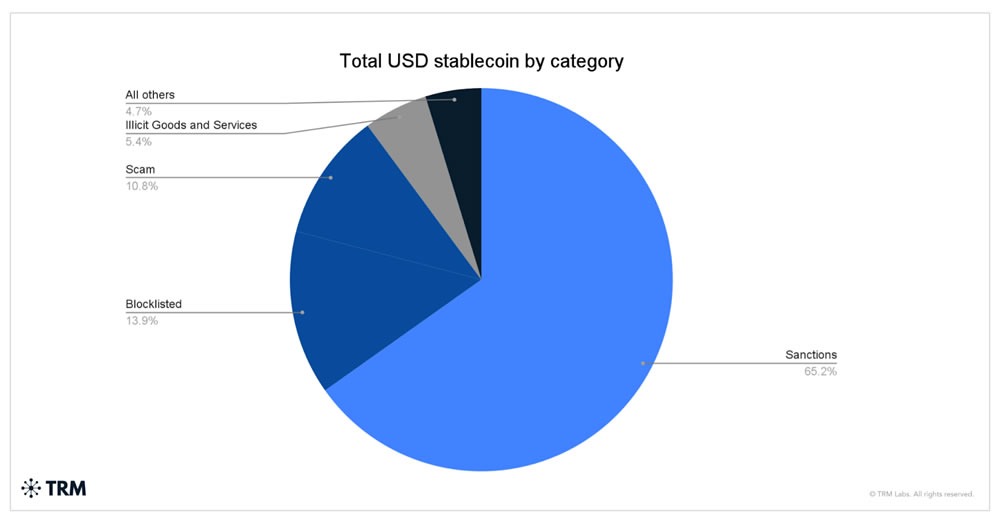

Sanctions-related activities accounted for 86% of all illicit crypto flows. Source: TRM Labs

Record Sanctions Evasion in Stablecoins

Half of the $141 billion stablecoin flow, $72 billion, is tied to the Russian ruble-pegged A7A5 token. All of its activity is concentrated in sanctioned ecosystems. Russian-linked A7 intersects with structures from China, Iran, North Korea, and Venezuela. Volume on guaranteed markets Huione reached $17 billion by year-end; 99% stablecoin.

- Illicit stablecoin volume: $141 billion (1% of total volume, $12 trillion)

- Sanctions: 86% share

- A7A5 volume: $72 billion

Crime Preferences in BTC and Stablecoins

Fraud, ransomware, and hacks prefer assets like BTC detailed analysis. This highlights the superiority of stablecoins in large transfers. Current BTC price $67,373.50 (+0.56%), in downtrend with RSI 35.36. While institutional buyers accumulate BTC, searches for "Will Bitcoin go to zero?" are increasing, but macro support is strong.

Critical Support and Resistance Levels for BTC

- Supports: S1 $65,071 (Strong, -3.34%), S2 $67,010 (Strong, -0.46%)

- Resistances: R1 $68,070 (Strong, +1.12%), R2 $70,541 (Strong, +4.79%)

Bitcoin miner Hive increased hash rate despite $91 million loss. Watch BTC futures.

Frequently Asked Questions About Illicit Stablecoin Use

Q: Why did the illicit stablecoin volume increase?

A: Sanctions evasion (86%) and operational advantages are the main factors.

Q: When is BTC preferred over stablecoins?

A: BTC dominates in ransomware, hacks, and fraud.

Q: What is the illicit ratio of total stablecoin volume?

A: Approximately 1% (141B/12T $).