21Shares Expands Crypto ETPs in Europe with Solana Addition Amid Rising US XRP Funds

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

21Shares has launched six new crypto ETPs on Nasdaq Stockholm, expanding its European offerings to include Aave, Cardano, Chainlink, Polkadot, and two basket products, bringing the total to 16 ETPs amid growing demand for regulated digital asset access.

-

21Shares manages nearly $8 billion in assets under management globally.

-

The expansion follows the recent launch of a Solana ETP and responds to strong Nordic investor interest.

-

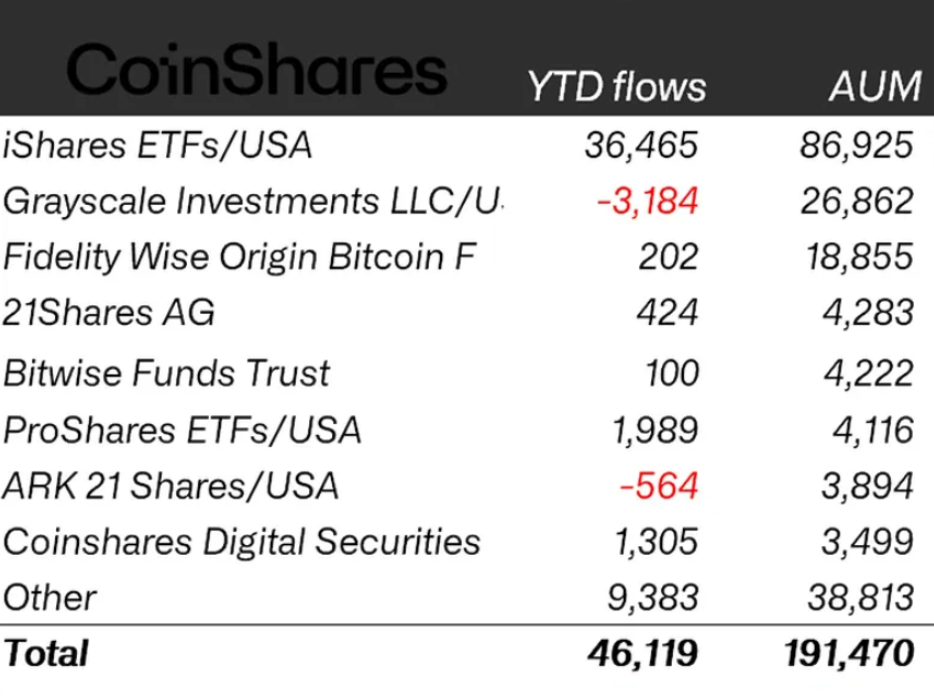

Europe’s crypto ETP market sees 21Shares holding about 4% of the $191.5 billion worldwide crypto ETF assets, per CoinShares data.

Discover how 21Shares is boosting crypto ETP options in Europe with new launches on Nasdaq Stockholm. Explore Aave, Cardano, and more for diversified digital asset investments—stay updated on regulated crypto products today.

What are the new 21Shares crypto ETPs launched on Nasdaq Stockholm?

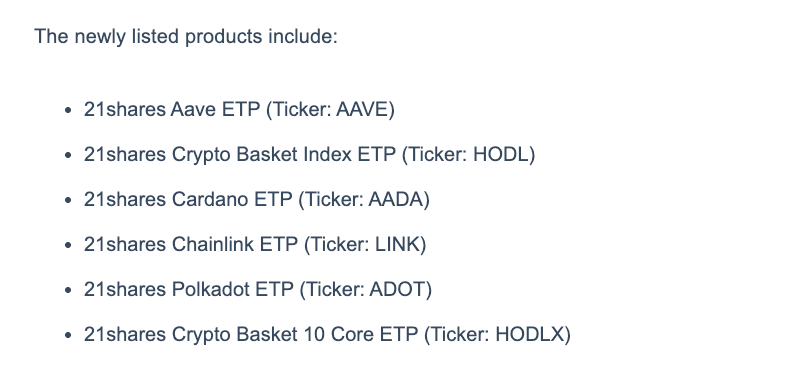

21Shares crypto ETPs on Nasdaq Stockholm now include six newly cross-listed products focused on key digital assets like Aave (AAVE), Cardano (ADA), Chainlink (LINK), and Polkadot (DOT), alongside two innovative crypto basket funds. This move enhances investor access to a broader range of cryptocurrencies through a trusted European exchange. Overall, it positions 21Shares to meet rising demand for secure, efficient exposure to the crypto market without direct ownership complexities.

How does this expansion impact European investors?

This development allows Nordic and broader European investors to diversify their portfolios with cost-effective, regulated crypto ETPs from 21Shares. According to the company’s head of EU investments, Alistair Byas Perry, the additions provide a comprehensive toolkit for both retail and institutional participants. Data from CoinShares indicates that such products are gaining traction, with Europe’s crypto ETP sector showing steady inflows amid global market volatility. Short sentences highlight the benefits: easier access, lower costs, and transparency through established exchanges like Nasdaq Stockholm.

The list of newly launched 21Shares crypto ETPs on Nasdaq Stockholm. Source: 21Shares

21Shares, a leading provider of crypto exchange-traded products, continues to solidify its presence in Europe by introducing more investment vehicles tailored for the region’s growing appetite for digital assets. With $8 billion in assets under management, the firm represents a significant player in the global crypto investment landscape. This latest initiative underscores the ongoing evolution of regulated crypto products, offering investors diversified options without the need for direct cryptocurrency handling.

The cross-listing of these 21Shares crypto ETPs on Nasdaq Stockholm marks a strategic step to cater to Nordic markets, where demand for straightforward digital asset exposure remains high. Investors can now access single-asset ETPs for prominent altcoins and thematic baskets that combine multiple cryptocurrencies, all traded on a reputable stock exchange. This expansion builds on 21Shares’ extensive European footprint, which includes listings on platforms like the SIX Swiss Exchange and Deutsche Börse Xetra.

Just prior to this announcement, 21Shares rolled out a Solana-focused ETP, reflecting the company’s proactive approach to incorporating high-potential assets into its lineup. The timing aligns with broader industry trends, as new crypto funds proliferate across continents. In Europe, these ETPs provide a bridge for traditional investors wary of unregulated crypto exchanges, emphasizing security and compliance under established financial frameworks.

21Shares manages $8 billion in AUM

Alistair Byas Perry, 21Shares’ head of EU investments, emphasized the strategic importance of this growth: “We continue to see strong demand from Nordic investors seeking diversified, cost-efficient access to digital assets through regulated exchanges.” He further noted, “This expansion enables us to offer an even broader toolkit of single-asset and index-based crypto ETPs, giving both retail and institutional investors the ability to tailor their digital asset exposure within a trusted and transparent framework.”

Globally, 21Shares oversees nearly $8 billion in assets, accounting for approximately 4% of the total $191.5 billion in worldwide crypto ETFs and ETPs, based on CoinShares research. About half of this amount stems from U.S.-based crypto ETFs developed in collaboration with ARK Invest, led by Cathie Wood. This substantial AUM demonstrates 21Shares’ expertise and reliability in the sector, attracting investors seeking professional management of volatile digital assets.

Crypto ETF/ETP issuers in Europe and the US by year-to-date inflows and AUM as of Monday. Source: CoinShares

The firm’s multi-exchange strategy ensures wide accessibility, with products available across Europe and the U.S. This diversification helps mitigate regional regulatory risks while maximizing investor reach. As crypto adoption accelerates, 21Shares’ focus on innovation positions it as a go-to provider for those entering the space through familiar investment vehicles.

Many, many crypto ETFs

The proliferation of 21Shares crypto ETPs coincides with a surge in new crypto investment products in the U.S., including the recent debut of spot XRP ETFs on Nasdaq. Following Canary Capital’s pioneering XRP ETF, additional funds from issuers like Bitwise and Grayscale are set to launch imminently, expanding options for XRP exposure. ETF analyst Nate Geraci observes that XRP now joins Bitcoin, Ether, Solana, Litecoin, and Hedera as the sixth asset backing a single-asset crypto ETF in the U.S. market.

Source: James Seyffart

Despite this enthusiasm, established Bitcoin ETFs have faced challenges. Since their January 2024 launch, these funds have encountered recent outflows, with BlackRock’s iShares Bitcoin ETF (IBIT) recording over $520 million in exits on a single day, as reported by Bloomberg ETF analyst Eric Balchunas. Year-to-date inflows for Bitcoin ETFs stand at $27.4 billion, a 30% decline from the previous year’s $41.7 billion figure, according to CoinShares data. This trend highlights the market’s sensitivity to broader economic factors and Bitcoin’s price fluctuations, such as its recent recovery above $92,000.

Europe’s more mature ETP ecosystem, exemplified by 21Shares’ expansions, offers a contrast to U.S. developments. Regulated products like those on Nasdaq Stockholm provide stability, appealing to conservative investors amid U.S. regulatory uncertainties. As global crypto inflows evolve, firms like 21Shares are pivotal in bridging traditional finance with blockchain innovations.

Frequently Asked Questions

What assets are included in the new 21Shares ETPs on Nasdaq Stockholm?

The six new 21Shares ETPs cover Aave (AAVE), Cardano (ADA), Chainlink (LINK), Polkadot (DOT), plus two crypto basket products that aggregate multiple digital assets for diversified exposure. These launches increase the total to 16 ETPs, enabling targeted or broad crypto investments through a regulated venue.

How do 21Shares crypto ETPs benefit Nordic investors?

For Nordic investors, 21Shares crypto ETPs offer secure, efficient ways to access digital assets via familiar stock exchanges like Nasdaq Stockholm. They provide low-cost diversification without handling cryptocurrencies directly, ensuring transparency and compliance that aligns with regional preferences for regulated financial products.

Key Takeaways

- European Expansion: 21Shares now lists 16 ETPs on Nasdaq Stockholm, enhancing access to altcoins and baskets for European investors.

- Global Scale: With $8 billion in AUM, 21Shares holds 4% of worldwide crypto ETF assets, per CoinShares, split between Europe and U.S. partnerships.

- Market Trends: Amid U.S. XRP ETF launches, Europe’s ETP growth counters Bitcoin ETF outflows, signaling sustained demand for regulated crypto options.

Conclusion

21Shares’ launch of new crypto ETPs on Nasdaq Stockholm reinforces its leadership in providing regulated access to assets like Aave, Cardano, and Polkadot across Europe. As the firm manages $8 billion in assets amid a dynamic global landscape, including U.S. innovations and Bitcoin ETF adjustments, investors gain more tools for strategic digital asset allocation. Looking ahead, continued expansions promise greater integration of crypto into mainstream portfolios—consider exploring these opportunities to align with emerging market trends.

Comments

Other Articles

Bitwise Launches 10 Crypto Index ETF on NYSE Arca with Heavy Bitcoin Weighting

December 11, 2025 at 05:11 AM UTC

21Shares Expands Nordic Crypto Access with New ETPs Featuring Bitcoin and Altcoins

November 20, 2025 at 03:17 PM UTC

SEC Approves Bitwise 10 Crypto ETF, Potentially Expanding XRP Exposure in Regulated Markets

November 19, 2025 at 07:54 PM UTC