21Shares TSOL Launch May Enhance Solana ETF Inflows and Institutional Interest

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

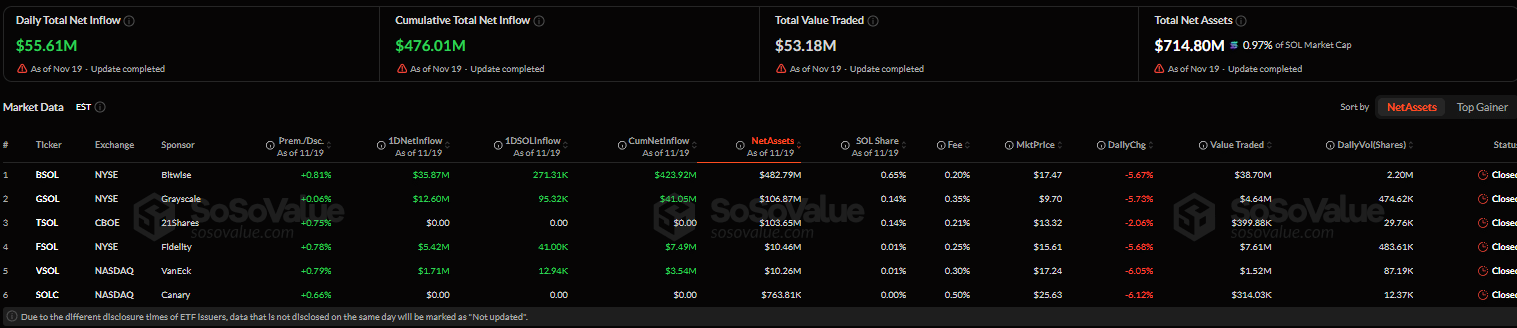

Solana ETF inflows have reached $476 million cumulatively as of November 20, 2025, driven by strong institutional demand following the launch of 21Shares’ TSOL. This surge reflects growing confidence in Solana’s ecosystem, with daily inflows hitting a record $55 million and open interest climbing to $3.2 billion.

-

Solana spot ETFs in the U.S. have seen consistent positive inflows over the past week, led by major funds like Bitwise’s BSOL.

-

21Shares’ new TSOL ETF complements its European offerings and highlights expanding crypto adoption in the U.S. market.

-

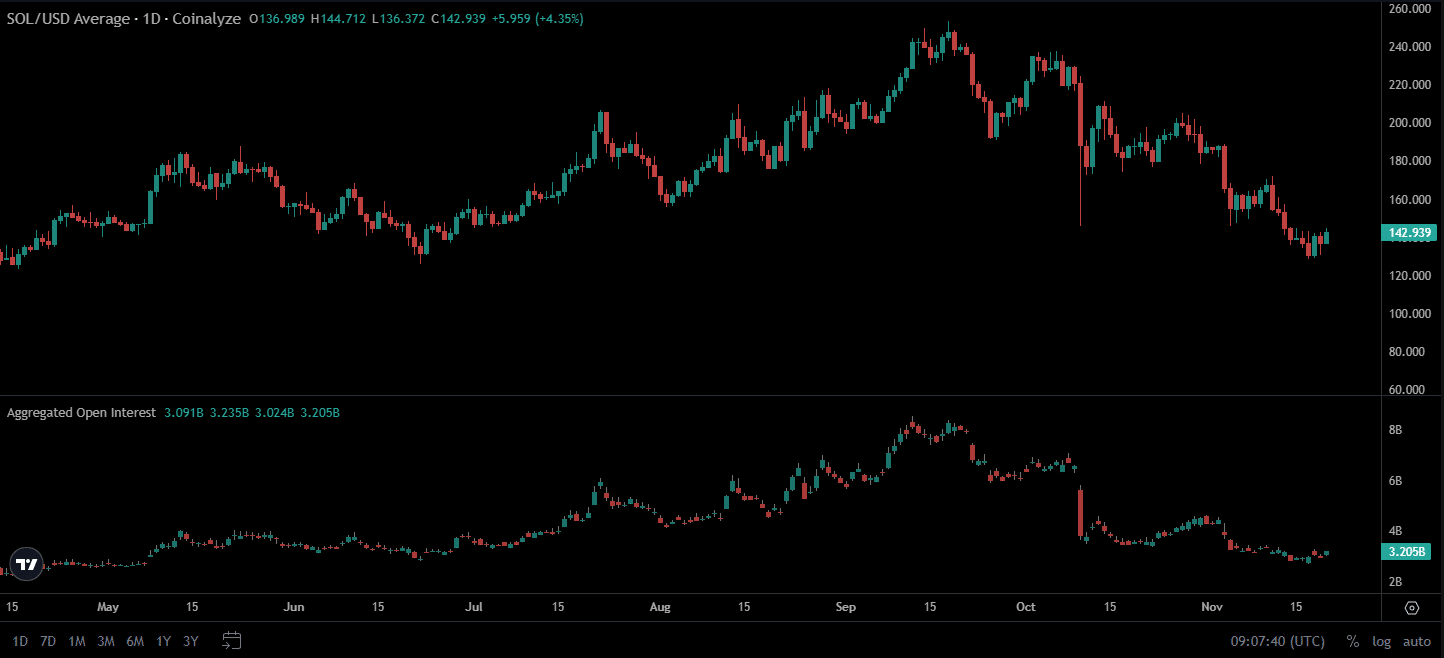

Open interest for SOL has increased by 5.28% to $3.2 billion, signaling heightened trader engagement and bullish sentiment.

Solana ETF inflows surge to $476M with TSOL launch boosting institutional interest. Explore how this impacts SOL’s price and market dynamics—stay informed on the latest crypto trends today.

What Are Solana ETF Inflows and Their Recent Trends?

Solana ETF inflows represent the net capital entering exchange-traded funds tied to the Solana blockchain’s native token, SOL, providing investors with regulated exposure to its performance. In recent weeks, these inflows have accelerated, reaching a cumulative total of $476 million by November 20, 2025, fueled by institutional adoption and new product launches. This momentum underscores Solana’s position as a leading layer-1 blockchain, attracting significant investment amid broader crypto market recovery.

How Has the Launch of 21Shares’ TSOL Influenced Solana’s Institutional Appeal?

The introduction of 21Shares’ TSOL marks a pivotal expansion for Solana ETFs in the U.S., building on the firm’s established European Solana ETP, ASOL, which remains its largest regional product. According to data from SoSoValue, daily inflows for Solana spot ETFs peaked at $55 million on November 20, with Bitwise’s BSOL leading at $35.87 million and Grayscale’s GSOL following at $12 million. This influx demonstrates sustained investor enthusiasm, as institutions seek diversified crypto portfolios. Federico Brokate, Global Head of Business Development at 21Shares, emphasized the shift in regulatory landscapes, noting that evolving frameworks are enabling transparent access to digital assets for global investors. Such developments not only enhance liquidity but also reinforce Solana’s scalability advantages, processing thousands of transactions per second at low costs, as reported by blockchain analytics platforms. The TSOL’s effective launch adds to a competitive lineup, potentially drawing more capital and stabilizing price volatility through broader market participation.

Solana ETF Inflows Continue to Gain Momentum

Over the last week, Solana ETFs have consistently posted positive flow activity, reflecting robust institutional confidence in the network’s growth potential. This trend aligns with Solana’s technical strengths, including its proof-of-history consensus mechanism, which supports high-throughput decentralized applications.

Source: SoSoValue

The steady inflows highlight Solana’s resilience, even as the broader cryptocurrency market navigates regulatory uncertainties. Analysts from firms like CoinShares have observed that such capital movements often precede price appreciations, with SOL demonstrating bullish patterns tied to ETF activity. For instance, the network’s total value locked has grown substantially, supporting DeFi and NFT ecosystems that drive long-term utility.

21Shares Launches TSOL

21Shares, a prominent issuer of cryptocurrency exchange-traded products, has officially launched its Solana ETF, TSOL, in the U.S. market. This move expands the firm’s portfolio, mirroring the success of its European counterpart, ASOL, and signals deepening integration of Solana into traditional finance. The launch arrives at a time when institutional investors are increasingly allocating to high-performance blockchains like Solana, known for its speed and cost-efficiency.

Federico Brokate, Global Head of Business Development at 21Shares, commented on the development: “It’s undeniable that crypto is here to stay and we believe it will play a massive role in the future of the financial system. It’s encouraging to see regulatory frameworks shift to allow investors around the world and in the U.S. to gain transparent exposure to the crypto asset class.”

TSOL’s entry is expected to amplify Solana’s visibility, particularly as open interest data indicates rising trader engagement. In the past 24 hours, SOL’s open interest rose by 5.28% to $3.20 billion, per Coinalyze metrics, pointing to sustained market interest and potential for further upside.

Source: Coinalyze

Beyond immediate market effects, the TSOL launch contributes to Solana’s maturing infrastructure. With over 1,000 validators securing the network and partnerships spanning gaming to payments, Solana ETFs like TSOL offer a gateway for traditional investors to participate without direct token custody. Data from Dune Analytics further illustrates this, showing a 20% increase in active addresses correlating with ETF hype, though experts caution that sustained growth depends on regulatory clarity and network upgrades.

Frequently Asked Questions

What Is Driving the Recent Surge in Solana ETF Inflows?

The surge in Solana ETF inflows, totaling $476 million as of November 20, 2025, stems from institutional demand for Solana’s high-speed blockchain capabilities. New launches like 21Shares’ TSOL have broadened access, while consistent daily inflows of up to $55 million reflect optimism about Solana’s role in DeFi and Web3 applications, backed by data from SoSoValue.

Will the TSOL ETF Impact Solana’s Price Stability?

The TSOL ETF is likely to enhance Solana’s price stability by increasing liquidity and institutional involvement, as seen in the 5.28% open interest rise to $3.2 billion. This broader participation can dampen volatility over time, making SOL more attractive for long-term holdings, according to insights from crypto analytics platforms like Coinalyze.

Key Takeaways

- Solana ETF Momentum: Cumulative inflows hit $476 million, with daily records underscoring institutional bets on Solana’s scalability.

- TSOL’s Strategic Role: 21Shares’ U.S. launch expands Solana’s ETF ecosystem, complementing European products and drawing global capital.

- Market Indicators: Open interest at $3.2 billion signals bullish trader sentiment—monitor for sustained price gains amid ETF activity.

Conclusion

The robust Solana ETF inflows and the strategic launch of 21Shares’ TSOL highlight a maturing crypto investment landscape, where institutional capital is increasingly flowing into high-performance assets like SOL. As regulatory environments evolve, these developments position Solana for greater adoption in finance and beyond. Investors should track ongoing ETF performance and network metrics to capitalize on emerging opportunities in the digital asset space.