2Z Price May Head Toward $0.16 as Liquidity Signals Upside Potential

AUCTION/USDT

$6,145,265.63

$4.90 / $4.58

Change: $0.3200 (6.99%)

+0.0050%

Longs pay

Contents

Double Zero (2Z) cryptocurrency has surged over 20% in the past 24 hours, outperforming the broader crypto market, but faced quick sell-offs pushing it below $0.15. Liquidity clusters indicate potential upside toward $0.18, signaling bullish momentum despite a bearish structure.

-

2Z’s recent 20% price spike highlights strong bull activity in the dePIN sector.

-

The token quickly erased gains due to seller pushback, reverting to the descending channel.

-

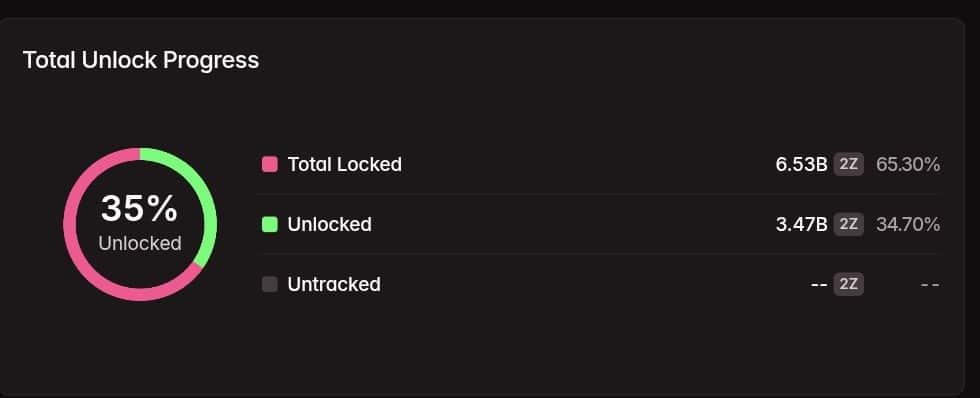

Liquidity analysis shows dense clusters above $0.16, with 65% of supply locked reducing immediate sell pressure.

Explore Double Zero (2Z) price action: 20% surge meets resistance at $0.18. Bulls defend key levels amid market outperformance. Stay updated on crypto trends and trading insights for informed decisions.

What is the current price outlook for Double Zero (2Z)?

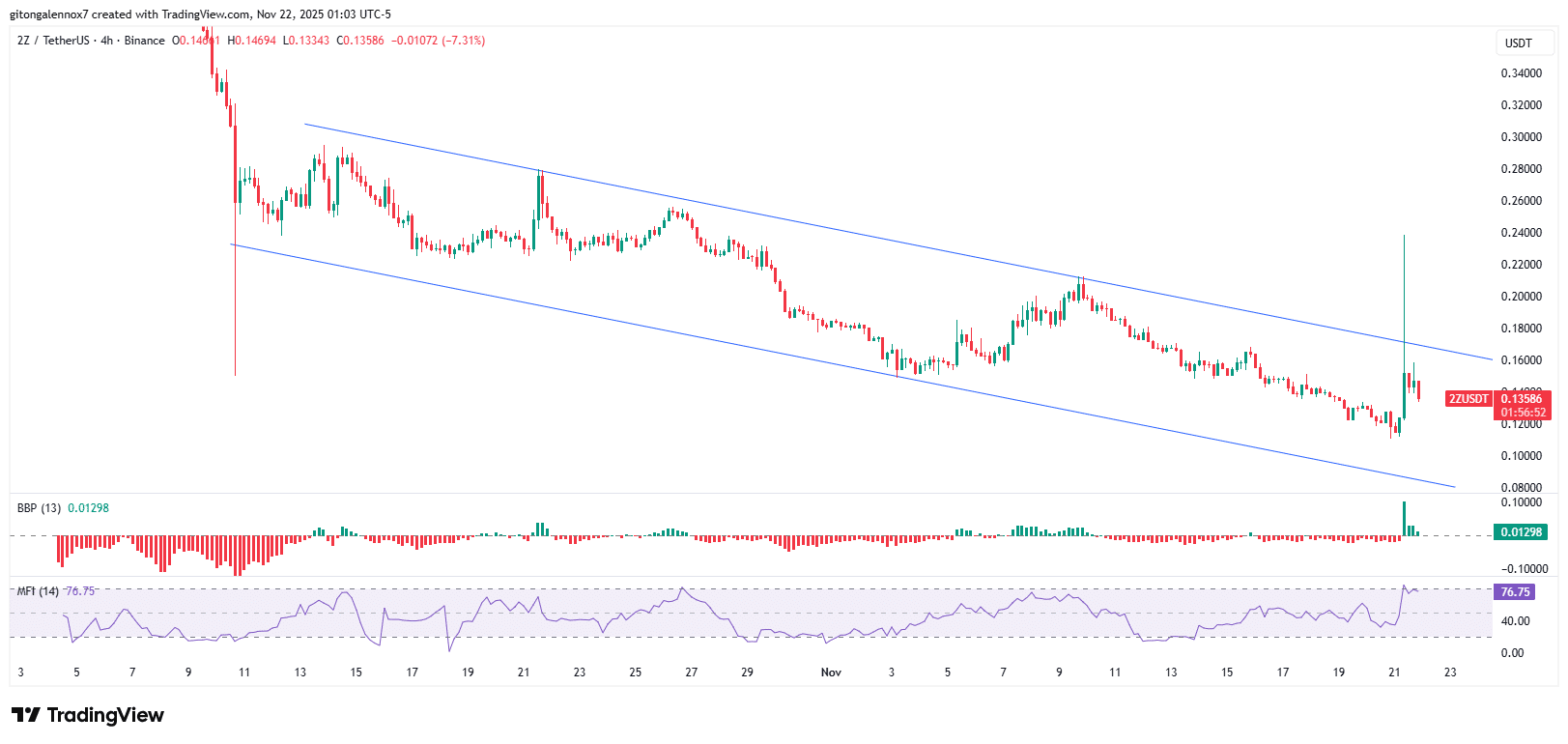

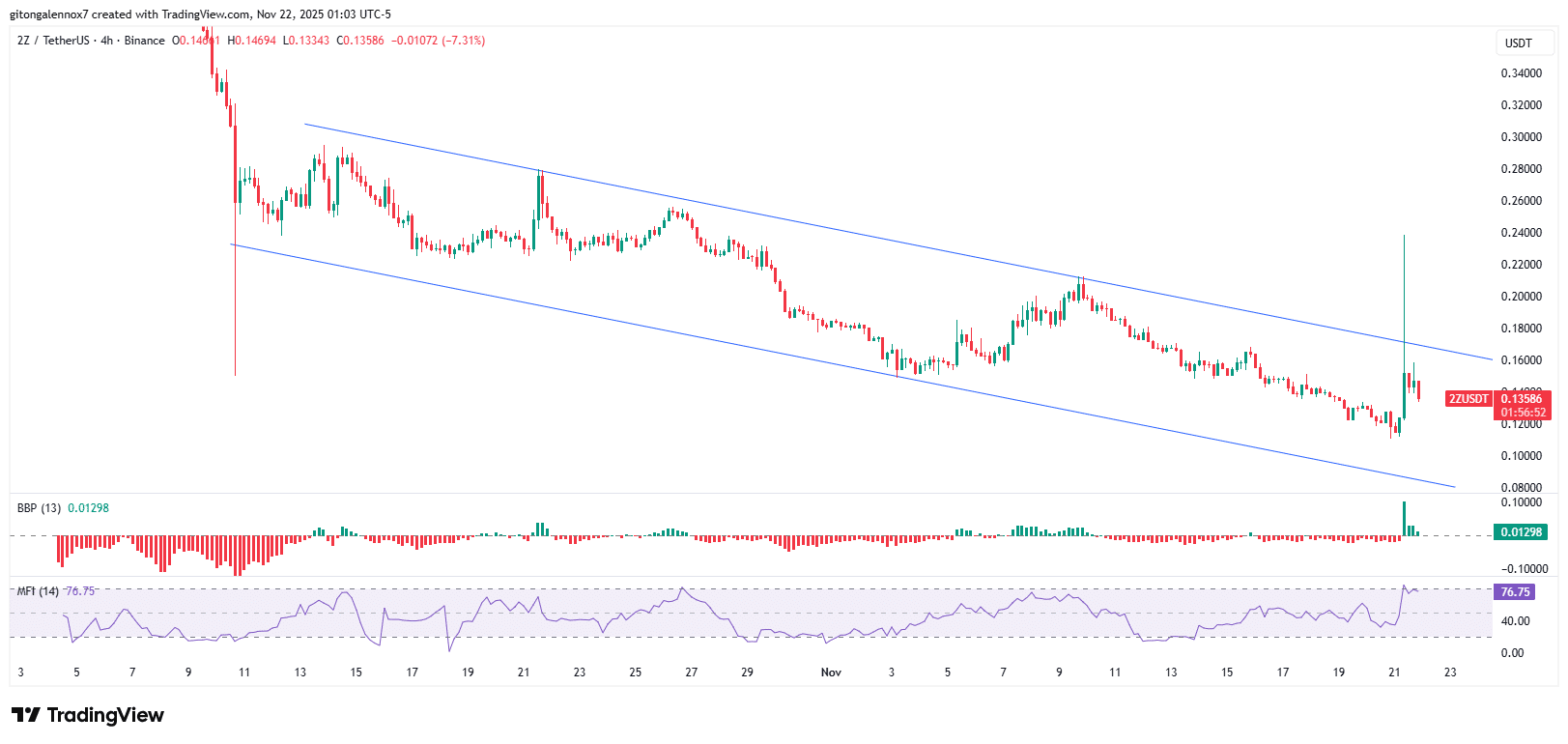

Double Zero (2Z), a prominent token in the dePIN sector, recently experienced a sharp 20% price increase within 24 hours, reaching a high of $0.2376 and breaking out of a descending channel on the 4-hour chart. However, this bullish move was swiftly countered by sellers, invalidating the breakout and driving the price back below $0.15. Despite the bearish overall structure, indicators like the Bull Bear Power (BBP) and Money Flow Index (MFI) suggest sustained bull strength, with potential for recovery if resistance at $0.18 is breached.

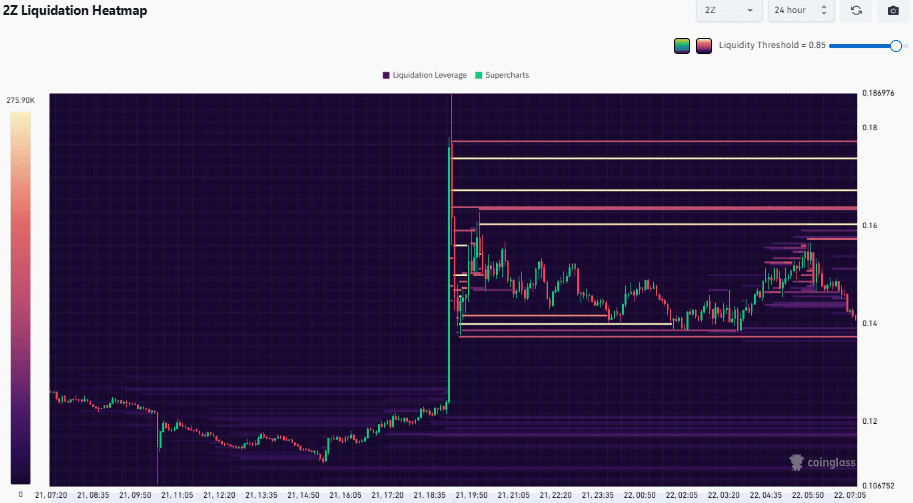

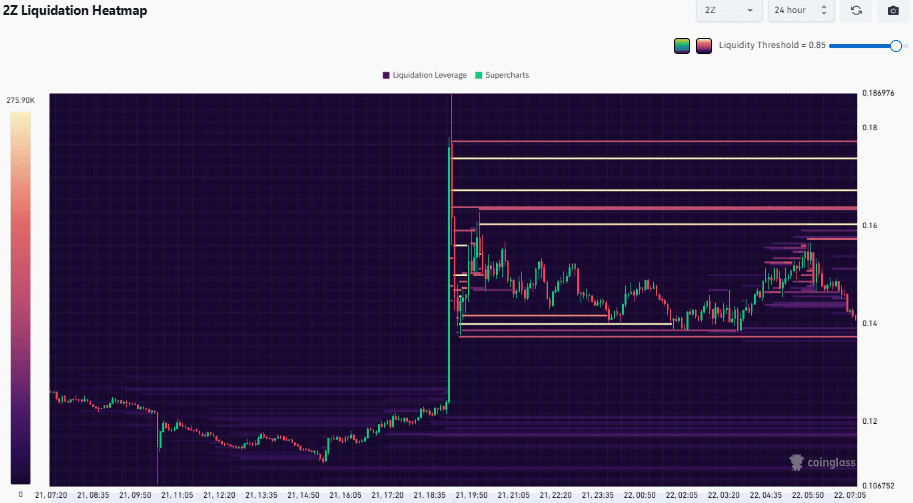

How do liquidity clusters influence 2Z’s price direction?

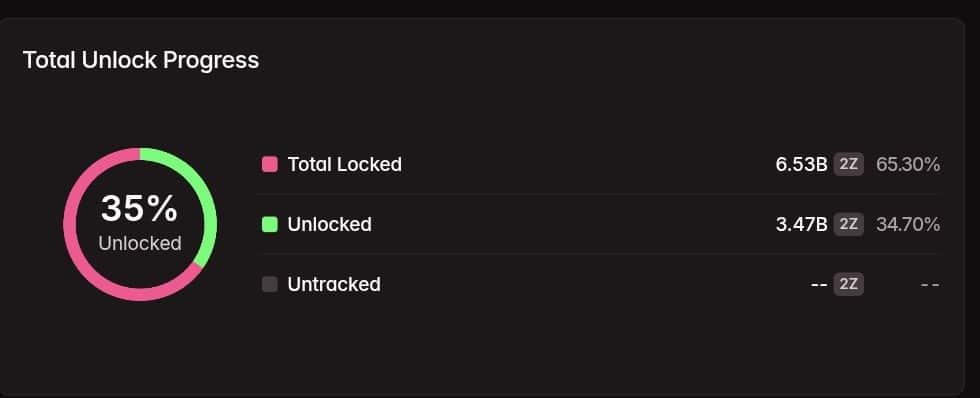

Liquidity clusters for Double Zero (2Z) are concentrated between $0.16 and $0.18, areas yet to be fully tapped, which could propel the price higher upon clearance. Data from market analysis tools reveals denser buy orders in these zones compared to below $0.14, indicating trader bets on upside momentum. According to TradingView insights, the current price proximity to lower supports makes an upward bounce more probable, though dynamic order books could shift if broader market weakness intensifies. Expert analysis from on-chain metrics, such as those tracked by CoinGlass, supports this, showing that 65% of the token’s supply remains locked, minimizing short-term sell pressure from unlocks scheduled over a year away. Short sentences for clarity: Bulls are defending the channel’s upper half. MFI dipped slightly from 80 to 76, reflecting minor capital outflow post-spike. A retest above $0.18 would confirm a structural flip to bullish.

Source: TradingView

In the dePIN sector, 2Z has extended its lead not just against peers but across the top 100 cryptocurrencies, as reported by CoinMarketCap data. This outperformance underscores growing investor interest in decentralized physical infrastructure networks, where 2Z plays a key role. The token’s ability to hold above the channel’s midpoint despite bearish pressures highlights resilient bull participation. Financial experts note that such sessions often precede volatility spikes, advising traders to monitor volume for confirmation.

Frequently Asked Questions

What caused the recent 20% surge in Double Zero (2Z) price?

The Double Zero (2Z) price surged over 20% due to heightened bull activity breaking a descending channel on the 4-hour chart, driven by sector-wide momentum in dePIN tokens. CoinMarketCap data confirms this outperformance against the broader market, with indicators like BBP turning positive. However, quick profit-taking by sellers erased most gains, stabilizing around $0.15.

Is Double Zero (2Z) a good investment in the current crypto market?

Double Zero (2Z) shows promise with liquidity clusters pointing to upside potential beyond $0.16, especially as 65% of supply is locked per Tokenomist figures, reducing near-term sell pressure. In a bearish structure, breaking $0.18 could signal recovery, but broader market weakness poses risks. Investors should assess personal risk tolerance and consult diversified strategies for voice-activated queries like this.

Source: CoinGlass

Further examination of the charts reveals that while lower liquidity below $0.14 exists, it pales in comparison to upper zones, reinforcing the likelihood of continued upward pressure. Market participants have noted in recent sessions that 2Z’s resilience stems from its utility in decentralized networks, attracting steady inflows. As per authoritative sources like CoinGlass, these clusters act as magnets for price action, often leading to tested breakouts.

Source: Tokenomist

The locked supply aspect, detailed in Tokenomist reports, further bolsters confidence, as it delays any significant distribution events. In professional financial journalism, such factors are critical for assessing long-term viability in volatile markets like crypto.

Key Takeaways

- 2Z’s Market Outperformance: Double Zero gained over 20% in 24 hours, leading the dePIN sector and top 100 cryptos per CoinMarketCap, though gains were partially erased by sellers.

- Bullish Indicators Amid Bears: BBP and MFI point northward, with bulls defending channel levels, but a break above $0.18 is needed for structural change.

- Upside from Liquidity: Clusters at $0.16-$0.18 suggest higher price potential; monitor for confirmation to capitalize on recovery signals.

Conclusion

In summary, Double Zero (2Z) demonstrates robust bull strength through its recent surge and liquidity positioning, outperforming the crypto market despite a prevailing bearish structure. With key resistance at $0.18 and locked supply mitigating sell pressure, the token’s path forward hinges on broader market dynamics. Traders should watch for breakout confirmations, positioning for potential gains in the dePIN sector as adoption grows in the coming months.