Aave DAO and Labs Clash Over AAVE Protocol Revenue Ownership

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

The Aave ownership crisis revolves around disputes between the Aave DAO and service providers like Aave Labs over protocol fees and revenue control. Triggered by a CowSwap integration that redirected swap fees away from the DAO, the conflict highlights tensions in decentralized governance, potentially costing the DAO over $10 million annually.

-

Aave Labs, a key contractor, has been paid by the DAO for building features, leading to claims that all associated revenues belong to the community.

-

The recent switch from ParaSwap to CowSwap has sparked backlash, as it bypasses revenue sharing with the DAO treasury.

-

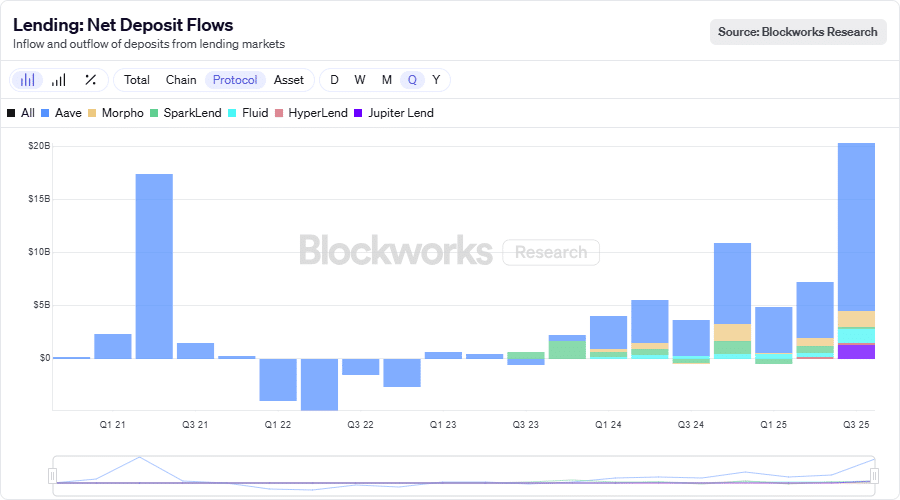

On-chain data indicates Aave saw $15 billion in net deposit flows in Q3 2025, underscoring the protocol’s growth amid internal disputes.

Discover the Aave ownership crisis: DAO vs. providers battling for fees after CowSwap integration. Learn impacts on revenue and tokenholders. Stay informed on DeFi governance—explore key insights now.

What is the Aave ownership crisis?

Aave ownership crisis refers to the ongoing conflict within the Aave ecosystem where the Decentralized Autonomous Organization (DAO) and its service providers, particularly Aave Labs, are clashing over control of protocol-generated fees and revenues. At its core, the dispute stems from the belief that the DAO, having funded the development of key features like user interfaces and branding, rightfully owns all associated income streams. A pivotal moment came with the integration of CowSwap, which altered fee flows and excluded the DAO, prompting widespread criticism from governance participants and token delegates.

How has the CowSwap integration impacted Aave’s revenue sharing?

The shift from ParaSwap to CowSwap marked a significant turning point in the Aave ownership crisis. Under the previous ParaSwap arrangement, swap fees were shared with the Aave DAO treasury, ensuring community benefits from protocol activity. However, the new CowSwap setup directs these fees to private service providers, sidelining the DAO entirely. One token delegate estimated this change could result in an annual revenue loss exceeding $10 million for the DAO, based on weekly transfers of around $200,000. This move has fueled accusations that contractors are privatizing assets developed with DAO funds. Governance discussions on platforms like X have amplified these concerns, with delegates arguing it undermines the decentralized ethos of the protocol. Despite Aave’s robust performance, with over $15 billion in net deposit flows recorded in Q3 2025 according to Blockworks Research, the revenue redirection raises questions about long-term sustainability and fair value accrual to AAVE tokenholders. Experts emphasize that transparent governance is crucial in DeFi to prevent such erosions of community control.

The Aave community is embroiled in an ownership crisis. Both the DAO (Decentralized Autonomous Organization) and the protocol’s service providers are fighting for revenue.

At the centre of the crisis is Aave Labs, the service provider or one of the contractors that builds part of the DeFi lending protocol’s features.

Who owns Aave’s fees?

According to multiple governance participants, contractors, including the Labs, were paid directly by the Aave [AAVE] DAO.

As a result, the user interfaces, brand, and other features and associated fees and revenues are “fully owned” by the DAO because it paid for them.

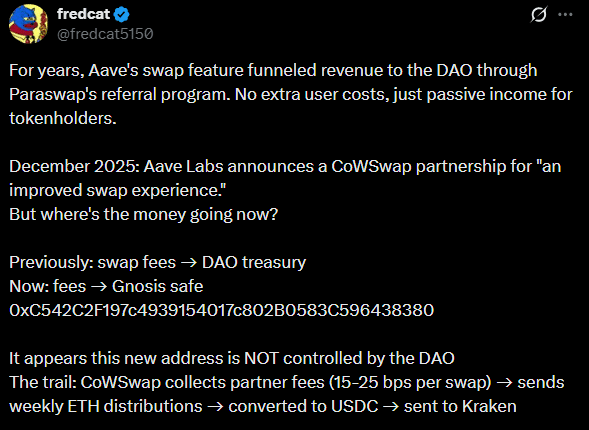

However, a recent CowSwap integration changed that perception.

Under the new setup, swap fees no longer flowed to the DAO treasury, triggering backlash from delegates.

One of the token delegates estimated the DAO’s annual revenue loss to be at least $10 million.

“A loss to the DAO over 365 days seen by at least over $10m, assuming a transfer of only $200k each week.”

Critics argued that the ParaSwap, which was replaced by CowSwap, shared revenue with the DAO. However, the current arrangement sidelined the DAO for the private service provider.

Source: X

Delegates raise the alarm

Earlier this year, Aave Labs proposed a tokenization product, Horizon, alongside a token, but it was shot down by the DAO.

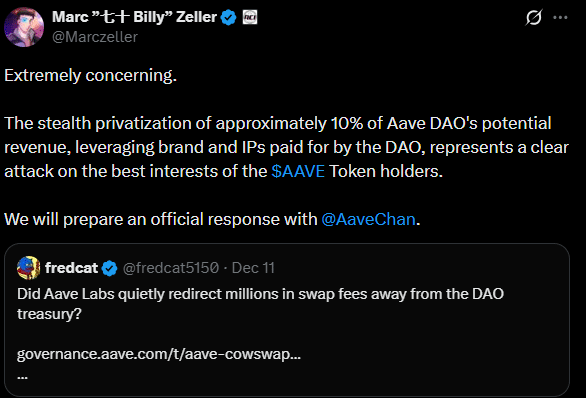

For Marc Zeller, Founder of a token delegate and DAO service provider, Aave-Chan Initiative, Aave Labs’ “privatization” of protocol revenue was a “concerning” and “clear attack” on tokenholders.

Source: X

Another VC partner, Louis, echoed a similar stance and added,

“The biggest threat to any token and DAO is a competing, independent equity vehicle. AAVE tokenholders should push back much more aggressively against this long-term risk.”

Aave Labs defends itself

The Aave token buyback is currently being undertaken by the DAO and is one of the mechanisms by which value accrues to tokenholders.

However, Stani Kulechov, the Founder of Aave stated that,

“Aave Labs has been contributing to the protocol and its benefit for over 8 years…It is responsible for innovation with Aave V4 and similar other protocol iterations and GHO, all those primitives that we built accrue revenue to the Aave DAO.”

On-chain data from Blockworks Research showed Aave recorded more than $15 billion in net deposit flows during Q3 2025.

Source: Blockworks

That said, the alcoin’s price didn’t get caught up in the debate, as it remained range-bound around $200 for the past week.

Frequently Asked Questions

What caused the backlash in the Aave ownership crisis?

The backlash in the Aave ownership crisis was primarily caused by the CowSwap integration, which redirected swap fees away from the DAO treasury to private providers. Previously, ParaSwap shared these revenues with the community, but the new arrangement has led to estimated annual losses of over $10 million, prompting delegates to demand greater transparency and control.

How does the Aave DAO accrue value to tokenholders amid this crisis?

The Aave DAO accrues value to tokenholders through mechanisms like ongoing token buybacks funded by protocol revenues and governance proposals that enhance ecosystem utility. Despite the current disputes, innovations such as Aave V4 and the GHO stablecoin continue to drive adoption, with Q3 2025 seeing $15 billion in net deposits, ensuring long-term benefits for AAVE holders.

Key Takeaways

- DAO Ownership Claims: The Aave DAO asserts full ownership of protocol features and revenues, as it has directly funded contractors like Aave Labs for development work.

- Revenue Redirection Risks: The CowSwap integration exemplifies how changes in service providers can divert millions in fees, threatening decentralized governance principles.

- Push for Accountability: Token delegates urge stronger pushback against privatization attempts to protect tokenholder interests and sustain protocol growth.

Conclusion

The Aave ownership crisis underscores the delicate balance between innovation and community control in DeFi lending protocols like Aave. With the DAO and providers such as Aave Labs at odds over fee ownership and revenue sharing, particularly following the contentious CowSwap integration, the debate highlights the need for robust governance to safeguard tokenholder value. As Aave continues to thrive with substantial deposit flows and upcoming upgrades like V4, resolving these tensions could strengthen its position in the evolving crypto landscape—community members are encouraged to participate in governance to shape a more equitable future.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026