Aave DAO Questions Fees from CoW Swap Integration Flowing to Aave Labs

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

The Aave DAO dispute centers on fees from the CoW Swap integration, where Aave Labs routes revenue to a private address instead of the DAO treasury, sparking concerns over transparency and governance. This has led to debates about revenue sharing and DAO control in DeFi protocols.

-

Aave DAO members accuse Aave Labs of diverting at least $200,000 weekly in Ether fees from CoW Swap swaps to a private address.

-

DAO pseudonymous member EzR3aL highlighted the lack of consultation, arguing fees should benefit token holders.

-

Aave Labs defends the setup, stating they funded adapter development and control front-end components, with protocol changes remaining under DAO oversight; total value locked in Aave exceeds $10 billion as per DeFiLlama data.

Aave DAO dispute erupts over CoW Swap fees routed to Aave Labs, raising governance issues in DeFi. Explore the clash, expert views, and implications for token holders. Stay informed on the latest crypto developments.

What is the Aave DAO dispute involving Aave Labs and CoW Swap fees?

The Aave DAO dispute revolves around the allocation of fees generated from the integration of the Aave protocol with CoW Swap, a decentralized exchange aggregator. Members of the Aave decentralized autonomous organization (DAO) have raised alarms that these fees, estimated at over $200,000 in Ether per week, are being directed to a private address controlled by Aave Labs rather than the DAO’s treasury. This controversy underscores tensions between the community-governed DAO and the primary development entity, Aave Labs, regarding revenue distribution and decision-making processes in decentralized finance (DeFi).

The integration allows users to perform crypto asset swaps directly within the Aave ecosystem, but the routing of swap fees has ignited a broader discussion on transparency and the principles of decentralization. According to forum discussions on the Aave governance platform, this arrangement could deprive the DAO of up to $10 million in annual revenue, prompting calls for immediate clarification and potential governance proposals to rectify the issue.

How are fees from CoW Swap integrations handled in DeFi protocols like Aave?

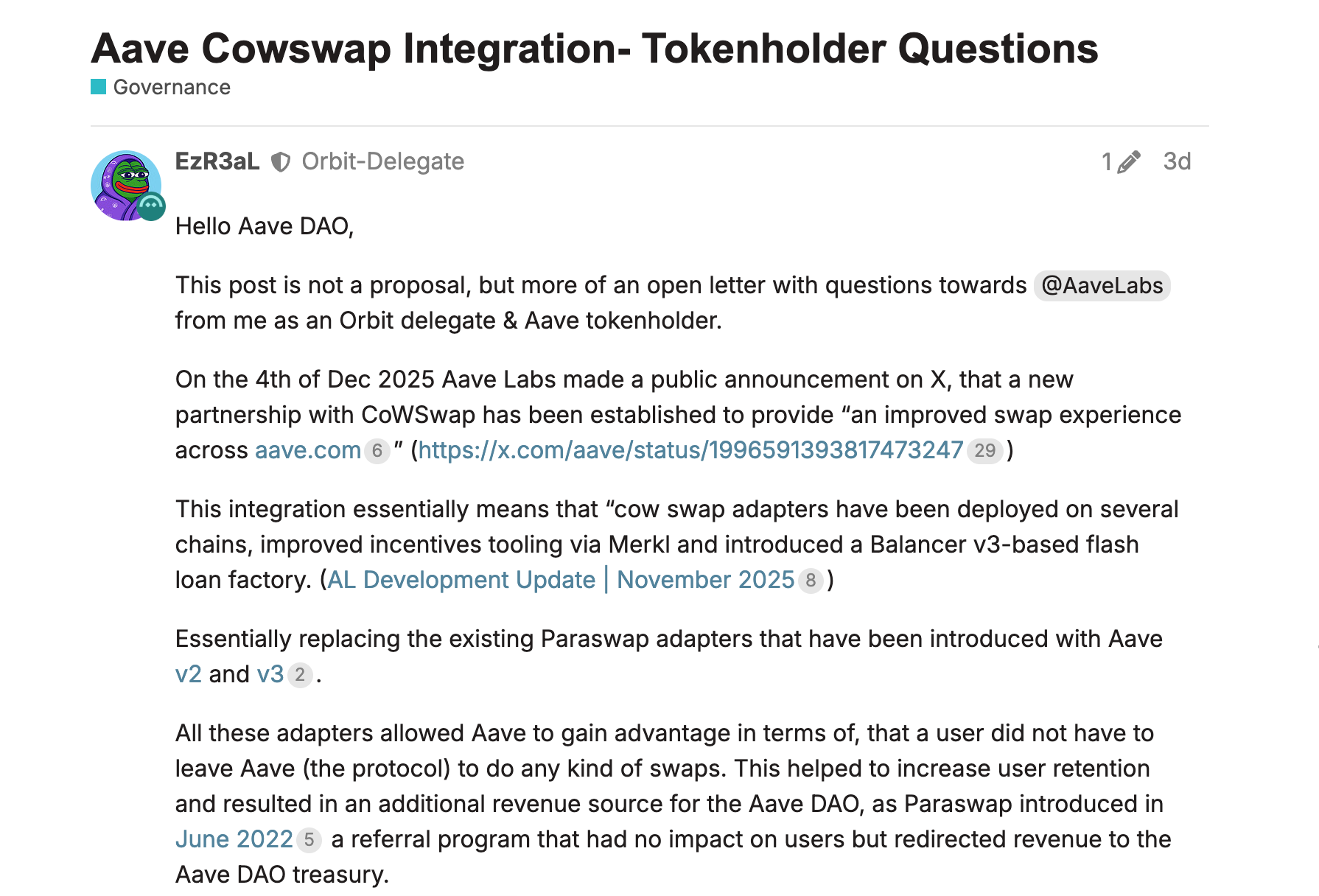

In DeFi protocols such as Aave, fees from integrations like CoW Swap are typically intended to support the ecosystem’s treasury, funding further development, security audits, and community initiatives. However, the current setup directs these fees to an on-chain address managed by Aave Labs, the entity responsible for building and maintaining core products. Pseudonymous DAO member EzR3aL pointed out that no prior consultation occurred with the DAO before implementing this fee structure, which they argue violates the spirit of community governance.

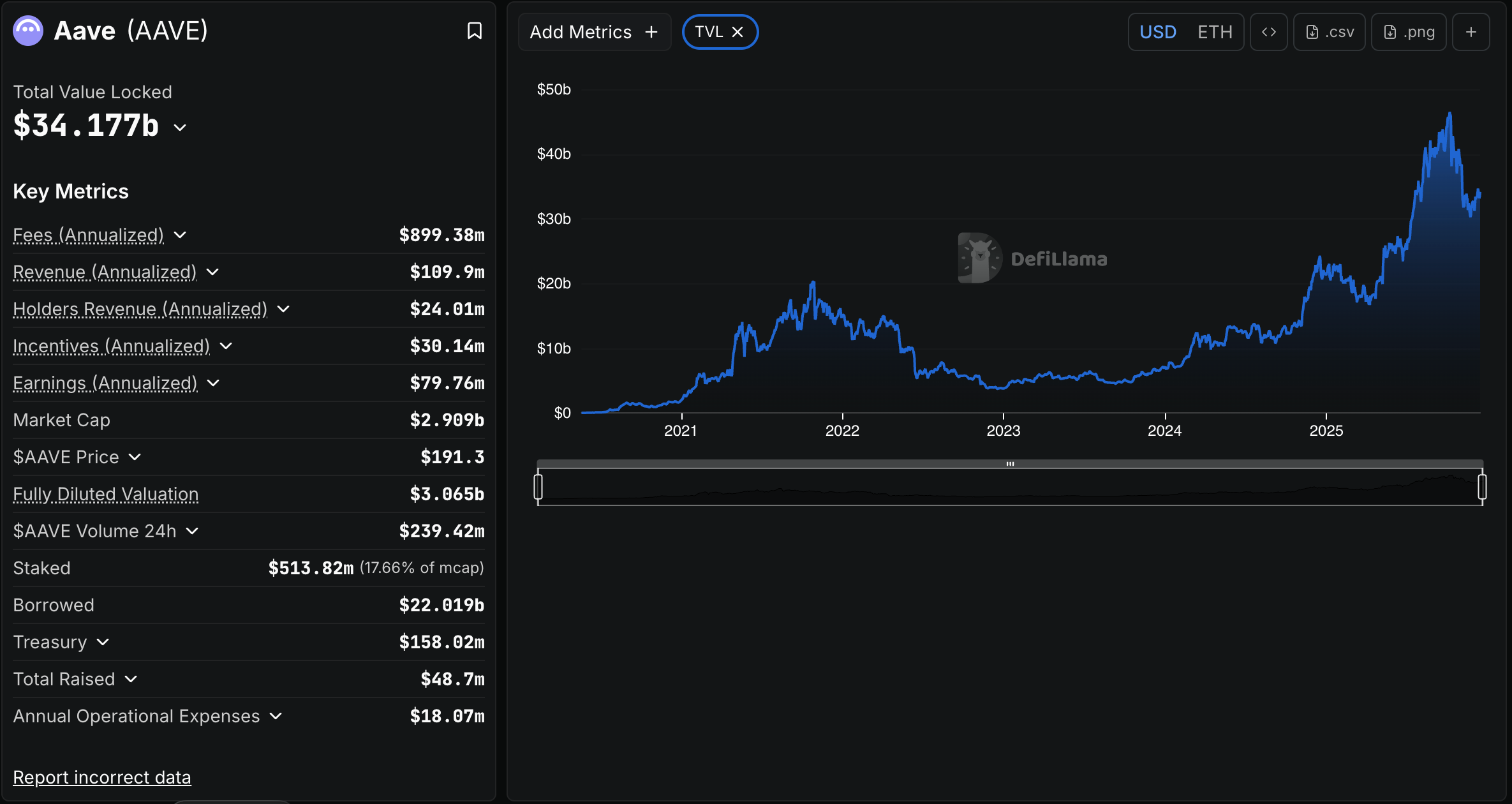

Aave Labs has countered that front-end elements, including website and application interfaces, fall under their purview, and they solely funded the development of the “adapters”—smart contract code enabling seamless swaps. Data from DeFiLlama indicates Aave’s total value locked (TVL) stands at over $10 billion, highlighting the protocol’s scale and the significance of these revenue streams. Marc Zeller, founder of the Aave-Chan Initiative, a key delegate in Aave governance, described the decision as “extremely concerning,” stating, “Aave Labs, in the pursuit of their own monetization, redirected Aave user volume towards competition. This is unacceptable.”

This handling of fees illustrates the nuanced balance in DAOs between centralized development teams and decentralized decision-making. While protocol-level adjustments, such as interest rate policies and smart contract upgrades, remain firmly under DAO control, ancillary revenue from integrations has become a flashpoint. Community members assert that the original adapter technology was DAO-funded, entitling the organization to the proceeds. The debate, initiated via a governance forum post on the Aave platform, has garnered significant attention, with calls for Aave Labs to disclose full details on fund usage and adapter development costs.

The governance forum post that sparked the debate. Source: Aave Governance

The ongoing Aave DAO dispute also reflects broader challenges in DeFi governance. DAOs offer advantages like transparent voting and community involvement, but they can struggle with enforcement and alignment between contributors. As Aave continues to innovate—recently launching a retail savings app offering up to 9% APY to rival traditional banks—this internal friction could impact user trust and protocol adoption.

The total value locked in the Aave protocol and a financial overview of the DeFi platform. Source: DeFiLlama

Efforts to resolve the dispute may involve formal proposals on the Aave governance forum, where token holders can vote on redirecting fees or establishing clearer policies for future integrations. Representatives from Aave Labs emphasized that while they appreciate the community’s input, their role in innovation justifies certain revenue allocations to sustain development efforts.

Frequently Asked Questions

What caused the Aave DAO dispute with Aave Labs over CoW Swap fees?

The dispute arose when DAO member EzR3aL discovered that swap fees from the CoW Swap integration were routed to a private Aave Labs address instead of the DAO treasury. This setup, lacking prior DAO approval, is projected to divert around $10 million annually from token holders, prompting questions on governance and revenue rights in about 45 words of direct explanation.

Why is revenue sharing important in Aave’s DeFi ecosystem?

Revenue sharing in Aave’s DeFi ecosystem ensures that protocol-generated fees support community-driven initiatives, security enhancements, and sustainable growth, fostering trust among token holders. Without it, as seen in the current Aave DAO dispute, imbalances can erode decentralization principles and user confidence, making equitable distribution key for long-term protocol health.

Key Takeaways

- Fee Diversion Concerns: The routing of CoW Swap fees to Aave Labs highlights potential conflicts between development teams and DAOs, with weekly losses estimated at $200,000 in Ether.

- Governance Role: While Aave Labs handles front-end and adapter development, DAO members argue that community funding of core tech entitles them to revenue shares, per statements from delegates like Marc Zeller.

- Implications for DeFi: This Aave DAO dispute serves as a reminder to monitor integration agreements; users should participate in governance votes to influence future revenue policies and maintain protocol integrity.

Conclusion

The Aave DAO dispute with Aave Labs over CoW Swap fees exemplifies the evolving pains of DeFi governance, where transparency and revenue sharing are paramount to upholding decentralization. As the community pushes for resolutions through formal channels, this situation could set precedents for how protocols balance innovation with token holder interests. Stakeholders are encouraged to engage in the governance process to shape a more equitable future for Aave and similar ecosystems.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026