AAVE Price May Test $160 Support Amid Whale and Retail Selling Pressure

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

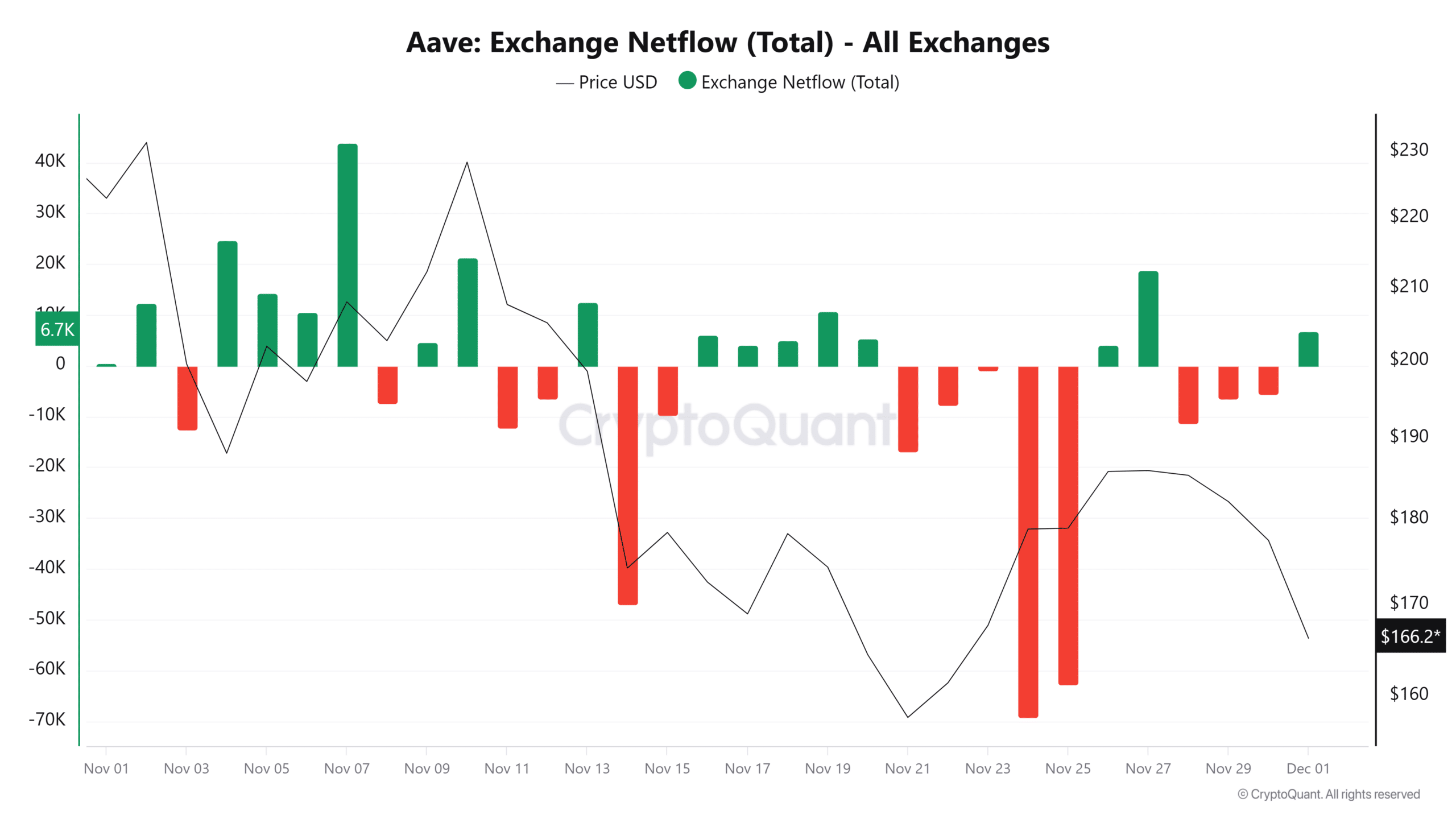

AAVE’s price has declined 10.17% to $166 due to intense selling from whales and retail investors, with a major whale incurring a $1.54 million loss. Exchange netflows turned positive, indicating more deposits and downward pressure, potentially testing the $160 support level.

-

Whale activity: A prominent whale sold 15,396 AAVE tokens at a $1.54 million loss after holding for 1.5 months.

-

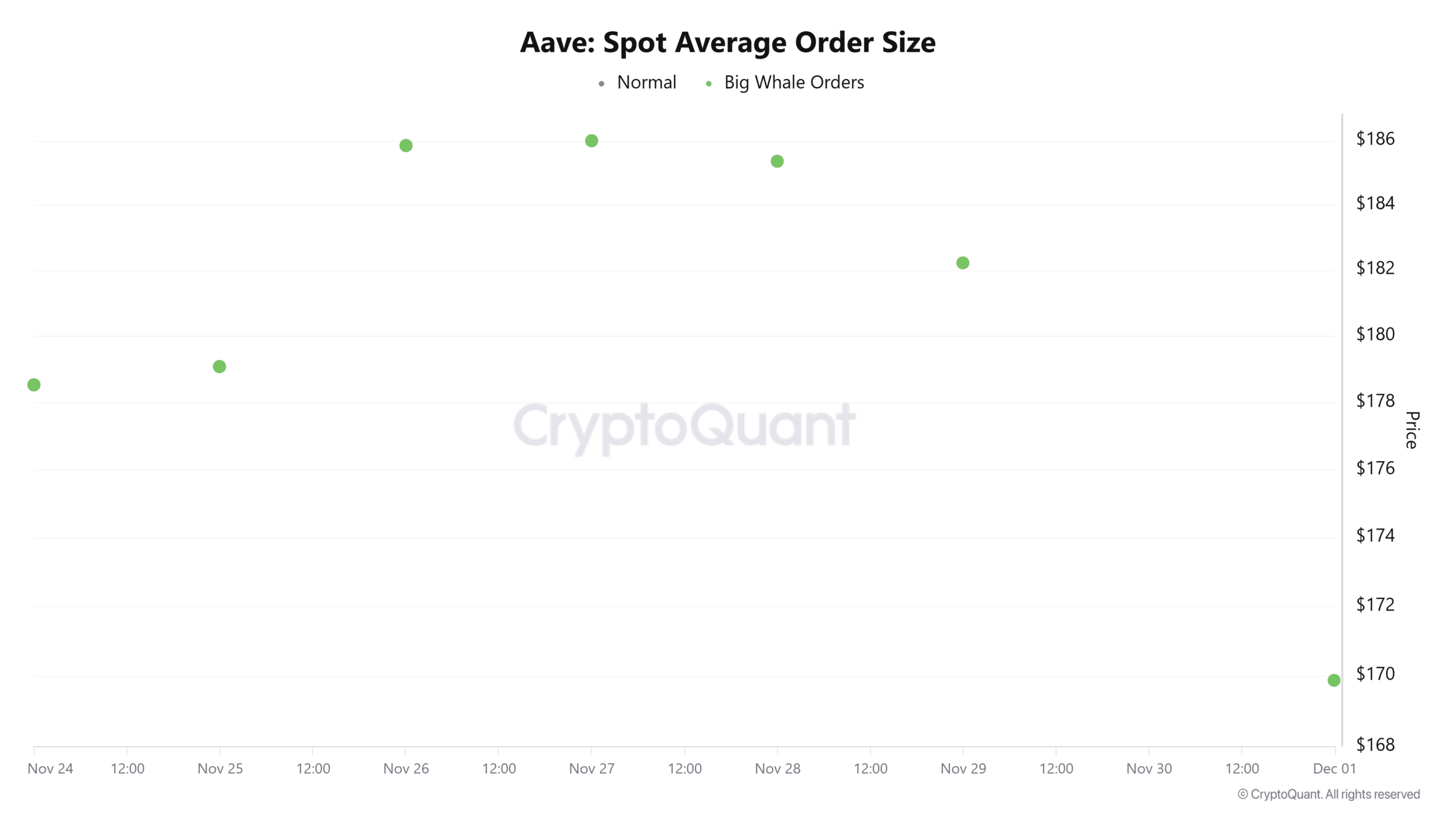

Spot average order sizes have hit weekly lows, showing reduced large-scale buying.

-

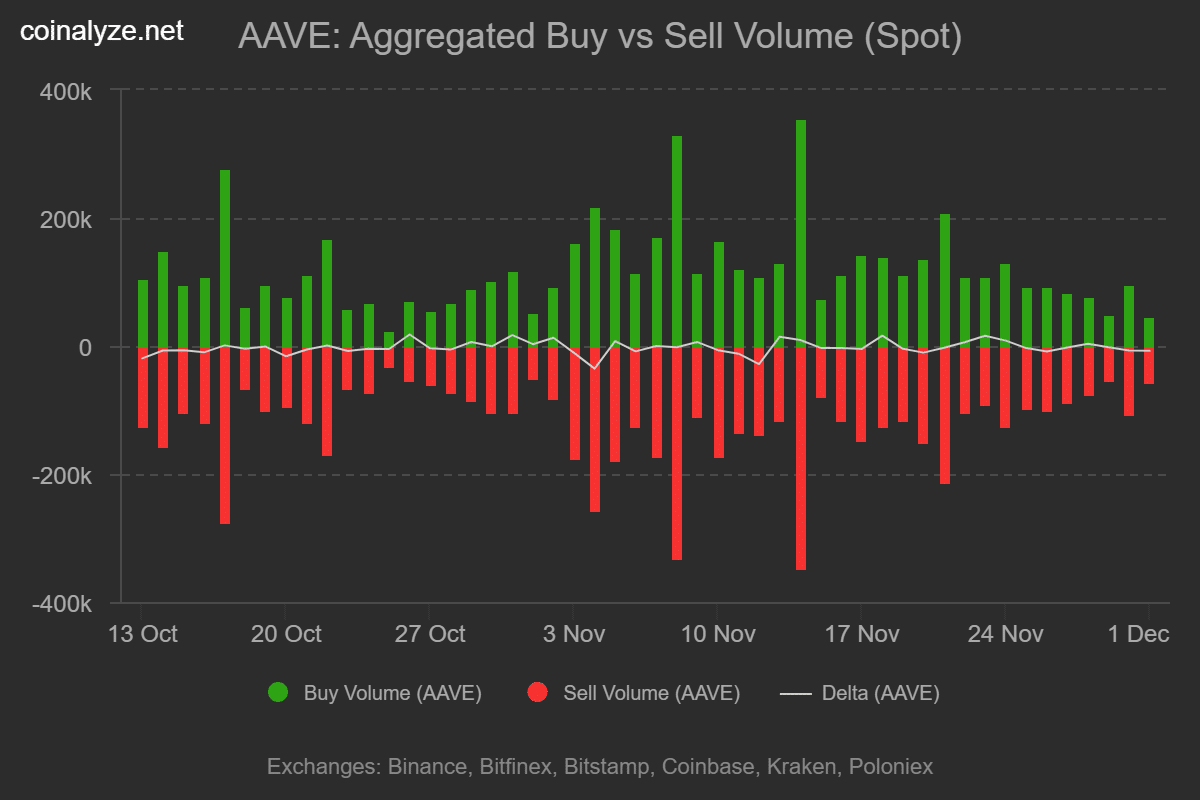

Negative buy-sell delta of -25.2k over 24 hours, with sell volume at 165.26k versus 140k buys, per Coinalyze data.

Explore the AAVE price decline: Whales and retailers sell off amid bearish signals. Learn why $160 support is at risk and what it means for investors. Stay informed on DeFi token trends.

What is causing the recent AAVE price decline?

AAVE price decline stems from sustained selling pressure following a rejection at $190, leading to four consecutive days of drops to a local low of $165. As of recent trading, AAVE is at $166, down 10.17% daily, with whales and retail investors offloading positions amid bearish market indicators. This activity has intensified the downturn, pushing the token below key moving averages.

How has whale activity contributed to AAVE’s sell-off?

Whale participation has significantly fueled the AAVE price decline. Data from CryptoQuant reveals a sharp drop in spot average order sizes, reaching weekly lows despite ongoing activity, indicating whales scaling back in the spot market. One notable whale, absent for 1.5 months, returned to deposit 15,396 AAVE tokens—valued at $2.57 million—to FalconX, after initially acquiring 20,396 AAVE worth $4.89 million and selling 5,000 for $779,056 earlier. This move realized a $1.54 million loss, signaling diminished confidence. Such aggressive whale selling during downturns often amplifies market pressure, as observed in historical patterns where large holders’ actions correlate with broader price movements. Onchain Lens tracked this transaction, highlighting how it exemplifies the bearish sentiment among major investors, potentially foreshadowing further volatility in DeFi tokens like AAVE.

Source: CryptoQuant

Experts in cryptocurrency analytics, such as those from CryptoQuant, note that reduced whale orders during declines often precede extended bearish phases. This data underscores the protocol’s vulnerability in the current DeFi landscape, where lending platforms like Aave face scrutiny amid broader market corrections. The whale’s loss highlights the risks of holding through volatility, with on-chain metrics showing a 20% reduction in large transaction volumes over the week.

Frequently Asked Questions

What triggered the AAVE whale’s $1.54 million loss in the recent sell-off?

The whale acquired AAVE at higher prices around $4.89 million for 20,396 tokens, sold 5,000 for $779,056, and later offloaded 15,396 more at $2.57 million due to the price drop from $190 to $166. This sequence, tracked by Onchain Lens, resulted in the loss as market pressure forced liquidation, reflecting panic selling amid four days of declines.

Is the $160 support level for AAVE likely to break soon?

Yes, with continued whale and retail selling, AAVE’s $160 support is at risk, as bearish moving average crossovers and positive exchange netflows of 6.7k tokens indicate incoming pressure. A close above $178 could reverse this, but current trends suggest potential drops to $155 if selling persists.

Source: Coinalyze

Source: CryptoQuant

Retail selling has compounded the issue, with Coinalyze reporting a negative buy-sell delta for three days straight. In the last 24 hours, sell volume reached 165.26k AAVE against 140k in buys, yielding a -25.2k delta that confirms aggressive spot market exits. Exchange netflows, per CryptoQuant, flipped positive at 6.7k AAVE—the first in four days—signaling more deposits that typically accelerate price drops. This influx to exchanges, often a precursor to sales, aligns with the broader bearish momentum observed across DeFi assets.

Source: TradingView

Technical indicators further validate the AAVE price decline. A short-term bearish crossover occurred as the 9-period moving average crossed below the 21-period, per TradingView analysis. The Relative Strength Index also showed a bearish crossover, reinforcing the downtrend. These signals suggest AAVE could breach $160 if selling continues, targeting $155. Conversely, reclaiming $178—above the moving averages—might spur a recovery toward $189. In the DeFi sector, such patterns have historically led to 5-15% further corrections when supported by on-chain selling data, as seen in similar events for lending protocols.

Key Takeaways

- Whale Losses Highlight Bearish Sentiment: A major holder realized $1.54 million in losses by selling 15,396 AAVE, contributing to spot market weakness and reduced large orders.

- Retail Selling Amplifies Pressure: Negative delta of -25.2k and positive netflows indicate widespread offloading, with sell volumes outpacing buys by 25k in 24 hours.

- Support Levels Under Threat: Monitor $160; a break could lead to $155, while $178 recovery might signal reversal—investors should watch moving averages closely.

Conclusion

The AAVE price decline reflects a confluence of whale and retail selling, bearish technicals, and rising exchange deposits, positioning the token at a critical juncture near $160 support. As DeFi markets navigate ongoing volatility, authoritative sources like CryptoQuant and Coinalyze provide essential insights into these trends. Investors may find opportunities in a potential rebound above $178, but caution is advised amid persistent downward signals—consider diversified strategies for long-term stability in cryptocurrency portfolios.