Aave’s 2026 Plan Targets $1B RWAs and V4 Scaling for Potential Trillion-Dollar Growth

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

Aave’s 2026 plan centers on scaling its DeFi protocol through the V4 upgrade’s Hub and Spoke architecture, targeting $1 billion in real-world asset deposits via Horizon, and expanding the mobile app to drive mass adoption and reach one million users.

-

Aave V4 introduces a unified crosschain liquidity hub with customizable markets for institutional-scale finance.

-

The Horizon platform aims to grow from $550 million to over $1 billion in RWA net deposits by partnering with major institutions.

-

Aave’s mobile app launch targets the $2 trillion fintech sector, offering simplified DeFi access to fuel protocol growth.

Aave’s 2026 master plan: Scale DeFi with V4’s Hub & Spoke, hit $1B RWAs on Horizon, and grow mobile app to 1M users. Discover how Aave leads in decentralized finance—explore the future now!

What is Aave’s 2026 Master Plan?

Aave’s 2026 master plan outlines a strategic roadmap to scale the decentralized finance protocol amid growing institutional interest. Founder and CEO Stani Kulechov announced the plan on X, emphasizing three pillars: Aave V4 for enhanced infrastructure, Horizon for real-world assets, and the Aave mobile app for broader adoption. This initiative builds on 2025’s successes, including over $550 million in RWA deposits, positioning Aave for trillions in total value locked.

Aave, a leading DeFi lending protocol, has demonstrated resilience and innovation throughout 2025, marking it as the platform’s most successful year to date. Despite these achievements, Kulechov views the project as being at “day zero” relative to its potential. The plan focuses on achieving key metrics, such as $1 billion in real-world asset deposits, to solidify Aave’s role in global finance.

“As it stands, our strategy going into next year has three main pillars: Aave V4, Horizon, and Aave App,” Kulechov stated in his announcement. This multi-faceted approach aims to address scalability, institutional integration, and user accessibility in the evolving DeFi landscape.

Source: Stani Kulechov

Aave V4 represents a major upgrade to the protocol’s borrowing, lending pools, user interface, and liquidation mechanisms. Kulechov described it as the “backbone of all finance,” highlighting the Hub and Spoke model. The hub serves as a single, unified crosschain liquidity pool centralizing all assets, while spokes enable highly tailored markets that draw from this core liquidity.

This architecture is designed to manage trillions in assets, appealing to institutions, fintech firms, and corporations seeking deep, reliable liquidity. “In 2026, Aave will be home to new markets, new assets, and new integrations that have never existed before in DeFi,” Kulechov noted. The rollout will involve close collaboration with the Aave DAO and partners to progressively increase total value locked throughout the year.

How Does Aave’s Horizon Platform Scale Real-World Assets?

Aave’s Horizon serves as the decentralized market for real-world assets, currently holding $550 million in net deposits. The 2026 plan targets rapid expansion to $1 billion and beyond by onboarding top financial institutions. Partnerships with entities like Circle, Ripple, Franklin Templeton, and VanEck will introduce major global asset classes to the platform, enhancing its appeal in the RWA sector.

Real-world assets bridge traditional finance and DeFi, tokenizing items like bonds, real estate, and commodities for on-chain efficiency. According to industry data from sources like Chainalysis, the RWA market in DeFi has grown over 500% in 2025, driven by regulatory clarity and institutional entry. Kulechov emphasized Horizon’s role in this trend: “We’ll look to quickly scale this to $1 billion and beyond by expanding our work with leading institutional partners.”

Expert analysts, including those from Deloitte’s blockchain reports, highlight that platforms like Aave are pivotal in tokenizing illiquid assets, potentially unlocking $10 trillion in value by 2030. Horizon’s integration ensures compliant, secure access, with features like permissioned pools for verified institutions. This structured growth will involve phased rollouts, monitored by the Aave DAO for risk management and yield optimization.

The third pillar, the Aave mobile app, launched on Apple’s App Store in mid-November 2025. Kulechov called it a “Trojan horse” for mainstream DeFi adoption, targeting the $2 trillion mobile fintech industry. By simplifying complex protocols into intuitive interfaces, the app offers superior savings products compared to traditional banks, driving user engagement.

“Early next year, we’ll begin the full rollout of Aave App and start the journey to our first million users,” Kulechov said. “This will directly fuel growth for Aave Protocol through an entirely new and untapped market. Aave cannot scale to trillions of dollars without mass adoption on the product level.” The app’s design prioritizes security, with features like biometric authentication and real-time portfolio tracking, making DeFi accessible to non-technical users.

SEC Ends Four-Year Investigation into Aave

On Tuesday, Kulechov confirmed the U.S. Securities and Exchange Commission’s closure of its four-year investigation into the Aave platform. He shared a letter dated August 12, 2025, signaling a clean resolution. “The platform is glad to put this behind us as we enter a new era where developers can truly build the future of finance,” Kulechov remarked.

This development removes a significant regulatory overhang, allowing Aave to focus on innovation without legal distractions. The investigation, initiated in 2021, examined the protocol’s operations amid broader SEC scrutiny of crypto platforms. Industry observers, including legal experts from Perkins Coie, note that such closures reflect evolving U.S. regulatory approaches to DeFi, prioritizing innovation over enforcement.

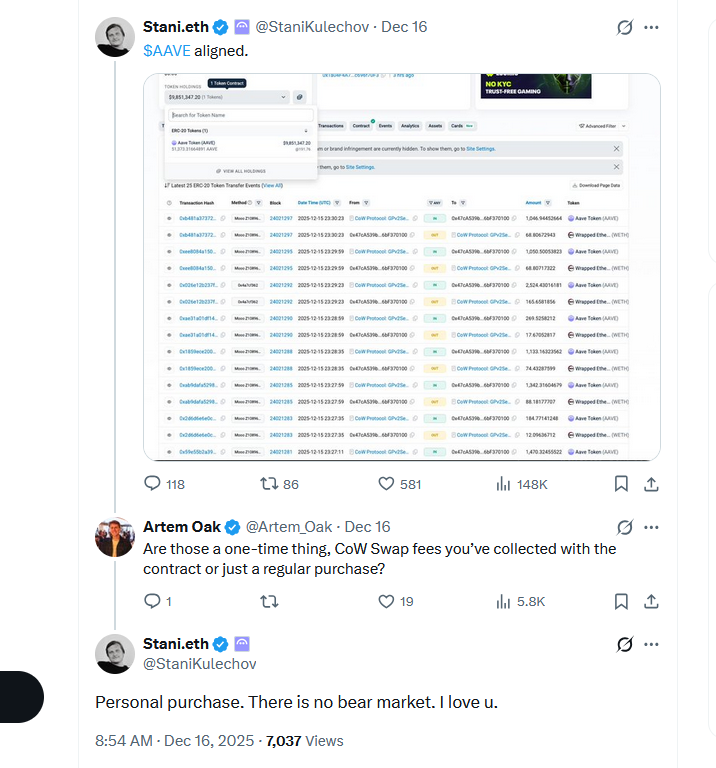

In a related move, Kulechov disclosed a personal investment of $9.8 million in AAVE tokens, independent of the Aave DAO’s buyback proposals. This vote of confidence underscores his commitment to the protocol’s long-term vision.

Source: Stani Kulechov

Frequently Asked Questions

What Does the End of the SEC Investigation Mean for Aave?

The SEC’s closure of its four-year probe into Aave, confirmed via an August 12, 2025 letter, clears the platform of wrongdoing and removes regulatory uncertainty. This allows Aave to accelerate its 2026 initiatives, such as V4 upgrades and RWA expansion, fostering greater developer and institutional confidence in DeFi lending.

How Will Aave’s Mobile App Drive DeFi Adoption?

Aave’s mobile app simplifies decentralized lending and borrowing for everyday users, integrating seamless onboarding and high-yield savings. Launching fully in early 2026, it targets one million users by tapping the $2 trillion fintech market, offering intuitive tools that make DeFi as easy as traditional banking apps while providing superior returns.

Key Takeaways

- Aave V4’s Hub and Spoke Model: Enables scalable, crosschain liquidity for trillions in assets, supporting new DeFi markets and integrations.

- Horizon RWA Growth: From $550 million to $1 billion in deposits through institutional partnerships, tokenizing global assets for DeFi efficiency.

- Mobile App Expansion: Rollout to one million users in 2026, bridging mainstream fintech with DeFi to boost protocol adoption and TVL.

Conclusion

Aave’s 2026 master plan, encompassing the V4 upgrade’s Hub and Spoke architecture, Horizon’s real-world asset scaling, and the mobile app’s push for mass adoption, positions the protocol as a DeFi leader. With the SEC investigation resolved and strong institutional momentum, Aave is poised for exponential growth. As Kulechov envisions, this roadmap paves the way for trillions in value—investors and users should monitor these developments closely for opportunities in the evolving decentralized finance ecosystem.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026