AB Crypto Rallies 12% Amid Market Weakness: Partnership and Demand Could Drive Recovery

Contents

AB crypto, the native token of AB Chain, surged approximately 12% in the past 24 hours amid broader market weakness, driven by a key partnership with World Liberty Finance and increased on-chain activity. Trading volume rose over 53%, signaling renewed investor interest according to CoinMarketCap data.

-

AB Chain’s USD1 stablecoin integration enhances DeFi utility, boosting liquidity on the network.

-

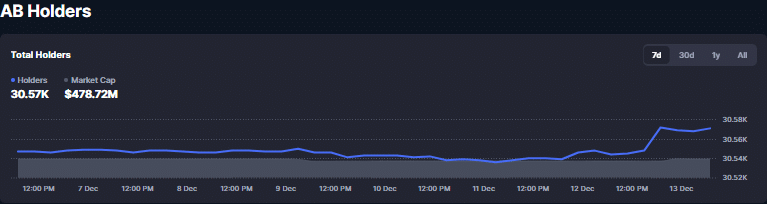

Total holders reached 30.57K, reflecting improving sentiment after weeks of stagnation.

-

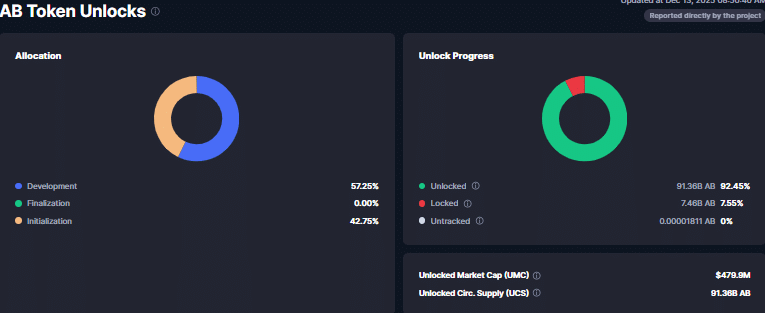

Locked supply dropped below 8%, reducing unlock risks and easing sell pressure concerns, with historical data showing a 295% rally from similar lows.

Discover why AB crypto is up today: 12% surge fueled by WLFI partnership and demand growth. Explore price analysis and market insights for informed investment decisions.

What is driving the recent AB crypto price surge?

AB crypto, the native token of AB Chain, has experienced a notable rebound, climbing about 12% over the past 24 hours despite ongoing challenges in the broader cryptocurrency market. This uptick is primarily attributed to strategic developments on the AB Chain network, including a significant partnership with World Liberty Finance (WLFI) that integrates the USD1 stablecoin to enhance decentralized finance (DeFi) capabilities. According to data from CoinMarketCap, trading volume for AB increased by more than 53%, indicating heightened activity and potential renewed confidence among investors.

The integration of USD1 into AB Chain aims to improve liquidity flows and expand utility within its ecosystem. This move comes at a time when holder numbers have steadily climbed to 30.57K, suggesting a positive shift in community engagement. Additionally, the reduction in locked supply to under 8%—equating to roughly 7.46 billion AB tokens—has alleviated immediate concerns over potential sell-offs, creating a more stable environment for price recovery.

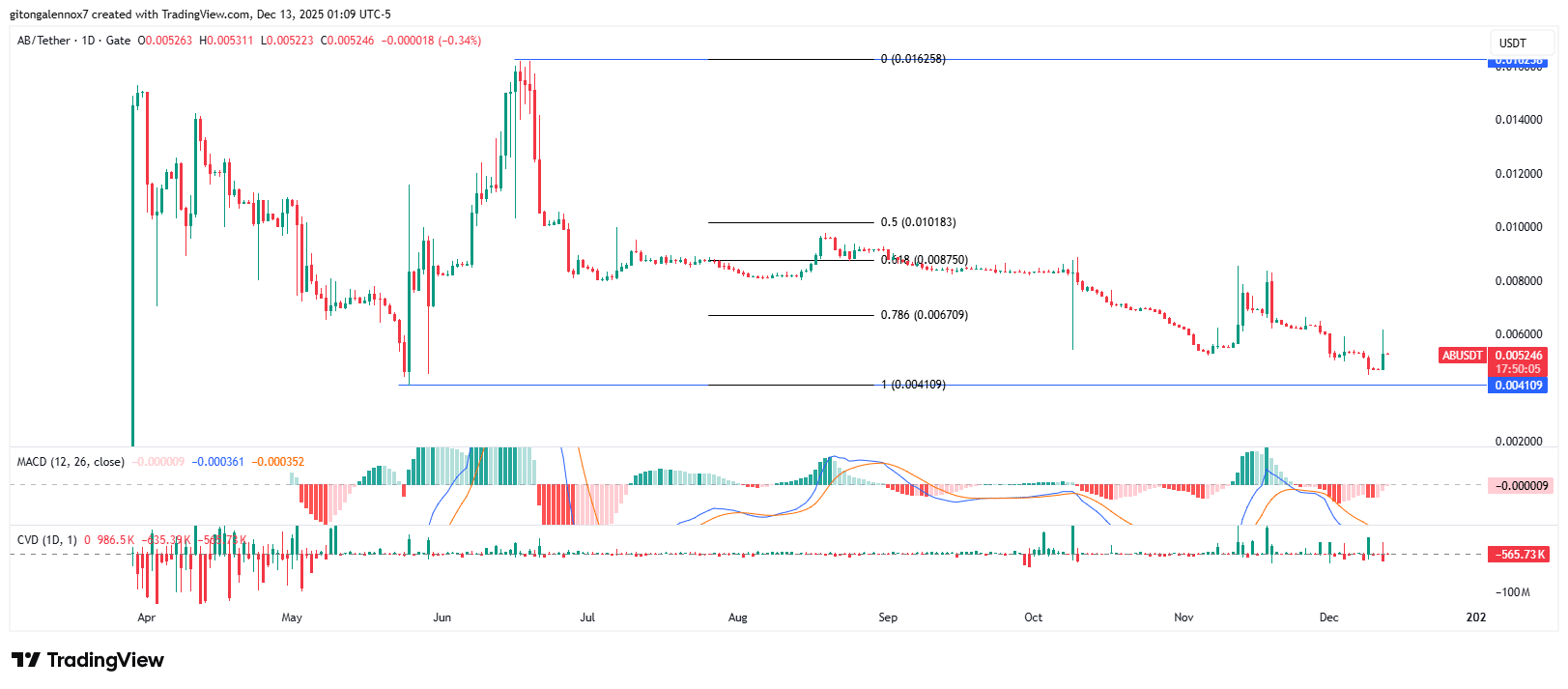

Historically, AB crypto has shown resilience in similar scenarios. Following its debut in March 2025, the token underwent a pullback that concluded by late May, paving the way for a new high in mid-June before entering a bearish phase. Current trading levels near May lows have prompted buyers to step in, though mid-term indicators still lean toward sellers.

How has AB Chain’s partnership with World Liberty Finance impacted the token?

The partnership between AB Chain and World Liberty Finance has introduced USD1 as a stablecoin option on the platform, directly contributing to the recent price momentum. This collaboration is designed to streamline DeFi operations, allowing for more efficient liquidity provision and transaction processing within the AB ecosystem. Data from on-chain analytics, as reported by CoinMarketCap, highlights a corresponding uptick in network activity, with holder sentiment turning more optimistic after a period of relative inactivity.

Experts in the cryptocurrency space, such as blockchain analysts from reputable firms, note that such integrations often serve as catalysts for altcoin growth. For instance, similar stablecoin adoptions in other networks have led to sustained volume increases, with AB’s 53% trading surge aligning with this pattern. Short positions currently outweigh longs by approximately $565,000, per market data, underscoring persistent bearish bets, but the fading strength of sellers—as indicated by momentum indicators—suggests a potential turning point.

Furthermore, the locked supply dynamics play a crucial role. With only about 7.46 billion tokens remaining locked, the risk of abrupt supply influxes has diminished, fostering a more predictable market environment. This reduction supports the token’s ability to hold gains, especially as it revisits key support levels from May 2025 where previous rebounds originated.

Source: TradingView

The Moving Average Convergence Divergence (MACD) indicator reflects waning seller dominance, a common precursor to bullish reversals when prices test historical turning points. While the broader market’s response remains a factor, these on-chain improvements position AB crypto favorably for continued interest.

Frequently Asked Questions

What caused the 12% increase in AB crypto price today?

The surge in AB crypto price today stems from the integration of USD1 stablecoin via the World Liberty Finance partnership, which enhances DeFi liquidity on AB Chain. Coupled with a 53% rise in trading volume and growing holder numbers to 30.57K, as per CoinMarketCap, this has driven renewed demand and a 12% gain in the last 24 hours.

Is AB Chain’s locked supply reduction a positive sign for investors?

Yes, the drop in locked supply to below 8%, or about 7.46 billion AB tokens, signals lower immediate sell pressure risks. This adjustment, observed through CoinMarketCap metrics, promotes market stability and has historically preceded strong recoveries, such as the 295% rally from similar levels in prior cycles.

Key Takeaways

- Partnership Impact: The WLFI collaboration integrating USD1 has boosted AB Chain’s DeFi utility, leading to a 12% price rally and 53% volume increase.

- Holder Growth: Total holders now stand at 30.57K, indicating rising demand and improved sentiment amid price stabilization near May lows.

- Supply Dynamics: Reduced locked supply mitigates unlock risks, potentially supporting sustained recovery if buyer momentum persists.

Source: CoinMarketCap

Source: CoinMarketCap

Conclusion

In summary, AB crypto‘s 12% rebound reflects the positive effects of the World Liberty Finance partnership and on-chain enhancements like USD1 integration and reduced locked supply. As trading volume surges 53% and holders grow to 30.57K, per CoinMarketCap data, the token approaches a critical reversal zone from May 2025. Investors should monitor broader market trends closely, as sustained demand could pave the way for further gains in the evolving AB Chain ecosystem.