AB Token Surges 13% on Bull Defense and TVL Growth, Faces Bear Risk at $0.0085

Contents

The AB token price is up today due to strong bullish defense at key retracement levels, a significant reduction in locked supply to under 12%, and a 7.26% surge in Total Value Locked (TVL) reaching $1.07 million. This has driven a 13% increase in the past 24 hours and 33% over the week, signaling renewed investor confidence in the Newton Project ecosystem.

-

Bulls defend critical 23.6% retracement at $0.0067, preventing further downside from recent highs.

-

Unlocked supply hits 87.63 billion tokens, minimizing sell-off risks ahead of full unlock in February 2026.

-

TVL growth of 7.26% to $1.07 million reflects increasing protocol adoption and liquidity.

Discover why AB token price is surging today amid key support holds and supply dynamics. Stay ahead in crypto investments—explore the latest trends and insights now.

Why is the AB token price up today?

AB token price has experienced a notable surge, climbing over 13% in the last 24 hours and 33% over the past week, reaching a market capitalization of $666 million. This upward momentum stems from robust bullish activity defending pivotal technical levels and positive on-chain developments like reduced locked supply and rising TVL. At current levels around $0.0075, the token demonstrates resilience in a volatile market.

How are supply dynamics influencing AB token performance?

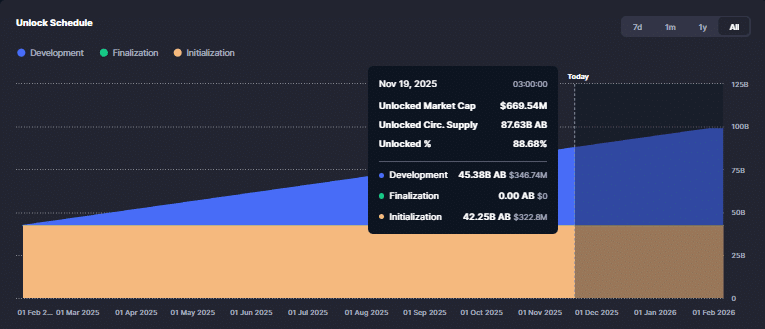

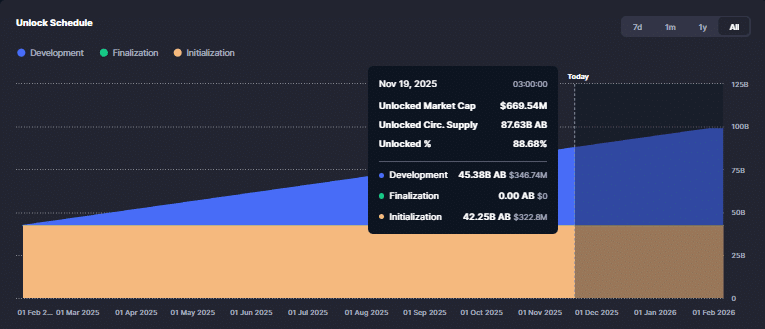

The AB token, part of the Newton Project launched this year, benefits from carefully managed supply mechanics that mitigate typical unlock pressures. With locked supply now below 12% and unlocked circulating supply at 87.63 billion out of a maximum 98.82 billion tokens, the gradual vesting schedule—culminating in full unlock on February 6, 2026—has fostered stability. This structure, as observed in data from CoinMarketCap, reduces the likelihood of abrupt sell-offs, encouraging sustained buying interest. Market analysts note that such tokenomics enhance long-term holder confidence, contributing to the recent price appreciation. Short paragraphs like this aid readability, while key metrics underscore the token’s foundational strength in decentralized finance applications.

Frequently Asked Questions

What factors are driving the recent AB token price increase?

The AB token price increase is primarily fueled by technical support at the 0.5 to 0.618 Fibonacci retracement zone, where bulls repelled declines from $0.0085 highs. Coupled with a drop in locked tokens and TVL rising 7.26% to $1.07 million per DefiLlama metrics, these elements have boosted sentiment, leading to a 13% daily gain without signs of immediate reversal.

Can AB token maintain its upward trend in the coming days?

AB token could sustain its upward trend if bulls maintain control above the $0.0067 support level, potentially targeting $0.0085 resistance. However, bearish pressure from negative Price Volume Trend indicators at -$11.23 million suggests caution, as a failure to break higher might trigger a pullback. Voice searches often highlight this balance of momentum and risk in crypto markets.

Key Takeaways

- Bullish defense at retracement levels: AB token rebounded from the 23.6% Fibonacci zone at $0.0067, showcasing strong buyer interest after a prior 39% decline.

- Supply unlock progress: Reduced locked supply to 12% with 87.63 billion unlocked tokens supports price stability and reduces future dilution risks.

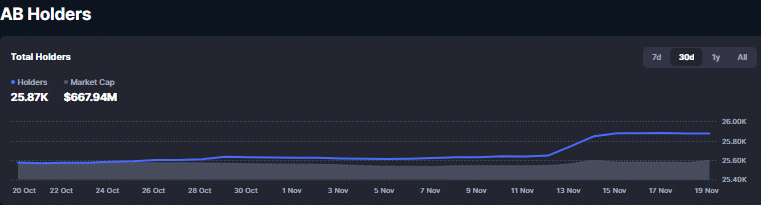

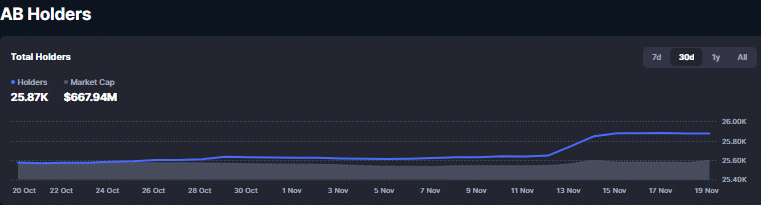

- TVL and holder metrics: A 7.26% TVL increase to $1.07 million bolsters ecosystem growth, though holder count remains steady at 25.87K, indicating room for broader adoption.

Conclusion

In summary, the AB token price surge today reflects a confluence of technical resilience, favorable supply dynamics, and growing TVL in the Newton Project framework. As bulls continue to hold key supports, investors should monitor resistance at $0.0085 for potential further gains. With the crypto market evolving rapidly, staying informed on these AB token developments positions traders for informed decisions in the dynamic digital asset landscape—consider tracking on-chain metrics for the next moves.

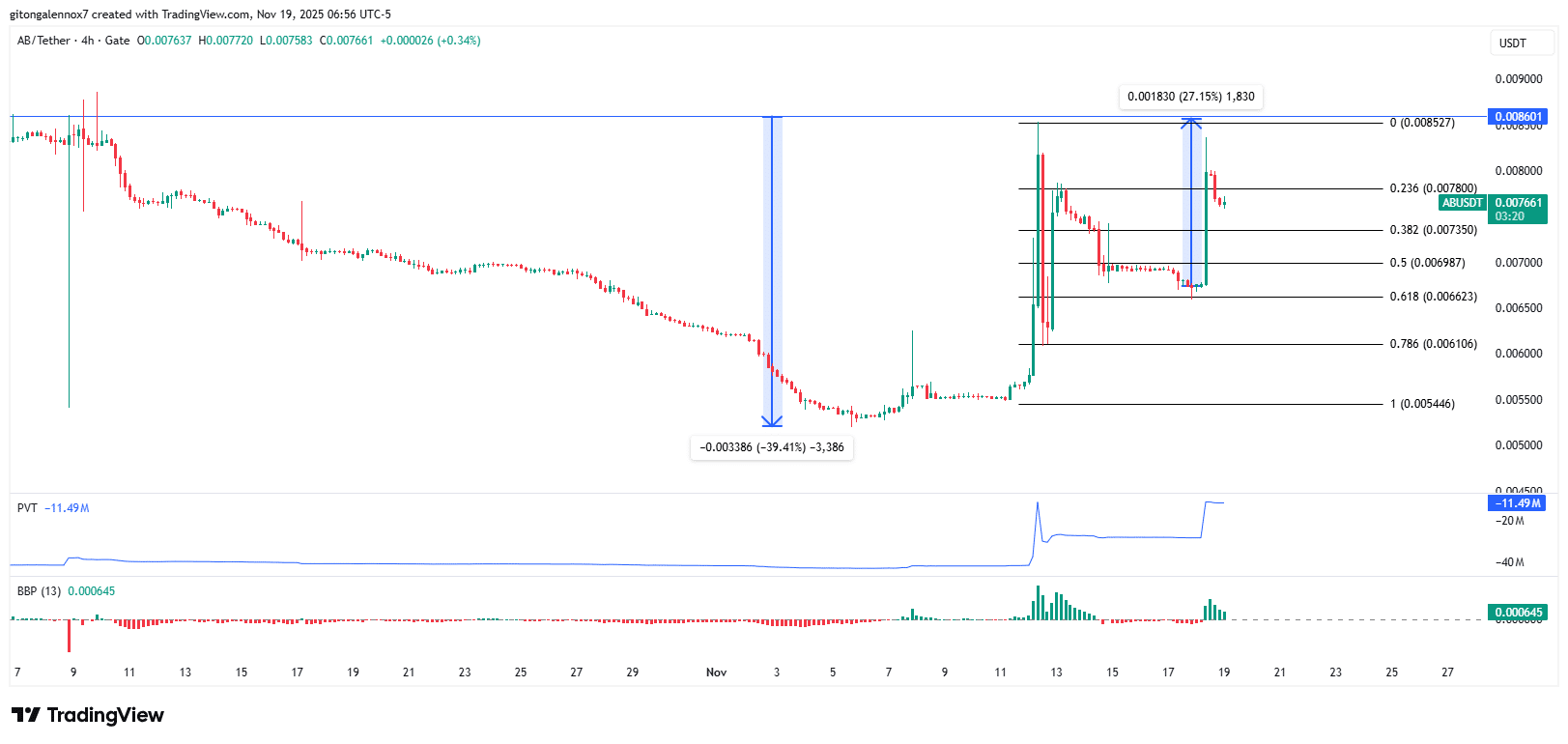

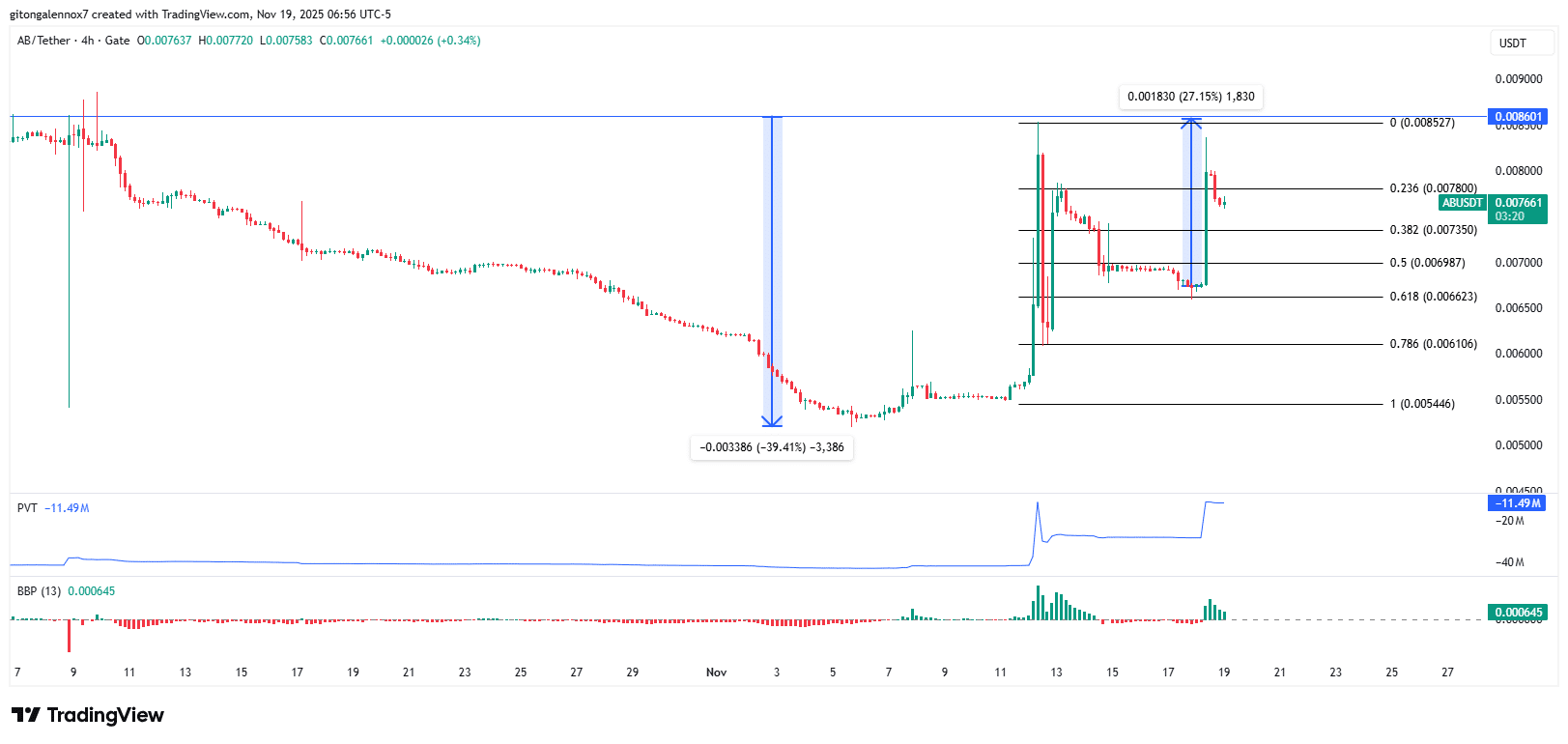

AB price respects the key retracement level

The price action of AB has shown a clear respect for the key retracement level, bouncing back from the 0.5 to 0.618 Fibonacci zone. This rebound indicates a healthy underlying trend, as the token found support where previous price inflections occurred. From its recent low of $0.0055, AB climbed to $0.0085, marking a 55% advance driven by broader market catalysts, including the integration of stablecoin mechanisms similar to those in World Liberty Financial deployments.

The latest 24-hour rally peaked at 24% before facing rejection near $0.0084, a level that previously sparked a 39% drop from October 9 to November 5. The Price Volume Trend (PVT) indicator stands at a negative $11.23 million, which accounts for the tempered daily gains despite the overall bullish setup.

Source: TradingView

The Bull Bear Power (BBP) indicator has turned bullish following two days of bearish dominance. Bulls successfully defended the $0.0067 zone but lacked the volume to surpass $0.0085 convincingly. If sellers regain footing, they could push prices back toward recent lows. Nonetheless, the ongoing defense of the 23.6% retracement level of the initial rally provides a solid foundation for potential continuation higher.

Why is the price of AB up?

One primary driver of the AB price uptick lies in its evolving circulating supply dynamics, which have been closely watched by market participants. The locked supply has decreased to under 12%, allowing the unlocked supply to expand to 87.63 billion AB tokens. This measured approach to token distribution, with the final unlock set for February 6, 2026, and a total maximum supply of 98.82 billion, helps avert the sharp price dumps often seen in less structured projects.

Source: CoinMarketCap

Complementing this, the Total Value Locked (TVL) in the AB ecosystem has surged by 7.26% over the past 24 hours, reaching approximately $1.07 million according to DefiLlama data. This influx signals heightened activity and trust in the protocol’s utility for decentralized applications within the Newton Project. Meanwhile, the total number of AB holders has remained stable at 25.87K over the last day, a slight dip from the week’s peak of 25.88K, but overall indicative of a maturing holder base without rapid dilution.

Source: CoinMarketCap

Overall, AB maintains a bullish posture in the current market environment but operates within a critical price zone. Sustaining momentum above $0.0067 will be essential for bulls to push toward higher targets, while any lapse could invite bearish corrections. As the Newton Project continues to develop its infrastructure, these metrics highlight AB’s potential as a stable player in the competitive crypto space, drawing interest from both retail and institutional observers. Data from established platforms like TradingView further corroborates the technical health, with indicators like BBP shifting favorably. In a broader context, the token’s performance aligns with increasing adoption of project-specific utilities, underscoring the importance of on-chain fundamentals in driving value. Investors are advised to consider these elements alongside global market trends for a holistic view.