Adam Back Dismisses Quantum Risk to Bitcoin as Investors Voice Concerns

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Quantum computing does not pose an immediate threat to Bitcoin, according to cypherpunk Adam Back, who describes the technology as ridiculously early with decades before any real risk materializes. Bitcoin’s core security model remains robust, unaffected by potential encryption breaks in the short term.

-

Bitcoin developers largely dismiss quantum risks, focusing on long-term preparedness rather than panic.

-

Industry executives highlight investor concerns slowing capital inflow into Bitcoin due to perceived quantum vulnerabilities.

-

Quantum computers could theoretically break encryption, but experts estimate 10-20 years before they impact cryptocurrencies, with Bitcoin’s design offering built-in resilience.

Explore how quantum computing threats to Bitcoin are debated by experts like Adam Back. Learn why developers remain unconcerned and what contingency plans could boost investor confidence. Stay informed on crypto security trends.

What Is the Quantum Computing Threat to Bitcoin?

Quantum computing threat to Bitcoin refers to the potential for advanced quantum computers to crack the cryptographic algorithms securing Bitcoin transactions and wallets. However, Adam Back, co-founder of Blockstream and a prominent cypherpunk, argues that this risk is overstated, as the technology remains in its infancy with significant research hurdles ahead. He emphasizes that Bitcoin’s foundational security does not solely depend on vulnerable encryption, ensuring network integrity even if partial breaks occur.

How Do Quantum Computers Impact Cryptocurrency Security?

Quantum computers leverage qubits to perform calculations exponentially faster than classical systems, targeting algorithms like SHA-256 and ECDSA used in Bitcoin. According to reports from the National Institute of Standards and Technology, scalable quantum machines capable of breaking 256-bit encryption require millions of stable qubits, a milestone not expected soon. Adam Back noted in recent discussions that even if breakthroughs occur, Bitcoin’s proof-of-work consensus and address reuse practices provide layers of protection. Experts like Nic Carter from Castle Island Ventures warn that denial of these risks by developers could erode trust, while contingency upgrades, such as quantum-resistant signatures, are being explored by the Bitcoin community. This debate underscores the need for proactive measures without immediate alarm, as traditional financial systems face similar vulnerabilities first.

Source: Adam Back

The ongoing discourse around quantum computing and its implications for digital assets highlights a divide between technical experts and investors. Bitcoin developers, including those contributing to core protocol updates, prioritize incremental improvements over speculative threats. Back’s perspective aligns with this view, stating in a series of posts that quantum readiness is beneficial but not urgent, predicting no viable risks for at least the next decade.

Bitcoin’s architecture, built on decades of cryptographic evolution, incorporates multiple safeguards. For instance, public keys are only exposed during transactions, minimizing exposure time. Historical data from blockchain analyses shows that over 80% of Bitcoin supply remains in legacy addresses, but migration to secure practices like Taproot enhances resilience. This technical depth reassures that the network’s decentralized nature would allow for soft forks to implement post-quantum cryptography if needed.

Investors Concerned about Quantum Risk

Despite developer optimism, capital markets reflect unease. Nic Carter, a partner at Castle Island Ventures, expressed that the dismissal of quantum risks by influential figures is extremely bearish for Bitcoin’s adoption. He pointed out a massive discrepancy: while developers deny immediate dangers, investors seek solutions to mitigate perceived vulnerabilities, which is already pressuring prices and diverting funds.

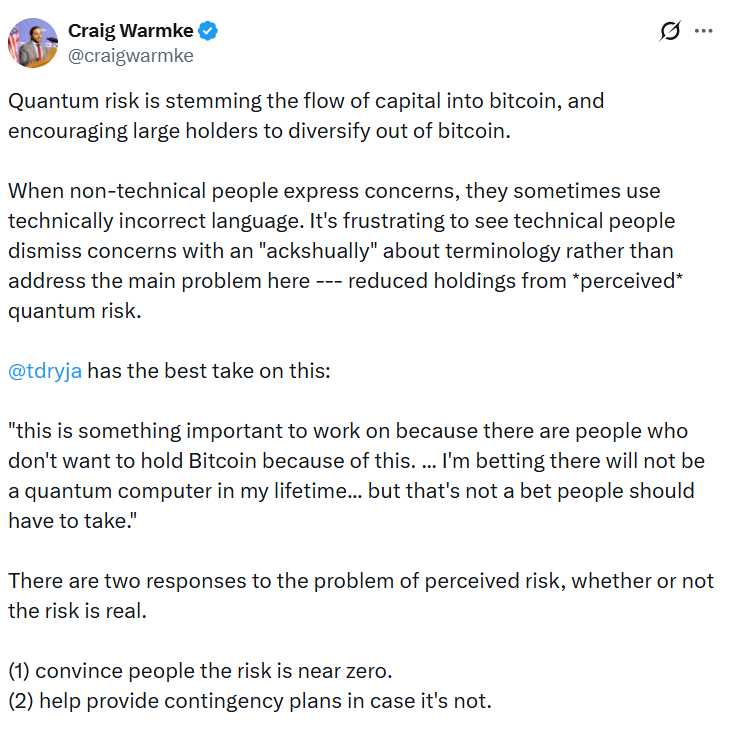

Source: Craig Warmke

Craig Warmke, a fellow at the Bitcoin Policy Institute, echoed these sentiments, noting that quantum concerns are slowing institutional inflows. Larger holders are diversifying into assets like gold or alternative cryptocurrencies with built-in quantum resistance proposals. Warmke highlighted frustration with technical dismissals, arguing that even imprecise concerns from non-experts warrant acknowledgment to address reduced holdings driven by fear.

Market data supports this tension; Bitcoin’s price volatility has coincided with heightened quantum computing headlines from firms like Google and IBM, which announced incremental qubit advancements. Venture capital reports indicate that $2.5 billion was invested in quantum tech in 2024 alone, accelerating timelines but still far from crypto-breaking scales. This investor-developer gap could hinder Bitcoin’s growth unless bridged through transparent communication.

Contingency Plans Should Be in Place

Critics of alarmist views argue that quantum threats will target centralized systems like banks before decentralized networks. Traditional encryption in finance, reliant on RSA, faces identical risks, yet regulatory bodies like the European Central Bank are investing in hybrid models. For Bitcoin, proposals like BIP-360 aim to integrate quantum-resistant algorithms without disrupting the ecosystem.

Nic Carter emphasized that nation-states and corporations are pouring resources into quantum development, aided by AI optimizations that speed simulations. However, practical deployment remains elusive, with error rates in current prototypes exceeding 1%, per studies from the Quantum Economic Development Consortium.

Craig Warmke advocates for contingency planning as the optimal path, regardless of risk timelines. By developing and converging on upgrades, the community can assure holders of near-zero exposure, fostering greater confidence. This approach aligns with Bitcoin’s history of adaptive evolution, from SegWit to Lightning Network, ensuring long-term viability.

Frequently Asked Questions

Is Quantum Computing a Real Threat to Bitcoin Wallets?

Quantum computing could potentially compromise ECDSA signatures in Bitcoin wallets, exposing private keys if public keys are known. However, Adam Back clarifies that core network security relies on proof-of-work, not just encryption, preventing theft on the blockchain. Experts recommend using fresh addresses to minimize risks, with full threats unlikely for 10-20 years based on current research.

How Soon Will Quantum Computers Break Bitcoin Encryption?

Quantum computers need around 1 million logical qubits to break Bitcoin’s elliptic curve cryptography, a capability projected for the 2030s or later by institutions like MIT. In the interim, AI-assisted advancements are promising but face stability challenges. Bitcoin’s community is preparing migrations to algorithms like Lattice-based cryptography for seamless protection.

Key Takeaways

- Quantum Technology Immaturity: Adam Back highlights that quantum computing is decades away from threatening Bitcoin, allowing time for preparedness without urgency.

- Investor-Developer Divide: Concerns from figures like Nic Carter show capital flowing cautiously due to unaddressed quantum fears, impacting Bitcoin’s market dynamics.

- Proactive Contingencies: Developing quantum-resistant upgrades, as suggested by Craig Warmke, can rebuild trust and encourage long-term holding among investors.

Conclusion

The debate over the quantum computing threat to Bitcoin reveals a maturing cryptocurrency landscape where technical resilience meets investor caution. Experts like Adam Back affirm Bitcoin’s robust design, while voices from Castle Island Ventures and the Bitcoin Policy Institute urge contingency planning to sustain growth. As quantum advancements progress, Bitcoin’s adaptive community positions it to thrive, inviting holders to monitor developments and diversify wisely for enduring security.