ADGM Recognizes USDT as Accepted Fiat Token, Potentially Enhancing Stablecoin Use in UAE

AVAX/USDT

$238,066,046.97

$8.98 / $8.42

Change: $0.5600 (6.65%)

+0.0001%

Longs pay

Contents

ADGM’s recognition of USDT as an accepted fiat-referenced token enables licensed firms in Abu Dhabi to provide regulated custody and trading services for the stablecoin, advancing its integration into the UAE’s financial ecosystem.

-

Regulatory Milestone: Tether’s USDT gains official status in ADGM, allowing institutional services.

-

Stablecoin Expansion: This approval supports trading, custody, and cross-border payments in a clear regulatory framework.

-

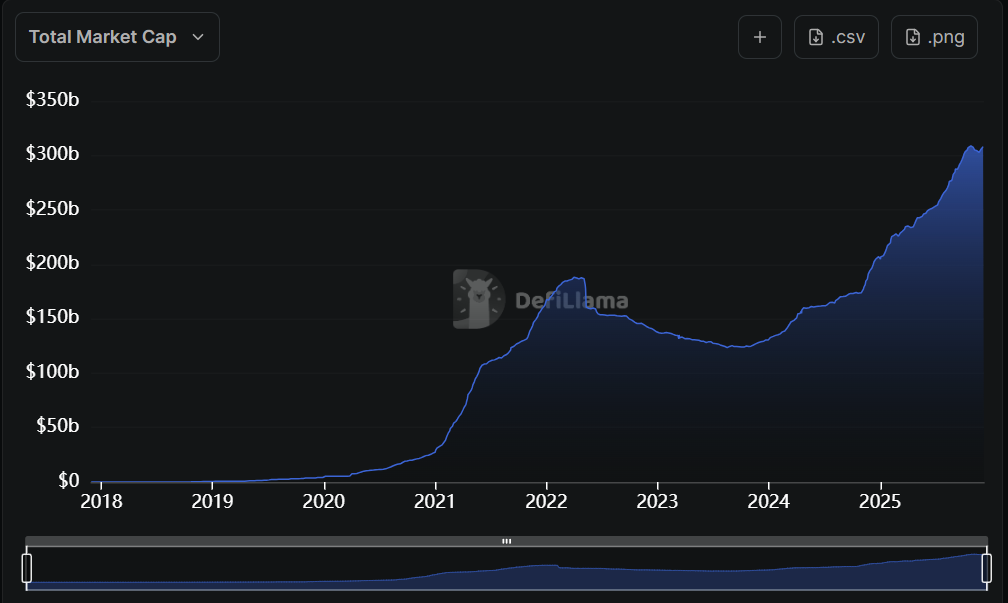

Market Growth: The global stablecoin market exceeds $300 billion, with USDT leading by circulation volume according to DefiLlama data.

Discover how USDT’s ADGM recognition boosts stablecoin adoption in UAE. Licensed firms can now offer secure custody—explore implications for crypto finance today.

What is the Significance of USDT Recognition in ADGM?

USDT recognition in ADGM marks a pivotal advancement for stablecoins in the UAE’s financial sector, enabling regulated firms to integrate Tether’s USDt into services like trading and custody. This official designation as an accepted fiat-referenced token aligns USDT with established virtual asset standards, fostering institutional confidence and expanding its utility in remittances and settlements. Announced on a recent Monday, the move positions Abu Dhabi as a hub for digital assets under structured oversight.

How Does This Approval Impact Stablecoin Services in Abu Dhabi?

ADGM’s framework now permits licensed entities to handle USDT across major blockchains, including Ethereum, Solana, and Avalanche, enhancing operational efficiency for fiat-pegged tokens. This extends to secure custody solutions, which are crucial for institutions managing large-scale digital holdings. According to regulatory filings from ADGM, such recognitions ensure compliance with anti-money laundering standards while promoting innovation in cross-border transactions.

The approval streamlines processes for financial institutions, reducing barriers to entry for stablecoin-based services. For instance, firms can now offer USDT-denominated products without navigating ambiguous guidelines, a development highlighted by industry observers as key to scaling digital finance in the region.

Source: Tether

Related: Binance secures ADGM licenses to operate international platform. This broader trend of licensing in ADGM underscores the center’s appeal to global crypto players seeking regulatory clarity.

Tether CEO Paolo Ardoino emphasized that this designation reinforces the essential role of stablecoins in modern finance, particularly for remittances and digital market settlements. Data from blockchain analytics shows USDT’s dominance, with over $100 billion in circulation, making it a cornerstone for stability in volatile crypto environments.

Abu Dhabi’s proactive stance builds on its status as an international financial center, attracting firms with incentives like tax efficiencies and robust legal protections. The integration of USDT aligns with global efforts to bridge traditional and decentralized finance, potentially increasing transaction volumes in the UAE’s trade-heavy economy.

Frequently Asked Questions

What Does USDT Recognition in ADGM Mean for Licensed Firms?

USDT recognition in ADGM allows licensed companies to legally offer services such as trading, custody, and settlement using the stablecoin, ensuring compliance with UAE regulations. This milestone, effective immediately, supports institutional adoption without the need for additional approvals, streamlining operations for over 100 registered entities in the zone.

Why is Abu Dhabi Emerging as a Stablecoin Hub?

Abu Dhabi is positioning itself as a stablecoin hub through clear regulations from ADGM and the UAE Central Bank, attracting major players like Tether and Ripple. With a supportive ecosystem for digital assets, it facilitates secure, efficient financial services, making it ideal for cross-border payments in the Middle East’s bustling commerce landscape.

Key Takeaways

- Regulatory Boost for USDT: ADGM’s approval enables regulated custody and trading, enhancing stablecoin legitimacy in the UAE.

- Growing Ecosystem: Similar recognitions for tokens like RLUSD signal broader institutional interest in fiat-pegged assets.

- Future Opportunities: Watch for dirham-pegged stablecoin launches, which could further integrate local currencies with global crypto markets.

Conclusion

The recognition of USDT in ADGM represents a significant step toward mainstream stablecoin adoption in the UAE, combining regulatory clarity with innovative financial tools. As Abu Dhabi continues to license crypto services and explore local stablecoins, this development paves the way for enhanced cross-border efficiency and institutional participation. Stay informed on these evolving trends to navigate the dynamic landscape of digital assets effectively.

Abu Dhabi Targets Stablecoins for Finance

Tether’s USDT isn’t the only stablecoin gaining traction in Abu Dhabi. Local regulators recently approved Ripple’s dollar-pegged RLUSD as an accepted fiat-referenced token, clearing the way for institutional use. This dual approval highlights the emirate’s commitment to fostering a diverse stablecoin environment.

The developments come amid rising expectations for additional initiatives involving prominent financial institutions. A consortium comprising ADQ—the emirate’s sovereign wealth fund—International Holding Company, and First Abu Dhabi Bank has outlined plans for a dirham-pegged stablecoin, subject to approval from the UAE Central Bank. Such a token would directly tie into the local economy, potentially revolutionizing domestic and regional payments.

Valued at over $300 billion, the global stablecoin market has experienced rapid growth over the past two years. Source: DefiLlama

Abu Dhabi and the UAE at large have solidified their roles as pivotal players in stablecoin and digital asset markets, benefiting from a transparent regulatory structure in a region renowned for global trade. ADGM serves as a primary licensing hub for exchanges, custodians, and other crypto-oriented businesses desiring predictable governance.

This environment not only supports immediate operational needs but also encourages long-term innovation. Experts from financial think tanks, such as those affiliated with the World Economic Forum, note that stablecoins like USDT reduce settlement times from days to seconds, a critical advantage for high-volume international trade. In the UAE, where remittances exceed $40 billion annually according to Central Bank reports, USDT’s enhanced usability could optimize these flows significantly.

Furthermore, the recognition aligns with broader Middle Eastern trends toward digital economy diversification. Countries like the UAE are investing heavily in blockchain infrastructure, with ADGM’s virtual asset regulations drawing comparisons to established frameworks in Singapore and Switzerland. Tether’s integration here exemplifies how stablecoins can serve as bridges between fiat systems and decentralized networks, minimizing volatility risks for users.

Looking ahead, the approval may spur further partnerships between traditional banks and crypto providers. For example, First Abu Dhabi Bank’s involvement in the dirham stablecoin project suggests a convergence of legacy finance and emerging tech. Regulatory bodies emphasize that all such tokens must adhere to strict reserve requirements and transparency standards, ensuring stability akin to traditional currencies.

In terms of market implications, USDT’s status in ADGM could accelerate its adoption for enterprise applications, such as supply chain financing in the UAE’s oil and logistics sectors. Blockchain data from sources like Chainalysis indicates that stablecoin transactions in the region have grown by over 200% in the last year, underscoring the demand for reliable digital dollars.

Challenges remain, including the need for uniform standards across Gulf Cooperation Council countries, but ADGM’s proactive measures position Abu Dhabi favorably. As quoted by Paolo Ardoino, stablecoins are becoming indispensable, and this recognition solidifies their place in the UAE’s forward-thinking financial architecture.

Magazine: The one thing these 6 global crypto hubs all have in common—clear regulations driving innovation.

Overall, this milestone for USDT recognition in ADGM not only validates Tether’s model but also invites other stablecoins to the table, promising a more inclusive and efficient digital finance ecosystem in the UAE. Institutions eyeing expansion in the Middle East should monitor these regulatory evolutions closely for strategic opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026