Aerodrome Finance (AERO) Sees Potential Growth Following Coinbase Base Chain DEX Integration

AERO/USDT

$6,470,700.56

$0.3320 / $0.3183

Change: $0.0137 (4.30%)

-0.0014%

Shorts pay

Contents

-

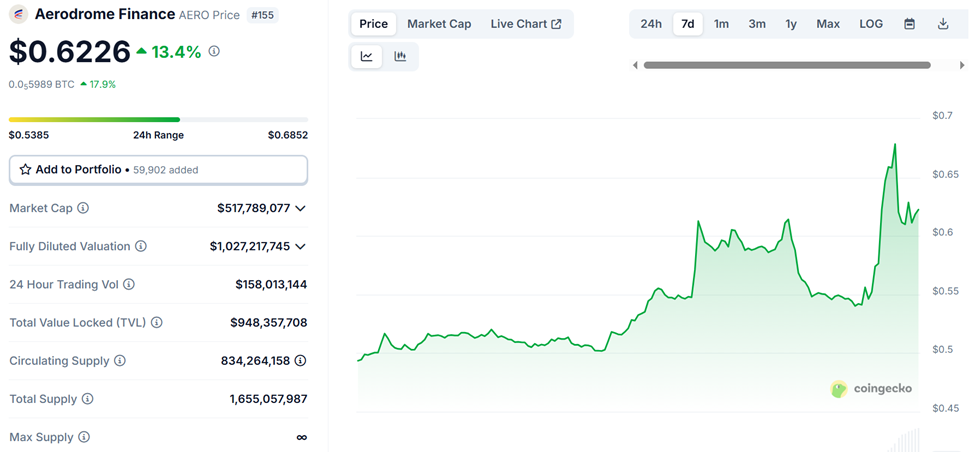

Aerodrome Finance (AERO) experienced a remarkable 35% price surge following Coinbase’s integration of Base chain DEX services into its app, significantly enhancing the token’s visibility and accessibility.

-

This strategic integration exposes Aerodrome to Coinbase’s extensive user base, reinforcing its position as a leading decentralized exchange on the Base network with robust liquidity and trading volume.

-

According to COINOTAG sources, despite short-term price fluctuations, Aerodrome’s strong total value locked (TVL) nearing $950 million underscores its long-term growth potential within the Layer-2 ecosystem.

Aerodrome Finance (AERO) jumps 35% after Coinbase integrates Base chain DEX services, boosting exposure and solidifying its role in the growing Layer-2 DeFi ecosystem.

Coinbase App Integration Propels Aerodrome Finance’s Growth on Base Network

The recent integration of Base chain decentralized exchange (DEX) services into the Coinbase app marks a pivotal development for Aerodrome Finance. This move not only spotlights Aerodrome as a core player within the Base ecosystem but also bridges centralized user experience with decentralized finance infrastructure.

Official announcements from the Base Chinese account on X (formerly Twitter) confirmed that Coinbase users will now have direct access to Base chain DEX functionalities through the app. This seamless integration is expected to drive significant user engagement and liquidity inflows to Aerodrome, enhancing its market presence.

The initial market reaction was swift, with AERO’s price surging nearly 35% before a moderate pullback. Despite this correction, AERO maintained a strong performance relative to other top-100 cryptocurrencies, reflecting investor confidence in its underlying fundamentals and strategic positioning.

Since its launch in 2023, Aerodrome has established itself as the second-largest DEX on Base by market share. Data from DeFiLlama highlights its substantial total value locked (TVL) of approximately $950 million and an average daily trading volume exceeding $500 million, underscoring its liquidity depth and user adoption.

Expanding User Access: Coinbase’s Role in Mainstreaming Base DEX Services

Coinbase’s decision to embed Base DEX access within its app represents a strategic effort to merge centralized exchange convenience with decentralized trading capabilities. This initiative aligns with Coinbase’s broader vision of advancing on-chain financial services, often referred to as the “on-chain summer.”

By routing DEX liquidity through Aerodrome within the Coinbase interface, users benefit from deep liquidity pools and reduced slippage without needing to leave the app environment. This integration not only enhances user experience but also positions Aerodrome as a critical infrastructure component in the evolving Layer-2 scaling landscape.

Base, as Coinbase’s Ethereum Layer-2 solution, continues to attract developers and DeFi protocols seeking scalable, cost-effective alternatives to Ethereum mainnet transactions. Aerodrome’s dominant presence on Base strategically situates it to capitalize on increasing institutional and retail adoption of Layer-2 chains.

While short-term volatility in AERO’s price may persist, the integration underscores a significant infrastructure convergence—centralized exchanges incorporating decentralized functionalities to meet growing market demands.

Competitive Landscape: Morpho Challenges Aerodrome’s Market Position on Base

Despite Aerodrome’s strong market presence, competition within the Base ecosystem remains intense. Morpho, another prominent protocol on Base, has recently overtaken Aerodrome as the largest DEX by total value locked, with a TVL surpassing $1 billion according to DeFiLlama data.

Morpho differentiates itself by enhancing lending efficiency through direct liquidity matching, which improves interest rates for users. The launch of Morpho V2 introduces fixed-rate, fixed-term loans designed to unlock the potential of on-chain lending, further intensifying competition within the Base DeFi ecosystem.

This competitive dynamic highlights the rapid innovation and evolving user preferences within Layer-2 decentralized finance, where protocols continuously seek to optimize user experience and capital efficiency.

Conclusion

Aerodrome Finance’s integration into the Coinbase app marks a significant milestone in its growth trajectory, amplifying its visibility and user access within the Base network. While facing formidable competition from protocols like Morpho, Aerodrome’s substantial TVL and strategic positioning within Coinbase’s ecosystem underscore its potential as a foundational Layer-2 DEX.

As the Layer-2 landscape matures, the convergence of centralized and decentralized finance through integrations like this will likely shape the future of on-chain trading, offering users enhanced liquidity, accessibility, and efficiency.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/8/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/7/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/6/2026

DeFi Protocols and Yield Farming Strategies

2/5/2026