AI Tokens Like Bittensor TAO Could Drive Crypto Rotation Toward 2026

TAO/USDT

$156,159,744.33

$181.60 / $165.60

Change: $16.00 (9.66%)

+0.0031%

Longs pay

Contents

Yes, 2026 could emerge as the year of AI tokens, driven by accelerating U.S. AI adoption and capital rotation from speculative memecoins to fundamentally strong AI assets. Leading tokens like Bittensor’s TAO have gained nearly 5% in market cap since early 2025, signaling growing investor conviction amid crypto market saturation.

-

AI tokens are outperforming memecoins: Bittensor’s TAO is up 5% year-to-date in 2025, while Dogecoin has dropped 50%.

-

Crypto market saturation limits individual coin growth, pushing capital toward AI narratives backed by real-world adoption.

-

Over $3 billion invested in AI in 2025 alone, with U.S. policies fostering crypto-AI overlap, positioning AI tokens for a potential 2026 surge.

Discover why AI tokens are set to dominate in 2026 amid crypto saturation. Explore performance data, market trends, and investment insights for the next big shift in digital assets.

What is the Future of AI Tokens in 2026?

AI tokens represent blockchain-based cryptocurrencies tied to artificial intelligence projects, enabling decentralized AI development and computation. In 2026, these tokens are poised for significant growth as U.S. AI investments surpass $3 billion in 2025, blending crypto innovation with AI advancements. This convergence could drive widespread adoption, with tokens like Bittensor’s TAO leading the charge by facilitating collaborative machine learning networks.

The cryptocurrency landscape in 2025 has been marked by intense saturation, with thousands of tokens competing for limited capital. This environment has diluted individual asset values, particularly for hype-driven memecoins, but AI tokens are carving out a distinct path. According to data from CoinMarketCap, the sector’s momentum is evident in recent launches and established projects alike, suggesting a strategic shift toward utility-focused investments.

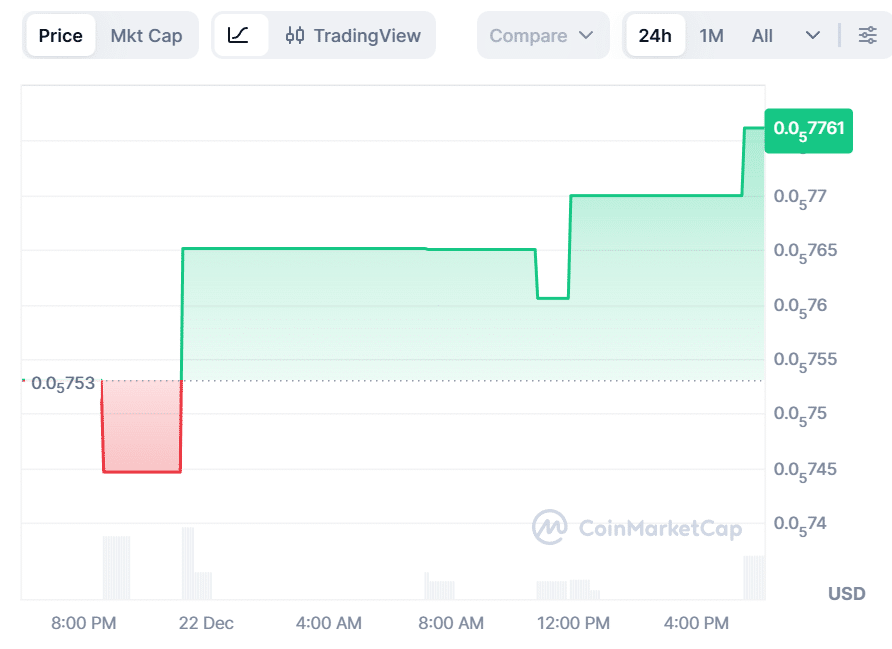

Source: CoinMarketCap

New entrants like Aionix (AIONIX), launched in August 2025 with an initial market cap of $7.76 million, have already shown resilience, posting a 3% gain in the last 24 hours despite broader market pressures. This performance underscores how AI tokens are attracting speculative yet informed capital, prioritizing projects with tangible technological applications over pure hype.

How Does Crypto Market Saturation Impact AI Tokens?

Crypto market saturation refers to the proliferation of over 20,000 tokens by late 2025, fragmenting investor attention and capital. While this caps upside for many assets, AI tokens benefit from a narrowing focus on high-potential sectors. For instance, memecoin launchpads have fueled short-lived rallies, but their volatility has led to a 50% decline in major players like Dogecoin since early 2025, per CoinMarketCap metrics.

In contrast, AI tokens are bolstered by real-world utility. The U.S. government’s push to become a global AI and crypto hub has channeled nearly $3 billion into AI initiatives in 2025, creating tailwinds for related blockchain projects. Analyst reports from firms like Chainalysis highlight this trend, noting a 25% increase in AI-crypto venture funding year-over-year. “AI tokens are not just another trend; they represent the fusion of two transformative technologies,” states a blockchain expert from a leading research institute.

Competition within the AI sector is intensifying, with launches like Aionix demonstrating quick traction. However, established leaders maintain dominance. Bittensor’s TAO, which powers a decentralized AI network, has added approximately $420 million to its market cap in 2025, up 5% from January levels. This outperformance illustrates how saturation weeds out weaker projects, allowing AI tokens to consolidate gains.

Source: CoinMarketCap

Price action further supports this narrative. While memecoins suffer from fading hype, AI tokens align with macroeconomic shifts, including U.S. policy incentives for AI innovation. Federal investments and regulatory clarity are expected to amplify this in 2026, potentially rotating billions from speculative assets to AI-driven ones. Data from Dune Analytics shows AI token trading volume up 40% in Q4 2025, indicating building institutional interest.

Frequently Asked Questions

What Makes 2026 the Year for AI Tokens?

In 2026, AI tokens are projected to lead due to U.S. AI investments exceeding $3 billion in 2025 and supportive policies merging crypto with AI tech. Tokens like TAO exemplify this by enabling decentralized AI, attracting capital shifts from underperforming memecoins and fostering sustainable growth.

Are AI Tokens a Safe Investment Amid Market Saturation?

AI tokens offer relative stability in a saturated market by tying value to practical AI applications, unlike volatile memecoins. With TAO up 5% in 2025 versus Dogecoin’s 50% drop, they appeal to investors seeking utility. Always conduct due diligence, as crypto remains high-risk.

Key Takeaways

- Crypto Saturation Limits Gains: Over 20,000 tokens dilute value, but AI sectors thrive on targeted investments exceeding $3 billion in 2025.

- Performance Edge for AI Assets: Bittensor’s TAO has risen 5% year-to-date, adding $420 million, outpacing memecoins like Dogecoin down 50%.

- 2026 Positioning Strategy: Investors should monitor U.S. AI-crypto policies for rotation opportunities, focusing on utility-driven tokens for long-term potential.

Conclusion

The crypto market’s saturation in 2025 has highlighted the resilience of AI tokens, which are benefiting from U.S.-led AI advancements and capital reallocation from speculative memecoins. With leaders like Bittensor’s TAO demonstrating steady growth and sector investments surpassing $3 billion, 2026 appears primed for an AI token surge at the intersection of blockchain and artificial intelligence. Stay informed on these developments to capitalize on emerging opportunities in this evolving landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026