Algorand Sees 300% Rise in Active Addresses Amid 10.5% Price Decline: What Could This Mean for Market Trends?

ALGO/USDT

$31,447,699.41

$0.1001 / $0.0956

Change: $0.004500 (4.71%)

-0.0086%

Shorts pay

Contents

-

Algorand’s recent surge in active addresses has sparked inflows and heightened interest, marking a significant shift in the network’s usage trends.

-

Despite a stellar uptick in active engagement, ALGO’s price has entered a correction phase, signaling a complex dynamic between adoption and price volatility.

-

“The uptick in active addresses is a solid indicator of network growth, essential for sustained price momentum,” stated IntoTheBlock’s analysts.

Algorand sees a 300% surge in active addresses but faces a 10.5% price drop, indicating a market correction amid rising adoption.

Significant Growth in Algorand’s Active Addresses

As reported by IntoTheBlock, Algorand’s active addresses have escalated by an astonishing 300% since December 1st. This increase is reflective of growing network utilization, which is crucial for establishing a vibrant blockchain ecosystem.

Source: IntoTheBlock

This sharp rise, which saw active addresses swell from 123.57k to 427.23k, suggests an increase in genuine user engagement rather than mere speculation. However, as of the latest reports, these figures have moderated to around 343.79k.

Correlation Between Address Activity and Market Performance

The recent spike in active addresses has had a noticeable effect on Algorand’s price performance. Past performance trends indicate that such engagements often lead to price increases, thus creating a positive feedback loop.

Currently, the altcoin’s price has witnessed a pullback as active addresses have started to decline, revealing the intricate balance between network activity and market sentiment.

Market Correction: What It Means for Algorand

The past 24 hours have been tumultuous for Algorand, where prices have dipped by 10.5% to $0.475. This decline aligns with a broader market correction where sellers have regained control.

Source: IntoTheBlock

Investor Behavior: A Shift Towards Caution

Investors have begun to exhibit caution as large holders have predominantly sold their positions, pushing netflow to a low of -25.34 million ALGO over the past days. This indicates waning confidence in price rebound prospects.

Source: IntoTheBlock

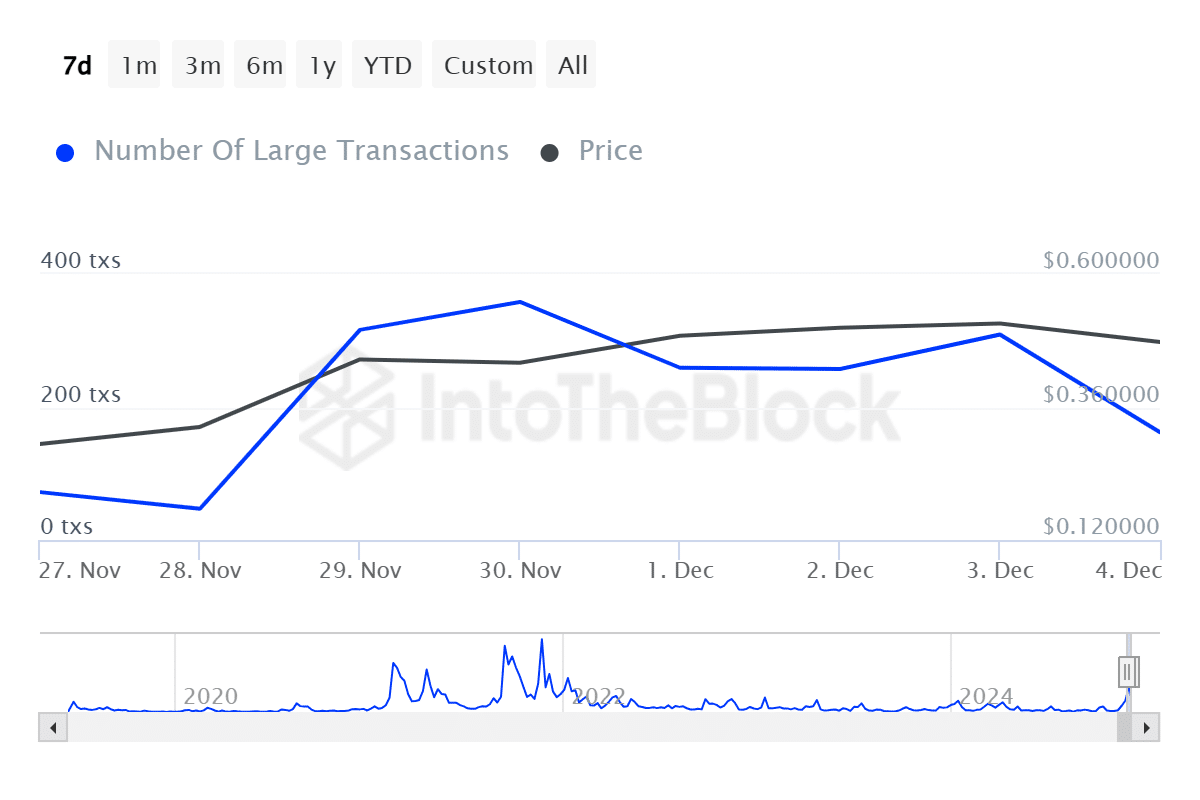

Moreover, a decrease in the number of large transactions, from 309 to 162, signifies that whale activity has considerably softened, leaving the market in a state of uncertainty as big players await a better entry point.

Market Sentiment and Future Outlook

Current market sentiment indicates a majority of traders are opting for short positions, with most investors betting on further price declines. The data from Coinglass confirms this bearish trend, paralleling a negative funding rate on the DyDx exchange.

Source: Coinglass

Conclusion

In summary, while Algorand is experiencing dramatic growth in network engagement, the accompanying price correction reflects typical volatility experienced in cryptocurrency markets. As active addresses begin to stabilize and market sentiment shifts towards caution, ALGO may find immediate support around $0.45 with resistance levels projected at $0.71. The landscape remains dynamic, and investors are advised to remain vigilant.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/9/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/8/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/7/2026

DeFi Protocols and Yield Farming Strategies

2/6/2026