AlphaTON Plans $420M Raise Despite Stock Drop, Eyes More TON Tokens

TON/USDT

$51,246,150.67

$1.306 / $1.224

Change: $0.0820 (6.70%)

-0.0132%

Shorts pay

Contents

AlphaTON Capital has exited SEC baby-shelf limits and filed a $420.69 million shelf registration to fund AI and Telegram ecosystem growth, despite a 64% stock drop to $1.71 and a $13 million market cap. This meme-inspired figure signals bold ambitions for a nano-cap firm holding $20.5 million in Toncoin.

-

AlphaTON Capital’s shelf registration allows raising up to $420.69 million, far exceeding baby-shelf caps for small issuers.

-

The filing targets GPU infrastructure for Telegram’s Cocoom AI and Toncoin acquisitions amid market challenges.

-

Stock fell 64% in November 2025 to $1.71, with $13 million market cap but $20.5 million in Toncoin holdings per CoinGecko data.

AlphaTON Capital’s $420.69 million shelf registration unlocks major fundraising for AI and TON growth. Despite stock dips, explore how this nano-cap eyes Telegram dominance—read now for investment insights!

What is AlphaTON Capital’s $420.69 Million Shelf Registration?

AlphaTON Capital’s $420.69 million shelf registration represents a strategic move by the small-cap firm to expand its fundraising capabilities beyond SEC baby-shelf restrictions. This filing, effective after exiting those limits, enables the company to potentially raise significant capital over time for targeted investments. The precise amount nods to crypto meme culture while underscoring ambitions in artificial intelligence and the Telegram ecosystem.

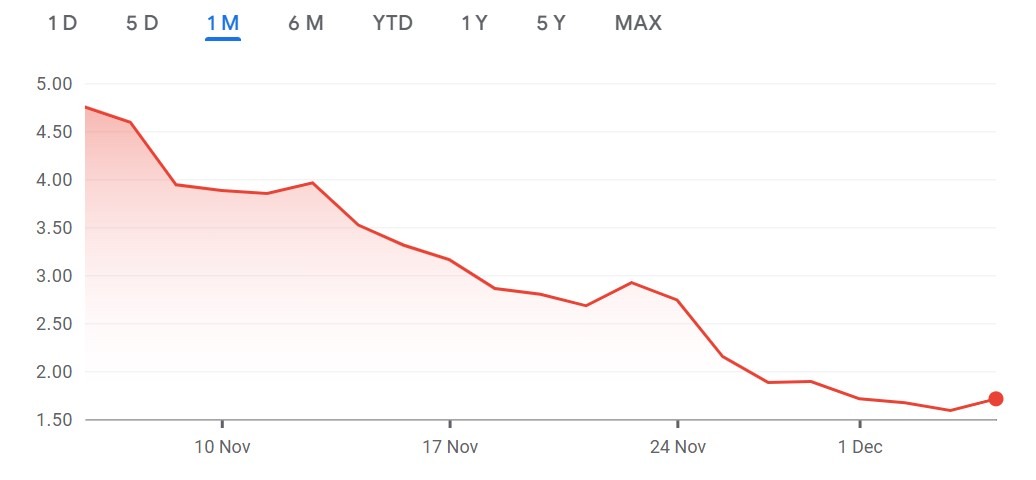

AlphaTON Capital’s stock performance in the last month. Source: Google Finance

How Has AlphaTON Capital’s Stock Performance Impacted Its Fundraising Plans?

AlphaTON Capital’s stock, ticker ATON, experienced a sharp 64% decline in November 2025, dropping from $4.75 on November 5 to $1.71, according to Google Finance data. This left the company with a market capitalization of approximately $13 million and an average daily trading volume of $1.55 million. Despite these setbacks, the firm holds over 12.8 million Toncoin (TON) tokens, valued at about $20.5 million based on CoinGecko pricing, providing a substantial treasury buffer.

The stock’s volatility highlights the risks for nano-cap issuers, yet the shelf registration announcement triggered a 14.7% rebound from a low of $1.49 to $1.71 shortly after. Experts note that such filings can signal confidence to investors, potentially stabilizing sentiment in the digital asset treasury (DAT) space. For instance, financial analyst reports emphasize that while dilution concerns loom for small floats, successful execution could drive value through ecosystem expansions.

AlphaTON’s limited float as a tiny public issuer makes this $420.69 million target ambitious, akin to mid-cap tech plays rather than typical blockchain treasuries. The SEC’s baby-shelf rules previously capped raises at one-third of public float to curb market flooding, but exiting them opens doors for larger, phased offerings. This shift aligns with broader DAT trends, though November 2025 saw sector inflows dip to $1.32 billion, dominated by Bitcoin while Ether-linked holdings faced outflows.

Frequently Asked Questions

What Are the Planned Uses for AlphaTON Capital’s Fundraising Proceeds?

AlphaTON Capital intends to allocate the $420.69 million primarily to scaling GPU infrastructure for Telegram’s Cocoom AI network, acquiring revenue-generating Telegram apps, and bolstering its Toncoin treasury. These initiatives aim to deepen integration within the TON ecosystem, potentially enhancing long-term shareholder value without immediate dilution guarantees.

Why Did AlphaTON Capital Choose $420.69 Million for Its Shelf Registration?

AlphaTON Capital selected $420.69 million as a deliberate reference to cryptocurrency meme culture, blending humor with serious intent to capture attention in the blockchain community. This figure exceeds prior limits while reflecting the firm’s focus on AI and Telegram growth, as outlined in its SEC filing for strategic capital access.

Key Takeaways

- Bold Expansion Strategy: AlphaTON’s exit from baby-shelf limits enables a $420.69 million raise, targeting AI infrastructure and TON acquisitions for ecosystem growth.

- Stock Resilience Amid Decline: Despite a 64% drop to $1.71, the announcement sparked a 14.7% uptick, with $20.5 million in Toncoin holdings offering stability.

- DAT Sector Context: November’s $1.32 billion inflows underscore timing challenges, urging investors to monitor execution for potential upside in Telegram-aligned plays.

Conclusion

AlphaTON Capital’s $420.69 million shelf registration marks a pivotal step for the nano-cap firm, navigating stock declines and DAT slowdowns to pursue AI and Telegram ecosystem opportunities. With substantial Toncoin reserves and clear fund allocation plans, this move demonstrates strategic foresight. As the blockchain treasury landscape evolves in 2025, stakeholders should watch for execution milestones that could redefine small-cap potential in crypto infrastructure.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise’s Bitcoin-Topped Crypto Index Fund Shifts to NYSE Arca Amid Institutional Inflows

December 9, 2025 at 06:27 PM UTC

Dogecoin ETFs Hit Lowest Trading Volume Since Launch, Hinting at Fading Interest

December 9, 2025 at 12:54 PM UTC