Altcoin Outlook: Bitcoin’s Dominance Rises Amid Trump Tariff Concerns and Market Uncertainty

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

-

The crypto market faces heightened volatility as Trump tariff fears intensify, with Bitcoin asserting dominance and pushing altcoins into decline.

-

Amid macroeconomic uncertainty, Bitcoin’s market share has surged, eclipsing the fortunes of many altcoins, which are now in precarious positions.

-

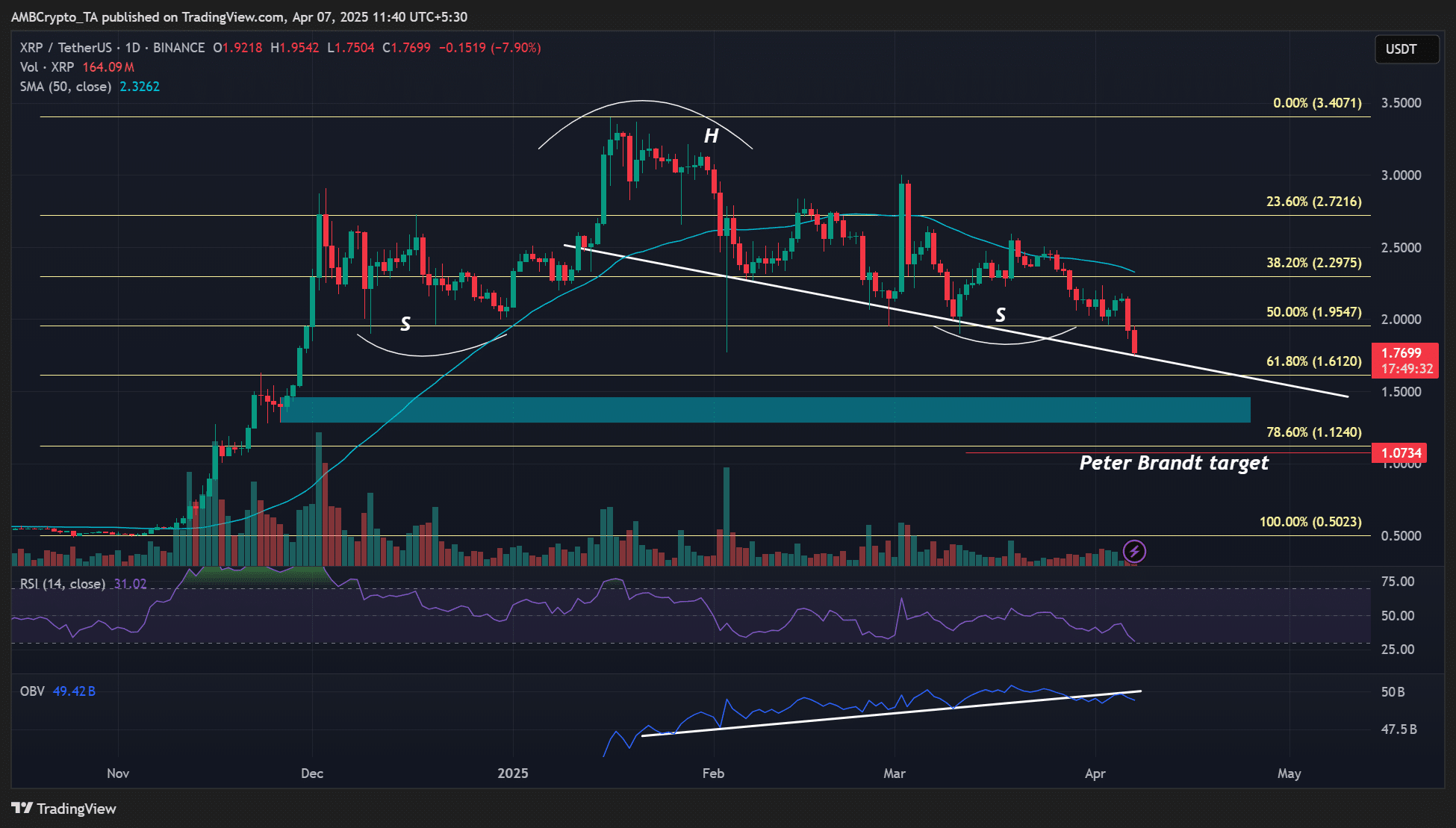

As noted by analyst Peter Brandt, “XRP’s price movement may confirm a bearish trend if critical support levels are breached,” highlighting the pressure on altcoins.

This article analyzes the current pressures on altcoins due to Bitcoin’s dominance and macroeconomic factors, particularly the impact of Trump’s tariffs.

Ethereum, XRP, and Cardano: Current Price Analysis and Market Sentiment

The ongoing macroeconomic uncertainty is impacting altcoins significantly, particularly Ethereum (ETH), XRP, and Cardano (ADA). Ethereum has seen bears firmly establish control, with the Relative Strength Index (RSI) indicating oversold conditions. This negative sentiment has affected its ETH/BTC ratio, which is now at a five-year low. A crucial level to watch is $1,500; if bulls fail to defend this support, ETH could slide into a troubling price range of $1,000 to $1,500.

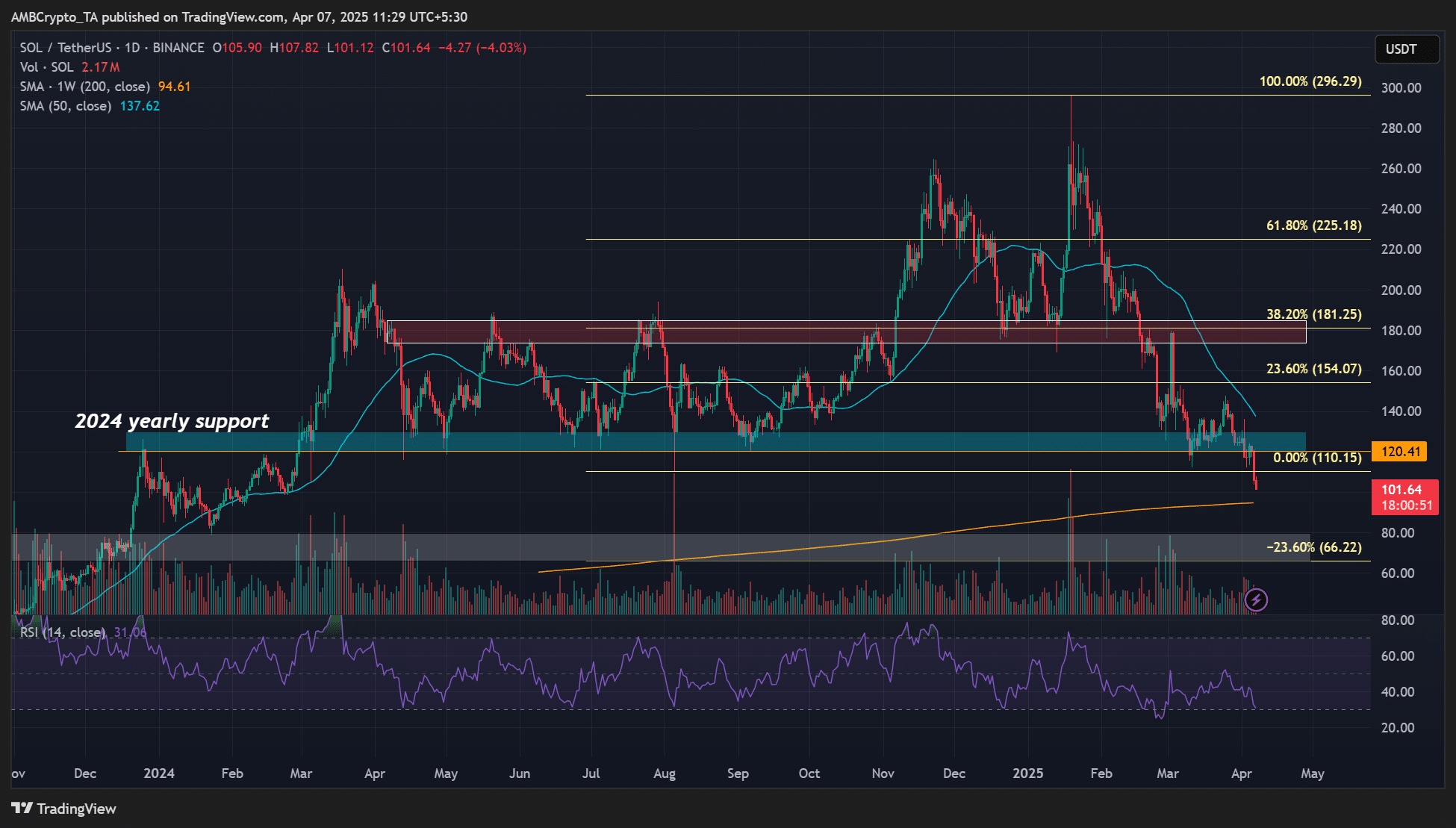

Solana’s Losses and Support Levels Under Pressure

Solana (SOL) has also succumbed to the broader market pressures, dropping below its key yearly support of $120 to $100 for the first time since early 2024. With losses of up to 67% from its peak of $295, investors need to monitor the price range of $80 to $120 closely. The 200-week moving average (WMA) at $94 will serve as a critical threshold for assessing market strength moving forward.

Source: SOL/USDT, TradingView

The Status of XRP and Cardano amidst Tariff Pressures

XRP has managed to retain 220% gains since the U.S. elections, yet the recent dip below $1.90 creates a potential risk for a bearish head-and-shoulders formation, with analysts warning that it could fall to $1.00 if bearish momentum persists. This scenario is supported by weak demand measured by the RSI and low trading volumes indicated by On-Balance Volume (OBV).

Source: XRP/USDT, TradingView

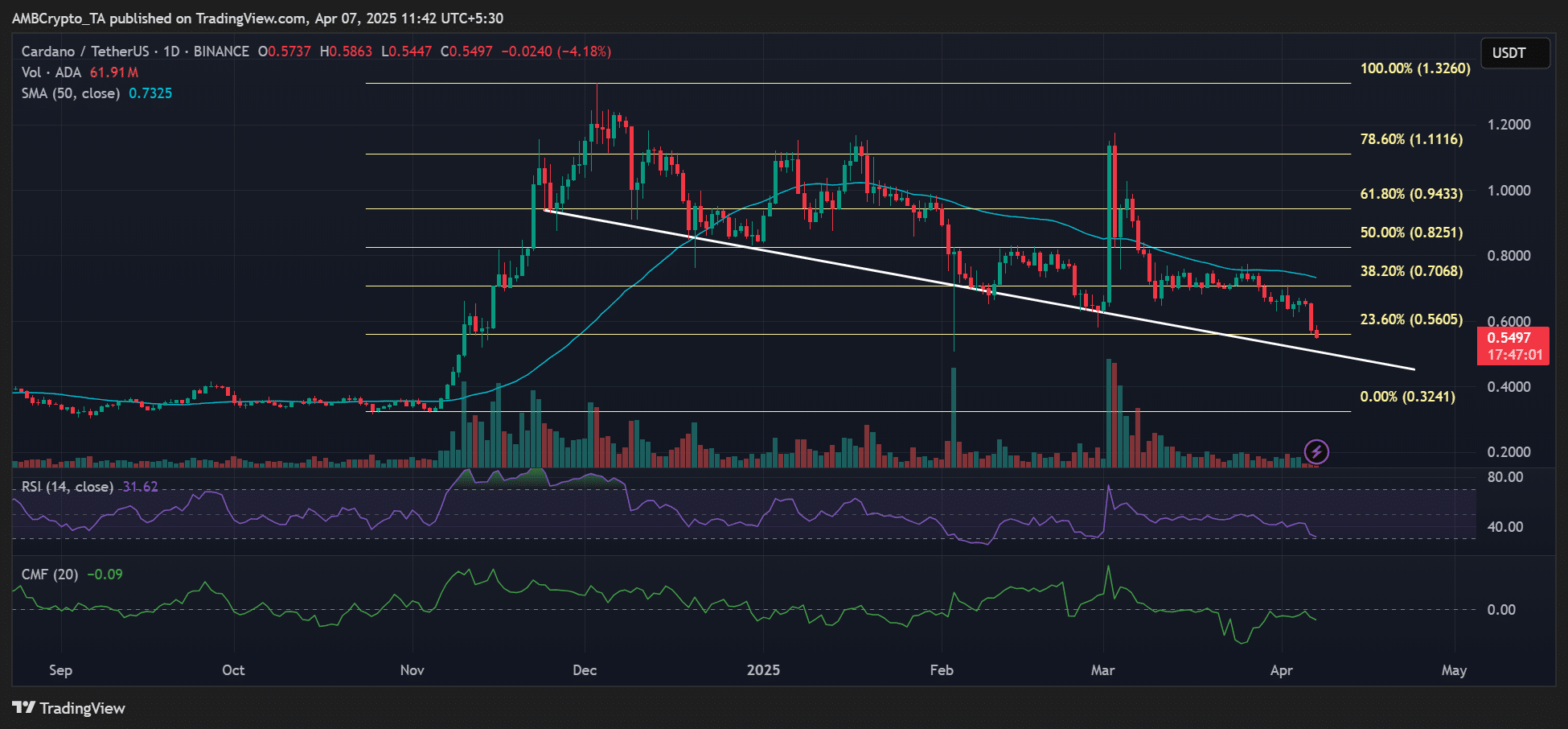

Cardano (ADA) is similarly experiencing a decline, with demand and capital inflows slowing down considerably after a brief recovery in March. Analysts caution that a breach below critical trendline support could lead to prices retreating towards pre-election levels beneath $0.40, indicating a bear trend.

Source: ADA/USDT, TradingView

Conclusion

In conclusion, the current pressures on altcoins such as Ethereum, Solana, Cardano, and XRP highlight the vulnerability of the cryptocurrency market in response to macroeconomic events. While key technical indicators suggest a potential for reversal, the overall market sentiment remains cautious. Investors are advised to remain vigilant of updates regarding Trump’s tariffs, as they could significantly impact inflation and asset prices going forward.

Comments

Other Articles

Oobit Crypto-to-Bank Transfer: 11 Assets Including BNB

February 24, 2026 at 04:34 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

USDC Tops 24-Hour Net Inflows into Crypto Spot Funds as BTC and ETH See Net Outflows, According to Coinglass Data

December 29, 2025 at 02:46 AM UTC