Altcoins Decline Sharply Excluding Bitcoin, Indicators Hint at Possible Rebound

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The altcoin market has declined sharply since early October, losing over $580 billion in value, with total capitalization now at $1.19 trillion. Despite this, only 3% of altcoins on Binance trade above their 200-day SMA, while technical indicators like compressed Bollinger Bands hint at a potential rebound.

-

Altcoin liquidations in October exceeded $19 billion, intensifying the market downturn and pushing prices lower.

-

Just 10 of the top 99 altcoins have posted gains in the last three months, led by AI-linked tokens like Aurelia [BEAT] and Pippin [PIPPIN].

-

The Altcoin Season Index sits at 17%, a level historically associated with rebounds, supported by positive accumulation/distribution metrics showing 136.57 trillion in trading volume.

Explore the latest altcoin market decline: $580B lost, cap at $1.19T. Discover resilient assets and rebound signals amid fear. Stay informed on crypto trends—read now for investment insights.

What is causing the current altcoin market decline?

Altcoin market decline stems primarily from a broader cryptocurrency sell-off that started in early October, exacerbated by massive liquidations totaling nearly $19 billion on October 10th. This event wiped out leveraged positions and triggered cascading price drops across altcoins, reducing their total market capitalization to $1.19 trillion from higher peaks. While sentiment remains bearish, pockets of resilience in select assets highlight shifting investor preferences toward specific narratives like AI and privacy.

How are technical indicators signaling a possible altcoin rebound?

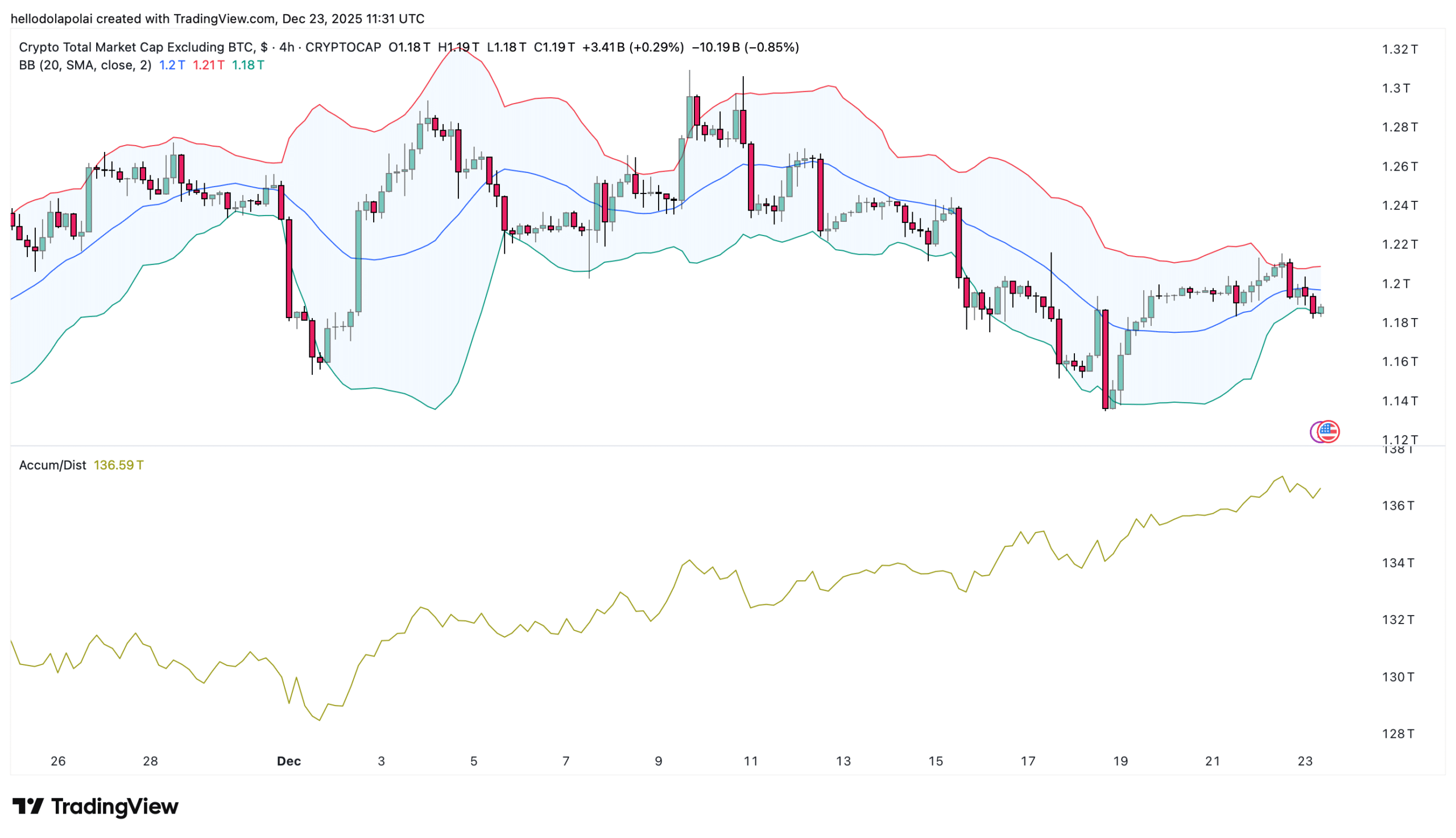

Technical analysis reveals several signs pointing to a potential recovery in the altcoin space. According to data from TradingView, the Bollinger Bands for altcoin market capitalization (excluding Bitcoin and stablecoins) have compressed toward the lower band, a pattern that often precedes increased volatility and acts as a historical support level. This compression suggests that downward momentum may be exhausting, potentially leading to a short-term bounce.

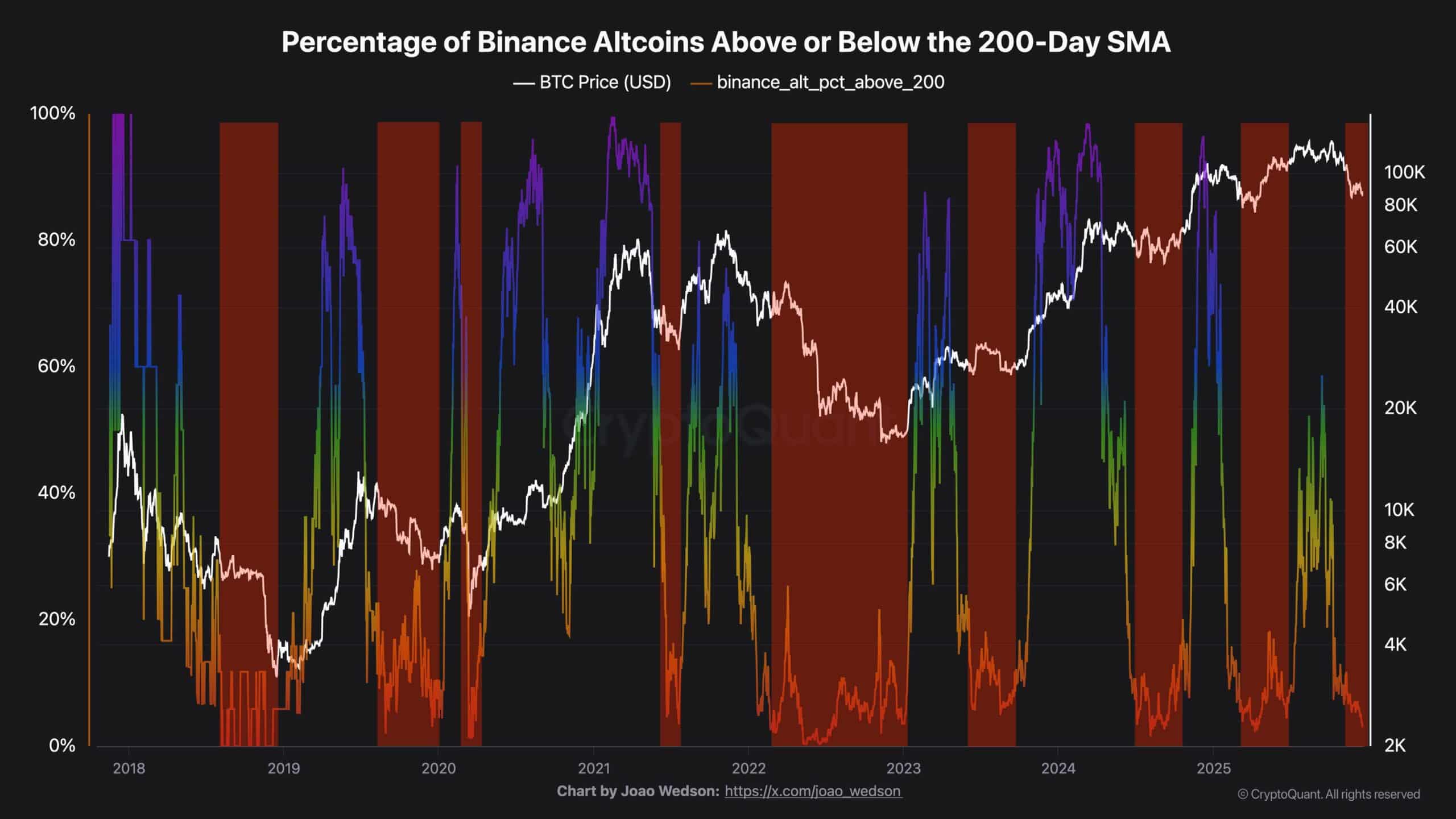

Further supporting this view, the Accumulation/Distribution (A/D) indicator remains positive at 136.57 trillion in trading volume, indicating sustained buying interest even amid the decline. CryptoQuant reports that only 3% of altcoins listed on Binance are trading above their 200-day Simple Moving Average (SMA), underscoring widespread weakness but also isolating stronger performers. Historically, trading near or below the 20-day SMA has served as a rebound zone, allowing investors to accumulate at discounted prices.

The Altcoin Season Index, another key metric, has fallen to 17%, a threshold that has aligned with market turnarounds in past cycles. Expert analysts, such as those cited in recent CryptoQuant reports, note that such low readings often reflect capitulation followed by renewed interest. However, any rebound could be modest initially, with projections estimating a rise to $1.21 trillion in altcoin capitalization, representing about a $20 billion recovery in the near term.

Source: TradingView

Despite these positive signals, liquidity constraints continue to weigh on the market, suppressing prices and limiting upside potential. The Fear and Greed Index, standing at 29, reflects extreme fear among investors, which typically drives capital toward safer or high-conviction assets rather than broad altcoin exposure.

October liquidations push altcoins lower

The altcoin market decline gained momentum following the significant liquidation event on October 10th, where nearly $19 billion in leveraged positions were erased across the cryptocurrency ecosystem. This shockwave amplified selling pressure, leading to a $580 billion drop in altcoin value since early October. As a result, the total altcoin market capitalization has settled at $1.19 trillion, one of the most pronounced contractions in recent history.

Data from CryptoQuant illustrates the severity: only 3% of altcoins on Binance are currently above their 200-day SMA, a metric that gauges long-term price trends. This low percentage indicates that the majority of altcoins are in downtrends, with limited participation from long-term holders. The scarcity of assets holding above this average points to diminished liquidity and a cautious investor base, as fewer participants remain to support prices during dips.

Source: CryptoQuant

Trading below the 20-day SMA has, in past instances, marked areas where rebounds could initiate, providing entry points for strategic accumulation. However, the ongoing market sentiment, characterized by elevated fear, suggests that any recovery will depend on improved broader conditions.

Concentrated gains show investor preferences

Amid the widespread altcoin market decline, gains have been highly concentrated among a select few assets. CoinMarketCap data over the past three months reveals that only 10 out of the top 99 altcoins have achieved positive returns. Leading this group are Aurelia [BEAT] and Pippin [PIPPIN], both leveraging artificial intelligence themes, which have captured investor attention in a risk-averse environment.

Following closely are privacy-oriented cryptocurrencies such as Zcash [ZEC], Dash [DASH], and Monero [XMR]. These assets’ performance underscores a trend where capital flows into narratives offering perceived utility or security, rather than speculative broad-market bets. This selective allocation reflects deeper market dynamics, where investors prioritize resilience over diversification during downturns.

Source: CoinMarketCap

The Fear and Greed Index at 29 reinforces this caution, as extreme fear levels encourage holdings in established or thematic strongholds. Analysts from CoinMarketCap emphasize that sustained bearish pressures could challenge even these gains, necessitating a holistic market uplift for lasting stability.

Frequently Asked Questions

What altcoins are performing best during the current market decline?

During the altcoin market decline, top performers include AI-focused Aurelia [BEAT] and Pippin [PIPPIN], alongside privacy coins Zcash [ZEC], Dash [DASH], and Monero [XMR]. These 10 out of 99 top altcoins have gained over the past three months, driven by investor interest in resilient narratives, per CoinMarketCap data.

Is there a rebound coming for altcoins soon?

Yes, technical indicators like compressed Bollinger Bands and positive A/D volume at 136.57 trillion suggest a potential altcoin rebound. The Altcoin Season Index at 17% historically precedes recoveries, though short-term gains may cap at $1.21 trillion in capitalization, according to TradingView analysis.

Key Takeaways

- Sharp Decline in Value: Altcoins have shed $580 billion since October, with market cap at $1.19 trillion due to $19 billion in liquidations.

- Concentrated Resilience: Only 10 top altcoins, like BEAT and ZEC, show gains, highlighting thematic investments in AI and privacy.

- Rebound Potential: Low Altcoin Season Index and positive accumulation signal buying opportunities; monitor for volatility expansion.

Conclusion

The altcoin market decline has reshaped the cryptocurrency landscape, with a $580 billion loss bringing total capitalization to $1.19 trillion amid liquidation pressures and bearish sentiment. Yet, resilient assets in AI and privacy sectors, coupled with rebound indicators like the 17% Altcoin Season Index, offer glimmers of hope. As technical signals from sources like CryptoQuant and TradingView point to accumulation, investors should prepare for potential volatility. Stay vigilant on market dynamics to capitalize on emerging opportunities in this evolving space.