Altcoins Rally on Sentiment Rebound, But Bitcoin Dominance Holds Firm

Contents

The recent altcoin rally in 2025 saw major assets like Ethereum, Solana, and Cardano post double-digit gains, driven by a sentiment shift from panic to optimism after MicroStrategy-related fears eased. Social volume data indicates a crowd-driven reversal, though broader market caps remain under pressure.

-

Ethereum surged 10%, Solana 12%, Cardano 14%, Chainlink 13%, and Sui 21% in a rapid relief bounce.

-

Altcoin market capitalization has declined for seven days, dropping from $1.36 trillion to $1.29 trillion despite the uptick.

-

The Altcoin Season Index stands at 21/100, confirming ongoing Bitcoin dominance with capital flows favoring BTC over altcoins (data from CoinMarketCap).

Discover the drivers behind the 2025 altcoin rally and what it means for crypto investors. Analyze sentiment shifts and market indicators for informed decisions on altcoin opportunities.

What Caused the Recent Altcoin Rally?

Altcoin rally in the crypto market emerged from a swift sentiment reversal, as indicated by on-chain analytics platforms like Santiment. Following heightened fear, uncertainty, and doubt (FUD) tied to MicroStrategy’s stock decline, social discussions turned positive, prompting traders to rotate into oversold assets. This crowd-driven move led to immediate price surges across large-cap altcoins, marking a temporary relief from recent downtrends.

Crypto markets staged an unexpected relief rally today, with several major altcoins recording double-digit gains immediately after sentiment indicators flipped from panic to optimism.

Fresh data from Santiment shows social volume turning overwhelmingly positive following a wave of MicroStrategy-related FUD, triggering what analysts describe as a “crowd-driven reversal” across large-cap assets.

Ethereum jumped 10%, Solana gained 12%, Cardano climbed 14%, Chainlink rose 13%, and Sui led the day with a 21% surge.

Source: Santiment

The rebound followed a sharp sentiment washout earlier in the week, suggesting traders had reached capitulation levels before rotating back into risk assets.

But despite the strong intraday moves, broader market indicators paint a far more cautious picture.

How Is the Altcoin Market Cap Trending Amid This Rally?

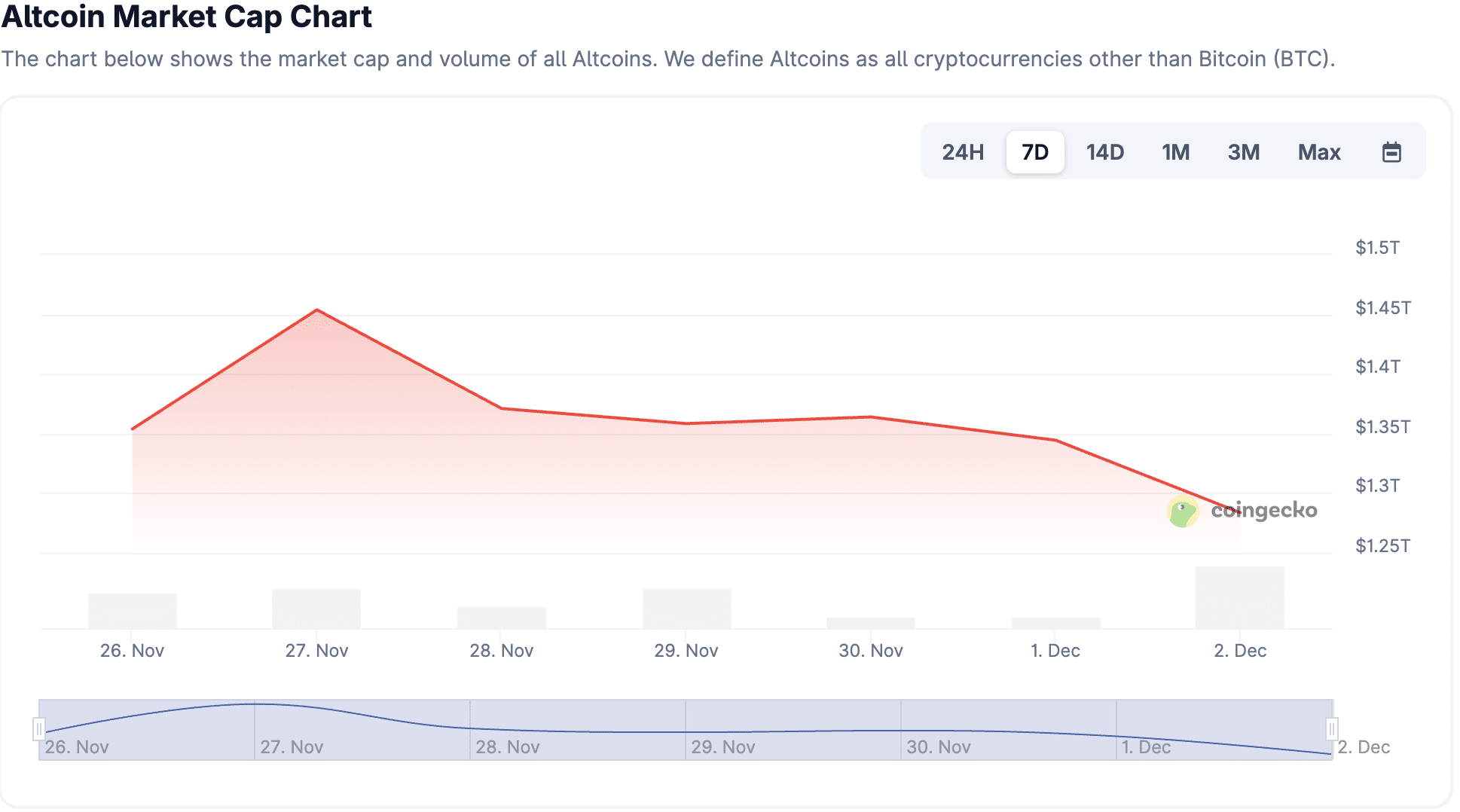

Despite individual coin gains fueling the altcoin rally, the overall altcoin market capitalization continues a seven-day decline, as tracked by Coingecko, falling from over $1.36 trillion to approximately $1.29 trillion. This persistent slide highlights underlying fragility in investor confidence, even as today’s bounce provides short-term optimism. Experts from on-chain analysis firms note that such divergences often precede either sustained recoveries or deeper corrections, with historical data showing similar patterns in past cycles where sentiment flips alone failed to reverse broader trends without increased capital inflows. For instance, during comparable periods in 2024, altcoin caps rebounded only after Bitcoin stabilized above key support levels, underscoring the sector’s reliance on BTC’s performance.

Altcoin market cap still sliding

Coingecko’s altcoin market cap chart shows the sector has been on a steady decline for seven consecutive days, dropping from above $1.36 trillion to roughly $1.29 trillion.

The rebound visible on Santiment’s price matrix has not yet reversed that broader downtrend.

Source: Coingecko

Even with today’s bounce, altcoins remain well below last week’s levels, underscoring how fragile market confidence remains.

Frequently Asked Questions

What Is the Altcoin Season Index Telling Us About the 2025 Rally?

The Altcoin Season Index from CoinMarketCap currently reads 21 out of 100, indicating a strong Bitcoin season rather than an emerging altcoin rally. This score reflects altcoins underperforming Bitcoin over multiple weeks, with capital concentrated in BTC and institutional investments flowing into Bitcoin ETFs. A reading below 25 typically signals caution for altcoin investors, as rotations to riskier assets remain limited.

Why Did Sentiment Shift So Quickly in the Crypto Market?

Sentiment in the crypto market shifted rapidly due to exhausted bearish commentary and easing FUD around corporate holders like MicroStrategy, according to Santiment data. As social volume flipped positive, prices rebounded as traders covered shorts and rotated into altcoins at perceived bottoms. This natural reset often occurs after capitulation, providing a brief window for recovery but requiring confirmation from volume spikes to sustain.

Altcoin Season Index confirms trend: still Bitcoin season

The CMC Altcoin Season Index sits at 21/100, firmly inside Bitcoin Season territory.

That means:

- Altcoins are underperforming Bitcoin on a multi-week basis,

- Capital remains concentrated in BTC,

- And institutional flows continue favoring Bitcoin ETFs, rather than rotation plays.

Just one month ago, the index stood at 29, indicating that altcoins have weakened relative to Bitcoin, despite today’s individual coin surges.

A sentiment reset may have caused the rally

Santiment attributes the sudden flip to crowd behaviour. Social data recorded a surge in bearish commentary across major assets, followed by a sharp reversal in price — a pattern often linked to forced seller exhaustion or short-term bottoming.

This move also arrived during a period of elevated volatility surrounding MicroStrategy, whose declining stock price had sparked fears of forced Bitcoin sales.

As those concerns cooled, speculative capital quickly rotated back into oversold altcoins.

Key Takeaways

- Sentiment-Driven Bounce: The altcoin rally stems from a quick reversal in social sentiment, but lacks broad market cap support for longevity.

- Ongoing Bitcoin Dominance: With the Altcoin Season Index at 21, capital remains BTC-focused, limiting altcoin upside without rotation signals.

- Watch for Confirmation: Monitor market cap recovery to $1.35 trillion and index rises above 25 for signs of a true altcoin season shift.

What comes next for altcoins?

For a sustainable trend reversal, analysts say two things must happen:

- Altcoin market cap must reclaim the $1.35T–$1.40T zone, signalling renewed sector-wide demand.

- The Altcoin Season Index must break above 25–30, showing that capital is rotating away from Bitcoin dominance.

Until then, today’s rebound looks more like a sentiment-driven relief move than the start of an altcoin breakout.

Final Thoughts

- Today’s altcoin rally reflects a sharp sentiment swing — not yet a structural market shift.

- Key indicators still show Bitcoin dominance, meaning altcoins need sustained inflows for a true recovery.

Conclusion

The 2025 altcoin rally highlights the crypto market’s volatility, with sentiment shifts driving short-term gains amid persistent Bitcoin dominance and declining market caps. As platforms like Santiment and Coingecko reveal, true recovery demands broader inflows and index improvements. Investors should stay vigilant, tracking these metrics for opportunities in an evolving landscape—consider diversifying positions as signs of rotation emerge.