Altcoins Risk Deeper Losses in 2026 Without DATs or ETFs as Bitcoin Dominance Grows

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

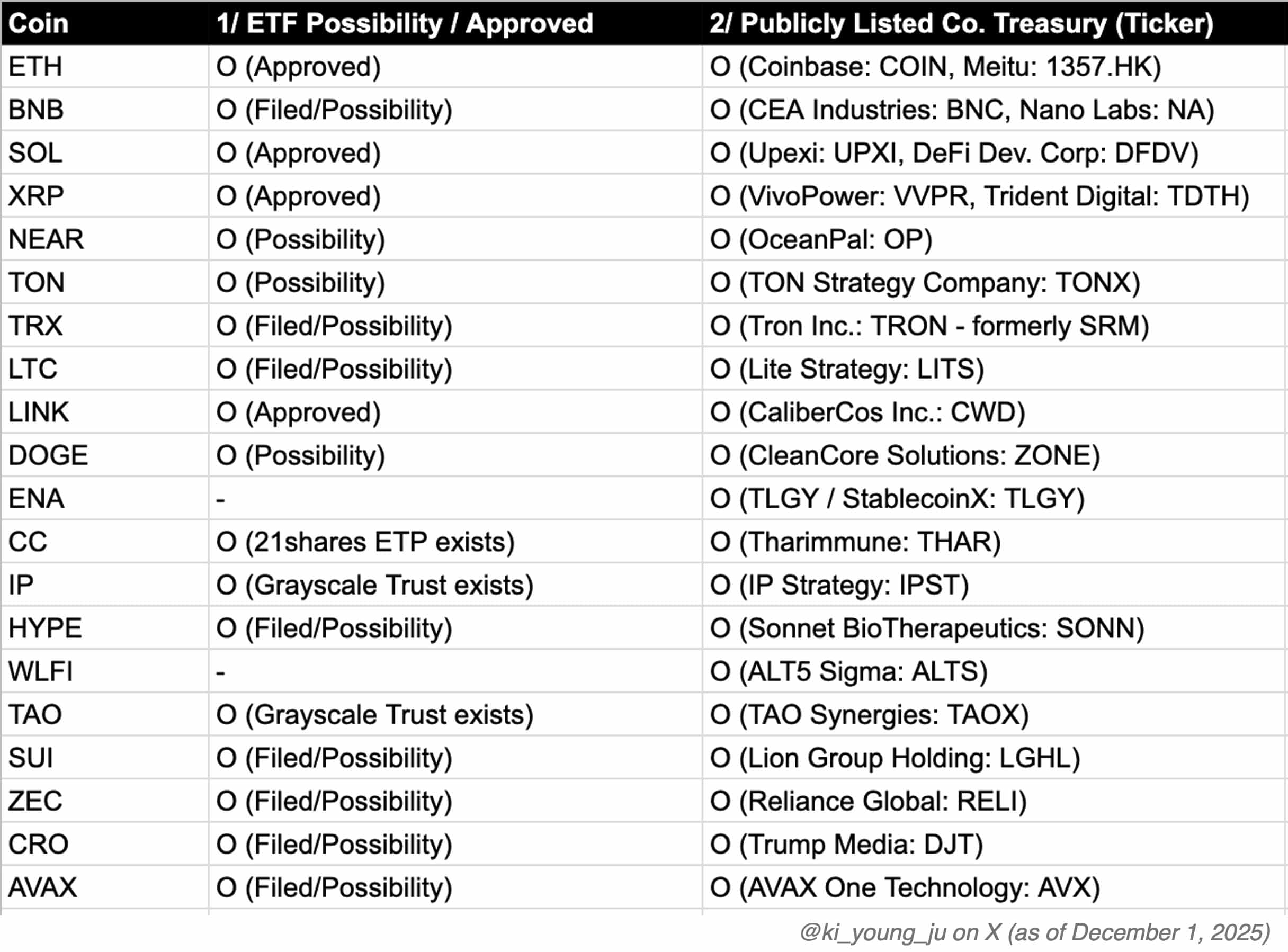

Altcoins DATs and ETFs can provide crucial liquidity during market downturns, helping select tokens survive potential 2026 sell-offs. According to CryptoQuant CEO Ki Young Ju, tokens without such support face high long-term risks as altcoin liquidity dries up, potentially leading to 70-90% further declines from 2024 peaks.

-

Altcoin liquidity is diminishing rapidly amid broader market cycles.

-

Digital Asset Treasuries (DATs) and Exchange-Traded Funds (ETFs) offer new demand sources for surviving altcoins.

-

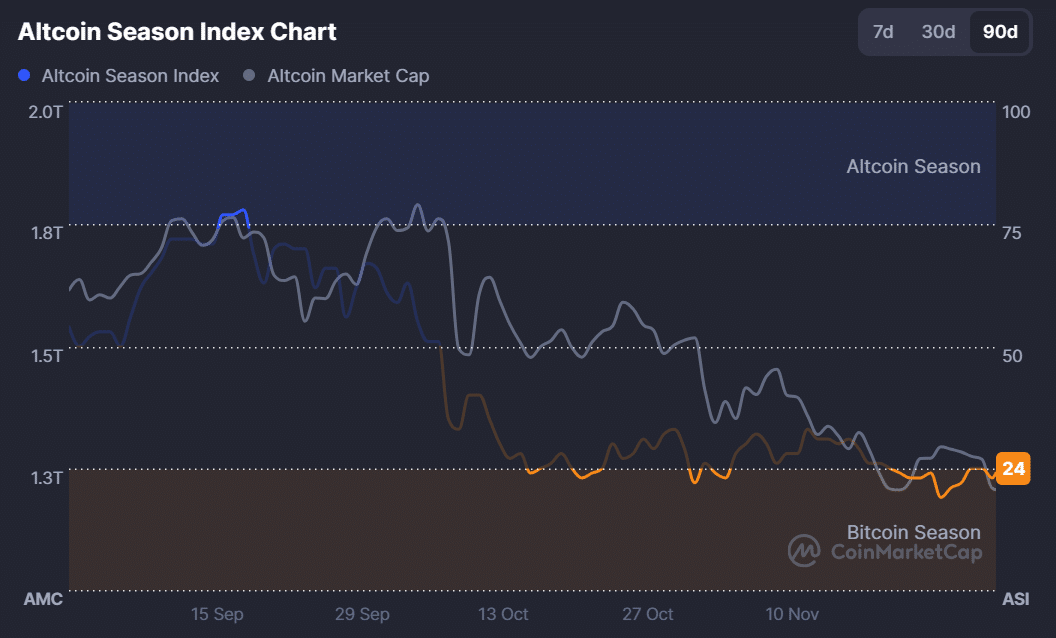

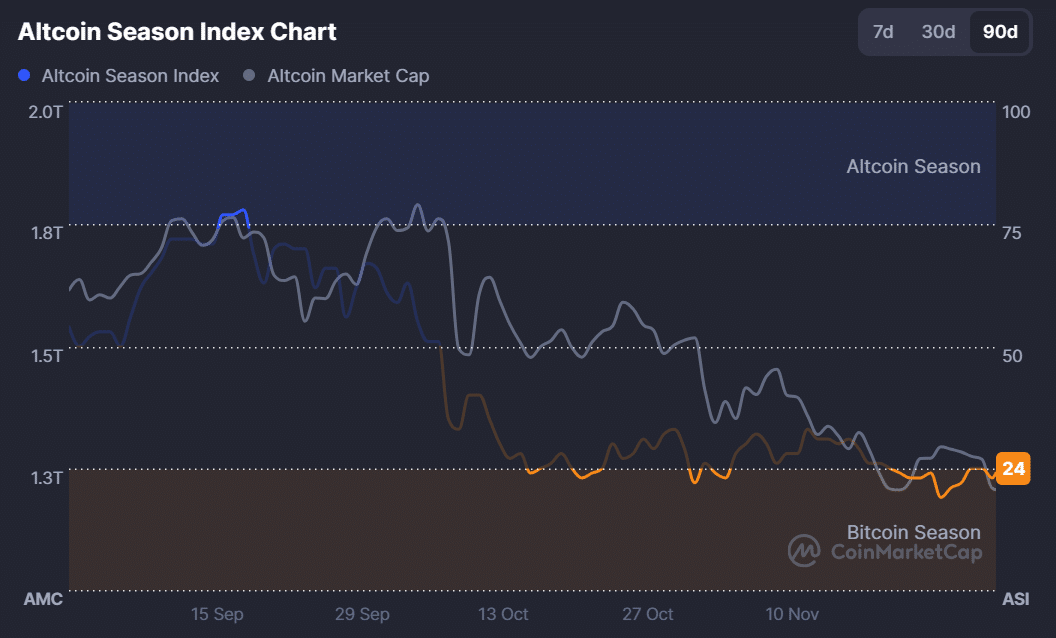

Over $600 billion has been erased from altcoin markets in Q4, with the altcoin season index at 24 signaling Bitcoin dominance.

Discover how altcoins DATs ETFs influence crypto survival in 2026 routs. Learn key risks and opportunities for investors navigating liquidity challenges—stay informed today.

What Role Do Altcoins DATs and ETFs Play in Surviving Market Routs?

Altcoins DATs and ETFs serve as vital mechanisms for injecting liquidity into the cryptocurrency ecosystem, particularly during extended downturns. These structures allow institutional players to hold and trade altcoins through regulated vehicles, potentially stabilizing prices against severe sell-offs. As the market anticipates another leg lower in 2026, mirroring historical cycles, only altcoins backed by such liquidity sources may endure, while others risk decimation.

How Are Critics Viewing the Impact of DATs on Altcoin Stability?

Critics argue that Digital Asset Treasuries (DATs) often function as hedging tools for venture capitalists, enabling quick sales during intensified market pressure to protect market-to-net-asset-value (mNAV) ratios. For instance, SharpLink liquidated millions in Ethereum holdings to repurchase shares and bolster its valuation, highlighting how DATs can amplify selling rather than provide consistent support. Limited historical data underscores this volatility, with some DATs rapidly offloading assets to maintain stock integrity amid crypto price drops.

The debate intensifies around larger holders like Strategy, the biggest public Bitcoin custodian, which faces similar mNAV concerns in depressed conditions. While DATs promise institutional demand, their dual role as both buyers and sellers during routs raises questions about long-term reliability. Experts note that in a deeper correction, these entities might prioritize corporate balance sheets over crypto holdings, exacerbating altcoin losses.

Exchange-Traded Funds (ETFs) present a mixed picture as well. In November, U.S. spot Bitcoin ETFs recorded $3.5 billion in outflows, limiting recovery efforts and demonstrating how these products can withdraw liquidity when investor sentiment sours. Put simply, while altcoins DATs and ETFs could act as a demand lifeline, they also risk becoming sources of downward pressure in prolonged bear markets.

Source: X

The broader market consensus points to a potential further decline in 2026 before a robust rebound, echoing past cyclical behaviors observed in cryptocurrency history. With many altcoins already down 70-90% from late 2024 highs, this scenario could severely impact the sector. CryptoQuant CEO Ki Young Ju emphasizes that survival hinges on new liquidity channels like DATs or ETFs, warning, “Altcoin liquidity is drying up. If your altcoin is not playing the liquidity game, its long-term risk is likely high.”

Market analysts, drawing from on-chain data and historical precedents, suggest that without institutional backing, altcoins may struggle to regain footing. This perspective aligns with observations from platforms like CoinMarketCap, where dominance metrics highlight shifting capital flows toward established assets like Bitcoin.

Frequently Asked Questions

Which Altcoins Are Most Likely to Benefit from DATs and ETFs in 2026?

Altcoins such as Solana and Ethereum, already equipped with DATs and ETF approvals, stand to gain the most. These structures provide steady inflows from institutions, buffering against retail sell-offs. In contrast, tokens without such support, like certain smaller projects, face heightened extinction risks during intensified market corrections.

How Has the Recent Crypto Rout Affected Altcoin Liquidity?

The Q4 rout has significantly eroded altcoin liquidity, wiping out over $600 billion in market value and pushing the altcoin season index to 24, a level favoring Bitcoin. This shift underscores the need for diversified liquidity sources, as traditional trading volumes plummet and investor caution prevails.

Key Takeaways

- Market Cycles Ahead: Expect another downturn in 2026, but altcoins with DATs and ETFs may weather it better than others.

- Liquidity’s Dual Edge: While providing demand, these vehicles can also trigger sales to protect valuations, as seen in recent ETH dumps.

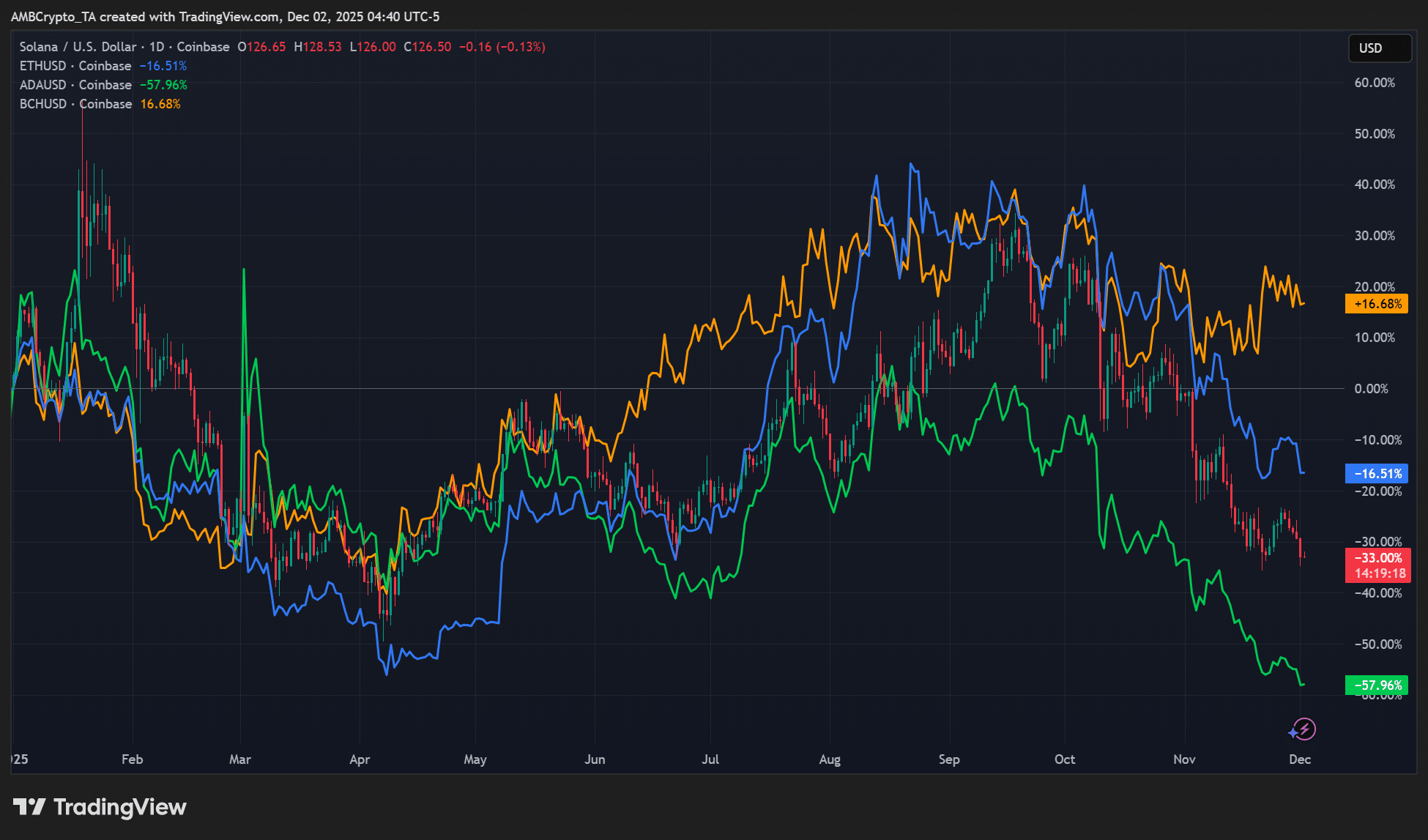

- Diversified Performance: YTD data shows varied outcomes—Solana down 32%, Cardano down 60%—highlighting the importance of institutional ties for resilience.

Source: Select altcoin performance (TradingView)

Performance across altcoins remains uneven. Year-to-date, Solana has fallen 32%, Ethereum 16%, both benefiting from DATs and ETFs. Conversely, Cardano dropped nearly 60%, while Bitcoin Cash rose 16%, despite lacking similar structures. This variance illustrates that while liquidity aids are advantageous, other factors like network utility and adoption play roles.

Source: CoinMarketCap

Conclusion

In summary, altcoins DATs and ETFs represent a double-edged sword in navigating potential 2026 market routs, offering liquidity to some while posing sell-off risks to others. With over $600 billion already lost in the altcoin sector and liquidity sources under scrutiny, investors must weigh these dynamics carefully. As cycles evolve, focusing on fundamentally strong projects with institutional support could position portfolios for the eventual rebound—monitor developments closely for informed decisions.