Altcoins Surge to 60% of Binance Volumes as BTC Activity Declines

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Binance altcoin trading volumes have surged to 60% of total activity, outpacing Bitcoin and Ethereum amid market volatility. This shift highlights robust liquidity in altcoins like ZCash, driven by speculative trading and curated projects on the platform.

-

Altcoins dominate Binance with 60% trading share as Bitcoin and Ethereum volumes decline due to selling pressure.

-

Stablecoin liquidity supports speculation in highly liquid altcoins on the exchange.

-

Activity rivals early 2025 levels, boosted by revived tokens like ZCash and derivative trading, per CryptoQuant data.

Discover why Binance altcoin trading volumes hit 60% amid BTC slowdowns. Explore liquidity, key tokens, and market trends for informed crypto strategies. Stay ahead with expert insights.

What is Driving the Rise in Binance Altcoin Trading Volumes?

Binance altcoin trading volumes have climbed to represent 60% of the platform’s total activity, even as Bitcoin and Ethereum trading slows. This resurgence stems from high stablecoin liquidity enabling speculation and the exchange’s focus on liquid, curated altcoins. Traders are capitalizing on volatility for short-term opportunities, with volumes returning to early 2025 peaks.

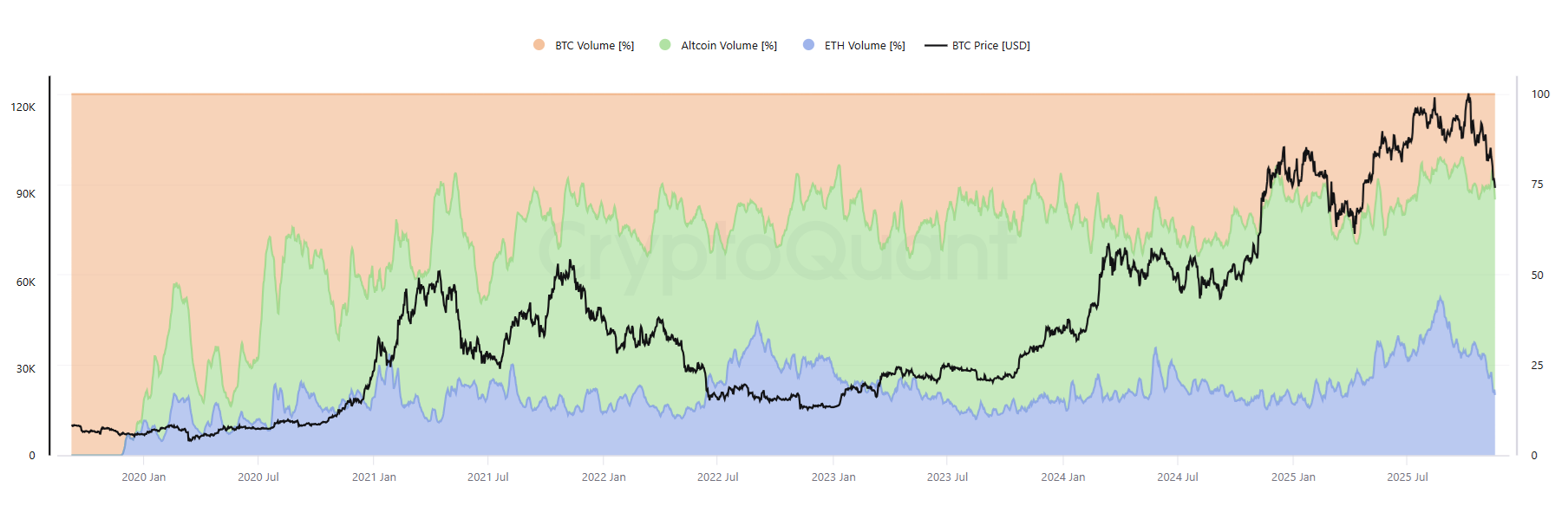

Altcoin volumes recovered on Binance, now making up more than 60% of trading activity. Both BTC and ETH trading activity took a bigger downturn. | Source: CryptoQuant.

Altcoin volumes recovered on Binance, now making up more than 60% of trading activity. Both BTC and ETH trading activity took a bigger downturn. | Source: CryptoQuant.Binance’s ecosystem plays a pivotal role in this trend. The platform hosts an extensive portfolio of tokens, including market-maker supported projects that enhance trading volumes. Despite broader market caution, altcoin activity persists through hedging via derivatives and arbitrage opportunities. Analysts from CryptoQuant note that this liquidity pool allows traders to navigate downturns without significant slippage.

How Are Altcoins Gaining Traction Over Bitcoin on Binance?

Altcoins are increasingly competing for attention on Binance, particularly as the altcoin season index lingers at 26, signaling ongoing Bitcoin dominance. However, specific altcoins like ZCash (ZEC) and Aster (ASTER) have outperformed Bitcoin recently, drawing inflows and boosting sector-wide interest. According to data from CryptoQuant, these gains follow targeted pumps in established tokens rather than a broad rally.

The exchange’s structure supports this shift. With record stablecoin reserves, Binance provides ample capital for speculative trades in volatile assets. Curated projects and invited market makers ensure higher liquidity, reducing risks for participants. For instance, perpetual futures and decentralized exchange integrations like Hyperliquid have redirected some activity, allowing altcoins to serve as hedging tools against Bitcoin’s slide to the $85,000 range.

Traders remain selective, focusing on blue-chip altcoins and occasional meme token surges rather than widespread adoption. Historical patterns suggest Bitcoin downturns could spark altcoin expansions, but in 2025, pressures like low-volume selling limit this effect. Expert commentary from blockchain analyst Maria Gonzalez emphasizes, “Liquidity in altcoins on centralized platforms like Binance creates isolated opportunities, but without macro catalysts, gains stay compartmentalized.” This cautious approach aligns with the platform’s 60% altcoin volume share, up from recent lows but below October’s 82% peak.

Revived interest in older coins contributes to the momentum. Tokens like ZCash have seen renewed trading, alongside Binance’s native assets. While not all altcoins recover—many extend multi-year bear markets—the liquid subset sustains activity. Derivative trading further amplifies volumes, with centralized and decentralized venues complementing each other for arbitrage plays.

Frequently Asked Questions

What Factors Are Boosting Altcoin Trading Volumes on Binance in 2025?

Key drivers include high stablecoin liquidity, curated token listings, and market-maker involvement, which together account for 60% of Binance’s trading. Speculative volatility in assets like ZCash supports short-term gains, even as Bitcoin faces selling pressure, according to CryptoQuant metrics.

Is It Bitcoin Season or Altcoin Season on Platforms Like Binance?

Currently, it’s Bitcoin season with the altcoin index at 26, but Binance shows altcoins capturing 60% of volumes through targeted liquidity. Traders hedge Bitcoin downturns using altcoin derivatives, creating a balanced yet cautious environment for voice-activated queries on market trends.

Key Takeaways

- Altcoin Dominance on Binance: Trading volumes for altcoins now comprise 60% of activity, surpassing Bitcoin and Ethereum due to enhanced liquidity and speculation.

- Liquidity’s Role: Stablecoin reserves and market makers enable safe trading in volatile tokens, as evidenced by CryptoQuant data from early 2025 recoveries.

- Cautious Market Outlook: Focus on select blue-chip altcoins and derivatives; monitor for broader rallies amid ongoing Bitcoin pressures.

Conclusion

In summary, Binance altcoin trading volumes at 60% reflect resilient liquidity and selective speculation, even as Bitcoin and Ethereum lag. Secondary factors like derivative hedging and token revivals, such as ZCash, underscore the platform’s evolution into an altcoin hub. As 2025 progresses, traders should watch for volatility-driven opportunities while prioritizing liquid assets—position yourself early to capitalize on emerging trends in the crypto landscape.