Aptos Stablecoin Surge Boosts Liquidity, But APT Price Remains Pressured

APT/USDT

$99,049,882.64

$0.9440 / $0.8650

Change: $0.0790 (9.13%)

-0.0043%

Shorts pay

Contents

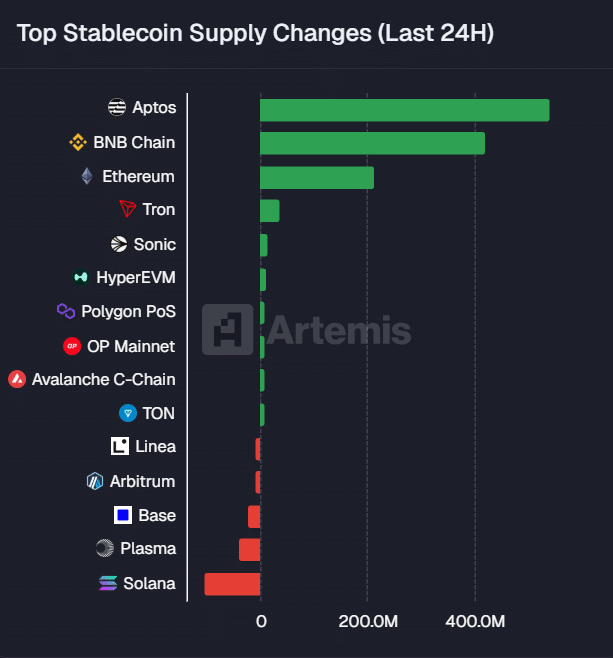

Aptos stablecoin supply has surged over 5x in the past year, driving significant liquidity growth on the Layer 1 blockchain and positioning it ahead of Ethereum and BNB Chain in recent stablecoin flows. Despite this, APT price remains down 11% weekly due to declining DEX volumes and slower transaction speeds.

-

Aptos stablecoin supply increased by more than $500 million in the last 24 hours.

-

BNB Chain follows with around $400 million, while Ethereum saw $200 million.

-

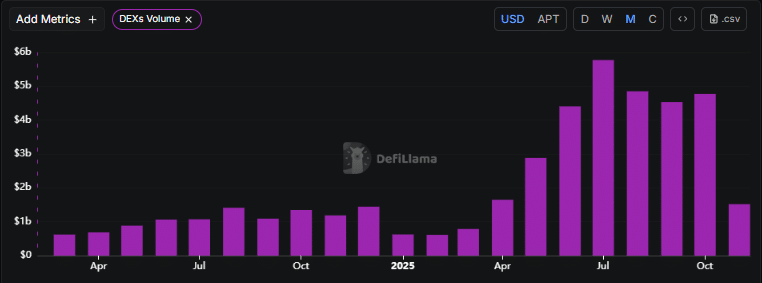

DEX volume on Aptos dropped from $4.77 billion in October to $1.52 billion in November, impacting price performance.

Aptos stablecoin supply explodes 5x yearly, boosting liquidity despite APT price dips. Discover why fundamentals lag and what it means for investors in this Layer 1 contender.

What is Driving Aptos Liquidity Growth Despite Price Declines?

Aptos stablecoin supply has experienced remarkable expansion, growing more than fivefold over the past year according to data from Artemis. This surge has enhanced liquidity on the Aptos blockchain, enabling it to outpace established networks like Ethereum and BNB Chain in stablecoin inflows over the last 24 hours. However, despite this positive development, the APT token price has declined by approximately 11% in the past week, influenced by weakening on-chain fundamentals and broader market pressures.

How Does Aptos Compare to Ethereum and BNB Chain in Stablecoin Flows?

The Aptos blockchain has demonstrated impressive momentum in stablecoin activity. Data from Artemis reveals that the stablecoin supply on Aptos increased by over $500 million in the past 24 hours alone, marking a substantial rise that underscores its growing appeal for liquidity provision. In comparison, BNB Chain recorded an inflow of just above $400 million, securing second place, while Ethereum trailed with $200 million—less than half of Aptos’s figure. This performance highlights Aptos’s ability to attract stablecoin deposits efficiently, potentially due to its scalable architecture designed for high-throughput applications.

This growth in stablecoin supply signals robust liquidity scaling on Aptos, as stablecoins like USDC and USDT provide a stable base for trading and DeFi activities. Experts in blockchain analytics, including reports from Artemis, note that such inflows often correlate with increased user adoption and developer interest. For instance, the Layer 1 network’s focus on parallel execution has allowed it to handle rising volumes without immediate congestion, though sustained growth will depend on maintaining competitive transaction costs. Short sentences like these emphasize key metrics: Aptos’s 5x yearly increase outstrips many peers, fostering an environment ripe for DeFi expansion. However, this liquidity boost has yet to translate into price appreciation for APT, revealing a disconnect between on-chain metrics and market sentiment.

Source: Artemis

While the influx of stablecoins bolsters Aptos’s ecosystem, analysts point out that liquidity alone does not guarantee token value accrual. The network’s total value locked (TVL) has seen fluctuations, but the stablecoin dominance suggests a foundation for future DeFi protocols. In the broader context, Aptos’s positioning against Ethereum—known for its security but criticized for high fees—and BNB Chain’s speed advantages shows a competitive landscape where Aptos carves out a niche through rapid adoption metrics.

Frequently Asked Questions

What Factors Are Contributing to the Decline in Aptos DEX Volume?

The decline in Aptos DEX volume stems from a sharp drop observed via DefiLlama data, falling from $4.77 billion in October to $1.52 billion in November—a reduction of over 3x. This trend, peaking midyear above $4 billion, reflects seasonal market dynamics and reduced trading activity amid bearish conditions, directly pressuring APT’s price performance.

Why Is Aptos Transaction Speed Slowing Down in 2025?

Aptos transaction speeds have decreased steadily in 2025, with transactions per second dropping from around 225 to under 100, as block times extend. This slowdown is typical during network scaling phases, where increased activity leads to temporary bottlenecks, according to on-chain performance trackers. Users may notice this in daily operations, but it positions Aptos for long-term efficiency improvements through ongoing optimizations.

Source: DefiLlama

These challenges in DEX activity and transaction processing highlight areas where Aptos must innovate to sustain its liquidity gains. The network’s developers have emphasized upgrades in their roadmap, focusing on enhancing throughput without compromising decentralization. For investors, monitoring these metrics alongside stablecoin trends provides a balanced view of Aptos’s trajectory in the competitive Layer 1 space.

Key Takeaways

- Surging Stablecoin Supply: Aptos stablecoin supply grew 5.3x yearly, leading to over $500 million in 24-hour inflows and surpassing Ethereum and BNB Chain.

- Declining Fundamentals: Monthly DEX volume plummeted from $4.77 billion to $1.52 billion, coupled with slowing TPS from 225 to under 100, contributing to bearish APT price action.

- Price Outlook: APT trades in a descending channel with mild bearish signals, but holding mid-channel support could signal potential reversal toward upper resistance.

Source: TradingView

On the price front, APT has maintained a position above the channel’s midline since mid-October, with On Balance Volume rising to $28.76 million indicating some accumulation. The Relative Strength Index shows divergence below neutral levels, suggesting caution. Should APT fail to defend $2.20 support, further downside looms; conversely, a breakout above resistance could initiate bullish momentum. Trading volumes spiked 36% recently, though predominantly from sellers, reinforcing the bearish structure. Blockchain experts from platforms like TradingView emphasize that while technical patterns provide insights, combining them with on-chain data like stablecoin flows offers a comprehensive assessment. Aptos’s liquidity advancements position it well for future growth, but addressing fundamental weaknesses will be crucial for APT holders.

Conclusion

In summary, Aptos stablecoin supply growth has propelled liquidity to new heights, outpacing Ethereum and BNB Chain, yet declining DEX volumes and transaction speeds continue to weigh on Aptos liquidity dynamics and APT price. As the network scales, these challenges present opportunities for optimization. Investors should watch for improved fundamentals and potential price reversals, staying informed on Layer 1 developments to navigate the evolving crypto landscape effectively.