Ark Invest Boosts Coinbase Holdings Amid Bitcoin’s Slight Recovery

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Ark Invest, led by Cathie Wood, recently purchased 28,315 additional Coinbase shares worth $7.5 million and 42,434 Bullish shares valued at $1.8 million through its ARKK ETF, boosting its crypto exposure amid market recovery.

-

Ark Invest’s strategy focuses on innovative sectors like crypto, with Coinbase now comprising 5.58% of ARKK holdings.

-

Recent buys follow a pattern of increasing stakes in crypto firms, including Circle and BitMine, to capitalize on emerging opportunities.

-

Coinbase shares trade at $67.16, up 0.21% today but down 20.33% monthly, while Bullish gained 4.96% amid Bitcoin’s 6.45% 24-hour surge to $93,058.

Discover how Ark Invest’s latest Coinbase purchase signals confidence in crypto amid recovery. Explore Cathie Wood’s strategy and market impacts for investors.

What is Ark Invest’s Latest Coinbase Purchase About?

Ark Invest’s latest Coinbase purchase involves acquiring 28,315 shares valued at $7.5 million through its flagship ARK Innovation ETF (ARKK) on Tuesday, enhancing its position in leading crypto exchanges. This move aligns with the firm’s broader strategy of investing in disruptive technologies, including blockchain and digital assets, as the market shows signs of stabilization. Just a week prior, Ark Invest added 62,166 Coinbase shares across multiple ETFs, underscoring a consistent bullish stance on crypto infrastructure despite recent volatility.

How Does Ark Invest’s Bullish Investment Fit into Its Crypto Portfolio?

Ark Invest’s purchase of 42,434 Bullish shares for $1.8 million via ARKK further diversifies its crypto holdings, building on a prior investment of $10.2 million in the exchange just two weeks earlier. According to disclosures from Ark Invest, Bullish represents a key player in the evolving crypto trading landscape, offering advanced platforms for institutional and retail users. This acquisition occurs as Bullish shares, trading at $7.20, record a 4.96% daily gain, contrasting with a 36.68% year-to-date decline, per data from Google Finance.

The firm’s approach emphasizes long-term growth in fintech and blockchain, with Cathie Wood highlighting crypto’s potential as a liquidity indicator during a recent market update webinar. Expert analysts from financial institutions like Bloomberg note that such investments reflect confidence in regulatory clarity and technological advancements driving adoption. For instance, Wood disputed claims of an AI bubble in a late November statement, arguing that liquidity squeezes in crypto and AI sectors would reverse soon, supported by historical patterns of market cycles observed in Federal Reserve data.

Additionally, Ark Invest added 1,951 Robinhood shares worth $245,000 through its ARK Next Generation Internet ETF (ARKW), signaling broader fintech exposure. On December 1, filings showed purchases of 22,650 and 48,850 shares in the ARK 21Shares Bitcoin ETF (ARKB) across ARKW and ARKK, respectively, bringing total crypto-related assets under management to significant levels. This structured portfolio allocation, capped at 10% per stock per Ark’s guidelines, demonstrates disciplined risk management while positioning for upside in a recovering market.

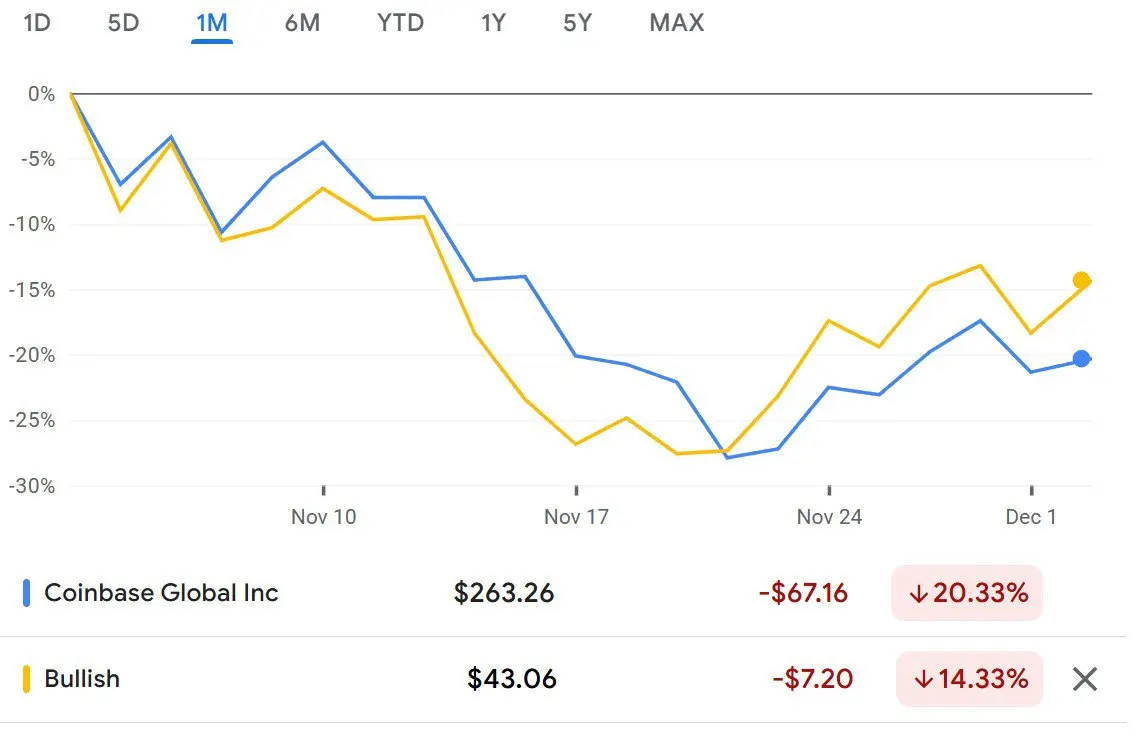

Source: Google Finance. Coinbase and Bullish 1M Performance

Source: Google Finance. Coinbase and Bullish 1M PerformanceCoinbase, now the second-largest holding in ARKK at 5.58%, alongside other crypto firms like Circle Internet Group and Bitmine Immersion Technology, underscores Ark’s conviction. Data from Google Finance indicates Coinbase’s current price at $67.16, with a 0.21% daily increase but a 20.33% monthly drop, offset by a 6% year-to-date rise. Bullish, meanwhile, faces steeper challenges with a 14.33% monthly decline, yet Ark’s repeated buys suggest undervaluation and growth potential in decentralized finance.

In mid-November, Ark Invest expanded further by acquiring $15.6 million in Circle shares across its ETFs: 38,313 via ARKW, 130,595 through ARKK, and 20,033 in ARKF. The same day saw $8.86 million in Bullish shares and $7.28 million in BitMine, following a $30 million Circle purchase the previous day. These actions, reported by financial outlets like Cryptopolitan, illustrate a proactive strategy amid uncertainty, with the overall crypto market cap rebounding as Bitcoin surpasses $90,000.

CoinMarketCap data reveals Bitcoin trading at $93,058, up 6.45% in 24 hours and 7.32% over seven days, though 26.27% below its November 10 all-time high of $69,044. This recovery aligns with Ark’s thesis that crypto will lead liquidity flows, as articulated by Wood. Institutional interest, evidenced by ETF inflows and corporate treasuries adopting digital assets, supports this outlook, with reports from Chainalysis indicating a 20% year-over-year increase in global crypto adoption.

Here’s every move Cathie Wood and Ark Invest made in the stock market yesterday 12/2 pic.twitter.com/uAlh4up9lU

— Ark Invest Tracker (@ArkkDaily) December 3, 2025

Ark Invest’s disclosures emphasize transparency, with daily trade updates available on their platform, fostering trust among investors. As a pioneer in thematic investing since 2014, the firm manages over $10 billion in assets, per their latest filings with the SEC. This expertise in high-growth sectors positions Ark to navigate crypto’s volatility, where regulatory developments from the SEC and CFTC play pivotal roles.

Broader market context includes a liquidity squeeze affecting both crypto and AI, as Wood noted in late November. She countered research from academic papers labeling AI as a bubble, citing robust fundamentals like computational power advancements tracked by NVIDIA’s earnings reports. For crypto, Wood envisions tokenized assets and blockchain interoperability driving the next bull cycle, backed by projections from Deloitte estimating the sector’s value at $16 trillion by 2030.

Frequently Asked Questions

What prompted Ark Invest’s recent Coinbase share purchases in 2025?

Ark Invest’s 2025 Coinbase purchases stem from its belief in the long-term viability of blockchain technology and crypto exchanges as core infrastructure for digital finance. The firm views current market dips as buying opportunities, with Cathie Wood emphasizing crypto’s role in upcoming liquidity reversals based on macroeconomic indicators from the Federal Reserve.

How has Bitcoin’s performance influenced Ark Invest’s crypto strategy?

Bitcoin’s recent surge to $93,058, gaining 6.45% daily, has bolstered Ark Invest’s confidence, reinforcing their strategy of accumulating shares in related companies like Coinbase during recoveries. This natural progression, ideal for voice queries, highlights how BTC acts as a bellwether for the entire crypto ecosystem, driving ETF inflows and stock valuations as noted in industry analyses.

Key Takeaways

- Strategic Crypto Exposure: Ark Invest’s ARKK now holds 5.58% in Coinbase, limiting risk while capturing growth in blockchain innovations.

- Diversified Fintech Bets: Additions in Bullish, Circle, and Robinhood reflect a multifaceted approach to digital asset ecosystems.

- Market Recovery Insight: With Bitcoin up 7.32% weekly, investors should monitor liquidity trends for potential portfolio adjustments.

Conclusion

Ark Invest’s Coinbase purchase and expansions into Bullish and other crypto stocks in 2025 exemplify Cathie Wood’s forward-thinking approach to disruptive technologies. Amid a recovering market with Bitcoin leading gains, these moves position the firm to benefit from increased adoption and regulatory tailwinds. As liquidity flows return, savvy investors may find opportunities in similar high-conviction plays—stay informed on evolving crypto landscapes for strategic advantages.