ARK Invest Bought Crypto Stocks During the BTC Dip

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

ARK Invest, led by Cathie Wood, made significant purchases in crypto-related stocks on Wednesday when Bitcoin (BTC) fell below $66,000. According to Cointelegraph data, 433,806 Robinhood (HOOD) shares were bought for approximately $33.8 million, 364,134 Bullish (BLSH) shares for $11.6 million, and 75,559 Circle (CRCL) shares for $4.4 million. These purchases took place despite the daily decline in the stocks; Robinhood shares fell 9%. ARK did not buy in this stock after selling $17 million worth of Coinbase (COIN) last week.

Source: Robinhood

ARK Invest's Robinhood and ETF Positions

Robinhood is the largest crypto-related position in the ARK Innovation ETF (ARKK), accounting for 4.1% of the portfolio (approximately $248 million). The company launched the testnet for Robinhood Chain, a layer 2 blockchain for financial services and tokenized RWAs. Although fourth-quarter net income reached $1.28 billion, it failed to meet Wall Street expectations ($1.34 billion). Eyes are on BTC for detailed BTC analysis.

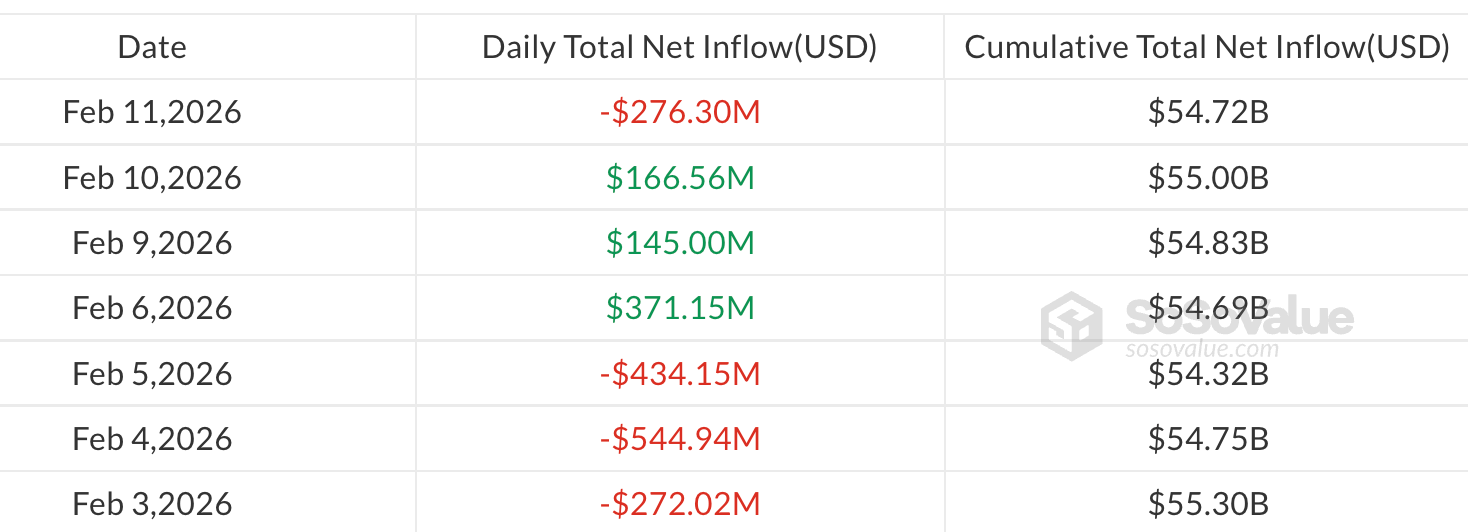

Daily flows in US spot Bitcoin ETFs. Source: SoSoValue

BTC ETF Flows and Current Technical Data

BTC ETFs experienced a net outflow of $276.3 million, ETH ETFs saw $129.2 million outflow; SOL ETFs recorded $0.5 million inflow. According to February 9, 2026 data, BTC ETFs had $144.9 million net inflow, ETH ETFs $57 million inflow. BTC is currently trading at $67,272 (+0.53%), RSI 30.40 (Oversold), showing downtrend and bearish Supertrend signal. EMA 20: $75,463. Strong supports: S1 $65,840 (75% score), S2 $59,998.

Institutional Purchases: Goldman Sachs and Binance Movements

Institutional interest is increasing when the market is at the bottom. Goldman Sachs holds $1.1 billion BTC, $1 billion ETH, $153 million XRP, and $108 million SOL. According to Arkham data, Binance's SAFU fund bought 4,545 BTC for $304.58 million. These purchases may signal recovery in the BTC futures market. Resistances: R1 $69,302 (72% score).

What Do SOL and ETH ETFs Tell Us?

- SOL ETFs are diverging positively with small inflows.

- Inflows after outflows in ETH are promising.

- ETF flows are critical for detailed ETH analysis.