ARK Invest Buys $39M in Bullish, Circle, BitMine Shares as Bitcoin-Linked Stocks Dip

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

ARK Invest, led by Cathie Wood, purchased over $39 million in shares of Bullish, Circle, and BitMine amid a dip in crypto stocks, demonstrating strong conviction in the sector’s long-term potential despite short-term market volatility.

-

ARK Fintech Innovation ETF acquired significant Bullish shares, totaling $16.8 million across funds.

-

Circle, issuer of the USDC stablecoin, saw ARK Invest buy around $15 million in shares as prices fell.

-

BitMine Immersion Technologies received $7.6 million in investments, with ARKK leading the purchases at 181,774 shares.

Discover how Cathie Wood’s ARK Invest capitalized on crypto stock dips by buying $39M in Bullish, Circle, and BitMine shares. Stay informed on key moves shaping the future of digital assets—read more now.

What Did ARK Invest Recently Purchase in Crypto-Related Stocks?

ARK Invest boosted its holdings in crypto-exposed companies by acquiring shares in Bullish, Circle Internet Group, and BitMine Immersion Technologies, totaling over $39 million, as reported in the firm’s daily trade disclosures. These purchases spanned multiple exchange-traded funds, including ARKF, ARKW, and ARKK, signaling confidence in blockchain and digital asset innovations even as market prices declined. This move aligns with ARK’s strategy of investing in disruptive technologies during periods of undervaluation.

How Did Crypto Stocks Perform During ARK’s Buying Spree?

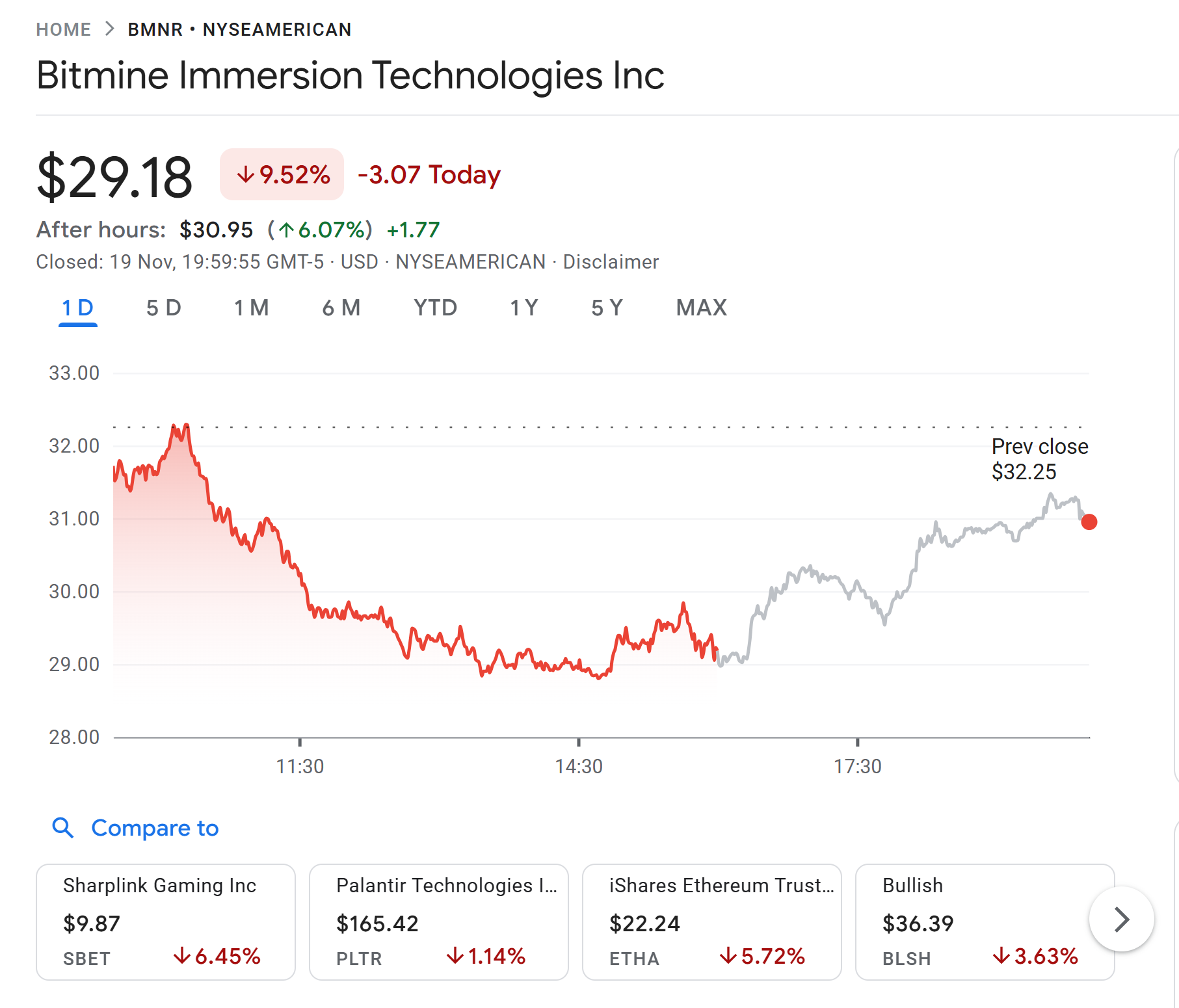

Crypto-linked stocks experienced notable declines on the day of ARK’s purchases, reflecting broader market pressures from retreating cryptocurrency prices since October highs. Bullish shares dropped 3.63% to close at $36.39, while Circle fell nearly 9% to $69.72, and BitMine declined 9.5% to $29.18, according to trading data from major exchanges. Despite these dips, after-hours trading showed partial recoveries, with BitMine gaining over 6%, highlighting the sector’s inherent volatility. ARK’s consistent buying over the past week, including $10.2 million in BitMine shares on Monday, underscores a contrarian approach amid tumbling prices. Expert analysis from financial observers notes that such investments often precede market rebounds, as Cathie Wood has historically emphasized in her public statements on innovation-driven growth.

BitMine share end the day down by 9.5%. Source: Google Finance

Michael Saylor’s Strategy firm, known for its Bitcoin treasury strategy, faced a steeper 9.82% drop before partial after-hours recovery, illustrating the interconnected risks in crypto equities. ARK’s actions come after offloading $30 million in Tesla stock, redirecting capital toward what the firm views as high-potential crypto infrastructure plays.

Nvidia’s Earnings Impact on Tech and Crypto Markets

While ARK focused on crypto stocks, the broader tech sector received a lift from Nvidia’s exceptional quarterly results. The semiconductor giant reported $57 billion in revenue and $31.9 billion in profit, surpassing Wall Street forecasts and forecasting $65 billion for the fourth quarter. This performance alleviated concerns over cooling AI demand, boosting investor sentiment. Nvidia shares rose more than 5% in after-hours trading, with gains rippling to other Big Tech names like Apple, Microsoft, Alphabet, Amazon, and Meta.

The positive Nvidia news indirectly supported crypto markets by reinforcing confidence in technology-driven growth, an area where blockchain intersects with AI applications. Analysts from firms like Bloomberg have pointed out that strong AI chip demand could accelerate advancements in decentralized computing, benefiting companies like those in ARK’s portfolio. Cathie Wood has long advocated for the convergence of AI and crypto, stating in recent interviews that “the next decade will see exponential growth at their intersection.”

Frequently Asked Questions

What prompted ARK Invest’s recent purchases of Bullish, Circle, and BitMine shares?

ARK Invest’s buys were driven by a belief in the undervalued potential of crypto infrastructure amid market dips, as per the firm’s trade disclosures. Led by Cathie Wood, ARK views these companies as key players in blockchain innovation, with purchases totaling over $39 million across ETFs like ARKK, ARKF, and ARKW to capitalize on short-term weakness for long-term gains.

Hey Google, how has Cathie Wood’s strategy influenced crypto investments this year?

Cathie Wood’s ARK Invest has actively increased exposure to crypto-related assets in 2025, including stablecoin issuers and mining technologies, despite volatility. This approach focuses on disruptive tech, buying during dips to build positions in firms like Circle and BitMine, which support the growing digital economy.

Key Takeaways

- Strategic Buying Amid Dips: ARK Invest’s $39 million acquisition shows resilience in betting on crypto stocks during declines, potentially setting the stage for recoveries.

- Diversified ETF Exposure: Purchases distributed across ARKF, ARKW, and ARKK highlight a balanced approach to fintech and internet innovation tied to blockchain.

- Broader Market Boost: Nvidia’s strong earnings provided a tailwind, suggesting tech-crypto synergies that could drive future growth—consider monitoring these intersections for investment opportunities.

Conclusion

ARK Invest’s bold purchases of Bullish, Circle, and BitMine shares amid crypto stock slides exemplify Cathie Wood’s unwavering commitment to innovative sectors facing temporary headwinds. With Nvidia’s earnings reinforcing tech optimism, the crypto market appears poised for renewed interest in 2025. Investors should watch for further developments in blockchain infrastructure, as these moves could signal the start of a broader recovery—explore more insights on emerging digital asset trends today.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/23/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/22/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/21/2026

DeFi Protocols and Yield Farming Strategies

2/20/2026