ARK Invest Buys Bullish Amid Crypto Stock Plunge; Bitcoin May Approach Bottom

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Crypto stocks plunged on Monday amid a broader market downturn, with major players like Coinbase, Marathon Digital, and Circle seeing sharp declines of up to 7%. Despite the sell-off, Cathie Wood’s ARK Invest increased its stake in crypto exchange Bullish by purchasing $10.2 million in shares at record lows.

-

ARK Invest’s strategic buy: The firm acquired over 277,000 Bullish shares across its ETFs, signaling confidence in the exchange’s long-term potential amid volatility.

-

Coinbase shares fell 7% to $263.95, reflecting widespread selling pressure on risk assets during the session.

-

Mining firms like Marathon Digital and Riot Platforms dropped around 4%, while Circle declined over 6%, contributing to a 18-26% five-day loss across the sector, per trading data.

Crypto stocks plunged on Monday, hitting Coinbase, Marathon Digital, and Bullish hard amid market turmoil. ARK Invest bought the dip in Bullish shares. Discover expert views on Bitcoin’s potential bottom and key takeaways for investors today.

What Caused the Crypto Stocks Plunge on Monday?

Crypto stocks plunged on Monday due to a combination of broader market pressures and sector-specific concerns, including liquidation events and uncertainty over Federal Reserve rate decisions. Major firms like Coinbase and Circle saw declines of 6-7%, while mining companies such as Marathon Digital and Riot Platforms fell around 4%, erasing recent gains. This downturn reflects ongoing volatility in risk assets, exacerbated by geopolitical tensions and tariff policy worries tied to recent political developments.

How Did ARK Invest Respond to the Bullish Stock Decline?

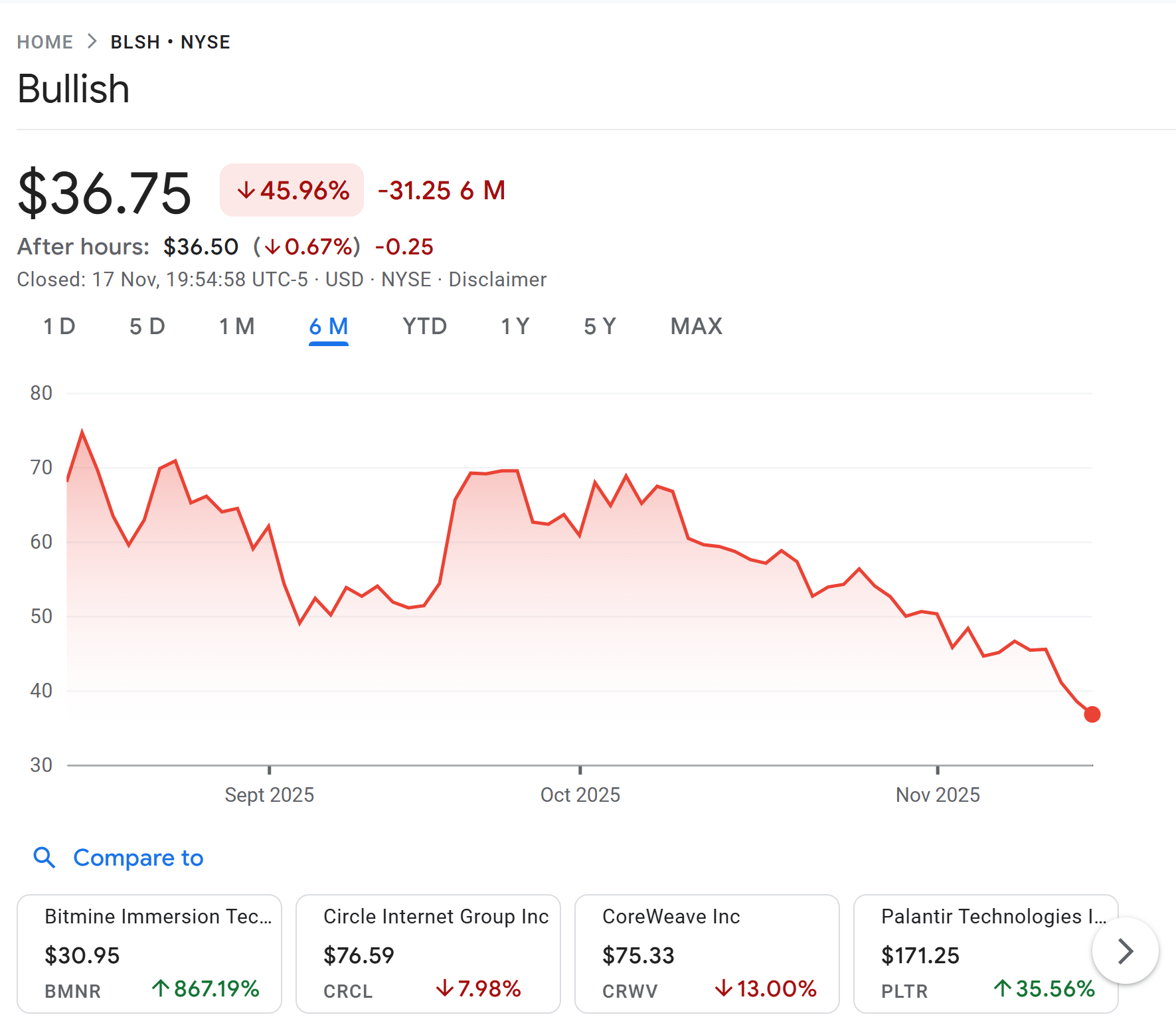

Cathie Wood’s ARK Invest capitalized on the dip by significantly increasing its exposure to the crypto exchange Bullish, acquiring $10.2 million worth of shares across multiple ETFs. According to ARK’s daily trade disclosures, the ARK Innovation ETF added 191,195 shares, the ARK Next Generation Internet ETF purchased 56,660, and the ARK Fintech Innovation ETF bought 29,208. This move occurred as Bullish shares dropped 4.5% to $36.75, marking a nearly 46% decline over the past six months and hitting a record low since its launch.

The timing is notable, coming just before Bullish’s third-quarter earnings report scheduled for Wednesday. In the second quarter, Bullish reported $57 million in adjusted revenue, a decrease from $67 million the previous year, but it achieved a net income of $108.3 million, a turnaround from a $116.4 million loss in the prior period. Backed by investor Peter Thiel, Bullish continues to navigate a challenging environment for crypto platforms, with ARK’s purchase underscoring belief in its operational strengths and growth prospects despite the market headwinds.

Bullish shares hit a record low since launch. Source: Google Finance

This acquisition aligns with ARK’s history of investing in innovative fintech and blockchain firms during periods of undervaluation, positioning the exchange for potential recovery as market conditions stabilize.

Crypto Stocks Sink Amid Market Crash

The crypto-linked equities sector experienced a pronounced pullback on Monday, driven by a cascading market crash that amplified selling across high-risk investments. Mining operations and supporting infrastructure providers bore the brunt of the decline, with Marathon Digital shares dropping 4% and failing to rebound from a week-long slide. Similarly, Riot Platforms and CleanSpark closed lower, underscoring the vulnerability of energy-intensive Bitcoin mining businesses to fluctuating cryptocurrency prices and operational costs.

Strategy, the Bitcoin treasury firm led by Michael Saylor, saw a 2% decline on the day, compounding to more than an 18% loss over the past five trading sessions. This reflects investor caution toward corporate Bitcoin holdings amid price uncertainty. Stablecoin issuer Circle, which debuted on public markets earlier this year, ended the session down over 6%, with a steeper 26% drop in the last five days, highlighting pressures on issuers tied to stable asset volumes.

Circle drops more than 6%. Source: Yahoo! Finance

Coinbase, as the leading U.S. cryptocurrency exchange, could not escape the rout, closing 7% lower at $265.95 after consistent intraday pressure. The decline mirrors a broader retreat from risk-on assets, influenced by factors such as ETF outflows and whale activity in the underlying crypto markets. ARK Invest’s recent purchases in related assets, including a $46 million stake in Circle, demonstrate selective opportunism even as the sector grapples with these challenges.

What Are Experts Saying About Bitcoin’s Potential Bottom?

Prominent analysts suggest Bitcoin may be nearing a market bottom this week, offering a potential entry point for investors. Tom Lee, chairman of BitMine Immersion Technologies, pointed to residual effects from an October 10 liquidation cascade and doubts about a December Federal Reserve rate cut as key drivers of the current rout. He referenced technical analysis from Tom Demar of Demar Analytics, which indicates selling exhaustion through momentum indicators and volume patterns, potentially signaling a reversal.

Matt Hougan, chief investment officer at Bitwise Asset Management, reinforced this outlook, describing the present price levels as a “generational opportunity” for those with a long-term horizon. He attributed the downturn to a mix of Bitcoin ETF redemptions, large-holder sales, escalating geopolitical risks, apprehensions over artificial intelligence stock valuations, and policy uncertainties surrounding President Trump’s proposed tariffs. These expert insights, drawn from recent market commentary, emphasize that while short-term volatility persists, underlying fundamentals like institutional adoption could support a rebound.

In the context of the broader crypto ecosystem, these views align with historical patterns where sharp corrections often precede consolidation phases. For instance, Bitcoin’s resilience post-liquidations has been documented in past cycles, with data from on-chain analytics showing reduced leverage in derivatives markets. Hougan’s perspective also highlights the interplay between traditional finance and crypto, where macroeconomic signals like interest rate trajectories play an outsized role.

Frequently Asked Questions

Why did crypto stocks like Coinbase and Marathon Digital decline on Monday?

Crypto stocks such as Coinbase and Marathon Digital declined on Monday due to intensified selling in risk assets amid a market crash, influenced by liquidation pressures and uncertainty over Federal Reserve policies. Coinbase fell 7% to $263.95, while Marathon dropped 4%, reflecting sector-wide losses of 4-7% as investors pulled back from volatile equities.

Is Bitcoin approaching a bottom according to market experts?

Yes, Bitcoin is likely approaching a market bottom this week, as noted by experts like Tom Lee and Matt Hougan. Lee points to technical exhaustion from recent liquidations, while Hougan sees it as a rare buying opportunity amid ETF flows and geopolitical factors, advising long-term holders to consider accumulation.

Key Takeaways

- ARK Invest’s Bullish Bet: By adding $10.2 million in shares during the dip, ARK demonstrates faith in Bullish’s earnings potential ahead of its Q3 report, despite a 46% six-month slide.

- Sector-Wide Declines: Stocks like Circle (down 6%) and Strategy (down 2%) highlight broader crypto market pressures, with five-day losses reaching 26% for some firms amid risk aversion.

- Expert Optimism on Bitcoin: Analysts Tom Lee and Matt Hougan view current levels as a bottoming signal, urging investors to monitor technical indicators and policy developments for recovery cues.

Conclusion

The crypto stocks plunge on Monday underscores the sector’s sensitivity to macroeconomic shifts and internal market dynamics, with ARK Invest’s move on Bullish shares offering a counterpoint of strategic accumulation. As experts like Tom Lee and Matt Hougan anticipate a Bitcoin bottom, investors should weigh these fact-based signals against ongoing volatility. Looking ahead, monitoring earnings reports and policy updates will be crucial for navigating this evolving landscape—consider reviewing your portfolio’s exposure to stay ahead in the crypto space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026