ARK Invest Eyes Potential Bitcoin Boost from Returning $300B Liquidity

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

ARK Invest forecasts an additional $300 billion in liquidity returning to markets after the U.S. government shutdown, easing the liquidity squeeze impacting cryptocurrency and AI valuations. This influx, combined with the Federal Reserve ending quantitative tightening on December 1, could spark a market reversal by stimulating economic activity and lowering borrowing costs.

-

$70 billion already returned: Since the shutdown ended, initial liquidity has boosted markets, with $300 billion more expected over the next five to six weeks as the Treasury General Account normalizes.

-

Monetary policy shift: The Fed’s pivot to quantitative easing on December 1 will involve bond purchases to support growth.

-

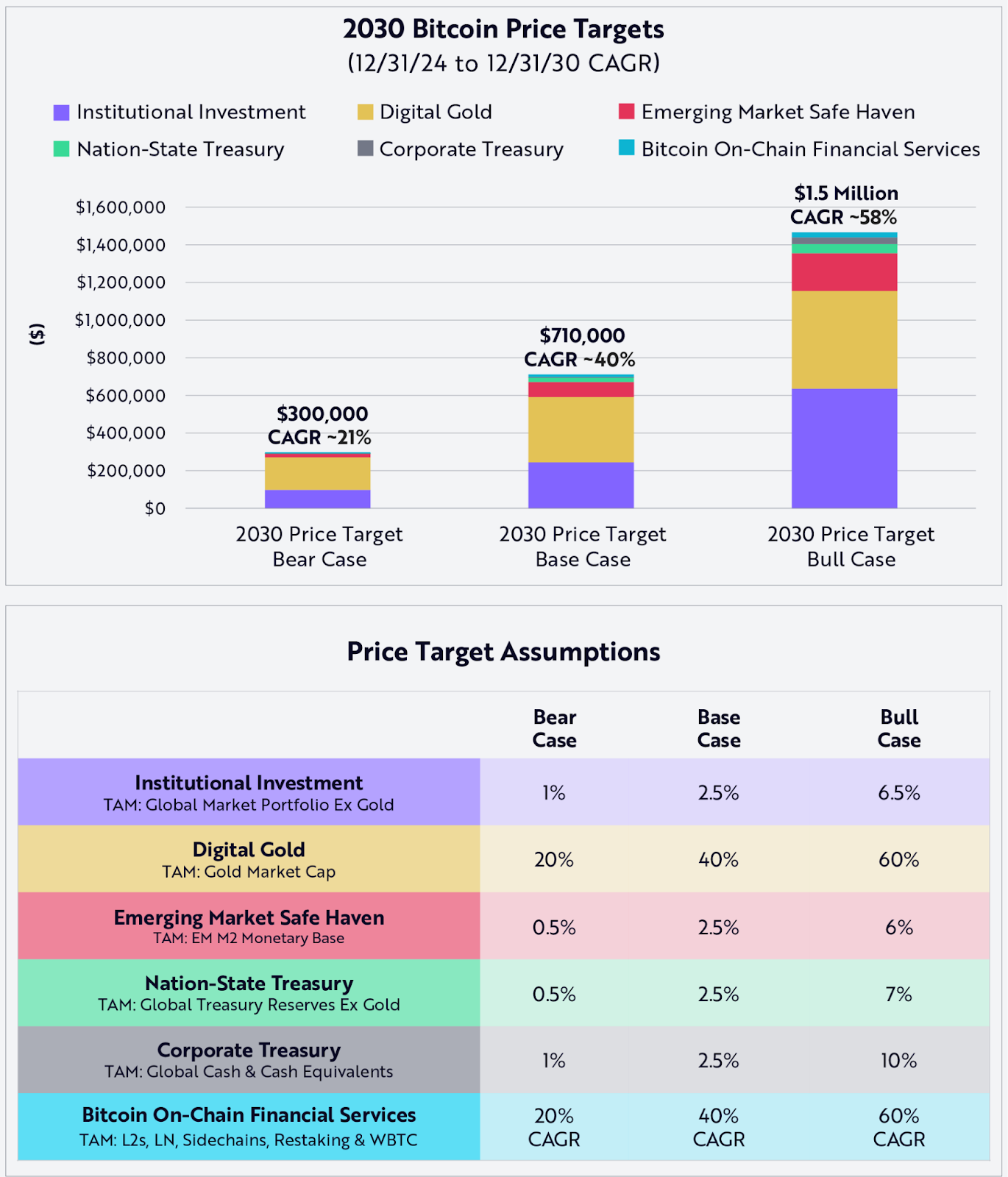

Bitcoin targets intact: ARK Invest maintains a $1.5 million bull case and $300,000 bear case for BTC by 2030, despite recent corrections.

ARK Invest predicts $300 billion liquidity boost post-shutdown, easing crypto squeeze. Fed QE pivot could reverse market drawdowns—explore impacts on Bitcoin and AI now. (142 characters)

What is ARK Invest’s Liquidity Forecast for Crypto Markets?

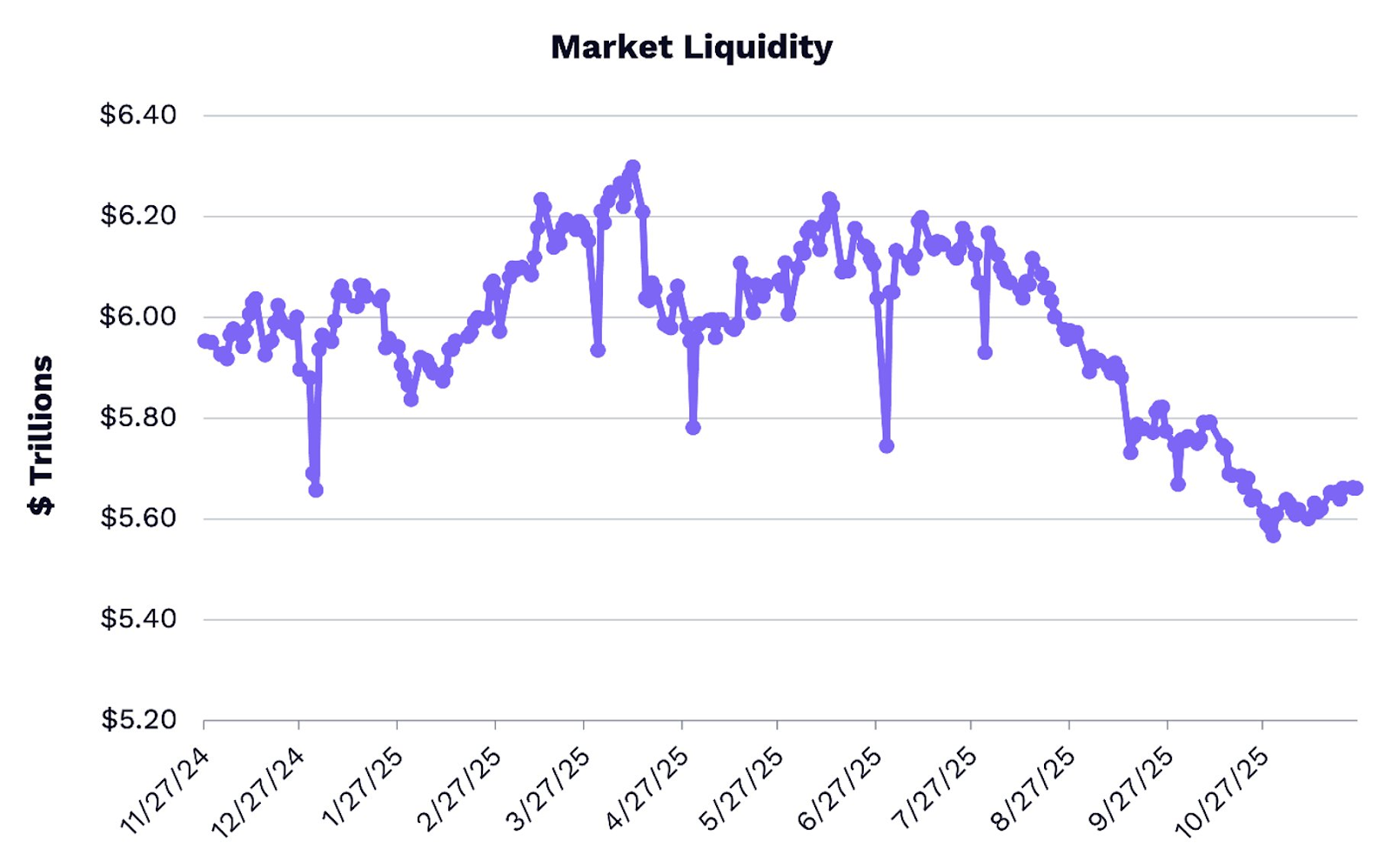

ARK Invest’s liquidity forecast anticipates $300 billion returning to financial markets in the coming weeks following the U.S. government shutdown, potentially alleviating the ongoing liquidity squeeze in cryptocurrency and AI sectors. This development, driven by the normalization of the Treasury General Account, has already seen $70 billion injected since the shutdown concluded. Combined with the Federal Reserve’s planned end to quantitative tightening on December 1, these factors could foster a more supportive environment for asset valuations.

Source: ARK Invest

Equities and cryptocurrency markets appear poised for a potential year-end turnaround as liquidity conditions improve and U.S. monetary policy adopts a more accommodative stance. The return of substantial funds is expected to counteract recent pressures, enabling broader market participation and valuation recovery.

ARK Invest highlighted this outlook in a recent statement, noting that with liquidity inflows accelerating and quantitative tightening concluding, market conditions are aligning for a reversal of recent downturns. This perspective underscores the interconnectedness of government fiscal operations and private market dynamics.

How Will the Liquidity Squeeze Impact Crypto and AI Valuations?

The current liquidity squeeze has constrained upside potential in cryptocurrency and artificial intelligence markets by limiting available capital for investment. According to Cathie Wood, CEO and chief investment officer of ARK Invest, this pressure is expected to reverse within the next few weeks as funds return to circulation. Supporting data from ARK’s analysis indicates that the initial $70 billion influx has already begun stabilizing valuations, with the projected $300 billion addition providing further relief.

Expert insights reinforce this view. During a recent webinar, Wood explained that while stablecoins have partially displaced Bitcoin’s safe-haven role, gold’s stronger-than-expected price appreciation has balanced the equation, leaving ARK’s Bitcoin price targets unchanged at $1.5 million in the bull case and $300,000 in the bear case for 2030. This resilience highlights the adaptive nature of crypto assets amid shifting liquidity landscapes.

Bitcoin price target for 2030. Source: Ark-invest.com

Other analysts echo these sentiments. BitMEX co-founder Arthur Hayes has forecasted a Bitcoin rally to $250,000 contingent on the Federal Reserve’s shift to quantitative easing. Meanwhile, Iliya Kalchev, a dispatch analyst at Nexo, emphasized that reclaiming the $92,000 level for Bitcoin would signal broader recovery if macroeconomic conditions continue to align positively.

Webinar by Cathie Wood, the CEO and chief investment officer of ARK Invest. Source: Ark-funds.com

Despite a recent market correction where over 8% of Bitcoin supply changed hands, indicating heightened volatility, the foundational bullish outlook persists. Stablecoin growth, while accelerating, has not derailed long-term projections, as Wood noted in her webinar: “The stablecoins have accelerated, taking some of the role away from Bitcoin that we expected, but the gold price appreciation has been far greater than we expected. So net, our bull price, which most people focus on, really hasn’t changed.”

This liquidity normalization process is crucial for sectors like cryptocurrency, where capital flows directly influence price discovery and investor confidence. Historical precedents, such as post-shutdown recoveries in 2019, suggest that such infusions can lead to sustained rallies, provided no unforeseen fiscal disruptions occur.

The Federal Reserve’s December 1 decision to halt quantitative tightening and initiate quantitative easing measures will further bolster this trend. By resuming bond purchases, the central bank aims to reduce borrowing costs and encourage economic expansion, indirectly benefiting high-growth assets like crypto and AI technologies.

Frequently Asked Questions

What Does ARK Invest Predict for Bitcoin Price in 2030?

ARK Invest maintains a bull case target of $1.5 million for Bitcoin by 2030, with a bear case at $300,000. These projections account for institutional adoption, network growth, and macroeconomic factors like liquidity improvements, remaining unchanged despite recent market corrections and stablecoin expansions.

How Might the Fed’s QE Pivot Affect Crypto Markets?

The Federal Reserve’s shift to quantitative easing on December 1 could significantly boost crypto markets by injecting liquidity and lowering interest rates, making risk assets more attractive. This policy change, as noted by analysts, may drive Bitcoin toward higher levels like $250,000 if combined with post-shutdown fund returns.

Key Takeaways

- Liquidity Influx Ahead: An additional $300 billion is expected to enter markets soon, building on the $70 billion already returned, to ease pressures on crypto and AI.

- Policy Support Incoming: The Fed’s end to quantitative tightening on December 1 signals a dovish turn, potentially reversing recent drawdowns in equities and digital assets.

- Bullish Targets Hold: ARK Invest’s $1.5 million Bitcoin forecast for 2030 remains intact, advising investors to monitor liquidity metrics for entry opportunities.

Conclusion

In summary, ARK Invest’s liquidity forecast points to a transformative period for cryptocurrency markets as $300 billion returns post-government shutdown, coupled with the Federal Reserve’s quantitative easing pivot. This liquidity squeeze relief could catalyze valuations in crypto and AI, fostering renewed investor optimism. As conditions evolve, staying informed on these developments will be key to navigating potential year-end reversals and long-term growth.