Ark Invest Increases Crypto Stakes in Bullish, Circle, and BitMine Amid Bitcoin Decline

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Ark Invest buys crypto stocks amid market downturn, adding $39.6 million in shares of Bullish, Circle Internet Group, and BitMine Immersion Technologies to boost exposure in the digital asset sector despite falling prices.

-

Ark Invest purchased 463,598 shares of Bullish for $16.9 million, following the exchange’s strong Q3 earnings.

-

Additional investments include 216,019 shares of Circle Internet Group valued at $15.1 million and 260,651 shares of BitMine for $7.6 million.

-

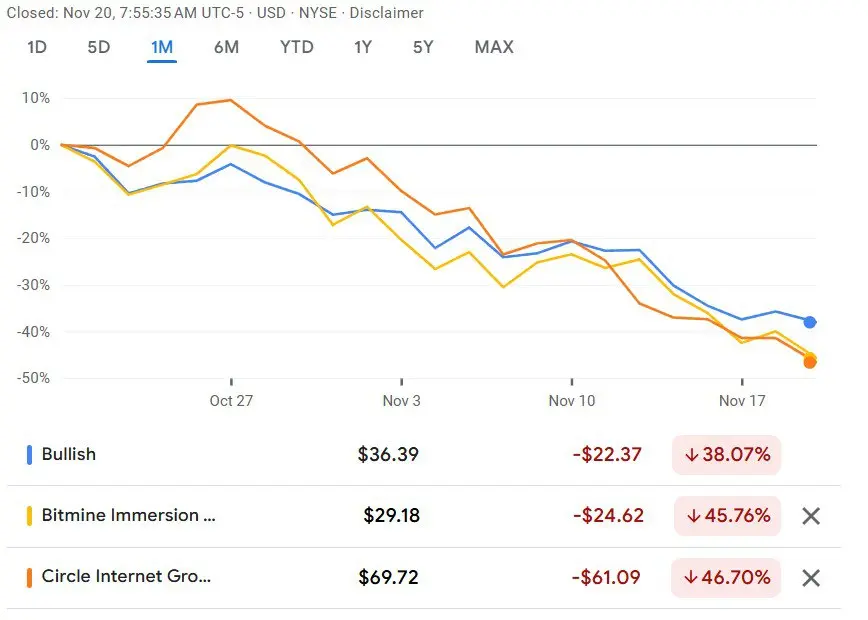

These buys occurred across ARKK, ARKF, and ARKW ETFs as crypto stocks decline 38-47% over the past month, per Google Finance data.

Ark Invest buys crypto stocks worth $39.6M in Bullish, Circle, and BitMine amid crypto market dip. Discover Cathie Wood’s strategy for long-term gains in digital assets. Read more now.

What is Ark Invest’s Latest Move in Crypto Stocks?

Ark Invest buys crypto stocks by increasing its holdings in key digital asset firms, investing $39.6 million across three companies despite ongoing market pressures. Led by Cathie Wood, the firm added shares to its exchange-traded funds, signaling confidence in the sector’s recovery potential. This strategy follows recent earnings reports and aims to capitalize on undervalued opportunities in the cryptocurrency ecosystem.

U.S.-based asset management firm Ark Invest continues to deepen its involvement in the cryptocurrency space through strategic acquisitions of publicly traded companies tied to digital assets. The latest purchases target Bullish, a cryptocurrency exchange backed by Peter Thiel; Circle Internet Group, a prominent stablecoin issuer; and BitMine Immersion Technologies, a crypto mining operation. These investments reflect Ark Invest’s bullish outlook even as broader market sentiment remains cautious due to macroeconomic challenges.

The transactions were distributed across three of Ark Invest’s flagship ETFs: the ARK Innovation ETF (ARKK), the ARK Fintech Innovation ETF (ARKF), and the ARK Next Generation Internet ETF (ARKW). This diversification helps mitigate risks while maintaining exposure to innovative technologies in finance and blockchain.

How Has Ark Invest’s Crypto Portfolio Evolved Recently?

Ark Invest’s recent activities demonstrate a pattern of consistent accumulation in crypto-related equities. On November 19, following Bullish’s third-quarter earnings release, the firm acquired 463,598 additional shares of Bullish at a value of $16.9 million. Bullish reported a net income of $18.5 million and adjusted revenue of $76.5 million for the quarter ended September 30, with adjusted EBITDA surging to $28.6 million from $7.7 million in the prior period, according to the company’s financial disclosures.

Complementing this, Ark Invest added 216,019 shares of Circle Internet Group worth $15.1 million. Circle, known for its USDC stablecoin, plays a critical role in providing stability within the volatile crypto market. The firm also invested $7.6 million in BitMine Immersion Technologies by purchasing 260,651 shares, focusing on efficient mining technologies that support blockchain network security.

Prior to this, Ark Invest had made similar moves. Reports from November 13 indicate the firm bought $30.5 million in Circle shares, totaling 353,328 shares distributed across its ETFs: 245,830 shares in ARKK, 70,613 in ARKW, and 36,885 in ARKF. The very next day, on November 14, another $15.6 million in Circle shares was added, alongside $7.28 million in Bullish and $8.86 million in BitMine. These sequential purchases underscore a deliberate strategy to build positions during periods of market weakness.

Bullish, BitMine, and Circle’s last 30-day performance. Source: Google Finance.

Bullish, BitMine, and Circle’s last 30-day performance. Source: Google Finance.Market data from Google Finance highlights the challenging environment for these stocks. Bullish shares are down 3.63% on the day, contributing to an 18.1% five-day drop and a 38.07% decline over the past 30 days, with year-to-date losses at 46.49%. BitMine Immersion Technologies has fallen 9.52% today and 45.76% monthly, though it boasts impressive year-to-date gains of 274.10%. Circle Internet Group shares have decreased 9.05% since market open, with a 46.70% monthly loss and 16.23% year-to-date decline.

The broader cryptocurrency market faces headwinds from macroeconomic uncertainties, including high interest rates and regulatory scrutiny, leading to over $1 billion in liquidations last week alone. Bitcoin, the leading cryptocurrency, has dropped more than 10% in the past seven days, trading at $91,706 as of this report—down 27.5% from its all-time high of $126,198.07, per data from CoinMarketCap. Institutional outflows from crypto investment products have exacerbated the downturn, prompting selective buying from firms like Ark Invest.

Experts view these investments as a vote of confidence in the long-term viability of blockchain technology. “Ark Invest’s approach aligns with a contrarian strategy, positioning for the next bull cycle,” noted a financial analyst familiar with the firm’s tactics, emphasizing the importance of patience in volatile sectors.

Frequently Asked Questions

What prompted Ark Invest’s recent purchase of Bullish shares?

Ark Invest’s acquisition of 463,598 Bullish shares for $16.9 million followed the exchange’s Q3 earnings on November 19, which showed $18.5 million in net income and $76.5 million in adjusted revenue. This strong performance amid market dips likely influenced the decision to increase exposure to the Peter Thiel-backed platform.

Why is Ark Invest increasing investments in Circle Internet Group now?

Circle Internet Group, issuer of the USDC stablecoin, provides essential stability in crypto trading. Ark Invest added $30.5 million in shares on November 13 and another $15.6 million on November 14 across its ETFs, betting on stablecoins’ growing role in global payments and DeFi applications despite the firm’s 46.70% monthly stock decline.

Key Takeaways

- Strategic Accumulation: Ark Invest buys crypto stocks totaling $39.6 million in Bullish, Circle, and BitMine, distributed across ARKK, ARKF, and ARKW to diversify risk.

- Market Resilience: Despite 38-47% monthly drops in these stocks, Ark’s moves highlight belief in blockchain’s fundamentals, supported by Bullish’s Q3 EBITDA rise to $28.6 million.

- Long-Term Outlook: Investors should monitor Bitcoin’s recovery from $91,706 and regulatory developments to assess Ark Invest’s strategy’s potential impact on portfolio growth.

Conclusion

Ark Invest buys crypto stocks like Bullish, Circle Internet Group, and BitMine Immersion Technologies, reinforcing Cathie Wood’s commitment to the digital asset ecosystem amid a bearish phase. With Bitcoin down 10% weekly and stocks under pressure, these $39.6 million investments signal optimism for future innovation in blockchain and fintech. As the market navigates uncertainties, staying informed on such institutional moves can guide informed decisions in the evolving crypto landscape—consider reviewing your portfolio strategies today.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026