Arthur Hayes Flips on Monad (MON) After Brief Pump, Sparking Volatility Debate

MON/USDT

$24,932,404.19

$0.02098 / $0.01941

Change: $0.001570 (8.09%)

-0.0009%

Shorts pay

Contents

Arthur Hayes, BitMEX co-founder, bought into Monad (MON) token on November 25, 2025, sparking a 30% price surge to $0.048, but sold within seven hours, calling it ‘dogshit’ and urging it to zero, highlighting MON’s extreme volatility due to its low float and high fully diluted valuation.

-

Hayes’ initial endorsement: Publicly announced buying MON, describing it as a low-float, high-FDV Layer 1 token in a bull market.

-

Price reaction: MON rallied over 30% intraday but collapsed after Hayes exited, dropping back to around $0.042.

-

Market impact: Trading volume hit $651 million with only 10.83 million circulating tokens, amplifying swings from influencer actions; fully diluted valuation stands at $4.09 billion per CoinMarketCap data.

Discover how Arthur Hayes’ rapid flip on Monad MON exposed risks in low-float tokens. Stay informed on crypto volatility and protect your investments today.

What Happened with Arthur Hayes and Monad?

Arthur Hayes, the influential co-founder of BitMEX and a prominent voice in cryptocurrency trading, made headlines on November 25, 2025, by publicly buying into the Monad (MON) token, only to reverse his position just seven hours later. This dramatic shift triggered a 30% price surge followed by a sharp reversal, underscoring the token’s susceptibility to influencer sentiment. Hayes’ actions highlighted ongoing concerns about MON’s tokenomics in a volatile market.

Why Did Arthur Hayes Quickly Reverse His Position on MON?

Hayes initially posted a playful endorsement of MON on social media platform X, labeling it as “another low float, high FDV useless L1” but noting he had “aped” into it amid a bull market. This sparked immediate buying interest, pushing MON’s price up over 30% to nearly $0.048. However, within hours, he announced his exit with a stark reversal: “I’m out. Send this dogshit to ZERO!” accompanied by a chart of the fading rally. Experts like those from crypto analytics firms attribute this to MON’s structure, where a circulating supply of just 10.83 million tokens against a $4.09 billion fully diluted valuation creates extreme sensitivity to capital flows. As reported by CoinMarketCap, such low-float setups often lead to amplified price swings, with trading volume reaching $651 million in 24 hours alone. This incident validates warnings from financial analysts about the risks of hype-driven trades in emerging Layer 1 projects.

Source: X

The swift backlash from the community included accusations of pump-and-dump tactics, though Hayes has not commented further. Data from on-chain trackers shows that MON’s liquidity remains thin, making it prone to such manipulations.

Hayes Pumps MON, Then Dumps Hours Later

Arthur Hayes’ social media activity on November 25, 2025, began with an endorsement that captivated traders. He shared his decision to invest in MON, framing it within the context of broader market optimism. The token, an emerging Layer 1 blockchain project, saw its price react almost instantaneously, climbing from around $0.037 to a peak near $0.048.

By late that day, Hayes posted again, this time signaling his complete withdrawal. The accompanying chart depicted the rapid decline, erasing most of the gains and leaving MON consolidating lower. This sequence of events drew sharp criticism from traders who viewed it as emblematic of influencer-driven volatility in the crypto space. According to market observers, Hayes’ influence stems from his track record at BitMEX, where he helped shape early derivatives trading, lending weight to his opinions.

Source: X

The community’s response was swift, with forums buzzing about the potential for regulatory scrutiny on such high-profile trades. Nonetheless, Hayes maintains a reputation for candid, sometimes provocative commentary that often influences market dynamics.

Monad’s Price Action Shows Classic Pump-and-Dump Pattern

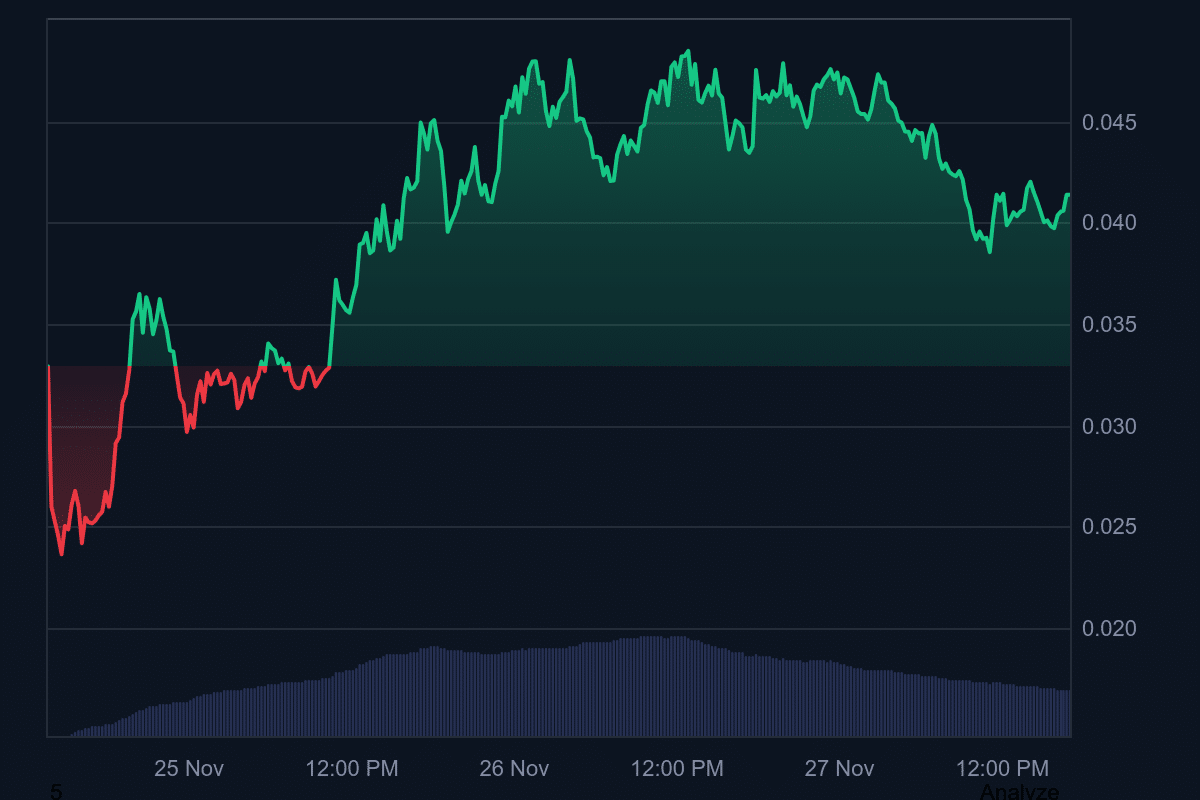

MON’s price chart from November 24 to 27, 2025, illustrates the volatility in stark terms. The token began a sharp upward move late on the 24th, building momentum into the 25th and peaking near $0.048 following Hayes’ initial post. A corrective dip ensued, aligning precisely with his exit announcement, bringing the price back to $0.040 before stabilizing around $0.040–$0.042.

- Sharp rally beginning late November 24, 2025.

- Breakout momentum peaking near $0.048 on the 25th.

- Corrective dip to $0.040 coinciding with Hayes’ exit.

- Current consolidation around $0.040–$0.042 as of November 27.

As of November 27, 2025, CoinMarketCap lists MON at $0.04204, reflecting a 59% gain from its initial listing price despite the setback. The disparity between its $651 million 24-hour trading volume and limited 10.83 million circulating supply exemplifies how minimal order book depth can lead to exaggerated movements.

Source: CoinMarketCap

Analysts from platforms like CoinGecko echo these observations, noting that MON’s fully diluted valuation of $4.09 billion far outpaces its current market cap, setting the stage for future dilution risks as more tokens enter circulation.

What’s Next for MON?

Even after the Hayes episode, MON continues to attract attention for several reasons. Traders speculate on potential listings on major Tier-1 exchanges beyond its current venues like Bybit and Gate.io. Additionally, narratives around upcoming airdrops for ecosystem participants could bolster interest. In the broader context, MON’s position as a Layer 1 contender fuels discussions on its viability amid a crowded field of blockchain projects.

- Speculation around Tier-1 exchange listings.

- Anticipated airdrop narratives for participants.

- Debate about Layer 1 sustainability in a saturated market.

Key Technical Levels

- Support at $0.040, marking the current consolidation zone.

- Resistance between $0.045–$0.048, the recent rejection area.

- A break below $0.040 would align with Hayes’ bearish outlook.

- Reclaiming $0.048 could spark short-term bullish recovery.

MON’s inherent supply dynamics mean volatility is not an exception but the norm. With ongoing token unlocks, early investors may add selling pressure, challenging the token’s ability to sustain gains from hype alone. Financial experts recommend caution, emphasizing diversified strategies over reliance on social media signals.

Frequently Asked Questions

What Caused the Sudden 30% Surge in Monad (MON) Price on November 25, 2025?

Arthur Hayes’ public announcement of buying MON on social media triggered the surge, as his endorsement drew rapid buying from followers and traders, pushing the price from $0.037 to $0.048 in hours amid the token’s low circulating supply of 10.83 million.

Is Arthur Hayes’ Flip on MON a Sign of Broader Crypto Market Risks?

Yes, this event underscores risks in low-float tokens like MON, where influencer actions can cause extreme swings. With a $4.09 billion fully diluted valuation and thin liquidity, such volatility highlights the need for careful risk assessment in crypto investments, as noted by market analysts.

Key Takeaways

- Arthur Hayes’ Influence on MON: His buy announcement sparked a 30% rally, but the quick sell-off erased gains, demonstrating the power and peril of key opinion leaders in crypto.

- MON’s Token Structure Risks: Low circulating supply of 10.83 million tokens against high FDV creates setups for massive volatility, with $651 million in volume amplifying even small trades.

- Future Outlook for MON: Watch support at $0.040 and resistance at $0.048; potential exchange listings and airdrops could drive momentum, but dilution looms as a key challenge.

Conclusion

The Arthur Hayes Monad episode serves as a cautionary tale in the volatile world of MON token trading, exposing how low-float structures and high fully diluted valuations can lead to rapid price swings from influencer actions. As the crypto market evolves, investors should prioritize thorough due diligence over social media hype. Looking ahead, monitoring MON’s technical levels and ecosystem developments will be crucial for navigating its path in the competitive Layer 1 landscape—consider building a balanced portfolio to mitigate such risks today.