Arthur Hayes Predicts Further Decline for MON After Post-Airdrop Volatility

MON/USDT

$24,932,404.19

$0.02098 / $0.01941

Change: $0.001570 (8.09%)

-0.0009%

Shorts pay

Contents

Monad’s native token MON has experienced a sharp price drop of over 14.5% to $0.039 following its airdrop, erasing early gains amid heavy shorting by whales and bearish predictions from BitMEX founder Arthur Hayes, who forecasts a potential total crash in this volatile altcoin market.

-

Arthur Hayes, BitMEX co-founder, publicly called for MON to hit zero, signaling lost confidence just days after initial optimism.

-

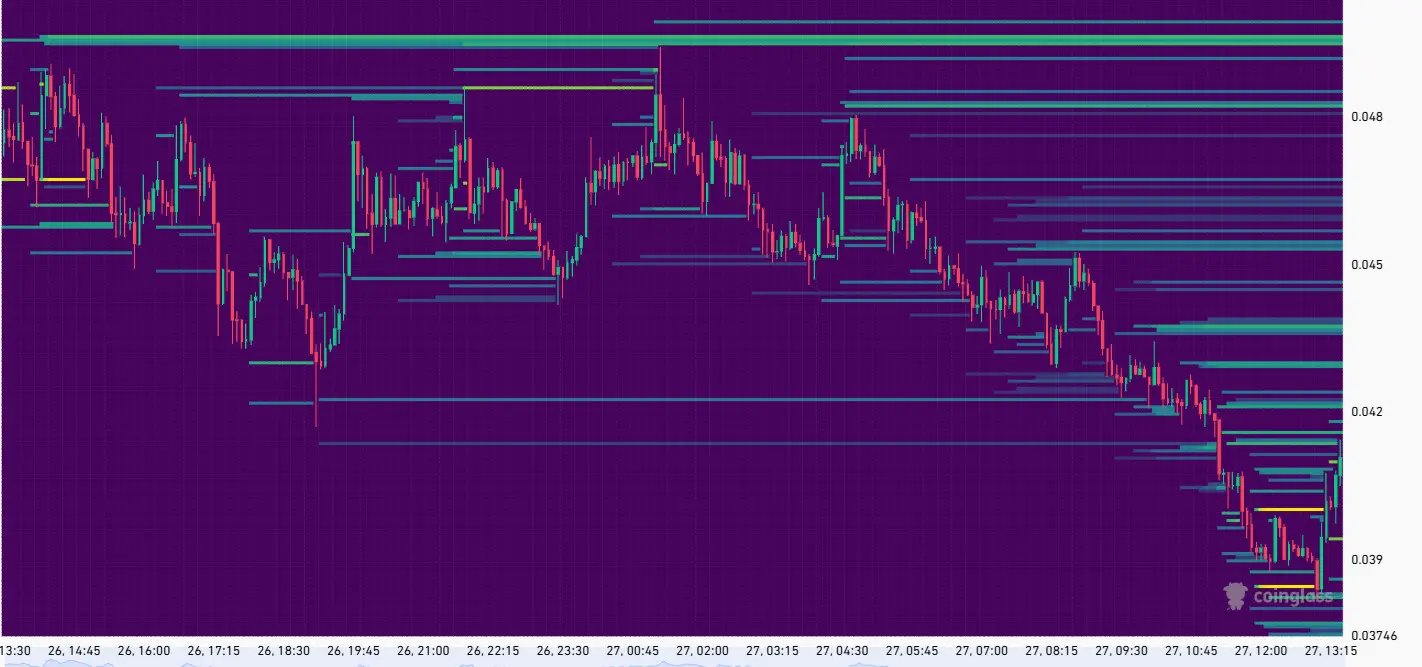

Whales are aggressively shorting MON, with liquidation heatmaps showing built-up short liquidity up to $0.05, indicating possible reversals but ongoing pressure.

-

Open interest exceeds $65 million on Binance, where 89% of derivatives trading occurs, while spot volumes are led by Coinbase and Bybit at over 37% of total activity, per Coinglass data.

Discover why Monad’s MON token is plunging after airdrop: Arthur Hayes predicts crash amid shorting frenzy. Stay informed on crypto volatility and protect your investments today.

What is Causing the Monad MON Token Price Drop?

Monad’s MON token has faced significant downward pressure in its first week post-airdrop, dropping over 14.5% to $0.039 and wiping out initial highs near $0.047. This volatility stems from aggressive shorting by large traders and shifting sentiments from key influencers like Arthur Hayes, who reversed his earlier positive outlook to predict a complete collapse. The token’s early price discovery phase in a sluggish altcoin environment exacerbates these risks, with market dynamics favoring sellers.

Why is Arthur Hayes Bearish on Monad’s MON Token?

Arthur Hayes, the influential co-founder of BitMEX and a prominent voice in cryptocurrency circles, has expressed deep skepticism toward Monad’s MON token. In a recent social media post on November 27, 2025, Hayes declared he was exiting his position and urged the token to “go to zero,” accompanied by multiple crying emojis to emphasize his frustration. This stark turnaround came just days after he had highlighted MON as a potential candidate for upward momentum in price ranges.

The shift underscores broader concerns in the crypto market, where new tokens like MON struggle amid limited liquidity and high speculation. Hayes’ commentary, drawn from his extensive experience in derivatives trading, highlights the perils of low-float, venture capital-backed projects. Such assets often face prolonged selling pressure, as evidenced by historical precedents where similar tokens failed to recover from early dips. Data from trading platforms shows MON’s open interest climbing to over $65 million, predominantly on Binance, which captures 89% of perpetual futures volume. Meanwhile, spot trading on Coinbase and Bybit accounts for more than 37% of overall activity, reflecting divided pressures between buyers and sellers.

I’m out. Send this dogshit to ZERO! $MON 😭😭😭😭😭😭😭😭 pic.twitter.com/qUYgmhvPsT

— Arthur Hayes (@CryptoHayes) November 27, 2025

Traders have noted that recent price action liquidated small long positions, while short liquidity accumulates up to $0.05, per liquidation heatmaps from Coinglass. This setup suggests a potential short-term rebound but warns of deeper declines if bearish momentum persists. MON’s trading on platforms like Hyperliquid places it among the top 10 most active tokens, alongside assets like ASTER and PUMP, yet negative fees on long positions deter bullish bets.

MON has liquidated the relatively small long positions, with an accumulation of short positions up to $0.05. | Source: Coinglass

MON has liquidated the relatively small long positions, with an accumulation of short positions up to $0.05. | Source: CoinglassDespite these challenges, Monad’s underlying technology—a high-performance layer-1 blockchain aiming for scalability—positions it for long-term potential. However, the token’s immediate fate hinges on resolving these market imbalances, as whale shorting continues to dominate sentiment.

Frequently Asked Questions

What Factors Are Driving Shorting Activity on Monad’s MON Token?

Aggressive shorting of MON stems from whale traders capitalizing on post-airdrop volatility, with negative fees on long positions discouraging upside bets. Liquidation data from Coinglass reveals short liquidity buildup to $0.05, while open interest on Binance surpasses $65 million, amplifying downward pressure in a risk-averse altcoin sector.

How Does Wintermute’s Role Impact Monad MON Token Liquidity?

Wintermute, a leading crypto market maker partnered with Monad, has borrowed MON tokens for up to a year, far longer than other makers’ one-month terms. This arrangement raises concerns over potential short-term dumping to repurchase at lower prices, exacerbating sell-side liquidity imbalances and contributing to MON’s price slide, especially as early backers face vesting locks.

Key Takeaways

- Post-Airdrop Volatility: MON’s price has erased gains, dipping 14.5% to $0.039 due to whale shorting and influencer bearishness.

- Market Maker Influence: Partnerships like Wintermute’s extended loan access could fuel selling pressure, with unique token unlocks adding to supply risks.

- Trading Dynamics: High open interest on Binance signals ongoing speculation; monitor liquidation levels for reversal cues before entering positions.

Conclusion

Monad’s MON token continues to navigate turbulent waters post-airdrop, with Arthur Hayes’ bearish stance and aggressive shorting underscoring the vulnerabilities of emerging altcoins in a cautious market. As Monad MON token price pressures persist amid market maker dynamics and low-float concerns, investors should prioritize risk management. Looking ahead, successful long-term development could stabilize MON, but current trends suggest vigilance; consider diversified strategies to weather crypto’s inherent uncertainties.