Aster DEX’s Stage 5 Buyback May Help Stabilize ASTER Amid Persistent Bearish Pressure

ASTER/USDT

$167,496,823.73

$0.7070 / $0.6650

Change: $0.0420 (6.32%)

+0.0031%

Longs pay

Contents

Aster DEX’s Stage 5 Buyback Program allocates up to 80% of platform fees and 100% of Shield Mode net profits to purchase ASTER tokens, aiming to reduce supply and stabilize price amid bearish pressure. This deflationary strategy has already bought 566,000 ASTER worth $399,000 since launch.

-

Aster DEX implements automatic daily buybacks using 40% of fees to counter sell-side pressure effectively.

-

The program builds on four prior stages, having repurchased over 209 million tokens valued at more than $140 million.

-

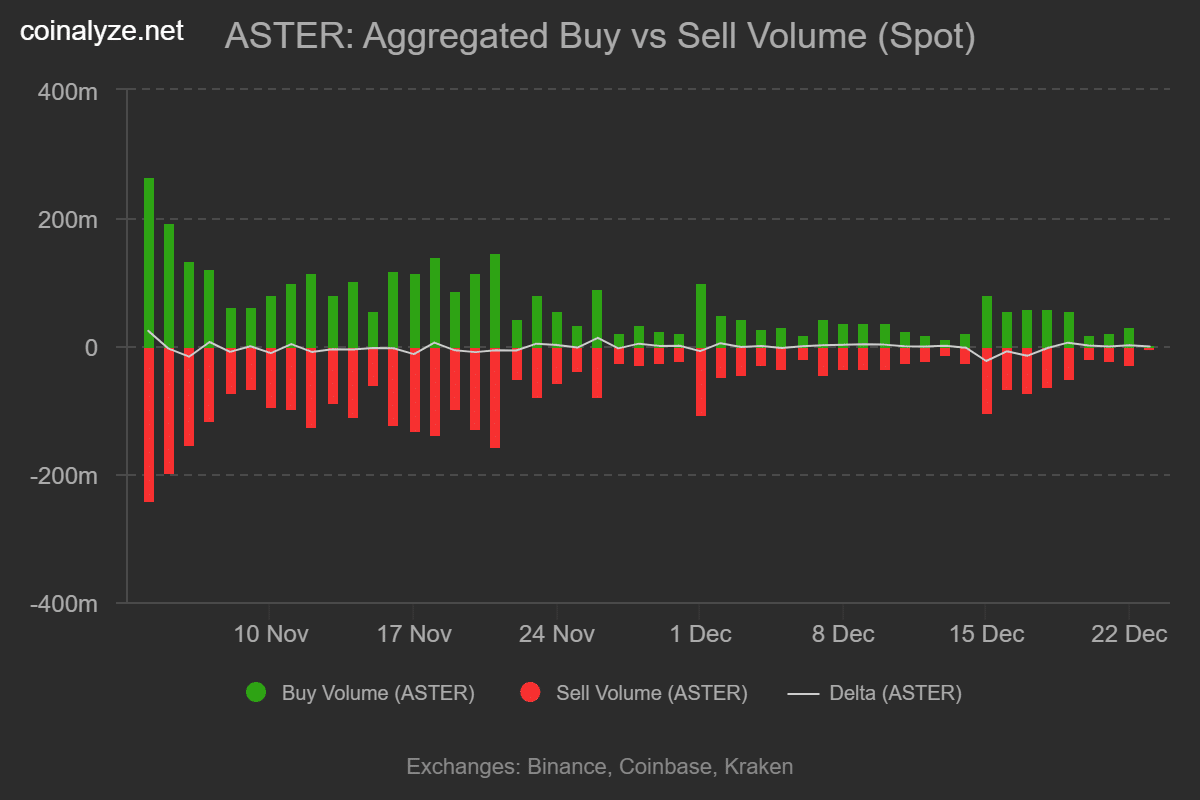

Despite efforts, ASTER faces intense selling with 4.43 million sell volume versus 3.54 million buy volume, per Coinalyze data, risking a drop to $0.60 support.

Discover how Aster DEX’s latest buyback initiative combats crypto market downturns, supporting ASTER price stability through deflationary tactics. Stay informed on key developments.

What is Aster DEX’s Stage 5 Buyback Program?

Aster DEX’s Stage 5 Buyback Program is a deflationary mechanism designed to stabilize the ASTER token price by reducing circulating supply through strategic token repurchases. Launched to address ongoing bearish trends in the crypto market, it allocates up to 80% of platform fees toward buybacks, with 40% directed to automatic daily purchases processed via a transparent wallet for community oversight. This initiative follows four successful prior stages and incorporates Shield Mode Fees, ensuring 100% of those net profits fund additional ASTER acquisitions.

How Do Shield Mode Fees Support ASTER Buybacks?

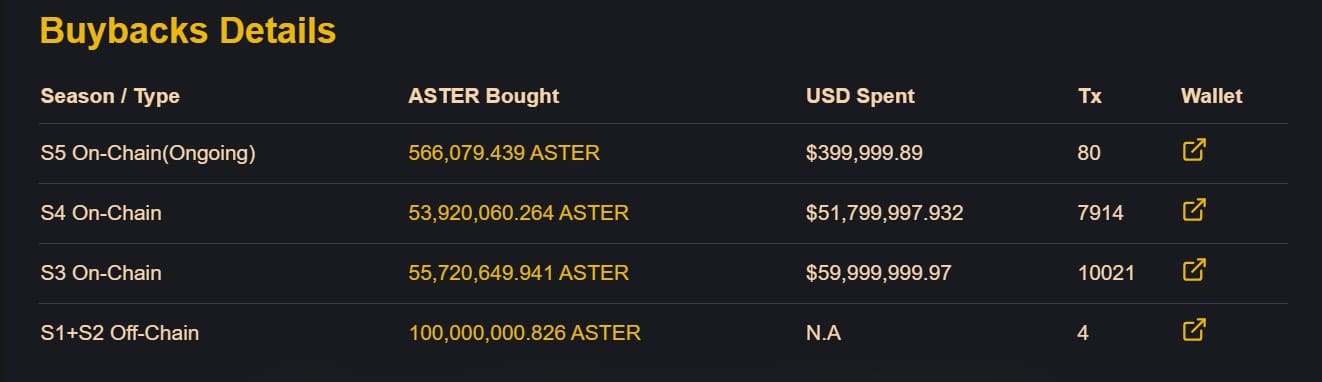

Aster DEX recently introduced Shield Mode Fees as an innovative profit-and-loss sharing structure to bolster token buybacks. Under this model, market participants incur a 15% fee on net profits with no charges on losses, directing all collected funds entirely toward ASTER repurchases. According to platform reports from Asterlify, since Stage 5 activation, the team has already acquired 566,000 ASTER tokens valued at approximately $399,000. This approach not only absorbs sell-side pressure but also builds a strategic reserve using 20-40% of total fees, enhancing long-term price resilience. Experts in decentralized finance note that such mechanisms can significantly mitigate volatility by aligning protocol revenues with token value appreciation, as evidenced by similar strategies in other DEX ecosystems.

Source: Asterlify

These measures reflect Aster DEX’s commitment to transparency, allowing token holders to track buyback activities in real-time through dedicated wallets. By consistently implementing such programs, the platform demonstrates a proactive stance against market downturns, fostering greater investor confidence in the ASTER ecosystem.

Frequently Asked Questions

What Has Aster DEX Achieved Through Previous Buyback Stages?

Aster DEX has executed four buyback stages prior to the current one, successfully repurchasing more than 209 million ASTER tokens at a total value exceeding $140 million. These efforts have directly countered sell-side pressures, reducing available supply and providing a foundation for the expanded Stage 5 program that now incorporates higher fee allocations for sustained impact.

Why Is ASTER Still Experiencing Bearish Pressure Despite Buybacks?

Even with robust buyback initiatives, ASTER faces persistent downward momentum due to aggressive selling from both retail and large holders. Recent data from Coinalyze shows a sell volume of 4.43 million compared to 3.54 million in buys, resulting in a negative delta of 890,000. Top holders offloaded 17 million tokens in the last 24 hours, keeping the price below key EMAs and within a descending channel.

Source: Coinalyze

This imbalance underscores the challenges in a broader crypto bear market, where external factors like macroeconomic trends amplify selling activity.

Key Takeaways

- Deflationary Focus: Aster DEX’s Stage 5 Buyback Program uses up to 80% of fees and 100% of Shield Mode profits to repurchase ASTER, building on prior successes totaling over $140 million in buys.

- Market Challenges: Despite these efforts, ASTER trades below the 20- and 50-EMA in a descending channel, with high sell volumes indicating ongoing bearish sentiment.

- Potential Reversal: A daily close above $0.83 EMA could signal a trend shift, while persistent selling might push prices toward $0.60 support—monitor volumes closely for entry points.

Source: TradingView

Technical indicators from TradingView confirm this pattern, with the token’s position below moving averages highlighting the need for stronger buying interest to reverse the trend. Platform developers emphasize that continued fee allocation to buybacks will gradually erode this pressure, potentially leading to improved liquidity and holder retention over time.

Conclusion

Aster DEX’s Stage 5 Buyback Program and integration of Shield Mode Fees represent a calculated response to the crypto market’s bearish pressures, actively working to stabilize the ASTER token price through supply reduction and transparent operations. While current sell volumes and holder distributions pose short-term risks, the platform’s consistent deflationary approach signals long-term resilience. Investors should watch for a breakout above key resistance levels, as these initiatives could pave the way for renewed market confidence in the evolving DEX landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026