Aster L1 Testnet Launched: Mainnet in Q1 2026

ASTER/USDT

$160,351,739.37

$0.7320 / $0.6900

Change: $0.0420 (6.09%)

+0.0031%

Longs pay

Contents

Aster, the decentralized crypto exchange (DEX) and perpetual futures platform, announced that it has opened its layer-1 blockchain testnet to all users; the layer-1 mainnet is planned to launch in Q1 2026. The Q1 launch will include fiat on-ramp, release of Aster code for developers, and L1 mainnet.

Source: Aster

Aster L1 Testnet Access and Developer Invitation

According to the Aster roadmap, it will focus on infrastructure, token utility, and ecosystem building in 2026. Users can now try perpetual futures trades on the testnet, offering the opportunity to test the platform's L1 chain optimized for high-volume trading. Aster, which rebranded as a perpetual futures DEX in March 2025, is a direct competitor to Hyperliquid, a rival offering SOL futures using its own L1 chain.

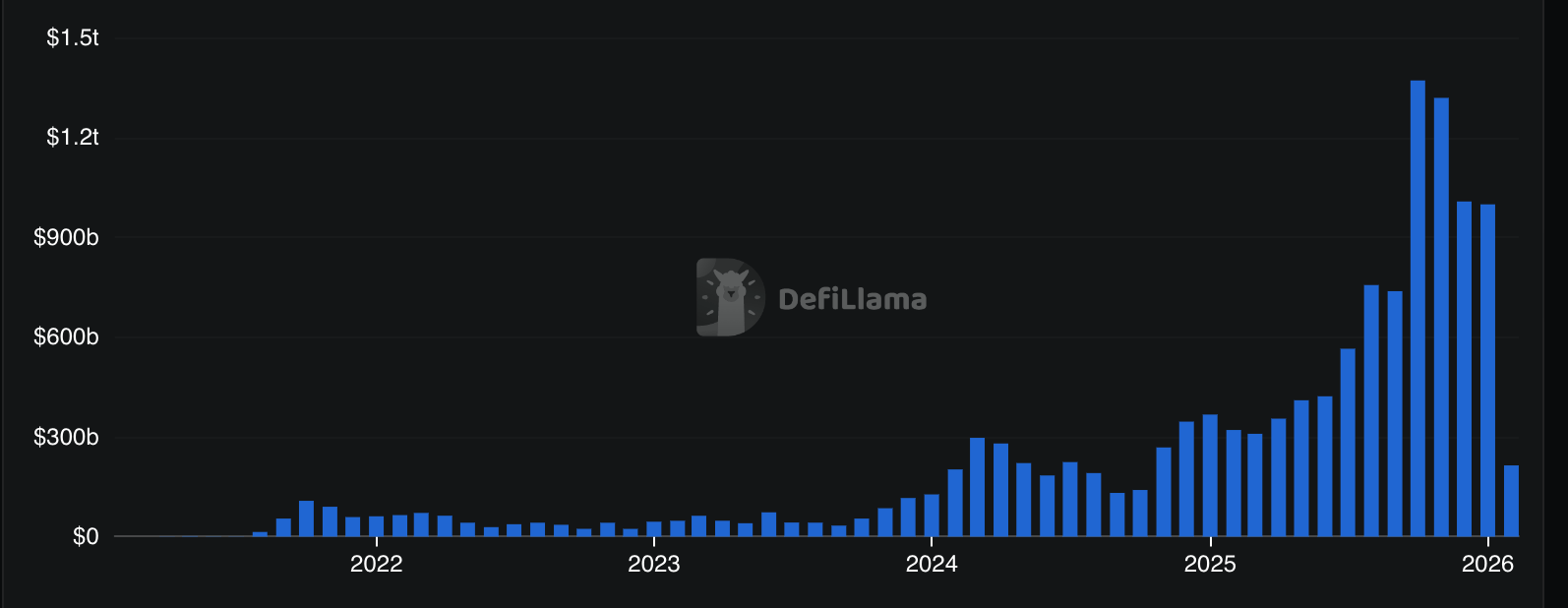

2025 Records in Perp DEX Volume

Monthly Perp DEX trading volume. Source: DefiLlama

In 2025, perp DEX cumulative trading volume rose from 4 trillion dollars to 12 trillion dollars; 7.9 trillion dollars of this occurred in 2025 (DefiLlama data). Monthly volume exceeded 1 trillion dollars in October, November, and December; this increase shows demand for crypto derivative products. This move reflects the trend of Web3 projects transitioning to specialized blockchains for high-volume trading instead of general-purpose chains like Ethereum or Solana.

Vitalik Buterin's L2 Criticism and Aster's Advantage

Ethereum founder Vitalik Buterin emphasized in his recent statements that L2s have deviated from the original vision and are not sufficiently scalable. This supports the rise of specialized L1 chains like Aster; platforms similar to Hyperliquid have the potential to overshadow SOL detailed analysis volumes in the Solana ecosystem.

SOL Technical Analysis: Support and Resistance Levels

SOL price at 82.77$ level, 24h change -9.42%. RSI 21.64 (oversold), trend bearish, Supertrend bearish. EMA 20: 113.85$. Supports: S1 82.44$ (strong, 78% score), S2 75.82$ (medium). Resistances: R1 86.81$ (strong, 75%), R2 96.04$ (strong). Perp DEX trend could trigger a rally for SOL like ETH futures.