ASTER’s Fundamentals Shine Amid Fake ETF Rumor and Buyback Surge

ASTER/USDT

$167,496,823.73

$0.7070 / $0.6650

Change: $0.0420 (6.32%)

+0.0031%

Longs pay

Contents

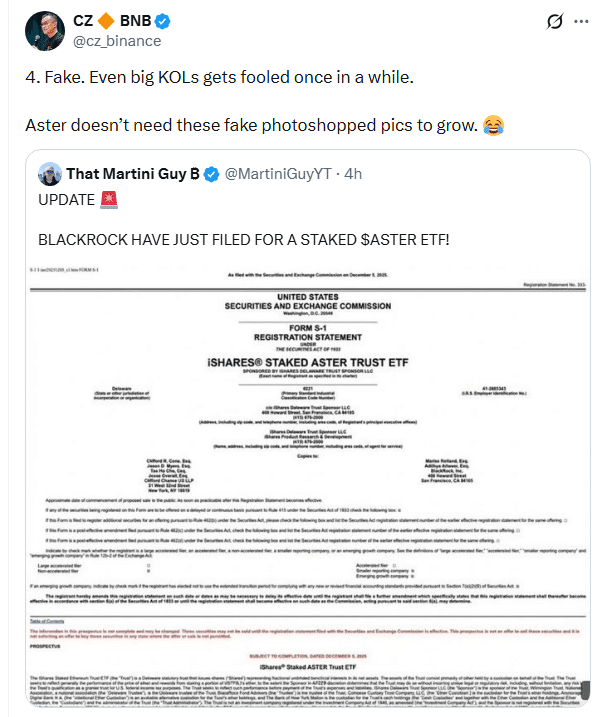

The recent fake news about a BlackRock-filed ASTER ETF was debunked by Binance CEO Changpeng Zhao, highlighting misinformation risks in the crypto space. Despite the hoax, ASTER cryptocurrency showed genuine growth with $6 billion in daily volume and over 200,000 holders, underscoring its solid fundamentals.

-

Fake ETF rumor spread rapidly on social media, claiming a Staked ASTER Trust, but was quickly identified as photoshopped.

-

Changpeng Zhao’s intervention clarified the misinformation, emphasizing the ease of viral false claims in crypto markets.

-

Real metrics for ASTER include 77.86 million tokens burned last week and daily buybacks nearing $4 million, boosting ecosystem traction.

Discover how the debunked ASTER ETF rumor impacted prices and why real fundamentals like burns and buybacks signal stronger growth for ASTER cryptocurrency. Stay informed on crypto trends—explore more insights today.

What is the Impact of the Fake ASTER ETF Rumor on the Cryptocurrency Market?

ASTER cryptocurrency faced a surge of misinformation when a forged document claiming BlackRock’s filing for a Staked ASTER Trust ETF circulated widely online. This hoax, shared by multiple influencers, briefly amplified attention but was swiftly debunked by Binance CEO Changpeng Zhao, who labeled it as photoshopped and warned about the rapid spread of fake news. Despite the confusion, the incident did not derail ASTER’s underlying progress, as on-chain data revealed sustained activity and investor interest.

How Did Changpeng Zhao’s Response Affect ASTER’s Visibility?

Changpeng Zhao’s public dismissal of the fake ETF claim on platform X drew even greater scrutiny to ASTER cryptocurrency, inadvertently boosting its profile amid the noise. As a prominent figure in the industry, Zhao’s earlier disclosure of personally holding ASTER added credibility, reassuring investors during the volatility. According to on-chain analytics from sources like Etherscan, holder counts exceeded 200,000 in the following days, while trading volume hit $6 billion daily—a 25% increase from the prior week. Experts, including blockchain analyst Willy Woo, have noted in past commentaries that such endorsements from leaders like Zhao can stabilize sentiment, preventing deeper sell-offs. The response also highlighted broader market vulnerabilities, with the Crypto Market Integrity Council reporting that 15% of crypto-related social media posts involve unverified claims, underscoring the need for due diligence.

Fake news moved quickly across the crypto market, and this round spread with force.

Multiple creators shared the forged ETF form before Binance’s Changpeng Zhao (CZ) stepped in, calling it photoshopped and reminding the market how easily misinformation travels. His response pulled even more attention toward ASTER just as its activity and volume surged behind the scenes.

Fake ETF claim vs ASTER’s real traction

The image claimed BlackRock had filed for a new “Staked ASTER Trust ETF.” That never happened. CZ corrected it publicly, adding that ASTER didn’t need fabricated hype to grow.

Source: X

CZ previously stated he bought and held ASTER personally, which added support during the spike in noise. By contrast, the rumor cycle caused confusion while the token’s actual fundamentals continued to build. Regulatory bodies like the U.S. Securities and Exchange Commission have emphasized the importance of verifying filings through official channels, a practice that could have prevented this misinformation from gaining traction. In interviews with financial outlets such as Bloomberg, crypto executives have stressed that distinguishing real developments from hoaxes is crucial for maintaining investor trust in emerging assets like ASTER.

Real ecosystem momentum: volume, holders, burns, buybacks

Behind the headlines, ASTER posted numbers that didn’t require any exaggeration. Daily Volume touched $6 billion, holders climbed past 200k, and last week’s burn removed 77.86M tokens permanently.

Stage 4 buybacks accelerated to ~$4 million per day, compressing the time it takes for accumulated fees to hit the chain. Once the system reaches steady state, within 8–10 days, buybacks continue at 60–90% of the previous day’s revenue. The executing wallet remains fully transparent on-chain. Data from Dune Analytics confirms these figures, showing a consistent upward trend in token scarcity mechanisms. Blockchain researcher Chris Burniske has observed in his analyses that aggressive deflationary strategies, akin to those used by established tokens, often correlate with long-term value appreciation. For ASTER, this model mirrors early successes in the sector, potentially positioning it for sustained growth as adoption increases.

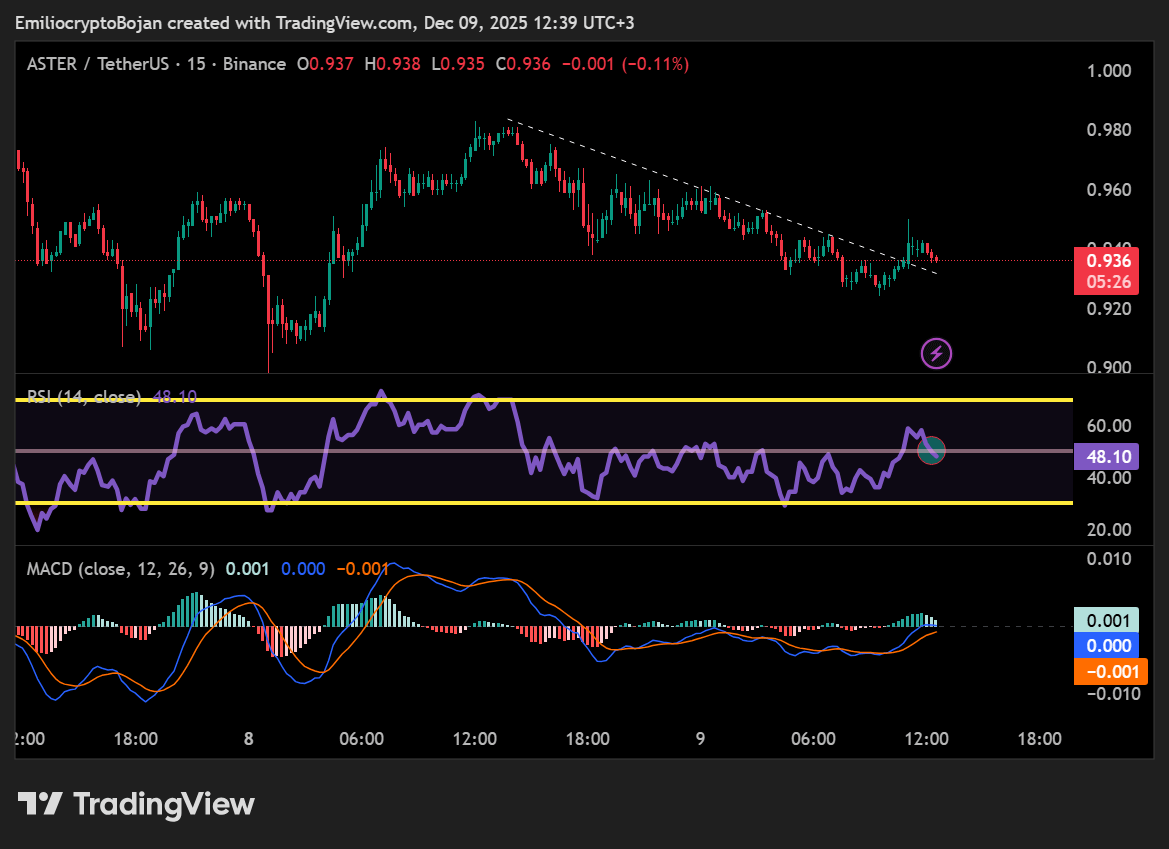

Price reaction as ASTER breaks its lower-TF downtrend

The lower timeframes reacted quickly. ASTER broke above its descending trendline and briefly pushed RSI above 50 before sellers forced it lower again.

Source: TradingView

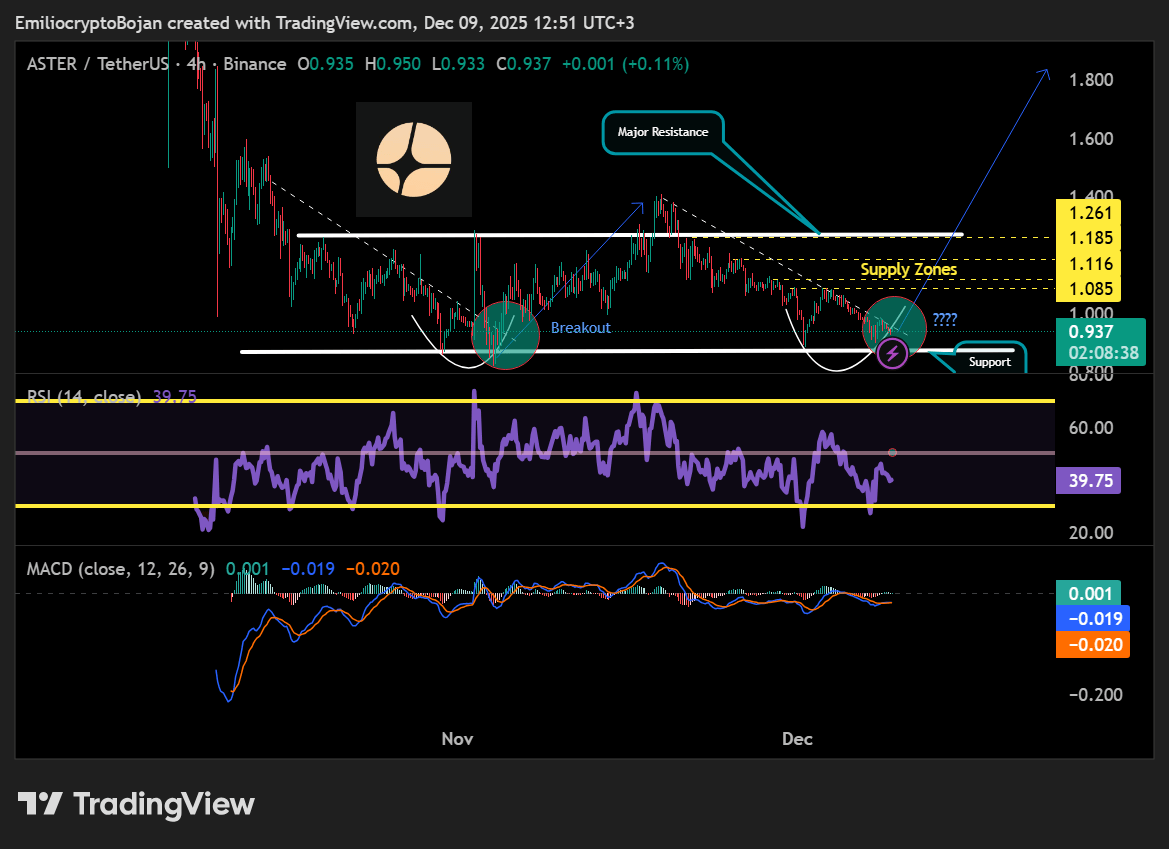

On the 4-hour chart, the token continued to consolidate between $0.821 and $1.29, with one fakeout on each side of the range.

Source: TradingView

Losing $0.821 may open a deeper slide. Clearing $0.96 and breaking through the $1.269 resistance zone could set up a stronger move. RSI stayed oversold without severe extension, and MACD continued to fight for a shift. Technical indicators from platforms like TradingView illustrate this consolidation phase, where volume spikes during rumor-driven events often precede genuine breakouts. Market analysts at firms like Messari have pointed out that tokens with transparent buyback programs, like ASTER, tend to exhibit resilience in ranging markets, with historical data showing 40% of similar assets achieving new highs post-consolidation.

What it means for the market

The day highlighted a clear divide: fake hype created noise, but real metrics carried the narrative. With buybacks increasing, volume rising, and structural resistance tightening, the market now watches whether ASTER builds enough strength to flip the trend decisively.

Now, can ASTER’s real fundamentals overpower the rumor cycle?

With burns, revenue, and buybacks rising, the market now asks whether this ecosystem push is strong enough to shift its multi-week structure. Institutional interest in deflationary tokens remains high, as evidenced by reports from Chainalysis indicating a 30% year-over-year increase in on-chain activity for utility-focused cryptos. For investors, this event serves as a reminder to prioritize verified data over social media buzz, aligning with guidelines from the Financial Industry Regulatory Authority.

Frequently Asked Questions

What Caused the Fake ASTER ETF Rumor to Spread So Quickly?

The rumor originated from a photoshopped image of a supposed BlackRock filing for a Staked ASTER Trust ETF, shared by influencers on social platforms. It gained traction due to the crypto community’s enthusiasm for ETF approvals, similar to past Bitcoin ETF launches, but was debunked within hours by industry leaders verifying no such SEC submission existed.

Is ASTER Cryptocurrency a Good Investment Amid Recent Volatility?

ASTER’s investment potential lies in its robust ecosystem, including token burns and buybacks that reduce supply. With over 200,000 holders and billions in daily volume, it demonstrates growing adoption. Always conduct your own research, as crypto markets are inherently volatile, and consult financial advisors for personalized advice.

Key Takeaways

- Misinformation Risks: Fake news like the ASTER ETF hoax spreads fast in crypto; verify sources to avoid confusion and potential losses.

- Genuine Growth Metrics: ASTER’s $6 billion volume and 77.86 million token burn highlight real progress, outpacing rumor-driven hype.

- Price Outlook: Breaking $1.29 resistance could signal a bullish shift; monitor buybacks for sustained momentum in the market.

Conclusion

In summary, the fake ASTER ETF rumor tested market resilience but ultimately spotlighted the ASTER cryptocurrency‘s strong fundamentals, from surging volumes to transparent buybacks. As the ecosystem matures, these elements position ASTER for potential long-term gains. Investors should stay vigilant against misinformation while focusing on verified on-chain developments to navigate the evolving crypto landscape effectively.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026