ATOM Price Rises 11% to $3: Potential Breakout Sustainability Hinges on Key Level

ATOM/USDT

$49,731,647.89

$1.858 / $1.767

Change: $0.0910 (5.15%)

-0.0371%

Shorts pay

Contents

Cosmos ATOM price has surged over 11% in the past 24 hours, breaking out from a descending channel above $3 amid whale accumulation and positive spot netflows. This recovery follows a monthly decline, with on-chain activity supporting the uptrend.

-

Whale activity: Large holders resumed accumulation after neutrality since October, driving buying pressure.

-

Spot inflows exceeded outflows by $769.54K, indicating fresh capital entry into ATOM.

-

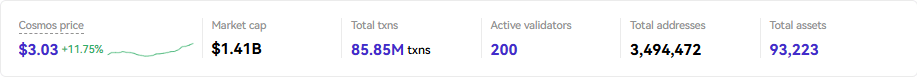

On-chain metrics: Cosmos Hub reached 85.85 million transactions and 3.494 million addresses, boosting network momentum.

Discover why Cosmos ATOM price is breaking out today with whale buys and strong spot flows. Explore the $3 support level and future outlook for this altcoin recovery—read now for key insights.

What is Driving the ATOM Price Breakout Today?

Cosmos ATOM price breakout is fueled by renewed whale accumulation and positive spot market netflows, leading to an 11% surge in the last 24 hours and reclaiming the $3 level after a month of declines. This movement follows a crash that nearly erased the altcoin’s value, with buyers gaining strength as indicated by the Bull Bear Power indicator. Sustaining above $3 is crucial to confirm the trend’s validity.

How Does On-Chain Activity Support ATOM’s Recovery?

On-chain data reveals growing engagement on the Cosmos Hub, which has processed a total of 85.85 million transactions supported by 200 validators. The network now hosts 3.494 million addresses, while assets on the blockchain exceed 93,000. According to data from the Cosmos Hub Explorer, these figures highlight increasing adoption, though compared to other Layer 1 blockchains on Token Terminal, Cosmos Hub’s activity share remains at 6.9K out of 18.6 million total L1 transactions. This relative weakness suggests room for growth if momentum persists. Expert analysis from blockchain metrics platforms like CryptoQuant emphasizes that such transaction volumes correlate with price stability during recoveries.

Examining ATOM’s Price Breakout

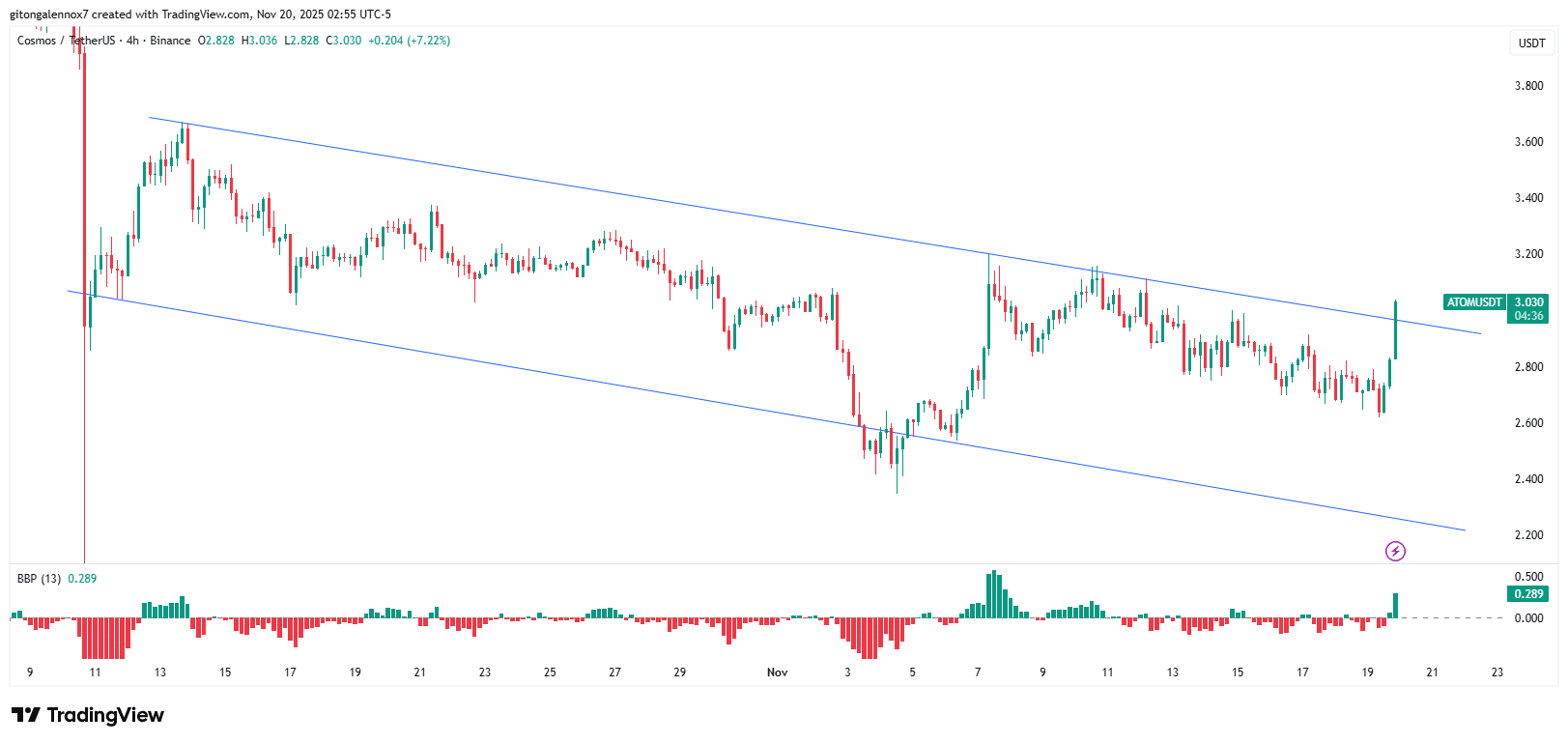

Cosmos ATOM has experienced a steady decline since October 10th, coiling within a descending trend channel that reflected bearish sentiment. The altcoin recently broke above this channel, with the Bull Bear Power indicator shifting to show buyer dominance. Comparable signals on November 4th propelled the price from $2.41 to approximately $3.20, demonstrating the pattern’s reliability.

In the past week, ATOM has maintained position on the upper boundary of the channel, allowing bulls to defend against potential drops to the lower support. This defensive stance has been pivotal in the recent 11% rally, reclaiming the critical $3 mark after broader market pressures nearly drove it to zero during the monthly downturn.

Source: TradingView

To sustain this ATOM price breakout, the token must hold above the $3 zone, as patterns like this at market bottoms often precede reversals. Failure to do so could invalidate the breach, reverting ATOM to its prior downtrend and exposing it to further downside risks. Market observers note that such channel breakouts have historically led to 20-30% gains in similar altcoin setups, provided support levels are respected.

The $3 level acts as a psychological and technical barrier, defining the breakout’s longevity. A dip below would signal seller resurgence, potentially targeting the channel’s lower boundary near $2.50. Conversely, consolidation above $3 could pave the way for testing higher resistances around $4, where previous selling pressure originated during the flash crash.

What’s Driving ATOM’s Price Action?

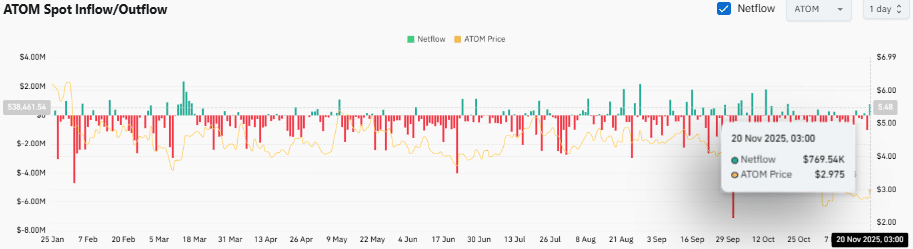

The primary catalysts behind ATOM’s recent price increase are whale accumulation and robust spot order activity, which have injected fresh momentum into the market over the past 24 hours. Data from CryptoQuant indicates that large holders, or whales, have shifted from neutrality—maintained since October 10th—to active buying, though current positions are smaller than during periods when ATOM traded above $5.

Source: CryptoQuant

Spot market dynamics further underscore buyer control, with the Spot Taker Cumulative Volume Delta showing dominance for the last three months. Net inflows stand at $769.54K as of recent data, surpassing outflows and signaling capital influx that directly correlates with the price surge.

Source: CoinGlass

Beyond trading volumes, on-chain metrics contribute to the bullish narrative. The Cosmos ecosystem’s expanding transaction base and address growth indicate rising utility and user interest. While activity lags behind top Layer 1 competitors, the upward trajectory supports the current ATOM price breakout.

Source: Cosmos Hub Explorer

Key resistance looms at $4, the origin of the recent flash crash, where significant selling occurred. Flipping this into support would solidify the uptrend, potentially extending gains beyond the $3 zone. Without a broader market shift, ATOM risks reverting to bearish patterns if these drivers wane.

Analysts from platforms like Token Terminal highlight that sustained on-chain growth is essential for long-term viability. For instance, increasing validator participation and asset diversity could enhance Cosmos’s interoperability advantages, drawing more developers and users to the network.

Frequently Asked Questions

Why is ATOM’s price up today after recent losses?

ATOM’s price rose 11% due to whale accumulation resuming after October neutrality, positive spot netflows of $769.54K, and heightened on-chain activity with 85.85 million transactions on Cosmos Hub. These factors countered the monthly decline following a near-zero crash.

What happens if ATOM falls below $3 in the breakout?

If ATOM dips below $3, the breakout from the descending channel would invalidate, signaling a return to the downtrend and potential retest of $2.50 support. This level serves as a critical threshold for buyer conviction, as noted in technical analyses from TradingView.

Key Takeaways

- Breakout Momentum: ATOM’s surge above $3 stems from whale buys and spot inflows, but holding this level is key to avoiding reversal.

- On-Chain Strength: With 85.85 million transactions and 3.494 million addresses, Cosmos Hub shows growing adoption despite lagging peers.

- Future Outlook: Flipping $4 resistance could extend gains; monitor netflows and market sentiment for sustained uptrend.

Conclusion

The ATOM price breakout marks a pivotal recovery for Cosmos amid whale-driven accumulation and robust on-chain metrics, reclaiming $3 after significant monthly losses. While spot netflows and transaction growth provide solid footing, maintaining above this support is essential to counter bearish pressures. As the ecosystem evolves, investors should watch for broader Layer 1 competition—positioning ATOM for potential long-term gains in the interconnected blockchain landscape.

Comments

Other Articles

Cosmos (ATOM) Breaks Support at $3.57, Potentially Extending Bearish Trend Toward $1.60

October 30, 2025 at 11:16 AM UTC

Qubetics Emerges as a Leading Crypto to Watch Amid Cosmos’ Recent Market Momentum

July 11, 2025 at 01:38 AM UTC

BlockDAG Emerges as a Leading Crypto Investment Option Amidst Cosmos, Polygon, and Algorand in 2025

June 6, 2025 at 09:06 AM UTC