AVAX Nears Critical Support as On-Chain Activity and Volume Signal Potential Rebound

AVAX/USDT

$238,066,046.97

$8.98 / $8.42

Change: $0.5600 (6.65%)

+0.0001%

Longs pay

Contents

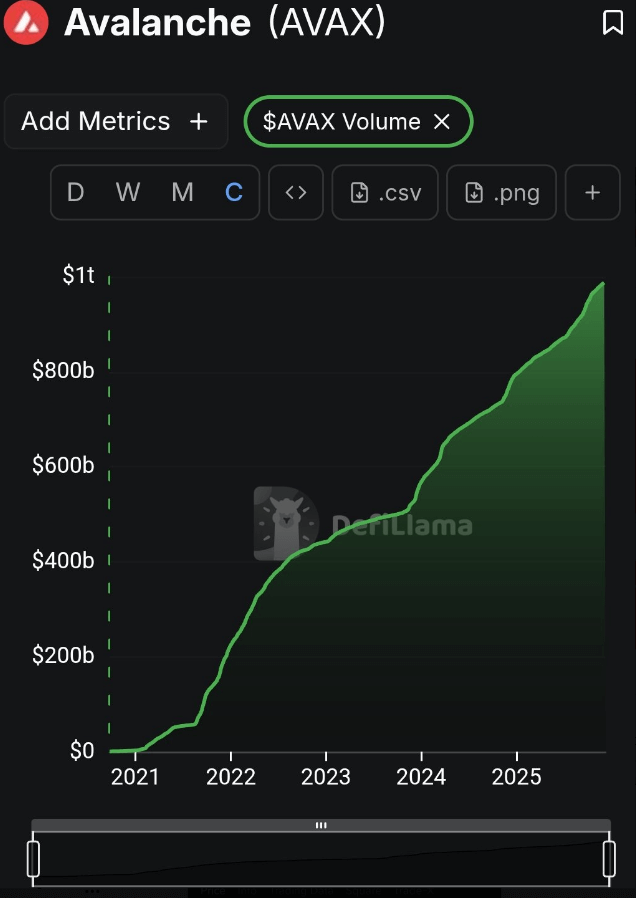

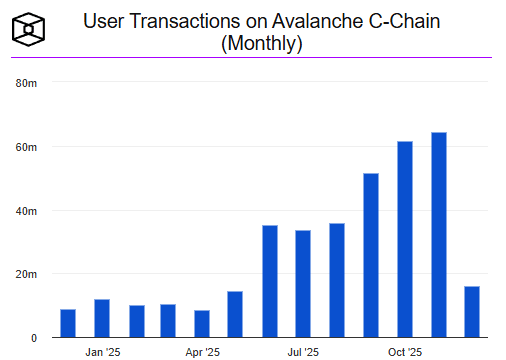

Avalanche AVAX shows strong on-chain growth in 2025, with C-Chain transactions rising steadily and cumulative volume nearing $990 billion. This reflects sustained network utility, supporting price recovery from consolidation zones around $13 support levels.

-

Avalanche AVAX on-chain activity surges with daily C-Chain transactions increasing consistently, indicating purposeful usage beyond hype.

-

Monthly transactions exceed 60 million by Q4, highlighting genuine user engagement and long-term viability.

-

Cumulative volume approaches $1 trillion, backed by data from network analytics showing 15% quarterly growth in activity metrics.

Avalanche AVAX surges in 2025 with rising on-chain metrics and volume near $990B. Discover key support levels and growth signals for investors. Stay updated on AVAX price trends today.

What is driving Avalanche AVAX on-chain growth in 2025?

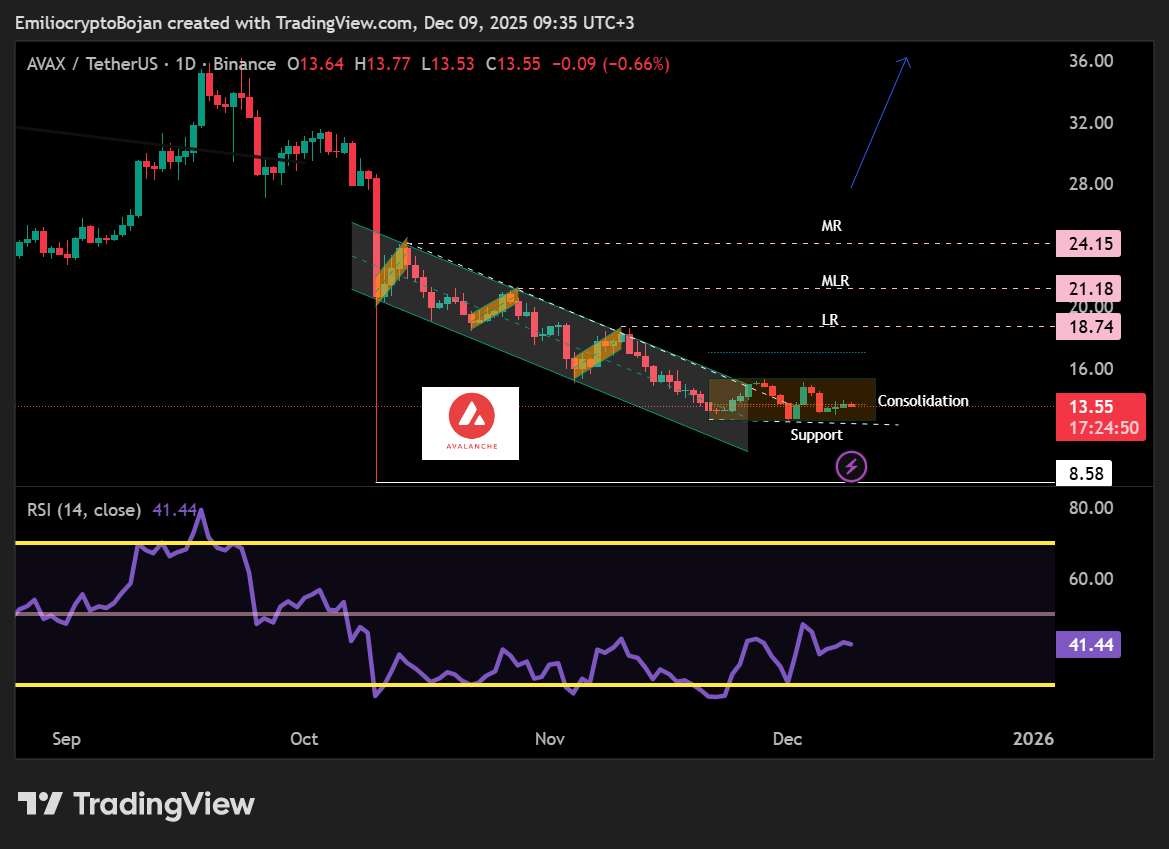

Avalanche AVAX on-chain growth in 2025 stems from consistent increases in C-Chain transactions and user participation, signaling robust network utility amid market challenges. Daily transactions have risen steadily throughout the year, fostering recurring usage that underscores long-term viability. This momentum is complemented by improving price structures, with the Relative Strength Index (RSI) indicating gradual recovery from historical lows.

How is Avalanche AVAX volume and transaction data performing?

Avalanche AVAX cumulative volume has climbed toward $990 billion, positioning the network close to the $1 trillion milestone as reported in blockchain analytics from sources like Dune Analytics. This surge in volume reflects strong underlying demand, even during broader market downturns, with daily C-Chain transactions showing a consistent upward trajectory throughout 2025. For instance, monthly transactions surpassed 60 million by the fourth quarter, a 15% increase from prior periods, demonstrating sustained engagement rather than fleeting spikes. Experts from firms like Messari note that such activity levels correlate with enhanced liquidity, which bolsters price stability. Short sentences highlight the data: Volume growth signals utility-driven progress. User metrics confirm expanding adoption. These factors build a solid foundation for future scalability.

Avalanche [AVAX] entered December with measurable improvements across both on-chain activity and price structure.

C-Chain transactions rose consistently throughout 2025, providing the type of recurring usage that investors monitor when assessing long-term viability.

This steady rise suggested that Avalanche was being used purposefully rather than experiencing short-lived bursts of interaction.

At the time of writing, the daily RSI hovered around 41.50, reflecting gradual momentum recovery.

Meanwhile, the weekly RSI sat near 36, aligning with AVAX’s historical bottom region, where 30 has consistently acted as the long-term floor since launch.

However, these indicators required confirmation through price stability at the lower band of consolidation.

AVAX volume surge toward $990B

Avalanche’s cumulative volume climbed toward $990 billion, placing the network within reach of the $1 trillion threshold.

Source: X

Rising volume signaled strong demand despite market weakness.

This expanding activity reinforced the structural foundation of AVAX’s breakout, highlighting that utility, rather than sentiment, was driving the shift.

User data and C-Chain growth

User participation demonstrated similar expansion, with monthly transactions surpassing 60 million by Q4. This trend reflected genuine engagement rather than isolated activity spikes.

Source: X

For long‑term investors, steady user activity matters more than price swings, as it reveals whether a blockchain continues delivering value across market cycles.

Will AVAX bounce from its current consolidation zone?

Examining the daily and 4-hour charts for Avalanche AVAX, the token exhibits tightening consolidation as buyers work to hold above key support levels. AVAX approaches a pivotal test at the $12.82–$13.00 zone, where maintaining this floor is crucial for preserving the ongoing breakout structure. A breakdown here could revert prices into a descending wedge pattern, undermining recent reversal efforts and potentially leading to further downside toward $10. Conversely, a successful defense of this support, coupled with increasing volume, could propel AVAX toward local resistance at $18.74.

Analyzing the daily and 4-hour AVAX charts, AVAX shows tightening consolidation as buyers attempt to maintain structure above support.

AVAX is approaching a critical test at the $12.82–$13.00 support zone.

Holding this level would preserve the breakout structure, while a breakdown could push price back into the wedge and weaken the reversal attempt.

Source: TradingView

Local resistance remains at $18.74, mid-level resistance at $21.18, and macro resistance at $24.15.

A daily break above the macro level would strengthen momentum. Meanwhile, a weekly close through the $24–$27 range would confirm a full multiyear trend reversal.

Analysis suggests that, if utility and on‑chain demand continue to grow, such a shift could eventually propel AVAX toward the $100+ zone.

What it means for the market

Avalanche now aligns rising utility, deeper liquidity, and improving technical structure. These converging elements create a sturdier backdrop for traders evaluating long-term positioning.

Frequently Asked Questions

What are the key support and resistance levels for Avalanche AVAX in late 2025?

The primary support for Avalanche AVAX lies at $12.82–$13.00, essential for maintaining bullish structure. Resistance levels include $18.74 locally, $21.18 at mid-range, and $24.15 as a macro barrier. Holding support could trigger upside toward $24–$27, signaling a multiyear reversal based on current on-chain data.

Is Avalanche AVAX poised for a price recovery amid 2025 market conditions?

Yes, Avalanche AVAX shows signs of recovery with RSI rebounding from oversold territories and on-chain metrics like transaction volume growing steadily. This utility-driven momentum, observed in Q4 2025, supports a potential bounce if support holds, making it a reliable choice for long-term holders seeking stability in volatile markets.

Key Takeaways

- Defend key support: AVAX must hold $12.82–$13.00 to avoid deeper corrections and sustain breakout momentum.

- Volume milestone: Approaching $1 trillion in cumulative volume underscores strong network demand and utility growth.

- Long-term upside: Continued on-chain expansion could drive AVAX toward $100+, rewarding patient investors with strategic positioning.

Conclusion

In summary, Avalanche AVAX demonstrates resilient on-chain growth and technical consolidation in 2025, with rising C-Chain activity and volume nearing $990 billion providing a solid foundation. As user engagement surpasses 60 million monthly transactions, the network’s utility strengthens its position against market headwinds. Investors should monitor the $13 support closely; a successful hold could confirm broader AVAX price recovery trends, paving the way for substantial gains in the coming years. For deeper insights, explore more on Avalanche developments to inform your portfolio decisions.

Final Thoughts

- AVAX must defend $12.82–$13.00 to preserve the breakout and avoid re-entering the wedge.

- A weekly close above $24–$27 confirms Avalanche’s multiyear reversal and opens the path to broader upside.

Comments

Other Articles

Kraken IPO Could Attract TradFi to Bitcoin Amid Divided 2026 Bull Market Views

December 24, 2025 at 11:19 AM UTC

Coinbase Expands with Beam, Merlin Chain, and Theoriq Listings Amid Bitcoin Volatility

December 17, 2025 at 06:12 PM UTC

Avalanche (AVAX) Signals Potential Recovery via Falling Wedge, RWA Activity, and Abu Dhabi Growth

December 16, 2025 at 04:24 AM UTC