AVAX One’s Aggressive Accumulation Signals Potential Bullish Shift for Avalanche

AVAX/USDT

$238,066,046.97

$8.98 / $8.42

Change: $0.5600 (6.65%)

+0.0001%

Longs pay

Contents

Avalanche’s AVAX token has seen aggressive accumulation by AVAX One Treasury, expanding its reserve to over 13.8 million AVAX tokens with purchases worth more than $110 million. This institutional move signals strong confidence amid rising network activity, potentially driving AVAX toward a bullish reversal.

-

AVAX One’s recent buys of 9.3 million tokens highlight institutional interest in Avalanche’s ecosystem growth.

-

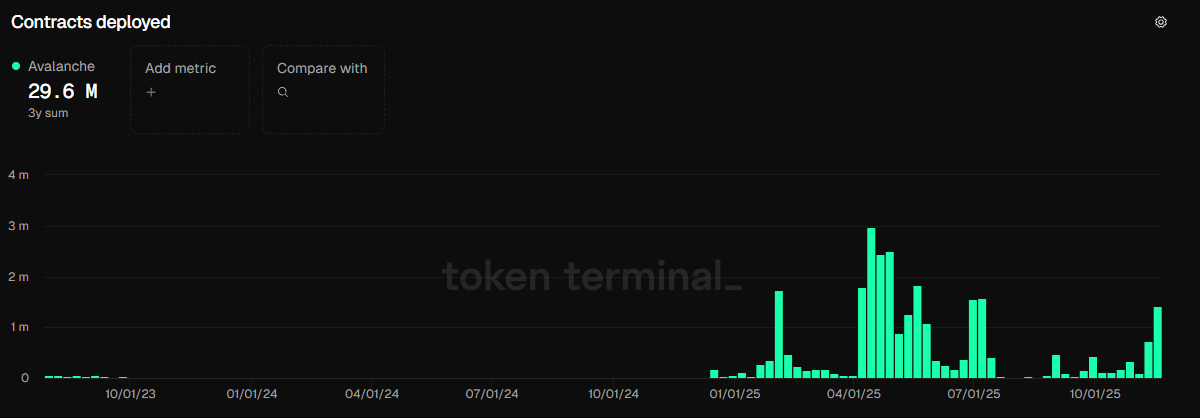

Deployed contracts on Avalanche surged, indicating increased developer engagement and on-chain activity.

-

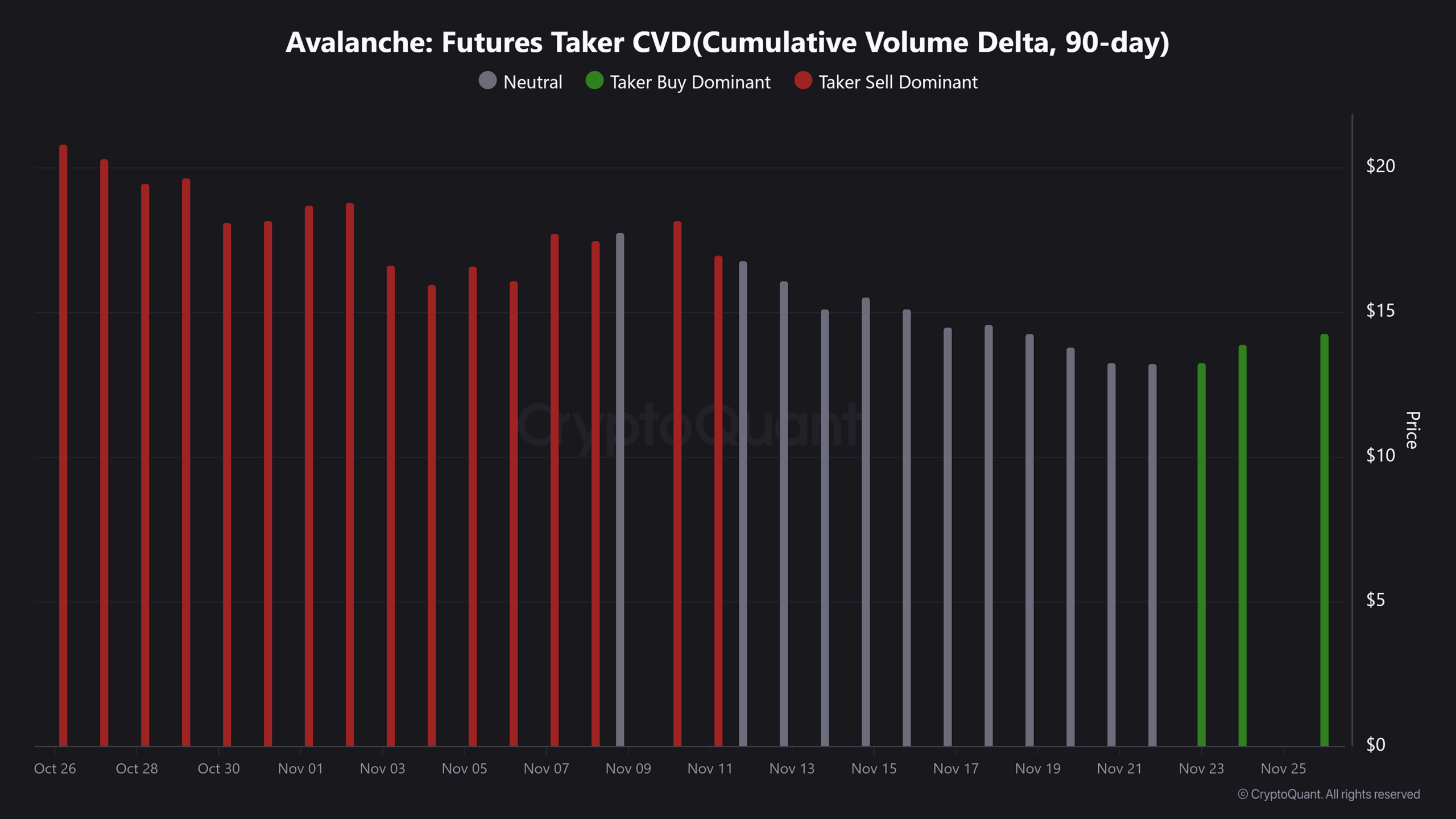

Buyer dominance in futures markets rose over the past three days, supporting sustained upward momentum for AVAX.

Explore how AVAX One’s massive accumulation of over 13.8M AVAX tokens boosts Avalanche’s outlook. Discover rising contracts and buyer trends signaling a potential bullish shift. Stay informed on this key crypto development. (148 characters)

What is AVAX One’s accumulation strategy for Avalanche?

AVAX One’s accumulation strategy for Avalanche involves strategic purchases of AVAX tokens to build a substantial reserve, reflecting institutional commitment to the network’s long-term potential. Between November 5th and 23rd, AVAX One acquired 9,377,475 AVAX at an average price of $11.73, investing over $110 million. This move expands their holdings to more than 13.8 million tokens, providing a foundation for enhanced market stability and growth within the Avalanche ecosystem.

How are on-chain metrics indicating a bullish trend for AVAX?

The Avalanche network has witnessed a notable increase in deployed contracts, a key metric tracked by platforms like Token Metrics, which correlates with heightened developer activity and project deployments. This surge often precedes improved token performance as it signals expanding ecosystem utility. For instance, data from COINOTAG’s analysis shows this rise aligning with broader market shifts, where higher contract deployments have historically supported AVAX price recoveries. Expert observers note that such on-chain growth underscores Avalanche’s scalability advantages, drawing more builders and users to its subnets.

Source: Token metrics

Frequently Asked Questions

What impact does AVAX One’s 13.8 million token reserve have on Avalanche’s market?

AVAX One’s reserve of over 13.8 million tokens acts as a significant support level for AVAX, reducing selling pressure and encouraging long-term holding. This accumulation, per reports from financial analysts, enhances liquidity and positions Avalanche for potential price appreciation amid recovering market conditions, fostering greater investor confidence in the protocol’s future.

Is Avalanche’s buyer dominance in futures a sign of an upcoming AVAX rally?

Yes, the increasing buyer dominance in Avalanche futures, as observed in recent cumulative volume delta trends, suggests building momentum toward a potential AVAX rally. This indicator reflects more aggressive buying than selling in derivative markets, which typically leads to upward price movements when combined with strong on-chain activity like rising contracts.

Key Takeaways

- Strong Institutional Backing: AVAX One’s aggressive purchases demonstrate deep confidence in Avalanche’s infrastructure, bolstering the token’s reserve and market resilience.

- Network Expansion: The sharp rise in deployed contracts highlights growing developer adoption, a fundamental driver for AVAX’s long-term value proposition.

- Bullish Momentum Signals: Increasing buyer dominance in futures points to sustained upward pressure, advising investors to monitor key support levels for entry opportunities.

Conclusion

Avalanche’s AVAX accumulation by institutions like AVAX One, coupled with robust on-chain metrics such as surging deployed contracts and buyer dominance, paints a promising picture for the token’s trajectory. These developments, drawn from analyses by sources like COINOTAG and CryptoQuant, underscore the network’s evolving strength in the competitive blockchain landscape. As market sentiment continues to improve, AVAX holders and prospective investors should watch for confirmation of this bullish shift, positioning themselves to capitalize on potential gains in the coming months.

Institutional accumulation raises market expectations

AVAX One’s recent accumulation strategy signals renewed institutional conviction in Avalanche AVAX at a pivotal moment for altcoins. This build-up of reserves not only fortifies the token’s base but also aligns with projections for increased revenue from Avalanche’s trading activity fees. Such fees, generated through high-throughput transactions, could further amplify the positive effects of these reserve developments, drawing more liquidity into the ecosystem.

According to detailed metrics from COINOTAG, the number of deployed contracts on Avalanche has climbed sharply, serving as a reliable proxy for developer interest and project proliferation. This uptick in on-chain engagement often translates to heightened utility and adoption, laying the groundwork for stronger AVAX price performance. Blockchain experts emphasize that Avalanche’s unique consensus mechanism enables this scalability, making it an attractive platform for decentralized applications.

Trend reversal ahead for AVAX?

AVAX has shown signs of recovery in recent trading sessions, with AVAX One’s substantial acquisitions providing an additional bullish catalyst. When major holders engage in consistent buying at current price levels, it typically stabilizes the market and paves the way for upward trends. This pattern is evident in historical data for similar layer-1 tokens, where institutional inflows preceded notable rallies.

Moreover, futures data from CryptoQuant reveals a steady rise in the takers’ cumulative volume delta, indicating growing buyer control over the past three days. This metric, which measures the net difference between buy and sell volumes in derivatives, points to sustained momentum if it continues. As a result, AVAX could see extended gains, particularly if broader crypto market conditions align favorably.

Source: CryptoQuant

The combination of expanding reserves and vibrant network activity establishes a solid base for a medium-term bullish adjustment in Avalanche’s market structure. Nonetheless, market participants remain vigilant around established support zones to determine if these indicators will culminate in a definitive trend reversal for AVAX.

Avalanche’s AVAX market is gaining traction following AVAX One Treasury’s expansion of its holdings to exceed 13.8 million tokens. This reserve buildup represents one of the quarter’s most determined accumulation efforts within the ecosystem. Reports indicate that AVAX One secured 9,377,475 AVAX from November 5th through November 23rd, at a total cost surpassing $110 million and an average rate of $11.73 per token.

These methodical, high-volume acquisitions occur as overall sentiment toward AVAX starts to pivot positively. The bolstered reserves offer enduring backing for long-term stakeholders, setting the stage for meaningful price dynamics in the near future. Analysts from established crypto research firms highlight how such institutional actions can catalyze broader adoption and valuation uplifts for scalable platforms like Avalanche.

In the context of mixed altcoin performances, AVAX One’s strategy stands out as a beacon of targeted investment. It not only mitigates downside risks but also amplifies the protocol’s appeal to developers seeking efficient, low-cost transaction environments. As Avalanche continues to innovate with features like customizable subnets, this accumulation could accelerate its position among leading blockchains.

Comments

Other Articles

Kraken IPO Could Attract TradFi to Bitcoin Amid Divided 2026 Bull Market Views

December 24, 2025 at 11:19 AM UTC

Coinbase Expands with Beam, Merlin Chain, and Theoriq Listings Amid Bitcoin Volatility

December 17, 2025 at 06:12 PM UTC

Avalanche (AVAX) Signals Potential Recovery via Falling Wedge, RWA Activity, and Abu Dhabi Growth

December 16, 2025 at 04:24 AM UTC