AVAX Shows Potential for Further Gains Amid Rising Activity and Key Resistance Challenges

AVAX/USDT

$188,919,487.08

$9.42 / $9.14

Change: $0.2800 (3.06%)

-0.0027%

Shorts pay

Contents

-

Avalanche [AVAX] has recently gained significant momentum with a notable uptick in trading activity and bullish metrics amid positive investor sentiment.

-

The altcoin has demonstrated impressive price resilience, with a 32% increase since bouncing off the crucial $39 support level, marking it as a key player in the current market rally.

-

“The increased large transactions and active addresses signal a strong potential for a breakout above the $65 resistance level,” according to analysts at COINOTAG.

AVAX surges 32% with rising activity and bullish sentiment, approaching the crucial $65 resistance level as large transactions soar. Explore more!

AVAX functionality drives whale activity

The recent surge in Avalanche’s price can be attributed to a remarkable increase in large transactions on the network. In fact, these transactions have skyrocketed by 298% in the last 24 hours, totaling approximately $797 million. This dramatic uptick speaks volumes about the growing confidence in the AVAX ecosystem as institutional and retail investors flock to the platform.

Source: IntoTheBlock

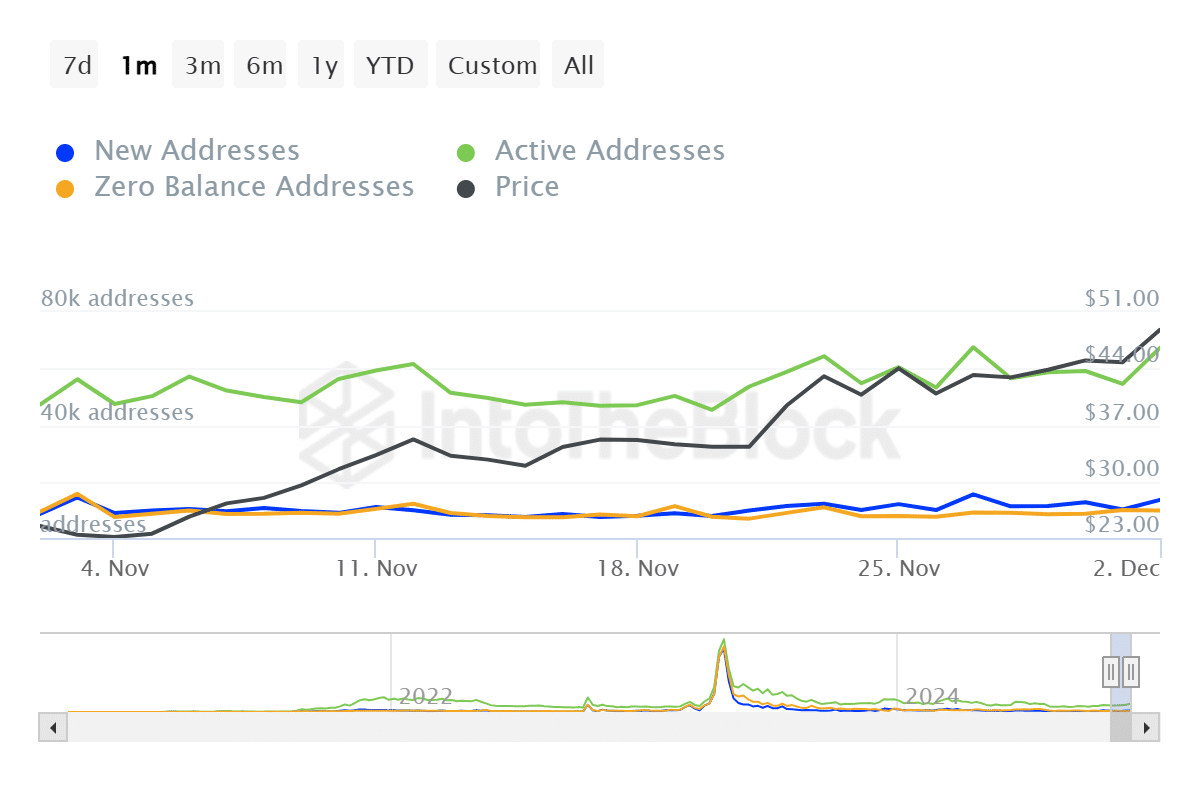

Active addresses signal a robust network

In tandem with the surge in large transactions, the number of active addresses on the Avalanche network has also experienced a significant uptick. Over the past 24 hours, active addresses have risen by 23%, indicating increased trading and engagement within the AVAX community. This influx of activity plays a critical role in solidifying the network’s health and investor interest.

Source: IntoTheBlock

Interestingly, data suggests that around 80% of AVAX addresses are currently in profit, reflecting a positive sentiment among holders amidst the altcoin’s recent upswing. This level of profitability not only attracts new investors but also fosters a sense of stability within the market.

As AVAX approaches the critical $65 resistance level, profitable holders face a key decision: realize gains or hold for potentially greater returns. The outcome of this dilemma could significantly influence AVAX’s forthcoming price action.

Source: IntoTheBlock

Forecasting further advancement in AVAX’s momentum

With the ongoing bullish momentum, AVAX showcases robust technical performance. The altcoin’s ability to rebound from the $39 support level underscores market participants’ resilience, while the increasing transactions and active addresses signal heightened enthusiasm among investors.

Source: TradingView

As the market sentiment continues to build, analysts suggest that if AVAX can decisively break through the $65 resistance, it may unlock new price levels, setting the stage for potential all-time highs.

Conclusion

The latest surge in AVAX, marked by substantial increases in large transactions and active addresses, paints a compelling picture of the altcoin’s bullish trajectory. While the stochastic RSI indicates an overbought condition that may lead to short-term corrections, the overall sentiment remains positive. Investors should closely monitor the crucial $65 resistance level as AVAX’s ability to overcome this barrier could unlock significant opportunities for future growth.

Comments

Other Articles

BNB Chain’s RWA Momentum Draws Institutional Interest Amid Market Caution

November 20, 2025 at 06:05 AM UTC

REX-Osprey XRP ETF Could Launch This Week; Dogecoin ETF Expected Under 1940 Act

September 16, 2025 at 04:23 AM UTC

Ethereum’s Staking Dominance and Spot ETF Inflows Suggest Potential for ETH Price Rally

June 10, 2025 at 05:05 PM UTC