Bank of America May Recommend 1%-4% Bitcoin Allocation for Wealthy Clients

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

Bank of America is now providing its wealthiest clients with direct access to Bitcoin ETFs starting January 5, 2025, marking a significant step in mainstream crypto adoption. This move allows over 15,000 wealth advisers to recommend modest cryptocurrency allocations of 1% to 4% for suitable investors, emphasizing regulated products and risk management.

-

Bank of America enables Bitcoin ETF access: Wealthy clients can now invest in four spot Bitcoin ETFs without prior requests, broadening institutional crypto exposure.

-

Advisers gain recommendation authority: For the first time, the bank’s network of over 15,000 advisers can suggest crypto investments through platforms like Merrill and Private Bank.

-

Institutional trend accelerates: This follows similar actions by Vanguard and aligns with recommendations from firms like BlackRock and Fidelity for 1% to 5% Bitcoin allocations, reflecting growing confidence in digital assets.

Bank of America Bitcoin ETFs access opens doors for wealthy clients to regulated crypto investments. Discover the 1-4% allocation advice and what it means for institutional adoption. Stay informed on crypto trends today!

What is Bank of America’s Approach to Bitcoin ETFs?

Bank of America Bitcoin ETFs access represents a pivotal shift for one of the largest U.S. financial institutions, allowing its high-net-worth clients to invest in spot Bitcoin exchange-traded funds directly. This policy change, effective January 5, 2025, extends to four specific ETFs: the Bitwise Bitcoin ETF (BITB), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Grayscale’s Bitcoin Mini Trust (BTC), and BlackRock’s iShares Bitcoin Trust (IBIT). Previously, such investments required special requests, but now they are seamlessly integrated into wealth management offerings across Merrill, Bank of America Private Bank, and Merrill Edge platforms.

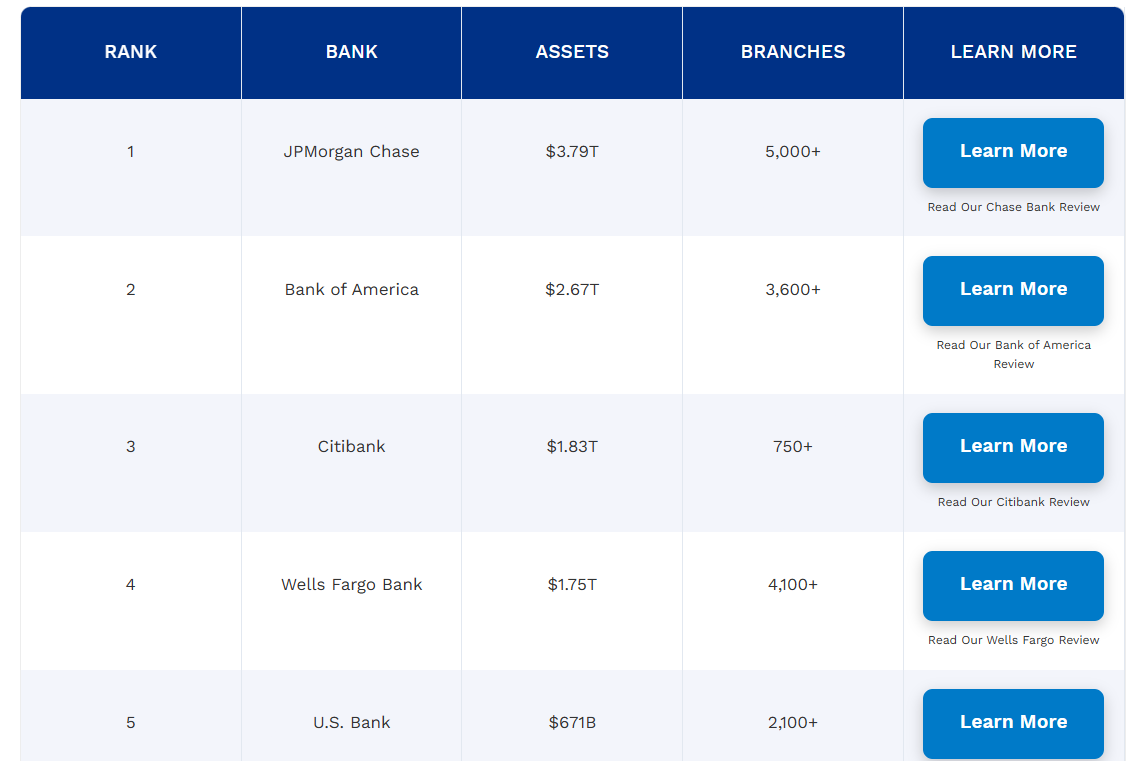

The bank’s decision underscores a maturing view of digital assets within traditional finance, prioritizing regulated vehicles to mitigate risks while capturing potential upsides. With assets exceeding $2.67 trillion and a vast network of branches, Bank of America’s endorsement could influence broader market participation in cryptocurrencies.

How Much Bitcoin Allocation Does Bank of America Recommend?

Bank of America advises a modest 1% to 4% allocation to digital assets for investors comfortable with volatility and interested in thematic innovations like cryptocurrency. This guidance comes from Chris Hyzy, chief investment officer at Bank of America Private Bank, who emphasized the importance of regulated products and a balanced understanding of both opportunities and risks. According to a statement shared with Yahoo Finance, this range suits portfolios seeking diversification without excessive exposure.

Supporting this, the recommendation aligns with data from major asset managers. For instance, a 2024 report from the bank highlighted how such allocations can hedge against inflation, similar to other alternative assets. Hyzy noted that this approach allows clients to benefit from Bitcoin’s growth potential while maintaining portfolio stability, drawing on historical performance where Bitcoin has shown annualized returns exceeding 200% over the past decade, per publicly available market data from sources like CoinMarketCap.

The policy also empowers the bank’s over 15,000 wealth advisers to discuss and recommend these options, a first in its history. This democratization of advice could lead to increased inflows into Bitcoin ETFs, potentially boosting liquidity and price stability in the crypto market.

More big-name financial institutions are opening the door to Bitcoin exposure, signaling a growing institutional appetite for regulated digital asset products. Bank of America, the second-largest U.S. bank, has recommended this allocation through its wealth management platforms.

“For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,” said Chris Hyzy in the statement.

Starting Jan. 5, the bank will enable its clients to gain access to these Bitcoin ETFs, which were previously only available upon request. The bank’s wealth advisers were unable to recommend any cryptocurrency investment products until now.

“Our guidance emphasizes regulated vehicles, thoughtful allocation, and a clear understanding of both the opportunities and risks,” added the bank’s chief investment officer.

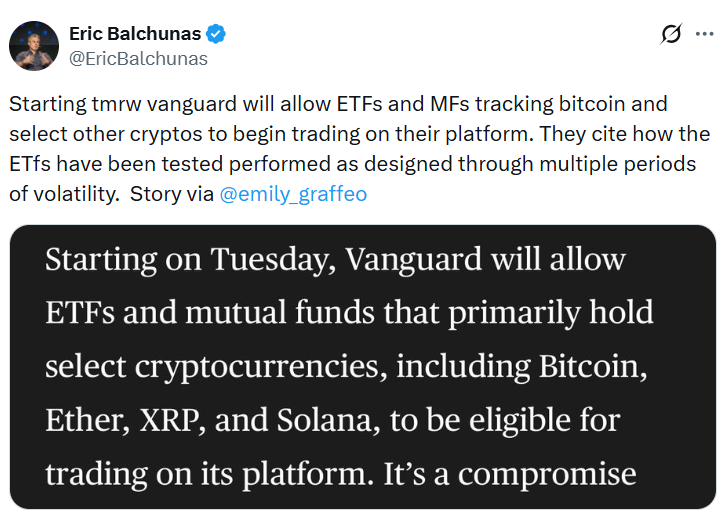

The bank’s Bitcoin allocation recommendation signals a wider institutional appetite for regulated cryptocurrency investment products. It comes a day after Vanguard, the world’s second-largest asset manager, enabled crypto ETF trading for its clients, reversing its previous stance on digital asset ETFs.

Source: Eric Balchunas

Bank of America has been contacted for more details on its crypto allocation recommendations.

Bank of America is the second-largest bank in the U.S. with about $2.67 trillion in consolidated assets and over 3,600 branches, according to Forbes.

Largest US banks by assets. Source: Forbes.com

Frequently Asked Questions

What Bitcoin ETFs Can Bank of America Clients Access?

Bank of America clients can access four spot Bitcoin ETFs: Bitwise Bitcoin ETF (BITB), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Grayscale’s Bitcoin Mini Trust (BTC), and BlackRock’s iShares Bitcoin Trust (IBIT). These regulated funds provide direct exposure to Bitcoin’s price movements without the need to hold the asset directly, available starting January 5, 2025, for eligible wealth management clients.

Why Is Bank of America Recommending Bitcoin Allocations Now?

Bank of America’s recommendation reflects evolving regulatory clarity and the success of spot Bitcoin ETFs, which have attracted billions in assets since their 2024 approval. As spoken by financial experts, this timing aligns with Bitcoin’s role as an inflation hedge, allowing institutions to offer diversified options to clients seeking innovative portfolio strategies in a post-ETF landscape.

Key Takeaways

- Expanded Access for Wealthy Clients: Bank of America’s policy change grants direct Bitcoin ETF investments to high-net-worth individuals, simplifying entry into crypto without special approvals.

- Adviser Empowerment: Over 15,000 advisers can now recommend 1% to 4% crypto allocations, promoting informed discussions on digital assets’ risks and rewards.

- Institutional Momentum: This move mirrors actions by Vanguard, BlackRock, and Fidelity, signaling a consensus on modest Bitcoin exposure to enhance portfolio diversification.

BlackRock Helped Set the Bitcoin Allocation Playbook

BlackRock, the world’s largest asset management firm, pioneered the trend by recommending up to a 2% Bitcoin allocation to its clients, as reported in December 2024. The firm’s analysis positioned Bitcoin as carrying similar portfolio risk to a typical stake in the “magnificent 7” tech stocks—Amazon, Apple, Microsoft, Alphabet, Tesla, Meta, and Nvidia.

“Around 1%–2% is a reasonable range for Bitcoin exposure, which poses the same share of overall portfolio risk,” stated BlackRock in its report. This guidance has influenced peers, including Fidelity, which in June suggested 2% to 5% allocations to balance crash risks with upside potential from Bitcoin as an inflationary hedge.

Earlier, in October, Morgan Stanley proposed a 2% to 4% crypto allocation for investors and advisers, indicating a converging strategy among large institutions for controlled digital asset integration. These developments highlight a shared playbook: modest, risk-aware exposure to foster long-term growth in cryptocurrency adoption.

Bitcoin to end four-year cycle, break out to new highs in 2026: Grayscale. Cathie Wood still bullish on $1.5M Bitcoin price target: Finance Redefined. Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin.

Conclusion

Bank of America’s foray into Bitcoin ETFs access and allocation recommendations marks a milestone in the fusion of traditional finance and digital assets, following the lead of firms like BlackRock and Fidelity. By advocating 1% to 4% exposures through regulated channels, the bank is guiding clients toward prudent innovation amid crypto’s volatility. As institutional interest grows, this could pave the way for even broader adoption—investors should monitor regulatory updates and consult advisers to align with their risk profiles.