Berachain Faces Potential Challenges as $1.2 Billion Outflows and TVL Drop Raise Concerns

OP/USDT

$73,974,294.66

$0.2029 / $0.1916

Change: $0.0113 (5.90%)

+0.0018%

Longs pay

Contents

-

Berachain faces a critical downturn with $1.2 billion in net outflows and a total value locked (TVL) drop exceeding 70%, signaling major challenges ahead for the blockchain platform.

-

The community sentiment has shifted dramatically from initial optimism during the testnet phase to growing skepticism as sustained losses erode confidence.

-

According to crypto analyst Rick, “Berachain is quickly becoming a ghost chain,” highlighting the urgent need for strategic action to restore platform stability and user trust.

Berachain’s $1.2B net outflows and 70% TVL decline highlight urgent challenges, with community sentiment shifting from optimism to skepticism amid sustained losses.

Outflows Reach $1.2 Billion as TVL Drops Over 70%

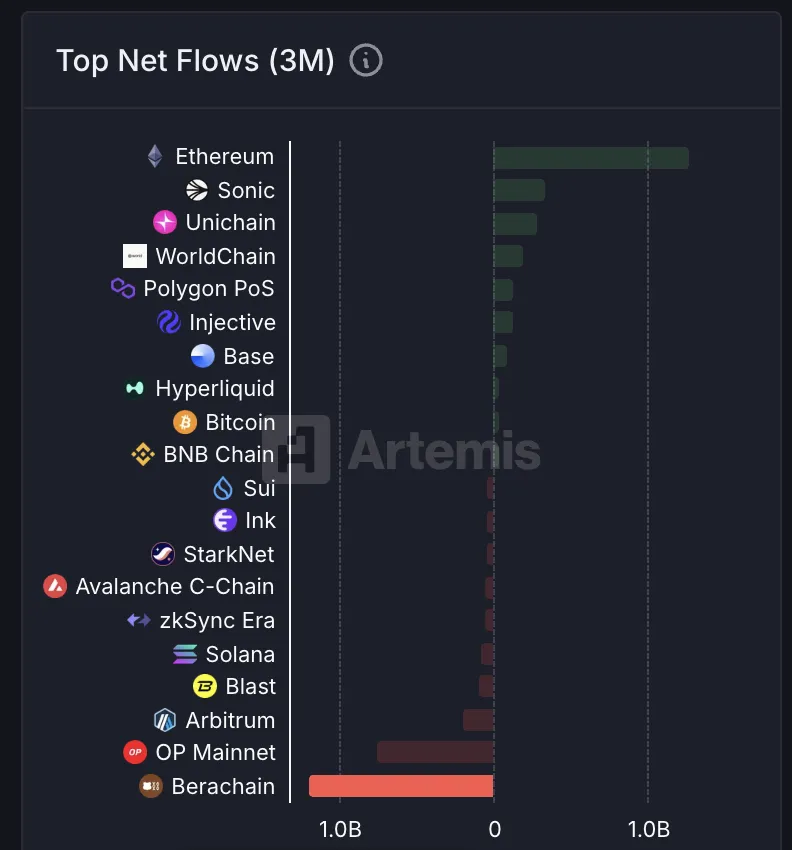

Recent data from Artemis reveals a significant capital exodus from Berachain, with $1.69 billion in inflows contrasted by $2.89 billion in outflows over a three-month period. This results in a net outflow surpassing $1.2 billion, positioning Berachain as the top chain by net outflows during this timeframe.

The sharp decline in liquidity is mirrored by a deteriorating community outlook. Early enthusiasm has given way to uncertainty, with many users questioning the platform’s ability to recover from these losses.

Crypto analyst Rick noted, “Berachain is quickly becoming a ghost chain. With over $1.1 billion in net outflows over the past 3 months and a token price down 82% from ATHs. There was so much life during Testnet and now all the ‘power users’ are gone farming the next airdrop.” This sentiment encapsulates the community’s growing disenchantment.

Critiques now extend beyond mere financial metrics, encompassing concerns over marketing strategies and the platform’s long-term viability. The shift from optimism to skepticism is palpable within the Berachain ecosystem.

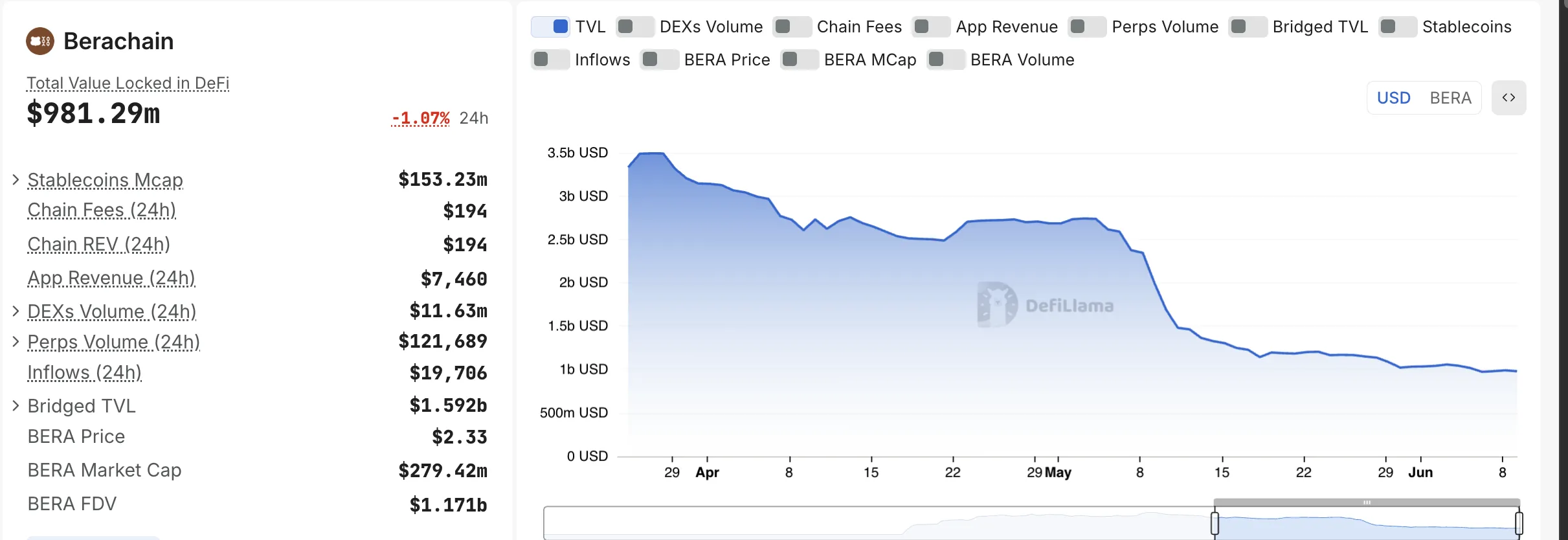

Supporting this trend, DeFiLlama’s TVL dashboard reports a plunge exceeding 70% from Berachain’s peak liquidity levels. This steep decline not only reflects reduced capital but also signals diminishing confidence among both users and developers, raising immediate questions about the protocol’s short-term stability.

What Lies Ahead for Berachain?

Analyzing on-chain metrics and TVL trends, it is evident that while Berachain’s underlying technology remains intact, the perceived value and growth potential are under significant pressure. To counteract this, developers and community leaders must engage transparently and implement swift measures to restore confidence.

Failure to address these challenges could cement Berachain’s reputation as a “ghost chain,” potentially accelerating user attrition and liquidity depletion. Proactive community engagement and strategic innovation are critical to halting this decline and maintaining relevance within the competitive DeFi landscape.

Ultimately, Berachain’s current trajectory underscores the fragile nature of emerging blockchain projects, where community trust can erode faster than liquidity. The platform stands at a crossroads, with data and sentiment signaling an urgent need for decisive action to secure its future.

Conclusion

Berachain’s substantial net outflows and steep TVL decline highlight a pivotal moment for the platform. Restoring user trust and stabilizing liquidity will require transparent communication and strategic initiatives from the development team. As the DeFi ecosystem evolves rapidly, Berachain’s ability to adapt and engage its community will determine its long-term viability and success.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/7/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/6/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/5/2026

DeFi Protocols and Yield Farming Strategies

2/4/2026