Berachain Founder Disputes Inaccuracy in BERA Investor’s Refund Report

Contents

Berachain’s founder has refuted a report claiming that investor Nova Digital received a one-year refund right on its $25 million Series B investment, describing it as inaccurate and incomplete. The arrangement was standard for all investors and included additional liquidity commitments from Nova.

-

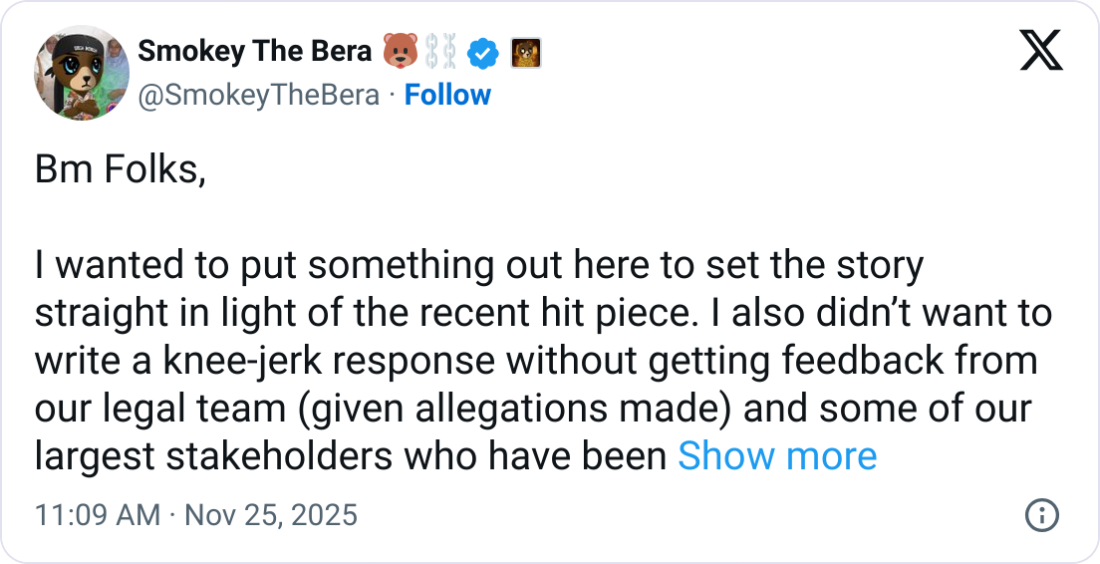

Berachain founder Smokey The Bera clarified that Nova participated under the same terms as other Series B investors.

-

The side letter addressed a specific risk of no token generation event, ensuring Nova’s liquid strategy remained viable.

-

Nova holds significant BERA tokens, including locked Series B allocations and open-market purchases, demonstrating ongoing commitment.

Discover the truth behind Berachain’s Series B refund report. Founder refutes claims of special treatment for Nova Digital in this $25M investment. Learn key details and implications for crypto funding today.

What is the Berachain Series B Refund Controversy?

Berachain Series B refund refers to a reported provision allowing investor Nova Digital a one-year window to recoup its $25 million investment following the blockchain’s token generation event in February 2025. Berachain’s founder, Smokey The Bera, has stated that this arrangement was part of standard terms extended to all Series B participants, not a special favor. The clause aimed to mitigate risks for Nova’s liquid-only investment strategy if the project failed to launch successfully.

In a detailed response, Smokey emphasized that the side letter signed between Berachain’s general counsel and Nova’s director was a mutual agreement to align interests, including Nova’s commitment to provide liquidity on the network post-launch. This setup ensured that all investors, including Nova from Brevan Howard’s Abu Dhabi office, operated under uniform paperwork from the April 2024 fundraising round.

How Did Berachain Address Nova Digital’s Specific Concerns?

Berachain founder Smokey The Bera explained that Nova Digital sought protections against a potential failure to achieve the token generation event (TGE) and subsequent listing. The side letter, effective for 12 months after the February 6, 2025 TGE, allowed Nova to recover some or all of its investment if locked BERA tokens became ineligible under their liquid strategy.

This provision was not designed to lure an uninterested party or shield against market losses post-launch but rather to facilitate the deal while committing Nova to additional roles, such as liquidity provision upon network activation. Smokey noted that such arrangements have precedent in crypto investments, particularly for funds like Nova that prioritize liquidity in volatile markets. Data from Berachain’s token metrics shows BERA trading at $1.05 as of recent reports, up 3.2% daily, despite a 93% decline from its $14.83 peak at launch, per CoinGecko tracking.

Expert commentary from industry observers, such as those cited in blockchain funding analyses, highlights that refund rights in early-stage crypto rounds are increasingly common to de-risk institutional participation. Smokey further pointed out Nova’s status as one of Berachain’s largest tokenholders, with holdings encompassing both Series B locked tokens and additional open-market acquisitions, underscoring their continued exposure even in a challenging altcoin environment.

Source: Smokey The Bera

Berachain’s approach demonstrates a balanced negotiation, where investor safeguards are paired with project contributions. This structure helps maintain trust in decentralized ecosystems, as evidenced by Nova’s increased BERA holdings over time.

Frequently Asked Questions

What terms did all Berachain Series B investors receive?

All Series B investors in Berachain’s April 2024 round, including Nova Digital, operated under identical paperwork and commercial agreements. This ensured fairness, with provisions like the refund right tailored to address collective risks such as delayed TGE, while requiring commitments like liquidity support from participants.

Why did Berachain agree to the side letter with Nova Digital?

The side letter with Nova Digital was a targeted response to their liquid-only fund strategy, protecting against illiquid tokens if no TGE occurred. In exchange, Nova agreed to provide network liquidity post-launch, fostering mutual benefits and aligning with standard practices in crypto venture funding for projects like Berachain.

Key Takeaways

- Standard Investor Terms: Berachain’s Series B refund provision applied uniformly, countering claims of preferential treatment for Nova Digital and reinforcing equitable fundraising practices.

- Risk Mitigation Focus: The arrangement addressed pre-launch uncertainties, ensuring Nova’s investment fit their liquid strategy without implying post-TGE protections against market downturns.

- Ongoing Commitment: Nova’s expanded BERA holdings and liquidity role highlight sustained investor confidence, offering insights for future crypto project negotiations.

Conclusion

The Berachain Series B refund controversy underscores the complexities of crypto funding, where Berachain refund rights like those extended to Nova Digital balance investor protections with project obligations. As Smokey The Bera clarified, these terms were standard and precedent-based, promoting transparency in the space. Looking ahead, such disclosures could shape more resilient investment models in blockchain ventures, encouraging deeper institutional involvement while prioritizing network growth—explore Berachain’s developments for emerging opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026